There are various reasons traditional experts do not understand bitcoin and thus have negative views on it.

Bitcoiners And Fiat Experts

Society has conditioned us to listen to experts. They teach us what to eat, what to learn, how to exercise, how to raise our children and how to care for the environment. We think they know better, that they have our best interests at heart. After all, they have fancy titles, decades of experience, appear in mainstream media and have tons of followers. Many of them even work in organizations that have “World” in the name. How prestigious is that!? We intuitively think we wouldn’t be able to decide what’s best for ourselves. Why would we or more importantly how could we go against advice from experts?

Money From First Principles

To understand Bitcoin’s value and I mean truly understand it, you have to start asking, “What is money?” This sends precoiners spiraling down the Bitcoin rabbit hole. After extensive research on money and economics, a veil is lifted from their eyes. They start thinking, “If I’ve been lied to about money, about inflation being normal, what else have I been taught that was a lie?” This is generally where people become skeptical which leads them to think critically and not take things at face value. For the first time, they start paying attention to what experts are actually saying. They begin seeing inconsistencies in between the various word salads. Some proceed to look at experts’ track records. How could these experts be so dead wrong about so many things for so many years? Even worse, nothing happens to them. They aren’t fired, there aren’t any consequences, no accountability.

That’s when some newcoiners begin their transformation. It’s because of experts’ incompetence, political agendas, manipulation and corruption. Newcoiners become obsessed with (re)learning everything. They begin studying history, philosophy, sociology, diet and environment. They are in pursuit of truth. In a world where everything is manipulated and politicized, they want realness.

In order to do so, you need to identify who the fiat experts are. It is helpful to use the following framework: First, people have to realize experts aren’t all-knowing and incapable of being irrational or outright wrong. They’re as human as you and me. As such, they are prone to error. Then, recognize that they have plenty of biases. This is arguably the most important part. Absolutely everyone has biases. The best you can do is be aware of them (both your own and others’) and in doing so minimize their impact. Sadly, it appears very few realize how impactful bias is in one’s decision-making. It doesn’t stop there, experts also have political agendas. After all, self-interest is a very powerful motivator. Experts, like everyone else, have bills to pay, want promotions and also just don’t want to get fired. The problem there is misaligned incentives. What’s best for the expert or organization isn’t always what’s best for their audience. Oftentimes, experts don’t have these high-level positions because they’re the best for the job but because they can be controlled. On top of that, humans have a hard time differentiating between confidence and intelligence. Be careful to not fall into this trap. The bigger the influence, the higher the accountability should be. Yet that’s the exact opposite of what happens in our society, the bigger a person’s influence, the more untouchable they are.

Fiat Experts Entering The Bitcoin Space

Experts have a hard time grasping the fact that they’re just like everyone one else when it comes to Bitcoin. Bitcoin doesn’t discriminate. Experts, in my opinion, do have one distinct advantage: They can simply tweet, “I want to understand Bitcoin,” and a flurry of Bitcoin authors and podcasters will appear offering them their precious time. That is extremely valuable. Experts are able to have one-on-one conversations with the brightest minds in the space. Instead, they come in thinking they have an original thought on why Bitcoin doesn’t work. This repeats over and over again. The same debunked criticisms, different critics (same bewildered reactions when Bitcoiners begin their attack). We’ve seen many examples of this already. Allen Farrington has slayed a few himself: A Tale Of Two Talebs and Gauge Theory Does Not Fix This come to mind. The former, a two-hour read, deconstructing everything that is wrong about Nassim Taleb and the latter in Allen’s own words: “I spent 3 weeks learning a completely irrelevant subject at postgraduate level whose alleged expert thought nobody would ever actually do and hence he could bullshit about it undetected.”

Lopp’s tweet sums up most critics of Bitcoin:

Bitcoin isn’t in any textbook; the world has never seen something like it before. PhDs try to mold Bitcoin into their theories, but Bitcoin works despite them.

Fiat experts fail to understand that Bitcoin’s biggest critics are Bitcoiners:

Experts should first dive deep down the rabbit hole before providing input. Their credentials just help them get their foot in the “influence door.” After that, if they don’t shut up and learn, they will get dismissed.

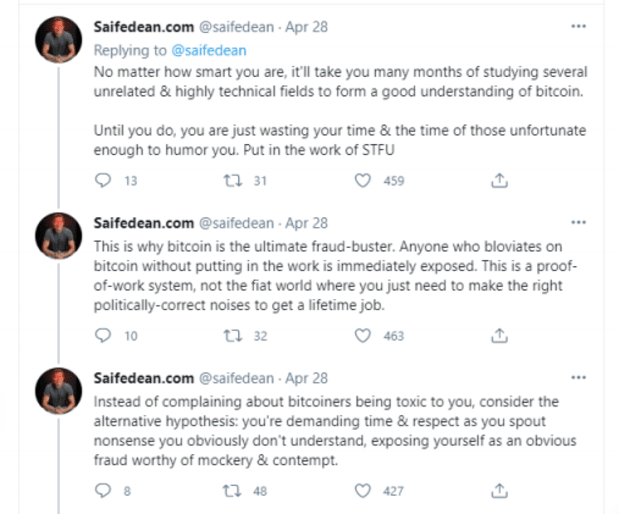

Saifedean’s thread articulates many Bitcoiners’ frustrations with fiat experts:

He also has a podcast episode about this topic with Allen Farrington.

Cyber Hornets

What drew me to Bitcoin Twitter was how different the community is in that they don’t rely solely on past accomplishments to continue to have influence. As soon as “influencers” start being inconsistent, unethical or malicious, they will get called out. No matter who they are, the cyber hornets will swarm. What I found interesting was Michael Saylor understanding this and publicly acknowledging his loyalty to Bitcoin:

Every expert should be held to a high standard of accountability in any industry. Like I said above, the bigger the influence, the higher the responsibility.

Reputation In A Bitcoin World

Soon, if not already, reputation will be almost like a currency. What you say and what you do will have great consequences, be that good or bad. A lot of people start with noble intentions but get corrupted along the way. That’s why there needs to be accountability at ALL times. “Don’t trust, verify” is built into Bitcoin. Bullshitters won’t survive for very long. When humans get comfortable in their positions, they become susceptible to corruption, greed or manipulation. Thankfully, if there is constant accountability, they won’t get too comfortable. In a Bitcoin future where people and organizations are allowed to fail, only the best will rise up.

I wrote this for those that are early on their Bitcoin journey and are trying to make sense of the world. When in doubt, approach from first principles and stay true to yourself. There is so much noise out there, Bitcoin is our signal.

This is a guest post by Pedro Neto. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.