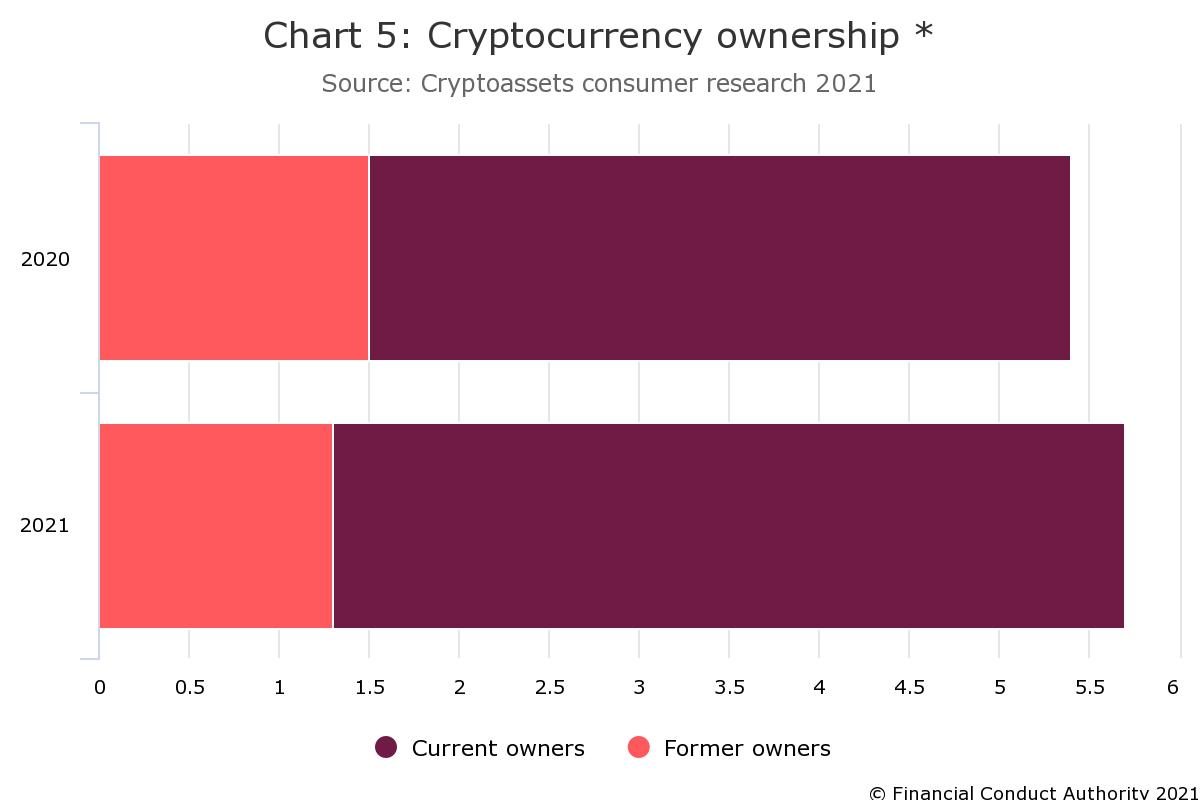

The UK’s Financial Conduct Authority (FCA) has published a research report that reveals crypto asset ownership has increased a great deal. According to the study, crypto ownership spiked more than 27% since last year as the FCA’s estimates show 2.3 million adults hold digital currencies, up from 1.9 million in 2020.

United Kingdom’s Regulator Publishes 2021 Crypto Consumer Report

The financial regulatory body in the United Kingdom that oversees 58,000 financial services firms and financial markets has published a report that covers the crypto asset economy.

Not only does it show crypto ownership has increased a great deal since last year, but the study also shows people consider digital currencies an “alternative to mainstream investments.”

The consumer research notes that attitudes toward cryptocurrencies have changed. “38% of crypto users regard them as a gamble (down from 47% last year),” the FCA report discloses.

“By contrast, the level of overall understanding of cryptocurrencies is declining, suggesting that some people who have heard of crypto may not fully understand, with only 71% correctly identified the definition of cryptocurrency from a list of statements,” the FCA says.

“Enthusiasm for [crypto assets] is growing with over half of crypto users saying they have had a positive experience so far and are likely to buy more (rising from 41% to 53%). Fewer people also regret having bought cryptocurrencies, down from 15% to 11%,” the FCA report adds.

In a note to Bitcoin.com News, the UK regional manager and head of business development at Etoro, Dan Moczulski, said the FCA’s report “paints an interesting picture of developments in the crypto asset market in the UK in the last year.” Moczulski further stated:

It shows a significant increase in the number of people using and investing in crypto, plus a wider awareness among the public. That there are now 2.3 million active crypto asset investors in the UK, [which] makes the asset class comparable in number of participants to active share traders – a not insignificant landmark. There are some really exciting opportunities in crypto, with a host of investable coins. These numbers show it has gone truly mainstream in the UK.

43% Discouraged from Buying Crypto, 12% Believe They Are Protected by the UK’s Consumer Protections

The research compiled by the FCA is the regulator’s fourth consumer research publication on crypto asset ownership. 1 in 10 people who have heard of cryptocurrency assets are also aware of some of the consumer warnings the FCA publishes from time to time.

“43% said they were discouraged from buying crypto. Most consumers recognise that crypto investments are not protected, although 12% of crypto users believe otherwise,” the FCA’s fourth consumer research study details.

“The research highlights increased interest in [crypto assets] among UK customers. The market has continued to grow, and some investors have benefitted as prices have risen,” Sheldon Mills, FCA’s executive director of consumers and competition said.

“However it is important for customers to understand that because these products are largely unregulated that if something goes wrong they are unlikely to have access to the FSCS or the Financial Ombudsman Service. If consumers invest in these types of products, they should be prepared to lose all their money,” Mills added.

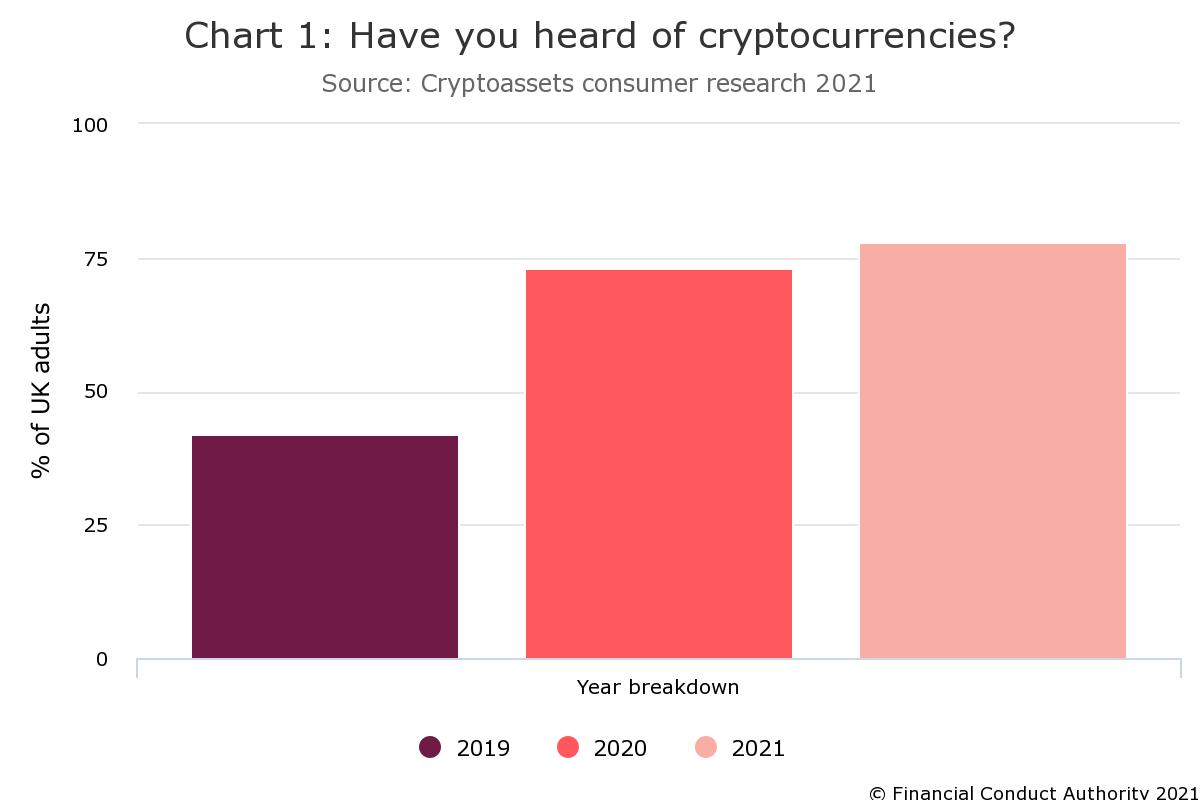

FCA Crypto Report Highlights: Understanding and Awareness Not the Same Thing

“We see 78% of UK adults have heard of cryptocurrencies. This has risen across our surveys – from 42% in 2019, to 73% in 2020, and now up a further 5 percentage points (pp) in 2021,” the FCA’s researchers stress. “But awareness does not necessarily equate to understanding. Only 71% of those who had heard of crypto correctly identified its definition from a list of statements. This was a statistically significant decline of 4pp from 2020.” The FCA’s report further emphasizes:

In other words, despite more people having now heard about cryptocurrency, the overall level of understanding has fallen. This suggests there may be a risk of consumers engaging with cryptocurrency without a clear understanding of it.

What do you think about the FCA’s fourth consumer research publication on crypto asset ownership? Let us know what you think about this subject in the comments section below.