The amount of mining power backing Bitcoin fell by 16.94% in the last 24 hours after authorities from China’s Sichuan province pulled the plug on 26 mining farms.

Falling hashrates can hurt Bitcoin’s price. In April, outages in Xinjiang cut Bitcoin’s hashrate by 30% and contributed to a $10,000 decline in Bitcoin’s price.

This time, Bitcoin fell 5.71% to $34,205. That’s a less pronounced dip than many of the top 20 coins by market cap.

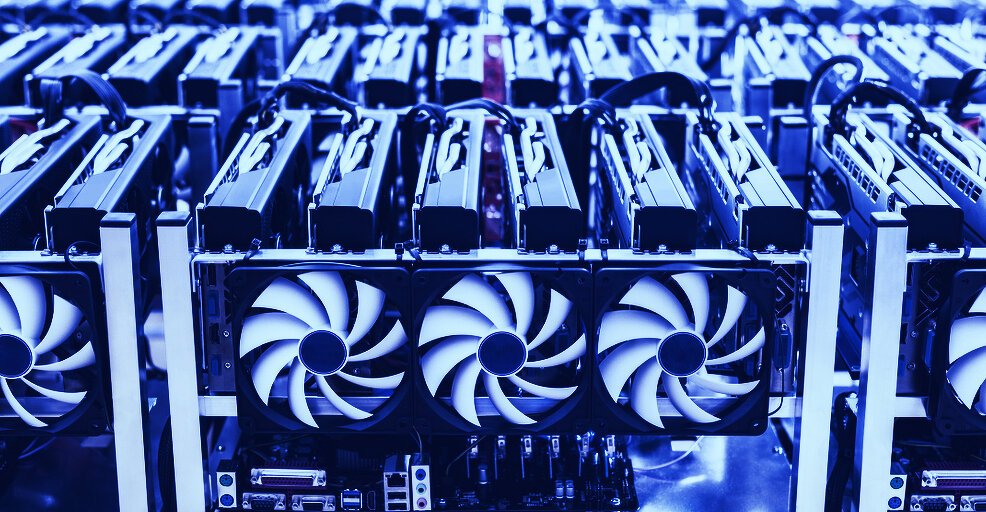

Some mining pools were hit harder by the shutdowns than other, more diversified pools. Data from BTC.com shows that mining pool BTC.TOP fell from the 11th to the 15th largest mining pool after losing 51.39% of its hashrate. The largest pool, Antpool.com, lost 14% of its hashrate.

The future of Chinese Bitcoin mining looks bleak. It’s a big deal for Bitcoin; by some estimates, about 65% of all the computational power backing the Bitcoin blockchain comes from China.

Sichuan in particular is very popular for much of the year. Miners draw from the excess cheap hydroelectric power generated by vast dams.

For the rest of the year, many miners migrate to Xinjiang, where the cold weather cools down the miners that feast on coal-powered energy sources. That saves on electricity costs.

But no more. Xinjiang ordered several crypto mining farms to shut down on June 9—one of several shutdown orders across the country.

China thinks that Bitcoin mining is a huge waste of energy and produces nothing useful. Advocates maintain that one use of the payments network is to help people get around surveillance states, like, uh, China.