The world’s best cryptocurrency interest accounts offer anywhere between 10x to up to 64x more APY than average interest-bearing accounts, making a strong case for how the cryptocurrency industry can disrupt the traditional financial services sector.

For example, BlockFi and Celsius offer around 8.6% to 11% APY on stablecoins, which digital assets pegged to the value of a dollar. Stablecoins like USDC and GUSD are designed to always (in theory) be $1 (despite a ~$0.02 fluctuation in either direction).

Ally Bank, for example, has often described itself as offering “industry-leading” rates, and currently offers 0.2% on savings deposits. In theory, one would earn more interest in just one month on BlockFi or Celsius (8.6%/12 = 0.71% per month) with a stablecoin than an entire year on Ally.

Further, cryptocurrency interest accounts also challenge other traditional investment vehicles. For example, the S&P 500 averages around 10%–11% per year (since 1926), and real estate averages around 9.4%.

So, if stablecoins can earn 43x to 55x more than their fiat counterparts in “high-yield” savings accounts, and digital assets on cryptocurrency interest accounts offer the same rates as other investment vehicles, what’s the catch? Are cryptocurrency interest accounts legit? Are they worthy of your assets?

We’re honored to be part of your due diligence on the top cryptocurrency interest account. While higher interest rates are inviting, don’t be quick to jump the gun. A cryptocurrency interest account is much riskier than fiat savings account for reasons we’ll get below.

Read along as we unpack the nitty-gritty scary and hairy questions about cryptocurrency interest accounts, the studs and duds, highest APY cryptocurrency interest accounts, and the highest sign-up (and most accessible) bonuses on platforms like:

Why is this the best darn cryptocurrency interest account review on the Internet? We’ve interviewed the founding and leadership teams of many of these companies ourselves (Alex Mashinsky, Celsius Founder in 2018 and 2020, BlockFi via a representative in 2019.)

Our community of CoinCentral Insiders have used or regularly use these platforms themselves, so we’re coming at this review from the point of view as customers ourselves. To that end, anyone in the CoinCentral community is welcome to email us or reach out on social if their experiences are contrary to what we’ve written.

So, what makes a top cryptocurrency interest account? We look at a few primary criteria:

-

- Notable investors and advisors. A company’s investors and partnerships will help navigate regulatory complexities and guide business growth.

- Leadership team. Gone are the ICO days where a cryptocurrency project’s success is detached from its leadership team. As the cryptocurrency ecosystem grows, so do the reputational stakes. Each platform should have the human firepower to accomplish its ambitious mission.

- Security measures. How safe is your money in a cryptocurrency interest account? What precautions do they take to keep your funds secure?

Before we dive into the thick of it all, let’s understand how cryptocurrency interest accounts are different from regular savings accounts.

Crypto “Savings” Accounts Vs. Regular Savings Accounts: What You Need to Know

Before you move a single Satoshi or stablecoin from your other wallets and exchanges, you need to be clear on a few aspects of cryptocurrency interest accounts.

Is a cryptocurrency interest account risky? Are cryptocurrency interest accounts FDIC insured?

Cryptocurrency interest accounts aren’t necessarily high-risk for those with moderate risk tolerance, but they are not risk-free. Although the platforms covered in this article go through extensive security protocols and have yet to experience a hack, we’d be doing our readers a disservice by not mentioning the risks, however minimal, involved with entrusting your cryptocurrency with a third-party provider.

A cryptocurrency interest account should be viewed as an investment and not a savings account. While the vast majority of bank accounts in the United States are covered up to $250,000 by FDIC (Federal Deposit Insurance Corporation) insurance, cryptocurrency accounts are not. Digital assets such as Bitcoin, Ethereum, and even fiat-pegged stablecoin deposits such as USDC, GUSD, and USDT aren’t covered by FDIC insurance.

Any loss of funds due to theft wouldn’t be covered by federal insurance. Calling them cryptocurrency savings accounts is a misnomer– they are investments and should be treated as such. Further, cryptocurrency interest accounts are relatively new innovations, and don’t have the predictability of the modern banking system, which has a history spanning over 500 years.

However, some cryptocurrency interest account platforms such as BlockFi are secured by private insurance; in BlockFi’s case, since it uses cryptocurrency exchange Gemini as its custodial service (BlockFi relies on Gemini to hold and secure its deposits), it is covered by Gemini’s private insurance pioneered to offer coverage to digital assets on Gemini’s platform. Celsius also has insurance from its custodial BitGo– it is also working to launch private insurance within its platform.

However, don’t bank on this insurance. It’s enough to cover some losses, but certainly not some catastrophic loss of funds.

Are cryptocurrency interest rates guaranteed?

In theory, no, but cryptocurrency interest rates have stayed relatively stable between 6-12%.

Do I need to only use one cryptocurrency interest account?

No. Many of these accounts offer comparable rates, some users might find value in spreading their cryptocurrency eggs over a few baskets. This diversification also helps mitigate some of the risks if an individual platform loses funds.

Many accounts also have “caps” on higher amounts of cryptocurrency, so using multiple platforms is a yield maximization strategy.

Further, many of these accounts are competing to acquire users, so there are plenty of fairly high sign-up bonuses available.

How is paying high interest on cryptocurrency deposits sustainable? How do cryptocurrency interest account companies make money?

Cryptocurrency interest account providers like BlockFi and Celsius make their money by lending user deposits, much like a traditional bank. You can also get a cryptocurrency loan from any of these providers, but our primary focus here is the interest account.

People borrow crypto for multiple reasons: get more leverage on their trades, the simplicity of a one-stop crypto loan versus the traditional loan path, and not wanting to liquidate their cryptocurrency assets, likely for tax purposes.

Can I trust a cryptocurrency interest account?

We have deemed all the cryptocurrency interest accounts on this list as trustworthy, but again, don’t invest anything you cannot afford to lose.

The Top Cryptocurrency Interest Accounts

There are a few notable leaders in the cryptocurrency interest account space.

BlockFi– The Venture Capital Darling

BlockFi – The NYC-based BlockFi was founded in 2017 by Zac Prince and Flori Marquez. The company has attracted a star-studded line of venture capital investments, raising over $508M from Valar Ventures (Peter Thiel-backed), Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Morgan Creek Digital, and more.

BlockFi offers 8.6% on stablecoins, paid monthly with no lock-up period or token requirement.

You can read our full BlockFi review here.

You can get up to $250 (starting at $25) in USDC when you open a new BlockFi account with at least $500.

Celsius – The “Power to the People” Grassroot Powerhouse

Celsius – Celsius was founded in 2017 by Alex Mashinsky (CEO), an NYC-based entrepreneur with accolades such as over $3 billion in exits and two of NYC’s top venture-backed exits since 2000. Mashinsky notes Celsius was founded on the premise of bringing 7.5B people from the traditional world of finance into the cryptocurrency sphere.

Celsius offers 10.5% APY on stablecoins, paid weekly, with no lock-up period or token requirement.

The Celsius team boasts a return of 80% of company revenue to users.

You can read our full Celsius review here.

You can earn $40 in BTC with your first transfer of $400 or more on Celsius.

Abra– The Daily Compounder

Abra – Abra allows users to earn around 10% and 4.5% interest on stablecoins and Bitcoin respectively, with as little as $5.

Best of all, it’s compounded daily.

You can read our full Abra review here.

Crypto.com– The Complicated One (But Can Be Worth It)

Crypto.com – The Hong Kong-based Crypto.com was founded in 2016, and lists four co-founders: CEO Kris Marszalek, CFO Rafael Melo, CTO Gary Or, and Head of Corporate Development Bobby Bao.

The company offers a Visa debit card, an app exchange, an instant loan product, and cryptocurrency “crypto earn” product.

Crypto.com offers the highest rates of all cryptocurrency interest accounts– 12% APY on stablecoins IF you lock your deposit up for three months, buy and stake (lock-up) 25,000 CRO (about $2,000). It’s a strong option, but we found the Crypto.com experience excessively complicated. If you wanted to go “all in” on the Crypto.com ecosystem, you would enjoy some of the highest rates, but there are many more hoops to jump through than its competitors.

Essentially, to earn close to the same rates as BlockFi or Celsius, you’d have to purchase some of Crypto.com’s dubious tokens (our dropped by 50% while writing this article, don’t say we never did nothin’ for you guys) and lock them up to achieve the highest tier of earnings.

Crypto.com’s platform can be so confusing that we’d be doing our readers a disservice by explaining it in detail in this article. You can learn more about it in our crypto.com guide, coming soon

You can get $25 USD as a signup bonus on Crypto.com

Nexo– The One You’ve Probably Seen Ads For

nexo interest account

Nexo – Nexo offers a high-yield savings account for cryptocurrency holders, and seems to cater its services to a European base of customers more than its competitors. Nexo uses BitGo as its custodian, a company backed by Goldman Sachs and is CCSS Level 3 and SOC 2 compliant. Nexo’s token, NEXO, provides holders a share of 30% of the company’s profits.

Nexo was founded in 2018 and is led by CEO Antoni Trenchev.

The site’s communications lean heavily on its lending model; optimistically, this points to the company developing a sustainable business model fueled by lending.

It has an “Earn in Nexo” option similar to Celsius’s (Earn in CEL), from which users get about a 2% boost per asset. Without the “Earn in Nexo” option, Nexo customers can earn around 10% APY on stablecoins, which is a higher return than BlockFi but lower than Celsius. Nexo also offers an XRP interest account.

The platform seems to cater its services to an international crowd, and it can be an excellent option for our readers in Europe.

You can read our Nexo review here.

Nexo currently does not offer a sign-up bonus.

Linus– Half the Trouble, Half the Rates

Linus – Linus comes in strong with a “what has your bank done for you lately” tagline.

Linus’s interest account product is unique in that it only accepts and allows withdrawals in USD, obfuscating the cryptocurrency layer for the end-user.

This is an excellent option for those that simply just to get higher interest and dip their toes into the cryptocurrency interest waters, but don’t want the complications of sending and holding crypto.

The account pays out 4% to 4.5% on USD deposits, which is still an advertised 64x that of traditional USD savings accounts.

Despite being fiat, deposits are not FDIC-insured,

Deposit $100 or more on Linus and get $20.

What is the Best Cryptocurrency Interest Account Platform?

We’ve used many of the services above for over two years, opened various customer support queries to gauge response, and interviewed founding teams. We’ve determined it’s a photo finish close tie between BlockFi and Celsius, with BlockFi just a hair ahead of Celsius. Both BlockFi and Celsius are excellent choices for a cryptocurrency interest account, and it’s not uncommon for people to have both.

Celsius offers a few features that BlockFi doesn’t.

Celsius offers weekly payouts; BlockFi only pays once per month.

Celsius is more of a grassroots endeavor: Whereas BlockFi leans heavily on its venture capital financing, Celsius raised the bulk of its capital via ICO (one of the few companies that ICO’d that actually went on to accomplish tremendous things.) It has an active Telegram community of over 17,000 people

Alex Mashinsky, Founder of Celsius, has multiple successful startup exits. This is the eighth Alex has founded, and two prior ventures, Arbinet and Transit Wireless are two of New York’s biggest venture-backed exits ever–$750M and $1.2B respectively.

A comparison between BlockFi and Celsius can go on for thousands of words, which it does on our BlockFi vs. Celsius guide.

Here’s why we think BlockFi has the edge.

Fund safety: BlockFi uses cryptocurrency exchange Gemini as its custodian. In other words, BlockFi relies on partner Gemini to keep its funds safe. Gemini has worked extensively with national regulating authorities and the more difficult NYC financial regulators. Gemini’s Digital Asset Insurance uses third-party underwriters to cover any losses due to theft or fraudulent transfers.

Company funding: BlockFi has attracted investments from many of the world’s best investors. As is typical with VC-backed FinTech companies, increasing user acquisition and reducing user churn is usually a priority. In theory, this should align BlockFi with providing a better user experience (for now) in order to showcase favorable growth rates to investors, should it consider raising subsequent rounds.

A list of BlockFi’s investors, via screenshot from its website.

User convenience: BlockFi offers both mobile and desktop apps, which puts it a hair above competitors that don’t yet have one or the other. Celsius, for example, doesn’t have a desktop app. BlockFi pays out on a monthly basis, and our experience with them has been very streamlined.

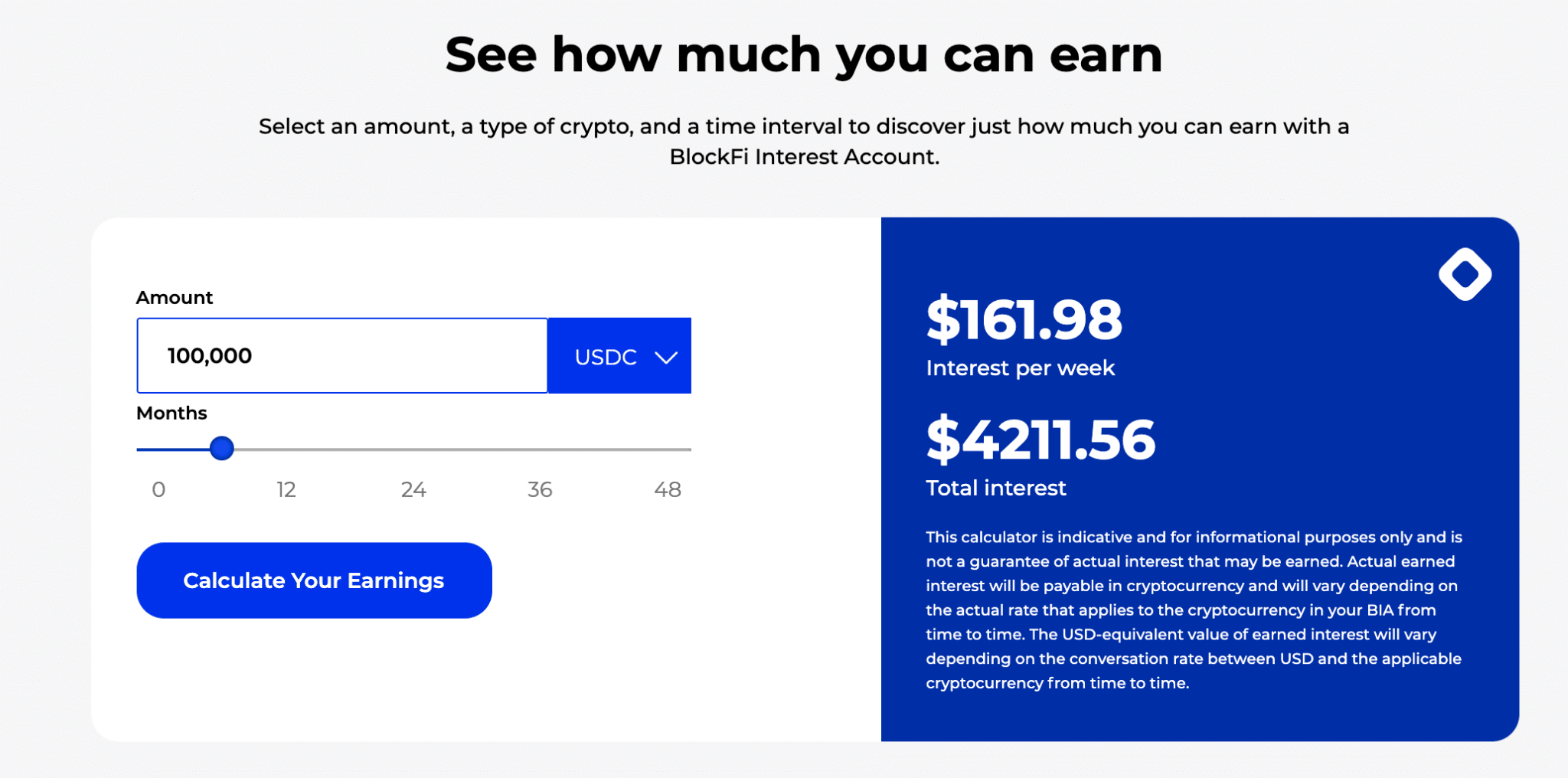

Interest calculator from BlockFi

Are Abra, Crypto.com, Nexo, and Linus Still Good Crypto Interest Options?

The rest of the lot are still decent options for a cryptocurrency interest account, otherwise, they wouldn’t have made this list.

Abra offers daily compounded interest, which is unique in the space. With 10% interest on stablecoin deposits and a very intuitive interface, it’s a strong choice for anyone looking to start earning interest on their cryptocurrency.

Linus offers 4% to 4.5% on USD deposits, and only allows the deposit and withdrawal in USD. For our readers that are a bit hesitant to enter the cryptocurrency industry but want to reap some of the benefit, Linus is an excellent option. However, it isn’t risk-free– its deposits are not FDIC insured.

The business model is unique: users deposit dollars into Linus, Linus exchanges them for various cryptocurrency assets to lend out, and when users want to withdraw, Linus converts crypto back into fiat. All the end-user sees is USD, whereas Linus takes care of the fiat-crypto exchanges. This convenience comes at about a 4.6% – 6% less return than other competitors, but may be a fit for a particular set of customers that prefer this feature.

What is the highest APY cryptocurrency interest account?

The highest APY cryptocurrency interest account is crypto.com… but there’s a catch, as we’ve outlined above and in detail in our Crypto.com guide.

The Top Cryptocurrency Interest Account Promotions

The following crypto interest account promotions are active, but subject to change. We’ll do our best to keep these updated, but get them while they’re hot if you want them.

Celsius: Sign up and earn $35 in BTC with your first transfer of $400 or more!

Crypto.com: Sign up and get $25 USD to sign up for Crypto.com. You may have to stake 2500 CRO (about $200)– the promotion isn’t clear.

Linus: Sign up and deposit $100 or more and get $20.

Final Thoughts – Are Cryptocurrency Interest Accounts Worth It?

If you’re someone looking to diversify your portfolio by buying and holding cryptocurrency, we strongly recommend checking out cryptocurrency interest accounts for yourself.

We urge our readers to always do their own research. Have this conversation with a financial advisor, and feel free to send them this article as a basis for the discussion. Cryptocurrency interest accounts like BlockFi and Celsius are actually investments and the returns are not guaranteed. Our content is purely intended to be educational and informational. A single dollar or satoshi shouldn’t leave your wallets without professional advice.

That being said, we’re a fairly paranoid editorial team that acknowledges the “be your own bank” and “not your private keys, not your bitcoin” ethos of the cryptocurrency industry.

The world’s best crypto interest accounts try to cater to user security, but at the end of the day, any time your funds leave your hardware wallets, you’re in the hands of the digital world. The risk is yours, and yours only, to make.

Before we let you go, let’s leave on this idea: if more digital asset holders are comfortable keeping their funds on a cryptocurrency interest platform, placated by relatively low-risk decent returns, volatility may decrease in the long run.

With digital assets like Bitcoin seen as less volatile due to fewer people selling Bitcoin, the case for institutional capital to enter the ecosystem becomes much stronger.

We believe cryptocurrency interest accounts are a small, but very important part, of maturing cryptocurrency as an asset class.

To better understand why cryptocurrency interest accounts are important, versus simply just knowing the best ones, we recommend reading our interview with Celsius Founder, Alex Mashinsky, exclusive on CoinCentral.

The post Top Cryptocurrency Interest Accounts 2021: Best Rates, Security, and Promos appeared first on CoinCentral.