Bitcoin (BTC) Price Prediction – May 6

After touching the daily high of $58,400, BTC/USD drops over 0.55% as it trades at the $57,185 level.

BTC/USD Long-term Trend: Ranging (Daily Chart)

Key levels:

Resistance Levels: $62,000, $64,000, $66,000

Support Levels: $53,000, $55,000, $57,000

The daily chart reveals that BTC/USD failed to break the $58,000 resistance level with the current consolidation pattern as it fails to stay above the 9-day and 21-day moving averages. The Bitcoin (BTC) started the day off by trending lower toward the $56,000 level within the channel. However, crossing below the moving averages may locate the first support level at $55,000. Beneath this, support lies at $53,000, $51,000, and $49,000 levels.

What is the Next Direction for Bitcoin?

BTC/USD has been gradually and persistently working on a recovery mission with the support of $53,000. Therefore, the largest cryptocurrency hovers at $57,185 as bulls battle to overcome the resistance above the moving averages. On the downside, immediate support has been provided by the 9-day moving average at the $56,433 level. Holding above the short-term support is the key for sustaining the uptrend due to the stability exemplifies in the market.

On the upside, the red-line of 9-day MA crossing above the 21-day MA would prove to investors that bulls are finally in control. As speculation increases for gains beyond $60,000, buying orders are bound to rise, adding to the tailwind force. Today, the Bitcoin price couldn’t go higher but seen dropping beneath the $57,000 level. Although the candle is still yet to close, however, it does look unlikely that the bulls may end up closing above this resistance should in case the technical indicator RSI (14) moves above 60-level. More so, toward the upside, resistance lies at $62,000, $64,000, and $66,000.

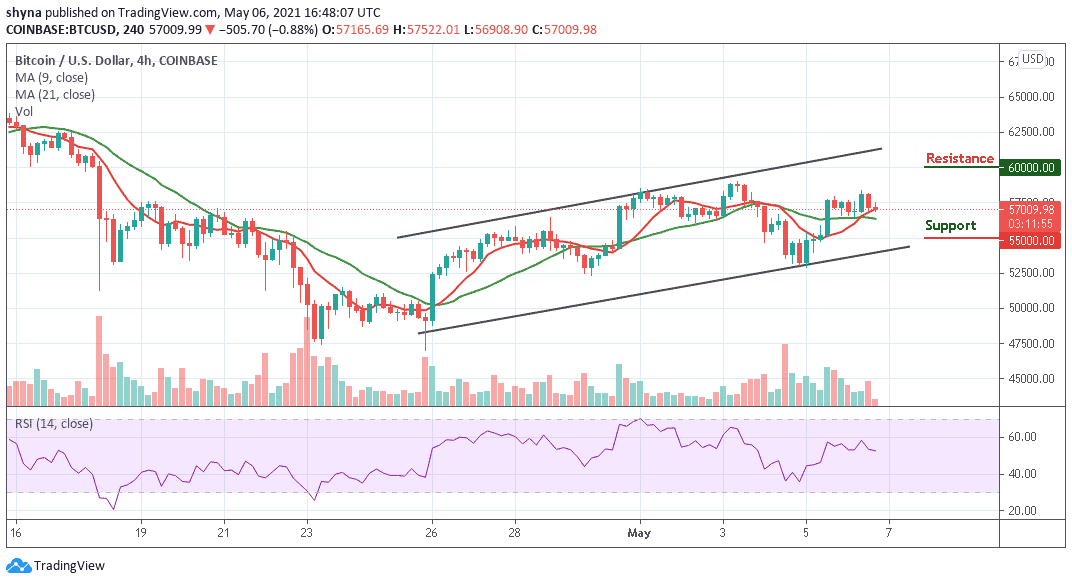

BTC/USD Medium-Term Trend: Bullish (4H Chart)

Looking at the 4-hour chart, the bears are now coming back into the market if the bulls failed to defend the support at $57,000. Nevertheless, the $55,000 and below may come into play if the bearish momentum increases in the market.

However, if the buyers reclaim the current movement and power the market, traders may expect a retest at the $57,522 resistance level; breaking this level may further allow the bulls to hit $60,000 and above. At the moment, the RSI (14) signal line is seen moving towards the downside which may give additional bearish signals in the near future.