Cryptocurrency interest accounts make it possible to earn relatively passive income on digital assets like Bitcoin, Ethereum, and stablecoins like USDC and GUSD, and BlockFi vs. Coinbase is a frequent point of comparison.

BlockFi is regarded as a staple in the cryptocurrency interest account industry, whereas Coinbase boasts perhaps the loudest and strongest reputation of the cryptocurrency exchanges.

Both platforms dabble in what the other specializes in– BlockFi offers the buying & selling of cryptocurrency, whereas Coinbase offers some modest interest-generating options for digital assets.

All things considered, which platform is better specifically for your cryptocurrency interest account needs? The following BlockFi vs. Coinbase comparison review will cover interest rates, payouts, and security.

By the end of it, you’ll better understand BlockFi and Coinbase as companies, the cryptocurrency interest account niche, and which options may or may not be right for you.

For a full individual breakdown, check out our BlockFi review, Coinbase review, and an overview of the best cryptocurrency interest accounts.

|

Reviews |

||

|

Site Type |

Cryptocurrency Interest Account + Basic Exchange |

Cryptocurrency Exchange + Basic Crypto Interest Account |

|

Beginner Friendly? |

Yes |

Yes |

|

Mobile App? |

Yes |

Yes |

|

Buy/Deposit Methods |

ACH, Wire Transfers, Crypto Deposits |

Credit Card, Debit Card, Bank Transfer, Crypto Deposits |

|

Sell/Withdrawal Methods |

External Crypto Wallet, Bank Account |

PayPal, Bank Transfer, Withdrawal to External Crypto Wallet |

|

Available Cryptocurrencies |

Bitcoin, Ethereum, Litecoin, Link + Stablecoins |

Bitcoin, Ethereum, Litecoin, and 58 more |

|

Company Launch |

2017 |

2012 |

|

Website |

Companies Bios: How Do BlockFi and Coinbase Compare?

Coinbase was founded in 2012 by Brian Armstrong and Fred Ehrsam. The company is based in San Francisco, CA, and is the most popular cryptocurrency exchange in the United States; it has about 56 million registered users and has over $200 billion assets under management.

It recently IPOd on the New York Stock Exchange and has about a $45 billion market cap, trading under $COIN.

BlockFi was founded by Zac Prince and Flori Marquez in 2017. The company received seed investments from ConsenSys Ventures and SoFi in 2018. BlockFi was valued at $3 billion during its last round of funding, which was completed in March 2021.

BlockFi has around 225,000 users and roughly $15 billion in assets under management. Plenty of notable names have invested in the company, such as:

- Winklevoss Capital

- Bain Capital Ventures

- Pomp Investments

- Tiger Global

- CMT Digital

- Kenetic Capital

Feature #1: Crypto Interest Rates: BlockFi vs Coinbase APY?

Let’s preface this section with a caveat and spoiler– BlockFi blows Coinbase out of the water for most APY because it was specifically created to be a cryptocurrency lending and borrowing platform. Coinbase started as an exchange, but seems to be increasingly warm, but has yet to confirm, to the idea of launching its own cryptocurrency interest account product. We will update this section as necessary in the future.

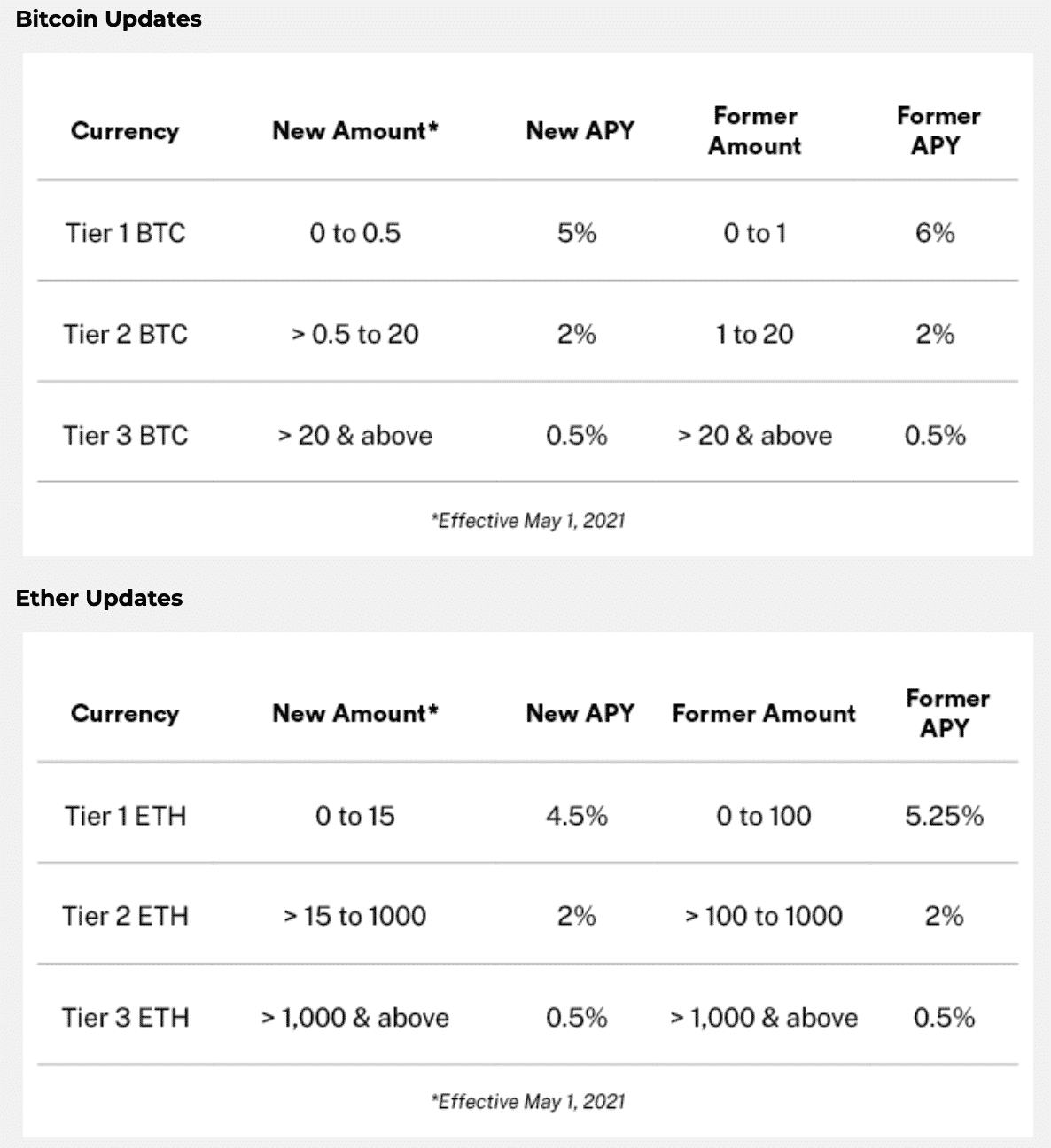

Bitcoin

BlockFi uses a tiered interest system for bitcoin. Users with between 0 and 0.5 BTC earn 5% APY. Those who have between 0.5 and 20 BTC earn 2% APY. And those with more than 20 BTC earn 0.5% APY.

BlockFi’s rates June 2021

Coinbase doesn’t offer any interest for BTC stored on its platform as of the time of writing.

Ethereum

BlockFi offers 4.5% APY for a user’s first 15 ETH, 2% on a user’s first 1,000 ETH, and 0.5% APY on anything beyond 1,000 ETH.

Coinbase offers ETH2 staking with an interest rate of 6% APY. However, this requires users to lock their ETH into a smart contract. Users can’t access any ETH deposited into this contract until ETH moves to its Proof of Stake model and the smart contract ends or Coinbase adds functionality to the contract that allows users to trade staked ETH for other assets.

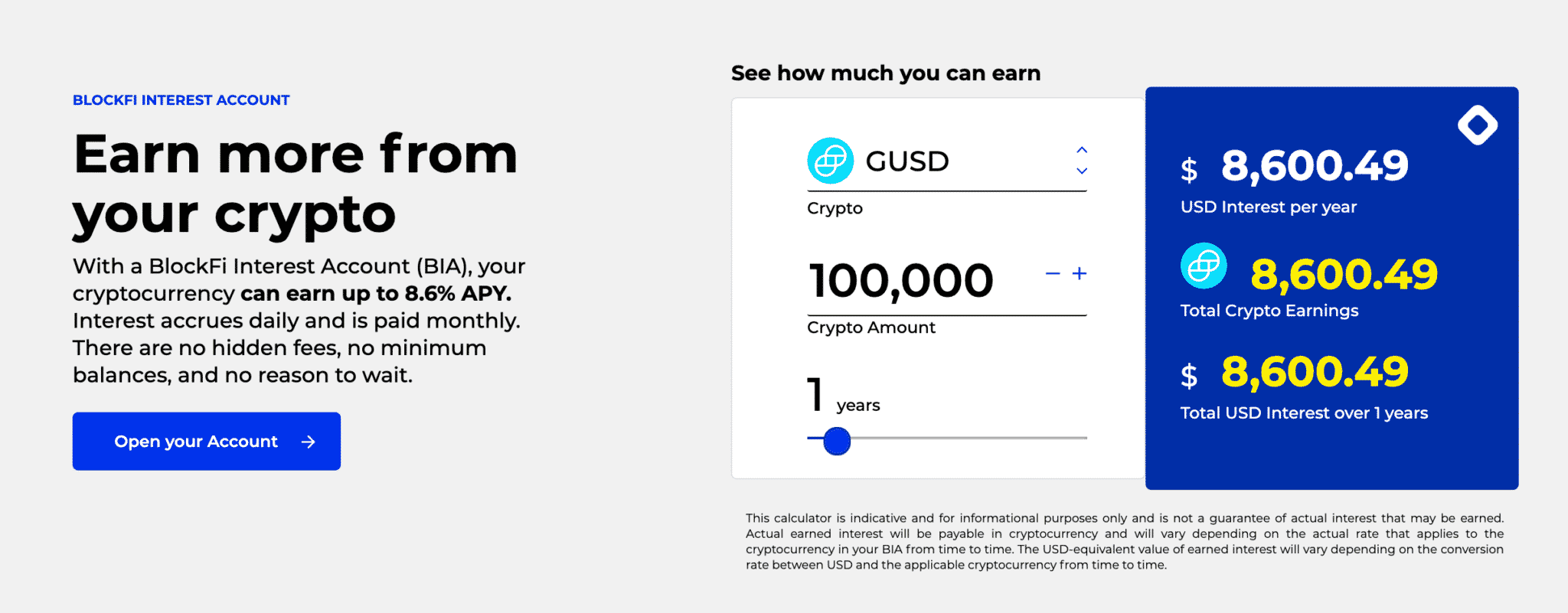

Stable Coins

BlockFi offers 8.6% APY on USDC, GUSD, PAX, and BUSD, and 9.3% APY on USDT.

Coinbase is actually the creator of the stablecoin USDC, but it only offers 0.15% on USDC. *sad trumpet sound*

Alt Coins

BlockFi offers 5.5% APY on LTC and 4.5% on LINK.

Coinbase offers staking for Cosmos and Tezos. The rate for these varies but can be as high as 7.5% APY.

How Do BlockFi and Coinbase Make Money?

BlockFi makes its money by borrowing funds for less than it lends them out.

For example, a BlockFi user can earn a maximum of 5% APY on Bitcoin that they deposit to the platform, but the company charges users around 9.75% for a USD loan.

BlockFi is a cryptocurrency lending platform– think of it kind of like a traditional bank. BlockFi’s loans are secured by the cryptocurrency that users have deposited to the platform. It’s typically necessary to maintain a 50% loan-to-value (LTV) ratio to keep a loan in good standing. For example, if you take out a loan of $10,000 with BlockFi, you need to keep at least $20,000 in crypto on the platform to maintain a 50% LTV ratio.

The risk here is that a sudden drop in crypto prices could cause the LTV ratio to drop below 50%, and you would have to deposit more crypto to return the loan to good standing. If you can’t do that, the company will liquidate your crypto at a time when the market is low, which could be an inconvenient loss for your cryptocurrency holdings.

Coinbase is an exchange, and it primarily makes its money by charging transaction fees whenever users buy, sell, or trade cryptocurrency in its platform.

To get a better idea of how Coinbase makes money, we recommend browsing its SEC Form S-1, a document required of companies seeking to be listed on a national exchange via IPO. This document alone provides a wealth of information on how Coinbase runs as a business. BlockFi, on the other hand, is privately held and its revenue streams are more opaque.

Feature #2: BlockFi vs. Coinbase Payouts and Withdrawals

Interest on BlockFi accrues daily and is paid out monthly. The company provides one free crypto and one free, stable coin withdrawal per month. It charges fees for each subsequent withdrawal in the same month.

Coinbase’s staking services accrue interest daily. However, customers need to wait an initial period of 35 to 40 days before withdrawing any of that interest. After that period is over, a user can make withdrawals every three days.

Feature #3: Security: BlockFi vs. Coinbase

95% of BlockFi’s funds are held in cold storage by its parent company, The Gemini Trust Company, which is regulated by the New York Department of Financial Services. The Gemini Trust Company also recently received recognition from Deloitte for its solid crypto storage practices.

Coinbase stores about 98% of its customers’ assets in cold storage as well. BlockFi provides FDIC insurance for any USD funds up to $250,000, a federal protection offered to the vast majority of banks that hold U.S. Dollars.

However, neither BlockFi nor Coinbase offer FDIC insurance on their cryptocurrency assets, which is what you would have to deposit in order to utilize their interest accounts. While both platforms go to great lengths to protect user funds, your deposits are not guaranteed or protected by federal insurance.

Users must be very mindful of their own security while using these platforms. A hacker with your log-in information can use it to access your account and potentially withdraw your funds. Since this is crypto we’re dealing with, transactions are generally irreversible.

However, BlockFi and Coinbase do offer additional measures to prevent this from happening, such as 2-factor authentication. 2FA is a standard second layer of protection; it requires users to submit a confirmation code from either a text message or an authentication app before any logging in or withdrawals can take place.

BlockFi also enables you to “whitelist” certain cryptocurrency addresses, meaning your cryptocurrency can only be sent to those addresses and no others, unless you go through an extensive process of adding a new address and identifying yourself.

Coinbase offers a vault feature where users can store cryptocurrency they don’t plan on trading in “vaults”. Cryptocurrency placed in a vault can’t be removed for 72 hours after a withdrawal is initiated. This gives users time to respond to an unauthorized withdrawal request and secure their funds if one were to take place.

Feature #4: Ease of Use

Both BlockFi and Coinbase are easy enough for a beginner to use. The platforms are straightforward and don’t require any specialized crypto knowledge to the vast majority of value.

Each service also has a mobile app, which enables users to check on their accounts while on the go.

BlockFi stablecoin interest account

Both platforms allow for the depositing of fiat.

BlockFi will require any fiat deposits to be automatically converted into GUSD, which immediately begins accruing interest at 8.6% APY per year. There is no fee for this service. Users can ACH deposit directly from fiat and claim up to a $250 bonus using this link.

Coinbase allows you to deposit fiat, with which you can directly buy USDC with no fee. Bitcoin, Ethereum, and other cryptocurrency can be purchased with a transaction fee. Pro tip: use Coinbase Pro (formerly known as GDAX) if you do want to buy other cryptocurrencies– simply make an account on Coinbase, deposit fiat, make an account on Coinbase Pro (it’s free), transfer the fiat, and buy a wider variety of crypto for much lower fees.

Feature #5: Standout Features

BlockFi’s standout feature is its upcoming cryptocurrency credit card. It has yet to be released, but the card will get users 1.5% back, paid in bitcoin, on all purchases.

Coinbase’s standout feature is its companion service Coinbase Pro, which is intended for more experienced cryptocurrency traders. It offers lower fees on trades and gives users access to extra cryptocurrency tokens.

The Court of Public Opinion: BlockFi vs. Coinbase Reddit

People on Reddit tend to see BlockFi and Coinbase as complementary services rather than direct competitors.

It’s true that BlockFi operates an exchange, but it only allows users to buy a small handful of cryptocurrencies and stablecoins. BlockFi’s primary purpose is to enable users to earn interest on cryptocurrency and to borrow USD against their digital assets.

Coinbase, on the other hand, is primarily a platform that people use to purchase cryptocurrency. It offers some staking opportunities but doesn’t provide enough interest for Bitcoin or stablecoins to compete with a platform like BlockFi– yet, at least.

Many people have gone to Reddit for advice about whether they should use Coinbase or BlockFi. Most of the responses suggest that the person buys crypto on Coinbase and then transfers it to their BlockFi account if they don’t plan on selling it or trading it anytime soon.

Customer Support

BlockFi has an online FAQ page, an AI-powered chatbot, and live phone support from 9:30 AM – 5 PM ET Monday through Friday.

Coinbase also has an online FAQ page. However, the company doesn’t currently offer live phone support. Instead, it gives users the option to submit an email request when they need help with something.

Can You Trust BlockFi and Coinbase?

BlockFi and Coinbase are two of the most trusted names in the cryptocurrency industry.

Both have significant rosters of renowned venture capital firms, and Coinbase is the first cryptocurrency unicorn (value over $1B) to IPO.

BlockFi’s security practices have earned it a stamp of approval from Deloitte and the New York Department of Financial Services.

Coinbase offers users up to $250,000 in FDIC insurance on any USD funds that they store on the platform. The company also says that it holds less than 2% of its customers’ funds online with the rest being placed in cold storage.

Coinbase says that it maintains insurance for the cryptocurrency that it holds online as well. So basically the company will either hold your cryptocurrency in an offline wallet where online hackers will have an incredibly difficult time reaching it or your cryptocurrency will be held online and insured. This makes Coinbase very trustworthy.

BlockFi vs. Coinbase: Which is the Better Crypto Interest Account?

BlockFi is a better cryptocurrency interest account platform than Coinbase; It offers much higher interest on Bitcoin, Ethereum, stablecoins like USDC and GUSD, and a variety of altcoins.

To be fair, Coinbase isn’t really a cryptocurrency lending or interest account platform, which is why BlockFi is basically a full head and shoulders better for this specific use case. Coinbase simply has some features that allow depositors to earn a bit of passive income on their deposits.

We’d speculate that offering higher interest rates on cryptocurrency isn’t too distant in Coinbase’s future, but that is just our educated, but wild guess. To Coinbase’s credit, it’s a much more robust trading platform than BlockFi– it has a wider variety of cryptocurrencies and industry-leading security practices.

Most people will benefit from using both Coinbase and BlockFi rather than just one or the other– Coinbase Pro to buy the cryptocurrency (as described above) and then BlocKFi for its interest account.

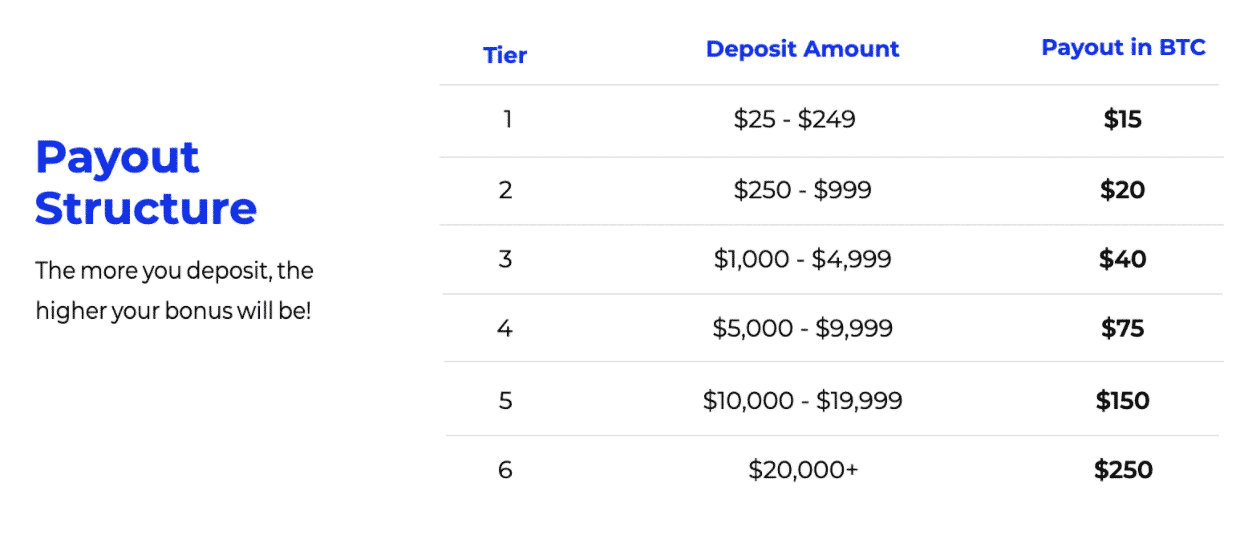

BlockFi and Coinbase have sign-up bonuses:

- BlockFi’s sign-up bonuses are staggered by deposit amount: as low as $25 will get you $15 in BTC, and $20,000+ gets $250.

- Coinbase offers a flat $10 when you buy or sell $100 on the platform.

BlockFI’s BIA signup incentives (source: BlockFi)

The post BlockFi vs. Coinbase: Who Has the Best Crypto Interest Account? appeared first on CoinCentral.