Bitcoin Price Prediction: Trading is Rangebound– June 2

The $40,000 to $35,000 level has been the major zone where Bitcoin versus the US Dollar trading is rangebound. The crypto’s price as of writing is at around $36,680, a 24-hour increase of 0.62%.

Trades in Ranges: BTC Market

Key Levels:

Resistance levels: $40,000, $45,000, $50,000

Support levels: $30,000, $25,000, $20,000

BTC/USD – Daily Chart

The BTC/USD daily chart now shows that the crypto market trades in a range of around $40,000 to $35,000. Previous moves lower have seen the price quickly bounce off support.

As in the previous sessions, the bearish trend-line remains drawn across the SMAs from the top, as the 50-day SMA indicator is intercepted by the 14-day SMA trend-line.

The Stochastic Oscillators are in the overbought region, seemingly trying to close the hairs a bit above range 80. And that could, at a later session, turn into a dynamic consolidation sign to indicate that the downward pressure isn’t fully exhausted.

Bitcoin price prediction: How long will rangebound trading last?

Considering the technical reading of what the Stochastic Oscillators are now signalling, coupled with the current BTC/USD rangebound trading, the downward pressure is not getting weaker, especially given that bulls have been finding the main resistance of $40,000 difficult to breach over the past couple of sessions. In that respect, decent buy orders would now have to feature at a lower value of around $35,000.

As regards the downsizing movement of the crypto’s valuation, continual pressure has to be mounted at the higher range level of $40,000. However, breaking out of that point is crucial in determining an end to the recent bearish forces that the market has faced.

Bitcoin’s proximity to the $35,000 level means a further breach to the downside could look for support around the $30,000 level.

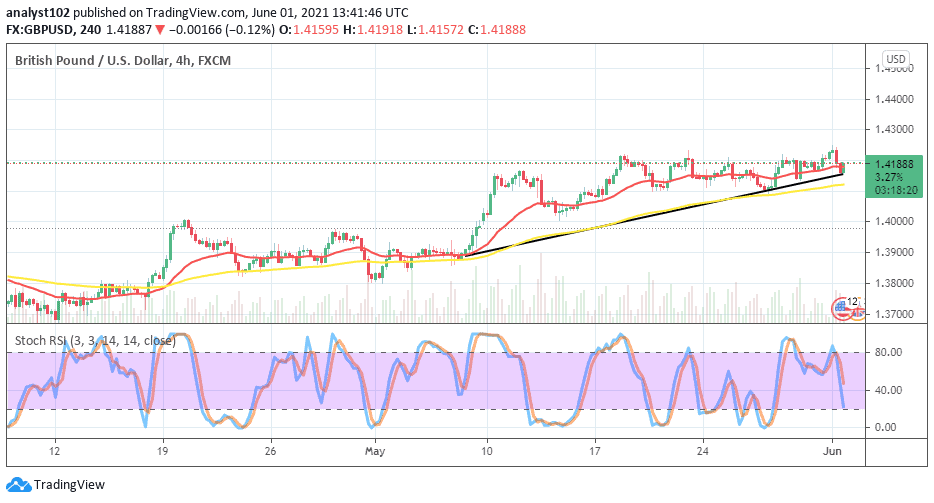

BTC/USD 4-hour Chart

After a notable downward trend in the medium-term run of the BTC/USD market operations, the crypto’s value now trades in a range around the smaller SMA from around May 24 until the present. The 50-day SMA indicator is located over the 14-day SMA trend-line.

Additionally, the bearish trend-line is drawn down to touch the smaller SMA from above to locate the current trading level of the crypto’s price. The Stochastic Oscillators have positioned between the overbought region and range 40 trying to cross the hairs toward range 80 probably to suggest the possibility of an upswing returning in no time.

All in all, the market resistance level of $40,000 would have to be the most important trading zone determining the change of the market direction between Bitcoin and the US fiat currency.

Looking to buy or trade Bitcoin (BTC) now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider