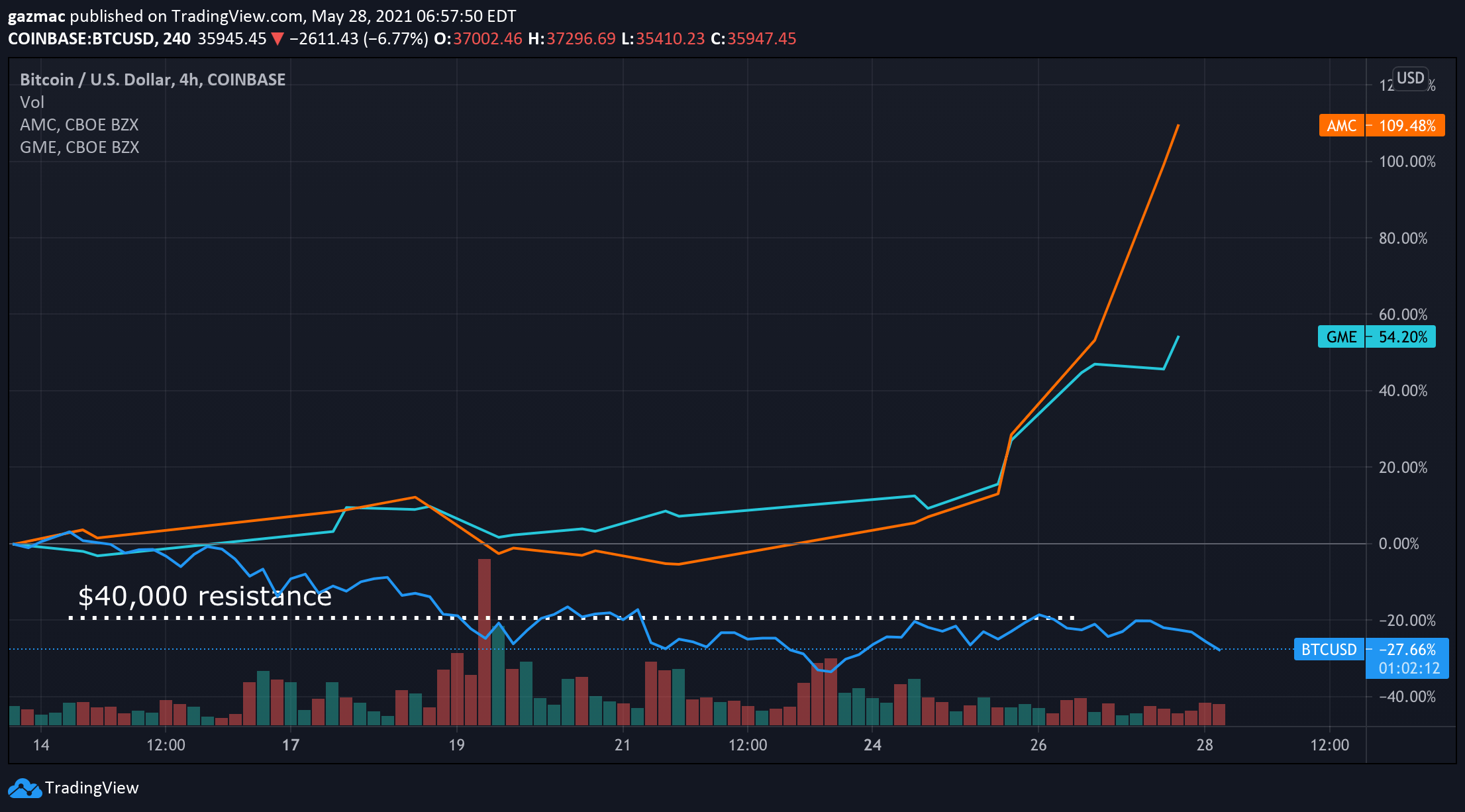

Meme stocks and crypto increasingly appear to be connected at the hip. And as the weekend approaches it looks like we can be sure of one thing – the price of crypto assets will fall. In fact the hyper volatility has already started, with bitcoin recoiling from the $40,000 hit just two days ago to currently trade at $36,000.

The correlation between crypto and the stock market has one that has been hotly debated. Back in the day it was the negative correlation that was seen as an enviable property of bitcoin, making it the ideal diversifier in a stock-heavy investment portfolio.

By the direction of travel and the focus of discussion has shifted now, to ponder on the positive correlation between crypto with at least certain sections of the stock market.

How bitcoin correlates with the S&P 500

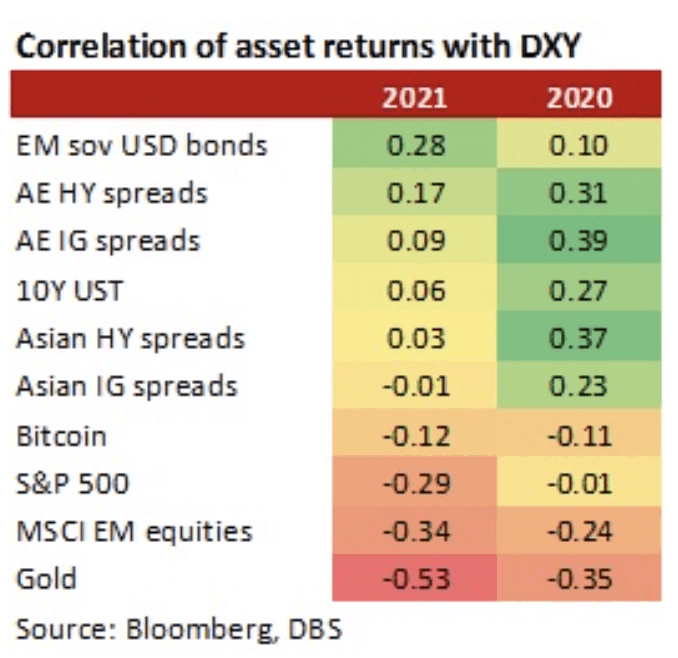

A report from DBS earlier this week drew out the data on the correlation between crypto and US stocks, albeit not hugely strong. But when certain sectors are considered, namely tech stocks, the correlations are more notable.

As far as bitcoin and the S&P 500 goes, here’s the most striking finding: “Our correlation analysis finds that Bitcoin and the S&P 500 shows a heightened positive correlation of 0.26 in the aftermath of an extreme move, as compared to just 0.19 under normal conditions. This suggests that broader equity sentiment could become more coupled with sentiment in Bitcoin markets for a temporary period of time (60h), post an unusually large move.”

In other words, when the crypto market goes into volatility overdrive, the bleed over into the S&P 500 becomes more marked, as shown in the table below – there’s a 0.26 positive correlation after extreme moves:

And for context here’s how bitcoin correlates with the US Dollar Index (DXY – dollar measured against a basket of the other top six internationally traded currencies:

As can be seen, the bitcoin correlation with the DXY is negative (-0.12), which is what we would expect to see if it is performing as ‘digital gold’ should – gold (-0.53) is even more negatively correlated with the DXY

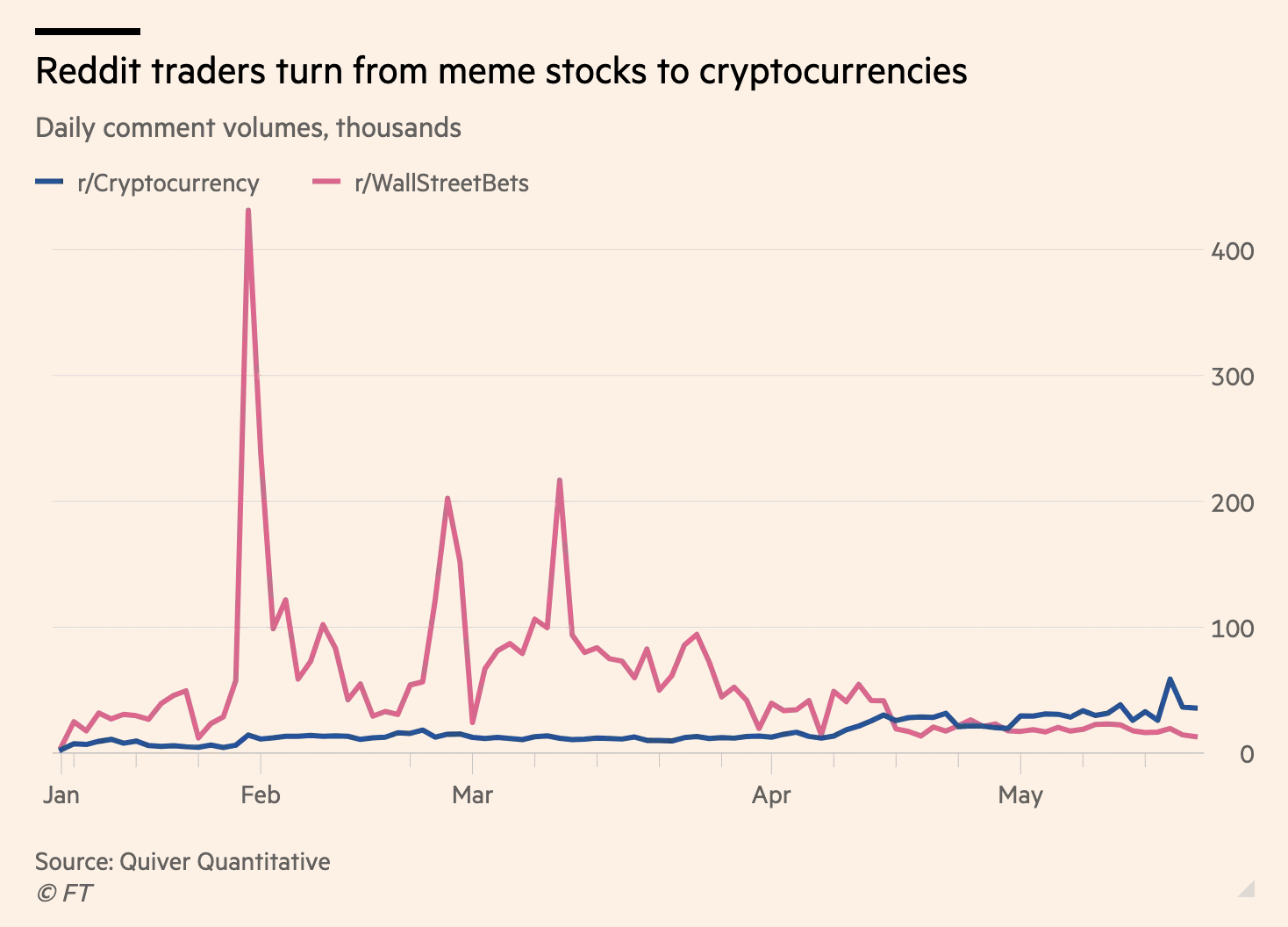

And when we look at meme stocks there are patterns that if not showing up in the correlation data are certainly evidenced in the musings of Redditors on WallStreetBets and the two main crypto subs: r/Bitcoin and r/Cryptocurrency.

Data from Quiver Quantitative for the first three weeks of May (1 May to 21 May) shows that comment volume rose 82% while for the same period comments on r/WallStreetBets dropped 42%

Meme stocks, the reddit effect and the crypto crash

Data from the research group Quiver shows that comment volumes on the social media site’s r/Cryptocurrency forum rose 82 per cent from May 1 to May 21, with almost 36,000 daily comments on Friday at the end of a volatile week for bitcoin and other digital currencies.

By contrast, the number of comments on r/WallStreetBets dipped 42 per cent over the same period, with just 13,000 on May 21.

The Financial Times ran a story based on this data, pointing to the rising prominence of the crypto “narratives” as against fading interest in meme stocks such as GameStop. Of course underlining the crypto narrative is its famed volatility and the gigantic returns to be made (and lost – although data from Glassnode shows that 76% of bitcoin holders are in the profit).

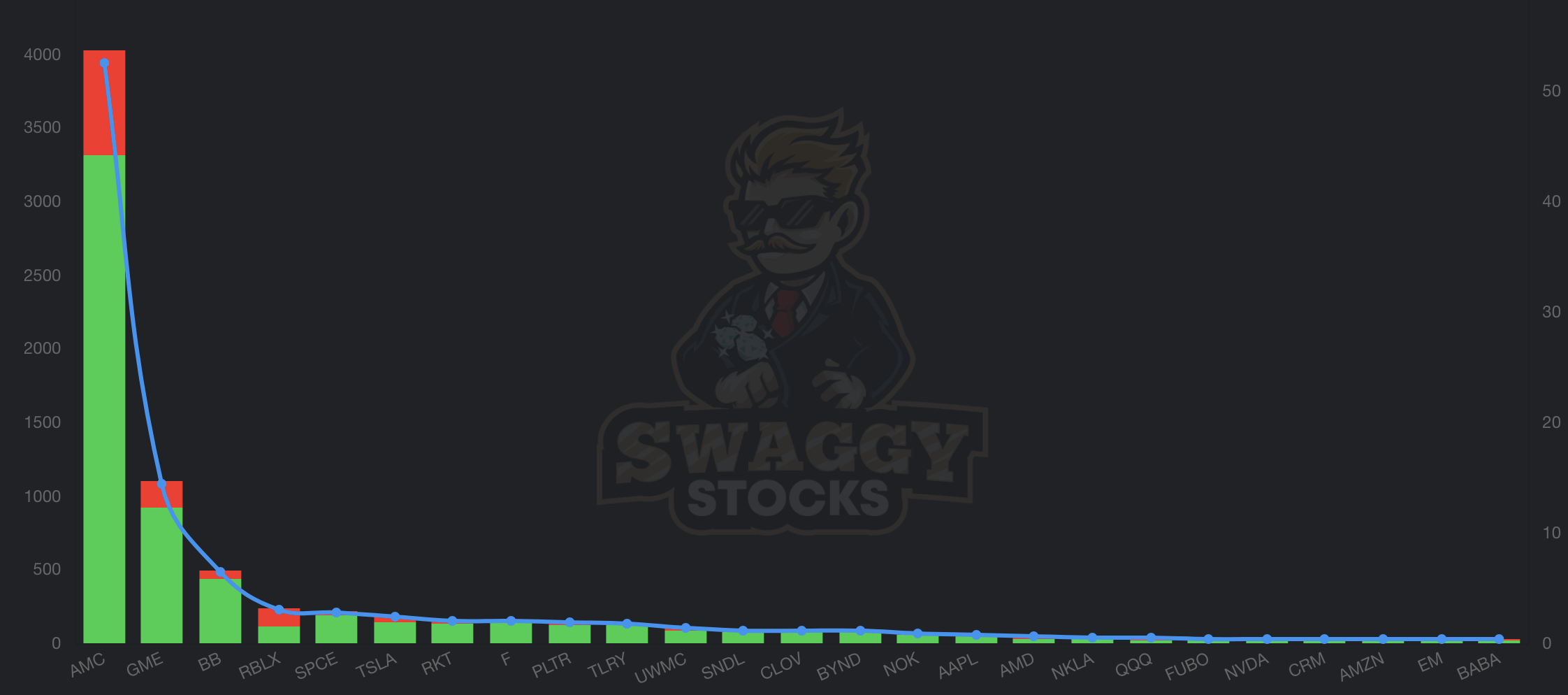

But since the 21 May a new juxtaposition has emerged, that perhaps is the exception that proves the rule (the rule being that there are growing tendrils connecting crypto and equities). This week meme stocks have had something of a breakout moment after weeks of treading water when compared against the parabolic gains and the popping of the “irrational exuberance” as short squeeze successes turned sour.

AMC, GME and BB tickers are back in vogue, with some new additions like RBLX and old flames such SPCE.

See below the top 2 meme stocks on the 4-hour chart compared to the bitcoin price:

So during May crypto was taking a lot of the air out of the meme stocks, as one analysts speaking to the FT describes.

“Investors still love a meme stock. Crypto was a purer expression of meme trading. It took a lot of steam out of stock and options speculation,” said Steve Sosnick, chief strategist at Interactive Brokers.

However, things have changed this past week, as bitcoin and top altcoins pull back sharply (meme coins like Dogecoin and Shiba Inu being the most exposed to brutal waves of selling) as we go into the weekend, while meme stocks again have their days in the sun.

Although reddit can be pivotal, it is the wider social media sentiment complex that is both reflecting and driving trading interest simultaneously, across meme stocks and crypto.

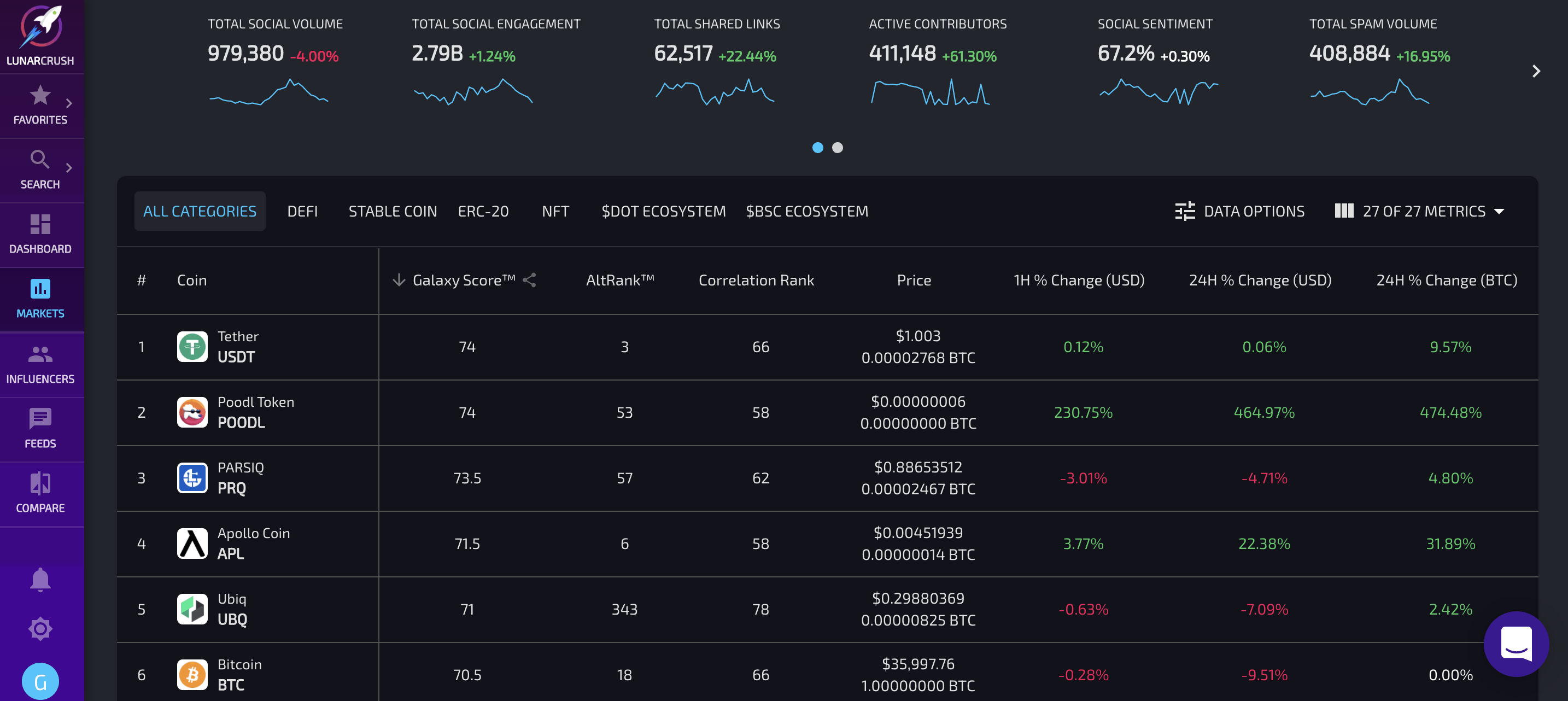

One of my favourite sites is LunarCrush, which users machine learning and natural language processing AI to generate its composite score that gauges social engagement – what it calls its Galaxy Score.

Is crypto a leading indicator for meme stocks?

To add another twist to the possible meanings of the interconnectedness between crypto and stocks, resting as it does in the demographic cross over of younger investors with a foot in both the meme stock camp and the crypto camp, is to ask the question, to what extent will either begin to act as a leading indicator for price movements in the other.

Today in the US after-hours market, StockTwits shows AMC up 19% and GME 3%, although that may quickly reverse as the latest crypto pullback’s effects weigh on the portfolios of those also present in the meme stock market.

Meanwhile, as the crypto rout deepens it suggests strong negative sentiment going into the weekend, when all eyes fall on crypto as the only asset to truly trade 24/7, unlike stocks.

For the pure trader who has no fundamental (or sentimental) attraction to a particular crypto asset, the huge price swings are mana from heaven. Get you call and put options ready.

Get Free Crypto Signals – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis