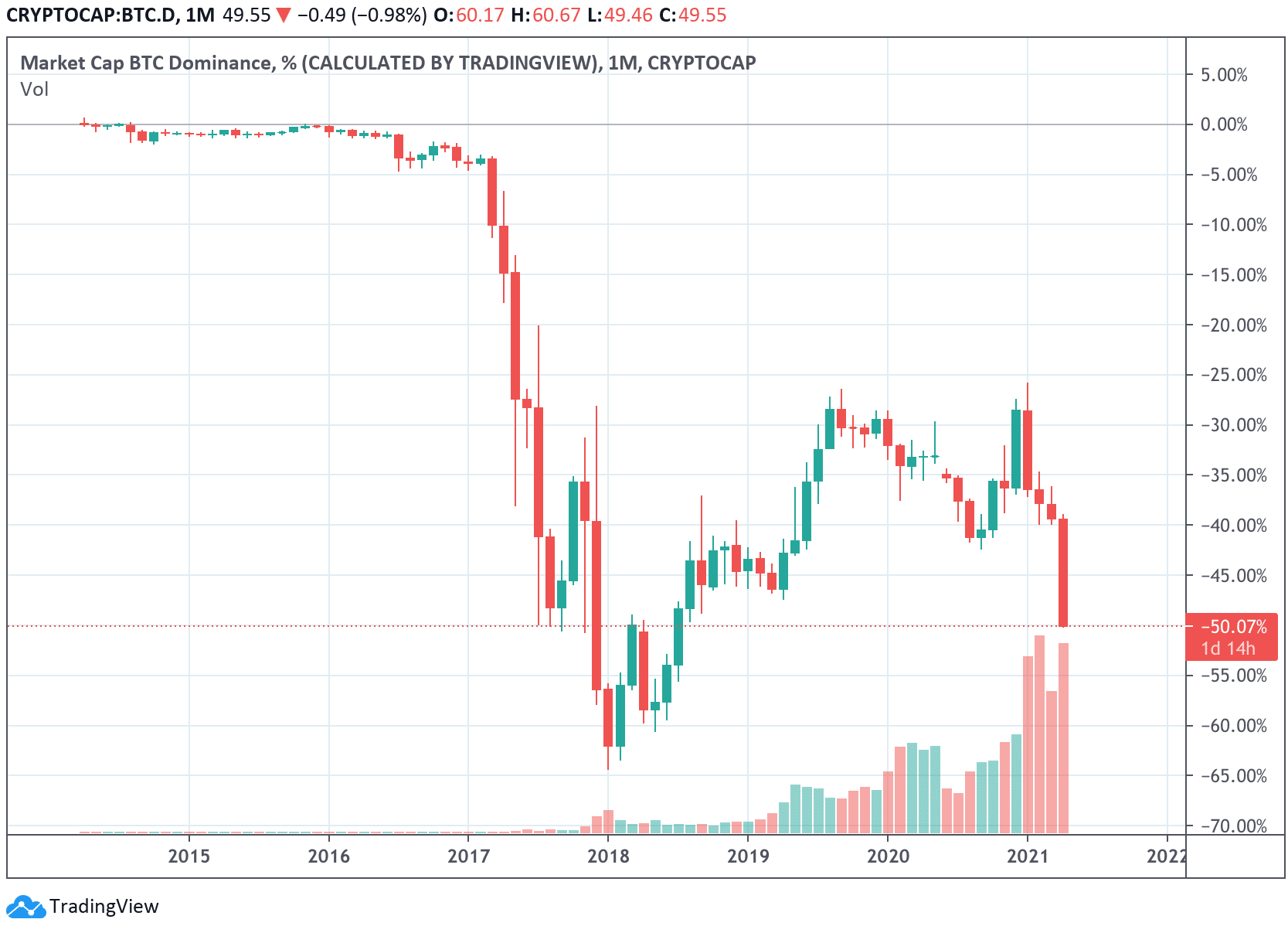

Bitcoin’s dominance continues to fall and has been below 50% for the past ten days despite the fact that the market cap has been above $1 trillion for some time now.

In fact, at a time when BTC’s market capitalization is at historic levels, unprecedented in the past, dominance is falling below 50%.

What has happened? Quite simply, the market capitalization of the so-called altcoins has also strengthened.

The first altcoin that is eroding bitcoin’s market share is of course Ethereum (ETH), whose dominance is now at 15%. The third cryptocurrency in the dominance ranking is Binance Coin (BNB) which has seen both its price and its capitalization grow significantly in recent months. This has propelled it up the rankings, leaving behind Ripple, Cardano and Tether, which until recently were battling for third place.

Bitcoin, market cap and dominance across time

Bitcoin’s dominance below 50% indicates that the long-awaited altseason is upon us. Indeed, investors seem to want to diversify their portfolios by investing not only in bitcoin but also in other cryptocurrencies. However, the figure of 48% is not the lowest figure of the market share held by bitcoin.

As Tradingview‘s chart shows, at the turn of 2017 and 2018, i.e. at the height of the speculative bubble, bitcoin’s dominance reached percentages between 35 and 40%, a sign that most of the market share was held by altcoins. That was the period of the ICOs, but as the months went by, bitcoin regained share.

Until a few months ago, in November 2020, bitcoin’s market share was over 70%. Then BTC’s price growth dragged the whole industry along with it. So many cryptocurrencies experienced price surges that led them to climb the rankings of the most highly capitalized, but this happened at the very expense of the bitcoin market.

Capitalization is the price of a cryptocurrency multiplied by the number of tokens in circulation. Therefore, as the price of bitcoin increased, so did its capitalization, which reached a trillion dollars. The increase in capitalization has thus occurred in conjunction with the sudden rise in price over the past six months.

In December 2017, when bitcoin reached the previous all-time high of $20,000, the market capitalization reached $277 million. The rise in price to $65,000 as well as the increase in circulating tokens has led the market cap to quadruple four years later. If the price continues to rise, the record of $1.1 trillion is also destined to be broken.

The post Bitcoin, record market cap but below 50% dominance appeared first on The Cryptonomist.