When it comes to evaluating the best cryptocurrency interest accounts, BlockFi vs. Celsius Network tends to be the most popular head-to-head comparison.

BlockFi and Celsius are the blue chips of cryptocurrency interest accounts. Both are at the forefront of decentralizing* the Big Banks, perhaps the most notorious of the cryptocurrency industry’s bogeymen.

The following guide will explore BlockFi versus Celsius, their various features, and ultimately, which one is the better cryptocurrency interest account.

In the red corner, Celsius. The NYC-based company is widely regarded as a cryptocurrency lending and borrowing pioneer. It has raised $93.8M in venture capital, private equity, and an ICO for its native token CEL. Celsius claims it’s “nothing like BlockFi.”

In the blue corner, BlockFi. The New Jersey-based company raised $508.7M in venture capital from over 30 investors.

*Both are centralized companies that use decentralized assets, hence being Centralized Finance “CeFi,” rather than Decentralized Finance “DeFi.” BlockFi and Celsius both take custody of your cryptocurrency. Cryptocurrency interest accounts shouldn’t be viewed as savings accounts because they come with a unique set of risks– neither your principal nor your interest is guaranteed.

So, how do BlockFi and Celsius stack up? Which platform is the best bang for your buck, dear reader? Where is your crypto the safest?

Let’s explore.

You can read a full breakdown of each individual platform on our BlockFi review, Celsius review, interviews (2018 and 2020) with Celsius CEO, Alex Mashinsky, and an overview of the cryptocurrency interest account industry.

Feature #1: Interest Rates– BlockFi vs. Celsius APY

Let’s start with meat and get to the potatoes later: how much money can BlockFi or Celsius make you?

Bitcoin:

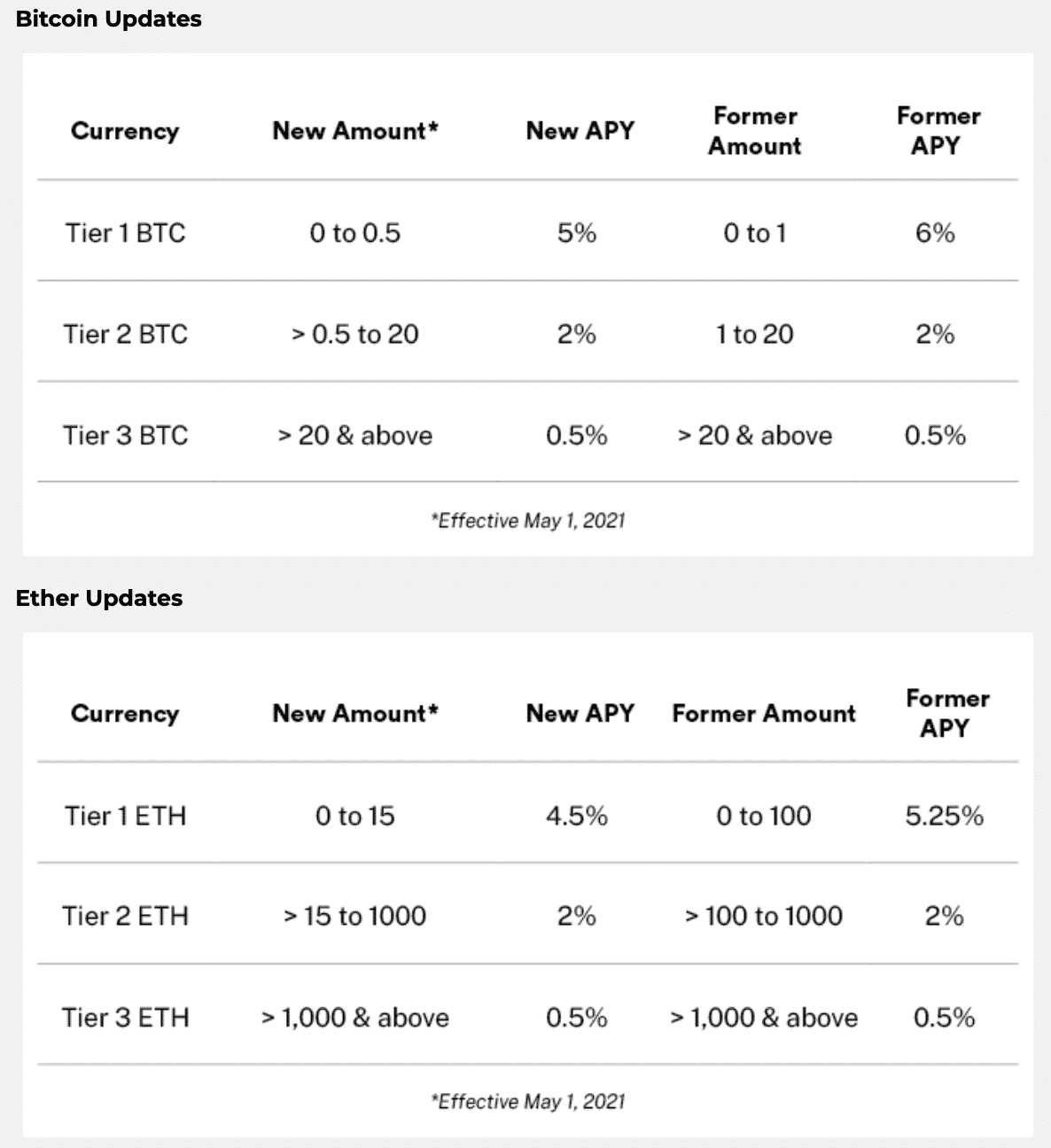

BlockFi offers 5% on your 0.5 bitcoin, 2% between 0.5 and 20 BTC, and then 0.5% on any amount over that.

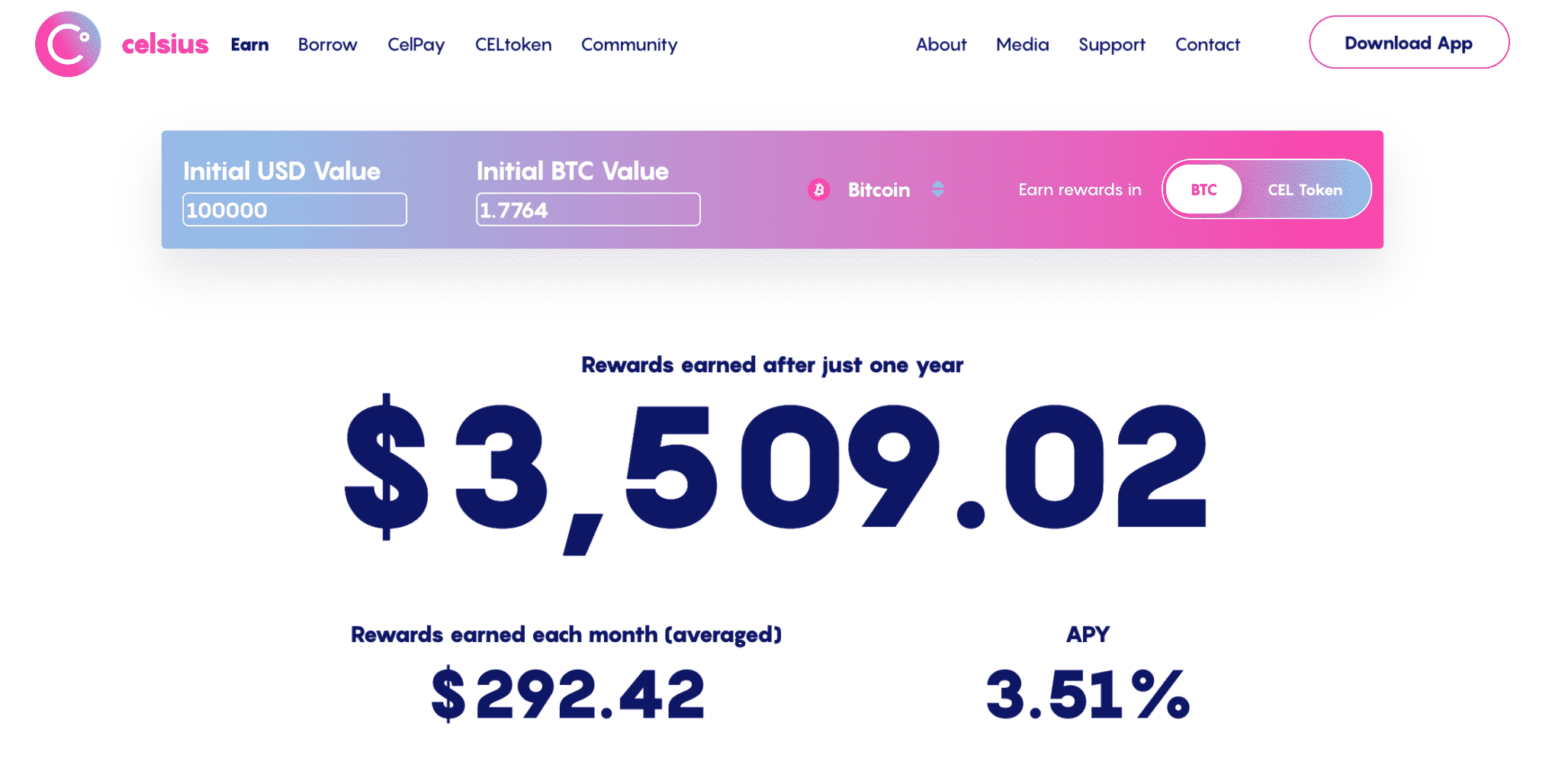

Celsius offers 6.2% for the first 2 BTC, and then 3.51%.

Bitcoin APY on Celsius

Ethereum:

BlockFi offers 4.5% on your 15 Ethereum, 2% between 15 and 1000 ETH, and then 0.5% on any amount over that.

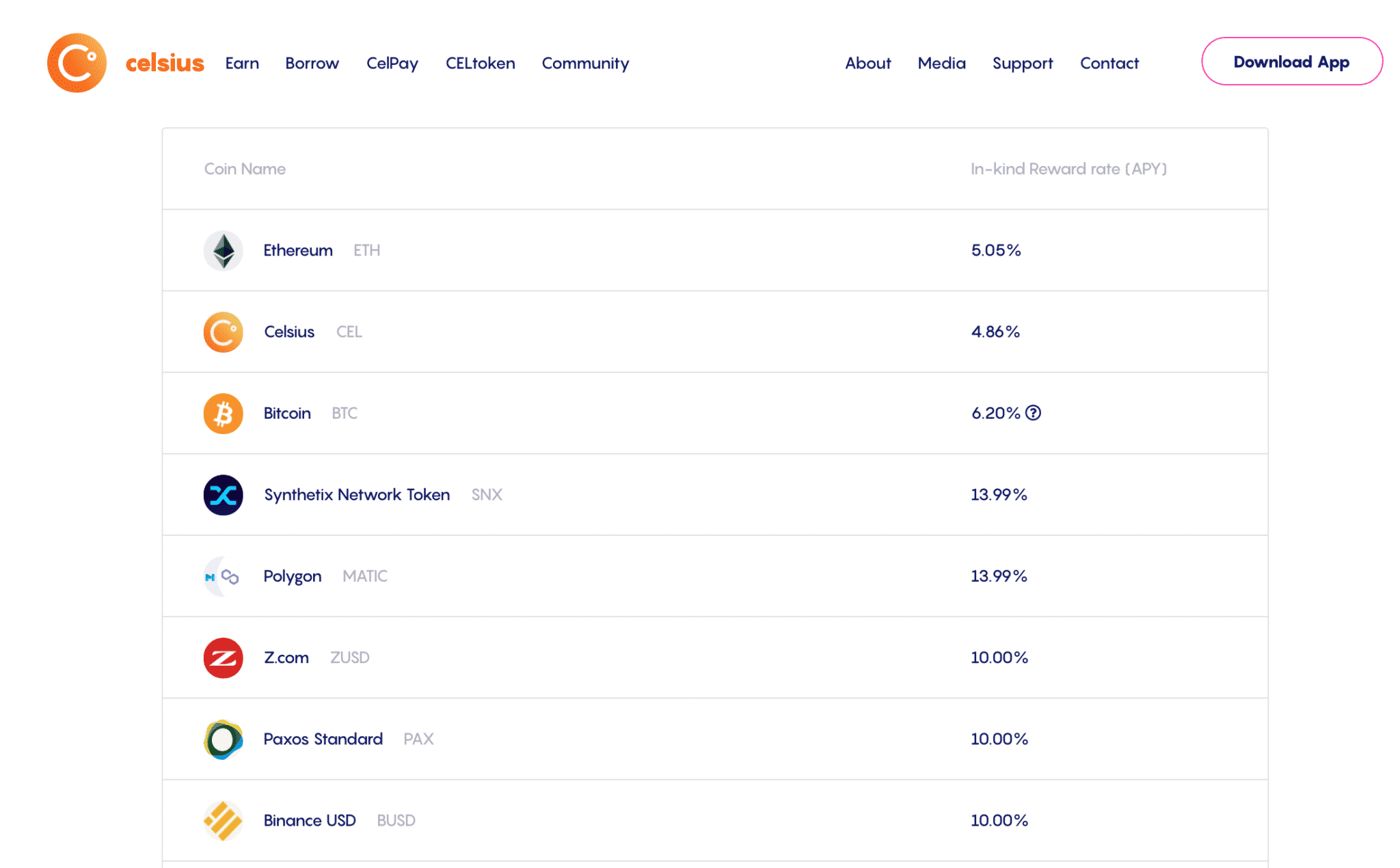

Celsius offers 5.5% for any amount of Ethereum.

Stablecoins:

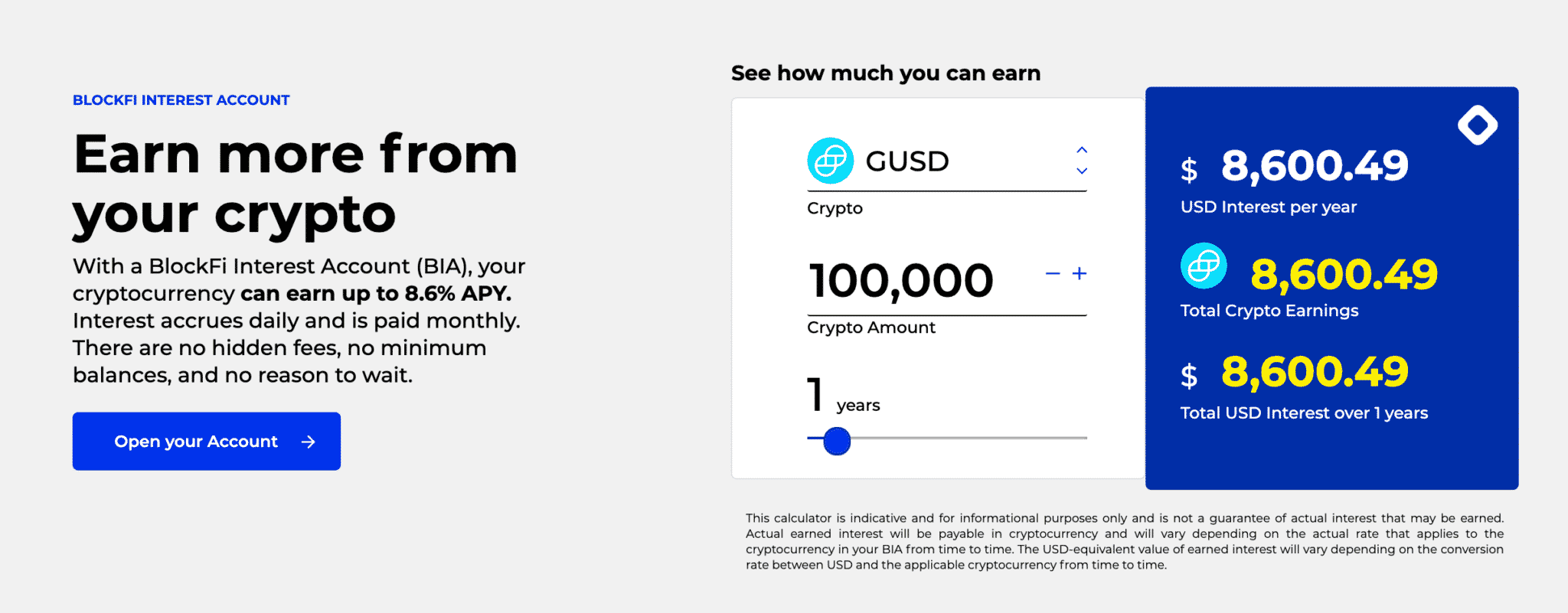

BlockFi offers a flat 8.6% on popular stablecoins like USDC and GUSD, and 9.3% on USDT.

BlockFi stablecoin interest account

Celsius offers a flat 10% on all stablecoins.

How Do BlockFi and Celsius Make Money?

Neither platform has yet to disclose a full transparent breakdown of its lending strategies, with their logic being to avoid the omnipresent threat of competitors leeching off their strategies.

BlockFi tends to be fairly conservative in risk management and credit assessments of institutional borrowers, such as Fidelity Digital Assets, a subsidiary of Fidelity Investments with more than $8.7 trillion assets under administration.

In a 2019 Celsius blog post, CEO Alex Mashinsky warned BlockFi customers that BlockFi may use venture capital funds to sustain its interest rates; if the VC money dried up, so would the potential interest rates. These words of warning carried much more weight in 2019 when BlockFi had only raised a fraction of its total funding of $508M today.

Celsius lends to cryptocurrency exchanges and hedge funds looking to borrow funds, and it distributes 80% of profits directly to holders of its native token, CEL.

However, Celsius differs in that it seems to be dipping its toes into DeFi, which is an inherently riskier (and more lucrative) strategy than simply taking over the borrowing/lending functions of a bank.

Some DeFi projects can return 30% to 100%+ per year, but there have been several instances of DeFi projects going awry, either through developmental malfunctions, rug pulls, or hacks.

The concept of a CeFi platform like Celsius entering DeFi is interesting and perhaps too chewy for the constraints of a comparison piece. The skinny– DeFi is risky and relatively more complicated than lending on a centralized platform; if Celsius can earn higher percentages (80% of which are shared with CEL holders) while minimizing loss (and fully re-enumerating any stable-penny or satoshi loss), it’s going to be very well positioned to offer higher rates.

Do you want us to explore this point deeper? Shoot us a tweet @realCoinCentral!

So, which matters more, how the cryptocurrency interest account hot dog is made, or how it tastes? We’ll leave it to you to determine which is more important, but our two satoshis is to consider all the risks involved when moving money and do your own research.

The winner:

Ultimately, if BlockFi is inherently less risky than Celsius if it is truly following a more conservative lending and yield-seeking approach. However, BlockFi’s BTC and ETH depositors may find some frustration in the frequent rate caps and limits– the company has reduced both twice in 2021 due to changing market dynamics.

Celsius offers higher rates for larger amounts and a wider selection of cryptocurrency. International users can even snag an additional 2% on stablecoins if they use the “Earn in CEL” option.

Celsius rates

If we were to separate the concept of fund safety entirely from rates, Celsius takes the cake over BlockFi, winning by an average of about 2% higher interest for every digital asset.

BlockFi’s new lower rates May 2021

Not to say Celsius is much riskier than BlockFi, but BlockFi has explicitly defended its rate cuts by advocating for its safer fund management strategies, whereas Celsius has mentioned its exploring DeFi strategies.

Feature #2: Payouts and Withdrawals

BlockFi pays out monthly, while Celsius pays out weekly.

BlockFi allows for one free cryptocurrency withdrawal per month, Celsius has unlimited free cryptocurrency withdrawals.

The winner: Celsius pays out more often and doesn’t have any withdrawal limits.

Feature #3: Security– Is BlockFi or Celsius Network Safer?

Celsius uses BitGo’s multi-signature wallets to secure user funds. BitGo has a $100M insurance policy spread over all its clients.

BlockFi uses Gemini and BitGo as its primary custodians. Both Gemini and BitGo have a private insurance on their deposits.

However, we should note that neither platform is fully protected by insurance. BlockFi, for example, revealed it has over 265,000 retail clients– $100M in insurance would cover each account up to $380.

Further, neither BlockFi nor Celsius are covered by FDIC insurance.

Celsius hinted at launching private insurance for its users, and we’ll update as soon as it is released.

There is also talk of third-party private insurance providers covering cryptocurrency interest accounts for about 2.6% of the return, but we’ve yet to experiment with any of these platforms.

The winner: Tomato, tomato (pronounce them differently in your head, please.)

Both BlockFi and Celsius use similar security precautions, and both are exposed to the same threats and risks of any company holding cryptocurrency. Since neither platform has been hacked for user funds, we’ve yet to see how either company would re-enumerate its users should one occur.

If Celsius is able to offer private insurance for its users within its platform, it would win the edge.

Feature #4: Standout Features

Celsius is mobile-only, which may be disappointing for our readers who prefer managing their cryptocurrency accounts on a desktop. BlockFi has both a mobile and web app.

Celsius’s native token CEL rewards CEL holders with a proportional share of 80% of their profits. International users can also gain an APY boost of around 2%, but this option isn’t available for U.S. users, who must “Earn in Kind.”

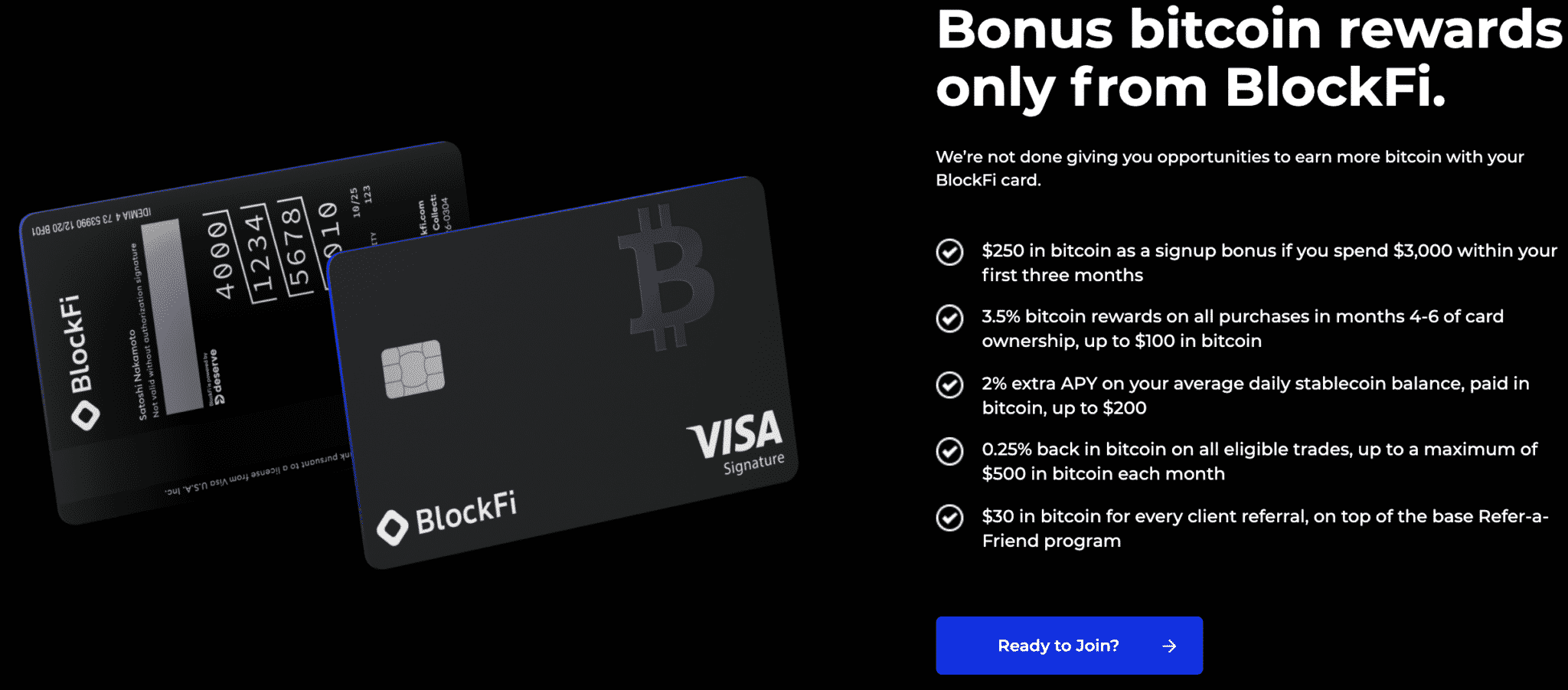

BlockFi is slowly growing its ecosystem beyond just cryptocurrency lending and borrowing. Its most notable standout feature is its upcoming BlockFi Credit Card, which gets users 1.5% back in bitcoin on all purchases.

Bonuses from BlockFi’s credit card landing page

Celsius offers competitive interest rates for a much wider variety of assets, including recent trailblazers like Synthetix, Polygon, Polkadot, Aave, and Compound.

The winner: You. Having the luxury of being able to use multiple cryptocurrency interest accounts, you can benefit from the best of both Blockfi and Celsius.

The Court of Public Opinion: BlockFi vs. Celsius Reddit

Both BlockFi and Celsius have ardent supporter bases, and outside of platform maximalism and tribalistic tendencies, the comparison between the two cryptocurrency account platforms is civil.

One popular Blockfi vs. Celsius Reddit thread on r/BlockFi captures the discourse well: many users lean towards Celsius for its higher interest rates, others prefer BlockFi’s more conservative lending and investment approaches. A strong majority advocate for using both platforms.

BlockFi and Celsius Reddit

The top-voted sentiment is to keep a diversified spread, with the most stablecoins on Celsius (if available in your state) and your other cryptocurrency you intend to hold long-term in BlockFi.

Which is the Better Cryptocurrency Interest Account, BlockFi vs. Celsius?

Celsius has a strong advantage over BlockFi in regards to interest rates, payouts, and withdrawals.

Celsius offers higher rates for its stablecoin interest account across the board, has better tiers and rates for Bitcoin and Ethereum.

The company is determined to democratize finance and to provide consistent yield and a safe store of value for the next hundreds of millions of people. It distributes 80% of its profits to its CEL token holders and has cultivated an active community of Celsius fans (over 16,000 on Telegram.)

However, the scales begin to tip to BlockFi’s favor when we consider its venture capital war chests and more conservative investing approach. Although both companies are aligned with the best interests of their stakeholders, BlockFi has over 30 notable and reputable investors it must stay accountable to. Currently in its Series D and likely on a rapid path to IPO, BlockFi must be extremely mindful of a variety of user-oriented metrics.

The winner: You (again) if you play your cards right.

Final Thoughts: BlockFi vs. Celsius? Why Not Both?

Disclaimer, this isn’t investment advice and all cryptocurrency interest accounts are risky, but here’s what one could do to get the best of both platforms.

BlockFi and Celsius both have some of the highest sign-up bonuses in the cryptocurrency account space.

Celsius’s current promotion gives you $40 for a $400 deposit.

BlockFi’s sign-up bonuses are staggered by deposit amount: as low as $25 will get you $15 in BTC, and $20,000+ gets $250.

Here’s what we would do: We’d start off by going after the free monies, because, well, it’s free.

BlockFi has a very convenient deposit by ACH option, which converts USD into GUSD (Gemini’s stablecoin) instantly without fees. You can ACH deposit directly from fiat and claim your bonus using this link, up to that $250 cap.

Next, and this may take thirty days as intro bonuses may require you to hold your deposits for 30 days, you can transfer that $400 minimum to Celsius to get that $40 bonus. Or, you can just deposit BTC, ETH, or any other asset. Try to send something with low network fees (obviously not a good play to pay $120 in ETH gas fees to make $40.)

If you are currently holding cryptocurrency and simply just want to transfer it to both platforms, that’s perfectly OK too– you’ll get your bonuses faster. Just make sure you’re double and triple-checking your sending addresses.

Once you’ve signed up for both accounts, we’d recommend diversifying your holding strategy. BlockFi’s BTC rate lowers significantly after 0.5 BTC (from 5% to 2%), whereas Celsius pays out 6.2% up to 2 BTC. We would spread our BTC (and ETH) accordingly.

However, it’s worth considering that 6% APY on BTC may be appealing enough to move your BTC onto a custodial platform, but that may be less appealing for just 2% APY. Playing your cryptocurrency interest accounts to the maximum yield and keeping any amount under than in your cold storage options is smart management.

Stablecoin interest accounts on both platforms are within 1.4% of each other. If you’re looking to earn interest on your stablecoins, we recommend spreading them out between both BlockFi and Celsius.

Ultimately, BlockFi and Celsius will continue to compete for leadership of the cryptocurrency interest account industry.

Having lowered its rates and tiers twice in a year, BlockFi seems to have conceded its attempts to compete on an APY-level with Celsius, but it still maintains a powerful value proposition as a company.

Both platforms, however, share a kinship in attempting to compete with the traditional finance industry and have been doing a great job in establishing themselves as an alternative investment vehicle in a relatively new industry.

The post BlockFi vs. Celsius Network: What’s the Better Crypto Interest Account? appeared first on CoinCentral.