With a 4% APY on BTC and 7.5% on stablecoins, the BlockFi Interest Account (BIA) is one of the most competitive cryptocurrency interest accounts on the market. The company is valued at over $3B from its most recent Series D and has attracted attention from cryptocurrency and traditionally non-crypto audiences alike.

Let’s explore how BlockFi (and other cryptocurrency interest accounts) work and whether it’s worth your time in our BlockFi review.

BlockFi Interest Account Quick Summary

BlockFi is a privately-held New Jersey-based lending platform founded in 2017. The BlockFi Interest Account is one of the only cryptocurrency storage options that offer rates that are competitive with most non-cryptocurrency account interest rates.

- BlockFi allows users to earn compound interest on cryptocurrencies such as BTC, ETH, LTC, USDC, USDT, GUSD, and PAXG.

- It keeps cryptocurrency deposits secure. BlockFi’s cryptocurrency holdings are held by the Gemini Trust Company, which is regulated by the New York Department of Financial Services.

- It’s available worldwide, outside of sanctioned or watch-listed countries.

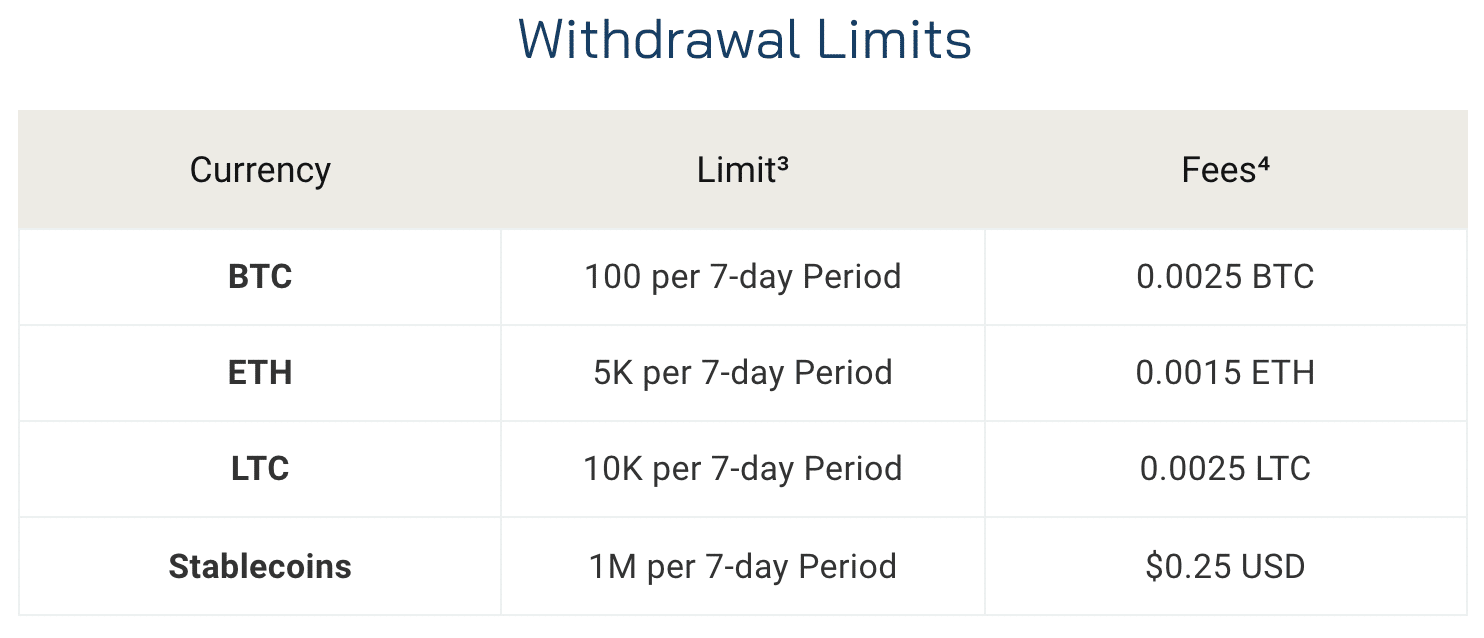

- Allows for anytime withdrawals. However, it’s worth noting users only get one free withdrawal per month.

- It offers simple and easy registration, with all the basic “Know Your Customer” KYC stuff you’re probably used to providing.

BlockFi is a fairly attractive option for individuals that have a beginner to moderate level proficiency with digital assets. The platform now offers direct ACH deposits, so it requires minimal cryptocurrency literacy.

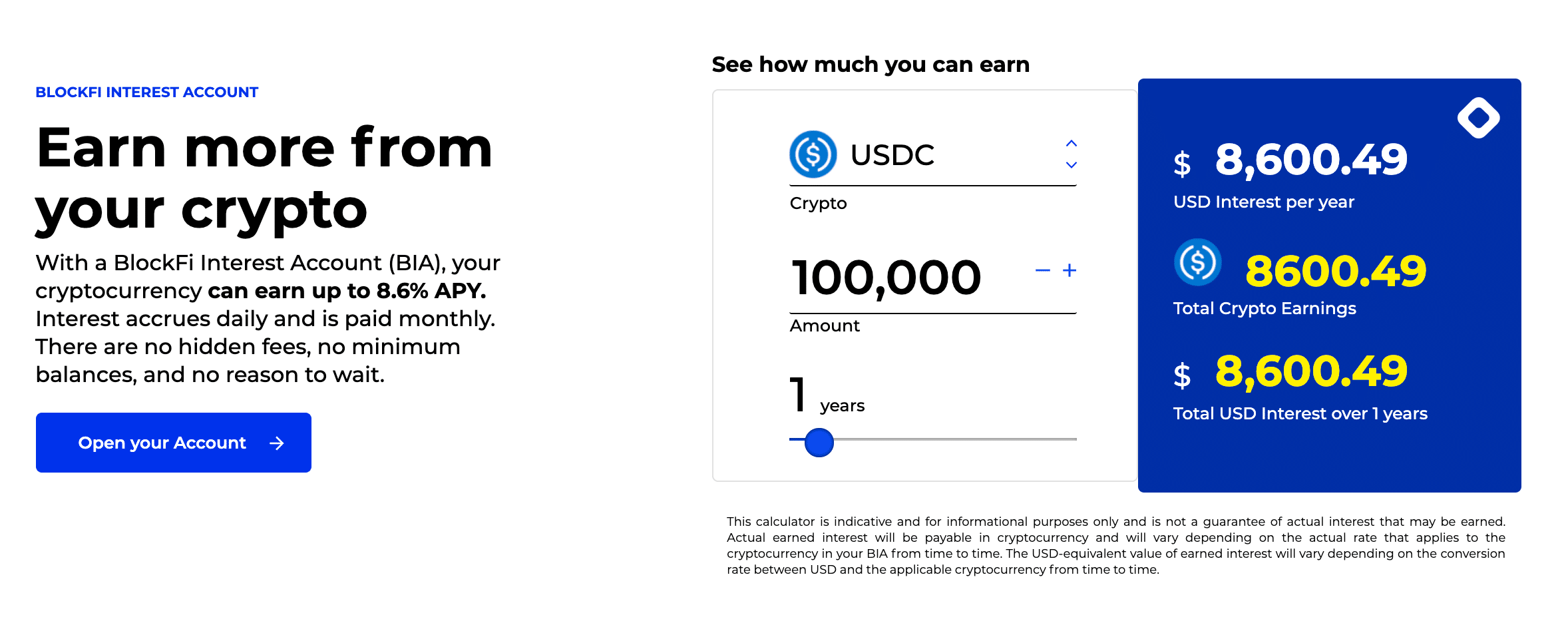

Screenshot from BlockFi’s interest calculator. 100,000 USDC will earn 8600 in USDC in 1 year.

Compared to more traditional investment accounts, BlockFi offers 43x more than “high-interest” savings accounts with Ally Bank (0.2%) and 4.7x than WealthFront (1.82%). However, it’s worth noting that BlockFi deposits aren’t FDIC insured, so BlockFi account shouldn’t be considered a savings account. It’s an investment account with a unique set of risks that traditional fiat savings accounts in banks do not.

- Minimum Deposit: $0

- Stablecoin Interest Rate: Up to 7.5% on USDC, USDT, GUSD

- Bitcoin Interest Rate: 4% in annual interest on deposits up to .25 BTC, 1.5% on any BTC between .25 and 5, and 0.25% for 20 BTC and above.

- Ethereum Interest Rate: 4% up to 5 ETH, 1.5% between 5 and 50 ETH, and 0.25% above that.

- Monthly Fees: $0

- BlockFi Referral Code & Promotions: Receive up to $250 (starting at $25) in USDC Bonus When You Click And Fund A New BlockFi Account With At Least $500. Terms Apply.

BlockFi also offers loans backed by your cryptocurrency with a 50% LTV ratio.

The following BlockFi review contains an exclusive interview with the BlockFi team. It has been written and regularly updated, primarily for the BlockFi Interest Account, not for the loan products, BlockFi credit card, or exchange.

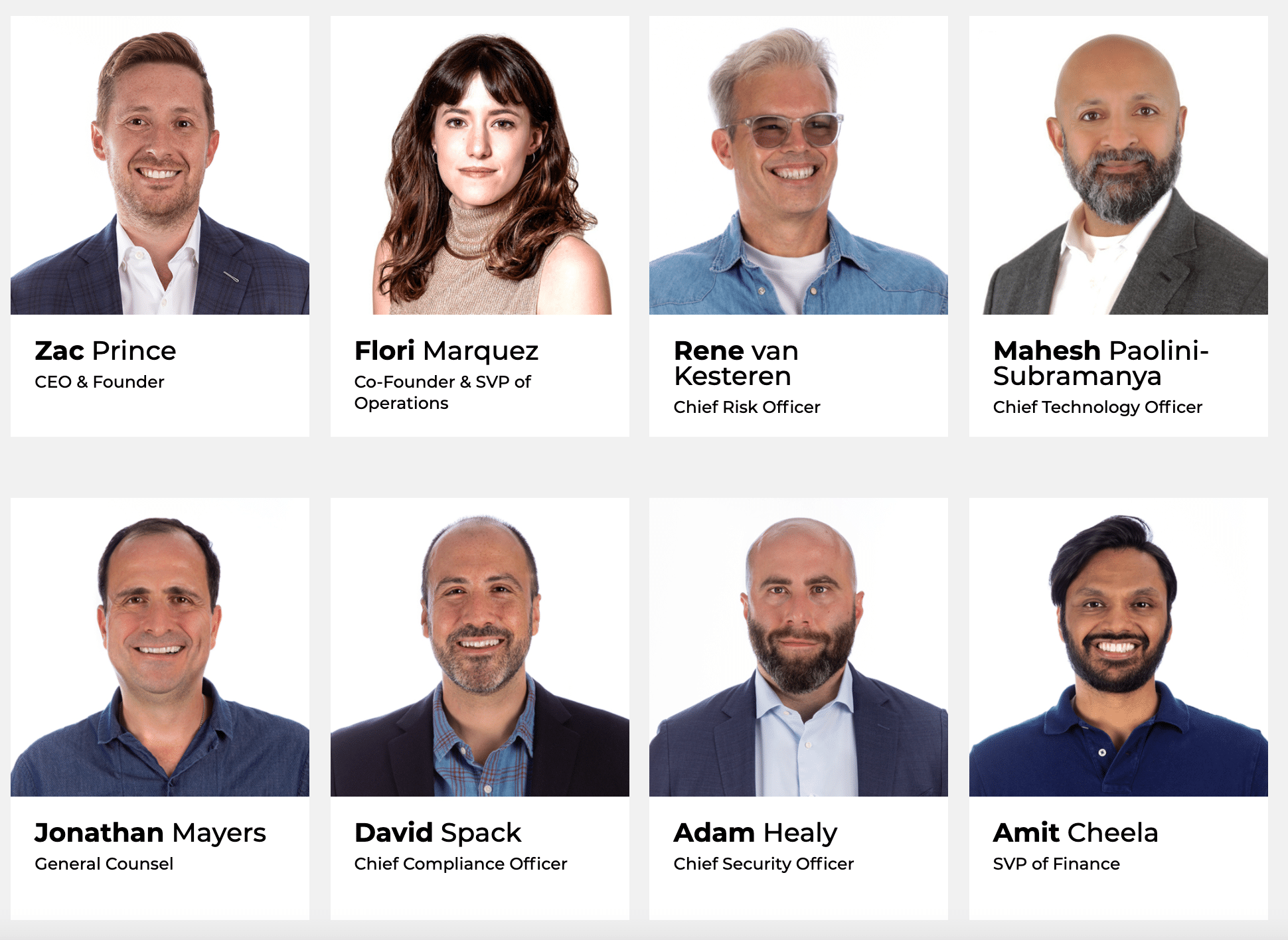

The BlockFi Team

BlockFi’s leadership team has decades of experience in the traditional financial services and banking world. The company claims to take a conservative approach to regulation to position itself favorably for sustainable long-term growth and expansion.

BlockFi Leadership team, including Founders Zac Prince and Flori Marquez

Founder & CEO, Zac Prince has leadership experience at multiple successful tech companies. Prior to starting BlockFi, he led business development teams at Orchard Platform, a broker-dealer and RIA in the online lending sector, and Zibby, an online consumer lender.

Co-Founder & VP of Operations Flori Marquez has experience managing alternative lending products. She helped build and scale a $125MM portfolio for Bond Street (acquired by Goldman Sachs) as Head of Portfolio Management. She managed all operations including point of origination, default, and litigation.

Chief Risk Officer, Rene Van Kesteren spent over 15 years at BAML as a Managing Director of ML Professional Clearing Prime Brokerage. He built the equity structured lending platform, including risk and regulatory compliance frameworks. Rene also worked as an equity derivatives trader in Caxton’s Strategic Quantitative Investment Division.

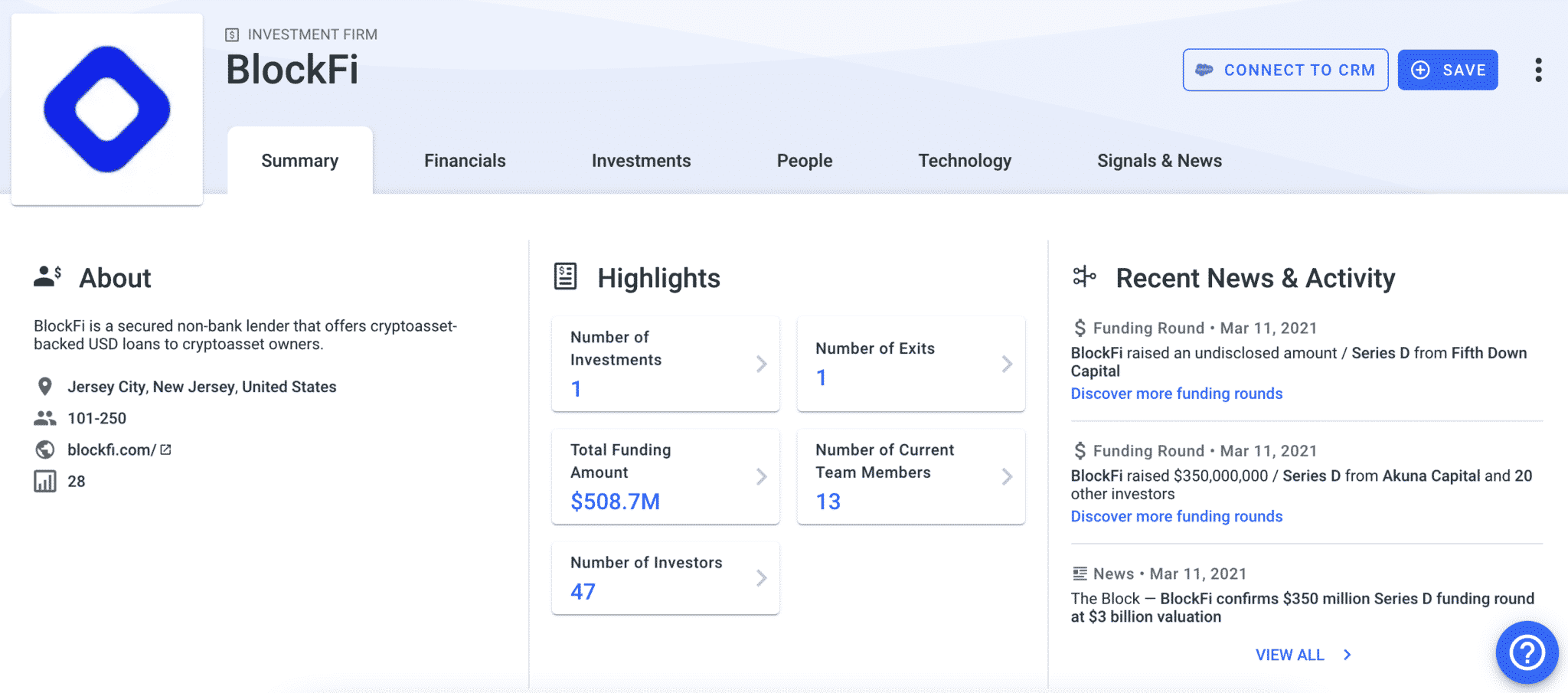

BlockFi Funding: How Much Money has BlockFi Raised?

BlockFi has raised a total of $508.7M, valuing the young company at $3 billion. BlockFi’s revenue has grown 10x over the past year, putting it on track to reach $100M in revenue over the next year. With over $1.5B in assets on the platform, and a 0% loss rate across its lending portfolio, BlockFi has made a strong case for establishing itself as a dominant entity in the overarching emerging FinTech space.

Most recently, BlockFi raised its lion’s share of funding in a $350M Series D, led by new investors such as Bain Capital Ventures, Pomp Investments, Tiger Global, and partners of DST Global. In a press release, BlockFi noted it plans to use the inflow of capital to explore further innovation in its product suite, accelerate new market expansion, and potentially fund new acquisition opportunities.

BlockFi raised $50 million in its Series C led by Morgan Creek Digital, with participating investors such as Valar Ventures, Winklevoss Capital, Kenetic Capital, CMT Digital, Castle Island Ventures, SCB 10X, HashKey, Avon Ventures, Purple Arch Ventures, Michael Antonov, NBA player Matthew Dellavedova, and two university endowments.

Prior to its recent Series C, BlockFi raised $18.3 million in Series A funding led by the Peter Thiel-backed Valar Ventures with participation from Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Akuna Capital, Avon Ventures, Susquehanna, CMT Digital, Morgan Creek, and PJC.

BlockFi’s fundraising on March 15th, 2021 (source: Crunchbase)

BlockFi has also raised earlier rounds by SoFi and Purple Arch Ventures.

The team notes that they anticipate raising additional capital in the future to facilitate continued product development and rapid growth.

As of March 2021, the platform has over 265,000 retail and 200,000 institutional clients, with reported monthly revenue of $50m in 2021, compared to $1.5m monthly revenue in 2020.

BlockFi Interest Account Review and BlockFi Interest Rates

The BlockFi interest rates are above-average in the cryptocurrency interest account market, and much better, albeit inherently riskier, than cryptocurrency on an interest-free exchange or wallet.

- Bitcoin: 4% in annual interest on deposits up to .25 BTC, 1.5% on any BTC between .25 and 5, and 0.25% for 20 BTC and above.

- Ethereum: 4% up to 5 ETH, 1.5% between 5 and 50 ETH, and 0.25% above that.

- Litecoin: 3% on the first 750, then 0.5% on 750+.

- Chainlink: 5.5% on all deposits.

All stablecoins receive 7.5% interest on all deposits under 50,000, and 5% on any amount above.

- Gemini Dollars (GUSD): 7.5% interest on all GUSD deposits.

- USDC Dollars (USDC): 7.5% interest on all USDC deposits.

- PAX: 7.5% interest on all PAX deposits.

- PAXG: 2% interest on all PAXG deposits.

- USDT: 7.5%% interest on all USDT deposits.

- BUSD: 7.5%% interest on all USDT deposits.

The interest rates are paid in their nominal cryptocurrency, so be mindful of the volatility of the asset– your cryptocurrency earned could either be more or less than its USD equivalent at the time of deposit, so plan accordingly.

However, earning 7.5% on a stablecoin such as Gemini Dollar eliminates some of the volatility risks. $10,000 in GUSD will earn you $750 in GUSD for the full year, and since it’s pegged to the U.S. Dollar, you won’t have to be concerned about its price being drastically different (provided something catastrophic doesn’t happen to Gemini or its GUSD.)

Please note that BlockFi charges flat withdrawal fees. which are subtracted from the total withdrawal amount. Users get 1 free withdrawal per month.

How Does BlockFi Make Money?

BlockFi is a spread business that makes money by borrowing capital at a certain rate (the interest rates it pays to users) and lends it a higher rate (the interest rates it offers for BTC/ETH/GUSD loans). A BlockFi blog post notes that the company primarily works with institutional counter-parties to offer them liquidity. These borrowers consist of:

- Traders and investment funds seeking arbitrage trading opportunities in a fragmented marketplace. They borrow cryptocurrency to close mispricing gaps between exchanges or dispersed markets. Margin traders will borrow to fuel their trading strategies.

- Over the counter (OTC) market makers that connect buyers and sellers that prefer not to transact over public exchanges, often at a steep mark-up. These parties need to keep cryptocurrency inventory on hand to meet demand. Since owning the cryptocurrency is very capital intensive and bears the risks of price volatility, OTC market makers will borrow from lenders such as BlockFi to facilitate their needs.

- Other businesses that need an inventory of cryptocurrency to provide their clients with liquidity. This category includes businesses such as cryptocurrency ATMs that keep the majority of their cryptocurrency assets in cold storage and need some level of liquidity to function on a daily basis.

Is BlockFi Safe? Is Your Money Safe on BlockFi?

Based on our research and conversations, BlockFi passes the safety test. Well, it’s about as safe as Gemini, its primary custodian. Gemini keeps 95% of its assets in cold storage and 5% in hot wallets that are insured by Aon.

Gemini is a licensed custodian and regulated by the NYDFS, and it recently received SOC2 compliance from Deloitte for its custody solution.

While BlockFi’s interest rates are appealing, it’s natural for cryptocurrency aficionados to be skeptical– and rightfully so, we tend to be a paranoid breed. That’s what this Blockfi review is for!

What happens to user funds during each of these scenarios? How are they protected?

Even if we trust a business, which there is little to indicate BlockFi can’t be trusted, the doomsday “what if’s” hold primary real estate in our brains.

We asked the BlockFi team some doomsday questions:

What happens if BlockFi gets hacked?: “Gemini is BlockFi’s primary custodian and BlockFi doesn’t hold private keys directly. Gemini keeps the vast majority of its assets in cold storage and is insured by Aon. Gemini is a licensed custodian and regulated by the NYDFS. They recently received SOC2 Type 1 compliance audit from Deloitte for their custody solution. We encourage users to read more about Gemini’s security. “

What happens if a user account is compromised?: “Since inception, BlockFi has not lost any customer funds. In the event that a user’s account is compromised, which our security protocols have caught in the past, we freeze the individual’s account for one week. Then, we conduct a Videoconference with the affected individual to verify their identity. We can then change their email address and password, so they can regain control of their account.”

What happens if suddenly everyone defaults on their cryptocurrency loans?: “When we lend crypto assets to generate yield, we have an extremely thorough risk management and credit analysis process. We only primarily lend to large, well-capitalized, institutional borrowers, or to counter-parties willing to post collateral and provide the ability to margin call them on a 24/7 basis.”

“What that means is, if we are lending $1M worth of BTC to Firm XYZ, Firm XYZ collateralizes the loan (typically ~120%) by giving us ~$1.2M USD. If the loan were to then enter margin call and the borrower was unable to provide additional collateral (default), we would use their USD collateral to buy crypto.”

“We have actively lent since January of 2018, including throughout multiple periods of high volatility, without any losses across our entire lending portfolio. BlockFi is bound by NDA’s to discuss terms of specific borrowers/rates.”

How do I apply for a BlockFi Account?

Signing up for a BlockFi account is fairly straightforward and can be done in under two minutes.

- You can start right from this BlockFi review. Go to the BlockFi website. Using this code, you can receive up to $500 on your deposit as a sign-up bonus, starting at $25 when you deposit a minimum of $500.

- Go to the “Earn Interest” option in the homepage slider, or “Get Started” in the menu.

- Enter your email and make a password to create your account.

- Enter the verification code sent to that email.

- Once logged in, select “Deposit” to verify your identity and make your first deposit.

- Enter your personal information for verification (part 1)

- Upload a form of ID such as a passport, driver’s license, or ID card and wait to be approved.

How do I get in contact with BlockFi Customer Service?

If you’d like to contact customer service, you can reach them at support@blockfi.com.

So far, BlockFi support has been well above average. Let us know how your experience was any different!

Is BlockFi insured?

Is BlockFi FDIC insured? Well, since FDIC insurance doesn’t apply to digital assets such as cryptocurrencies, your deposits in BlockFi are not covered by FDIC insurance. However, BlockFi uses partner company Gemini as its custodial service, and Gemini does have its own insurance for its deposits. However, take this with a grain of salt, as BlockFi has yet to experience a hack for user funds– insurance is only as good as it works, and it has yet to be determined (and hopefully never will be!)

BlockFi Interview: Does BlockFi Work?

How is offering a 4% on BTC interest rate sustainable?

“The interest we are able to pay is based on the yield that we are able to generate from lending, which directly correlates to the market demand in the space (I.e. what rate institutions are willing to pay to borrow specific crypto assets, as it varies from asset to asset). We are bound by NDAs to discuss specifics (institutions, specific rates, etc).”

How about the 7.5% interest rate on Gemini Dollars? Can you talk about why Gemini?

“We are able to use stablecoin deposits to fund our consumer loans (average APR is ~10-13%) so we can afford to pay higher interest to GUSD / Stablecoin depositors.”

The BlockFi interest rate is subject to change on a monthly basis, could you explain why this is?

“Upcoming changes are announced typically 1-2 weeks prior to a new month, giving clients ample notice and time to prepare. The interest we are able to pay is a function of the borrowing demand.

To date, our top-tier BTC interest rate and GUSD interest rate have not changed. You can read more about why our rates are variable and how the lending market works here and here.”

What happens in the case of a BTC/ETH fork? Will a user’s balance be credited with the forked coin as well?

“Gemini is our custodian and has all of the information about what happens in the case of a forked network. Please refer to their user agreement here where you can read more about that.”

What does the future look like for BlockFi? How will this BlockFi review be different in a year?

“We’re confident that we will become a very large and successful company that provides financial services on a global scale to the benefit of millions of clients. We plan on going through three distinct growth phases based on our addressable market and products:

-

Phase 1

- Products for people who already own Bitcoin or another crypto asset that’s supported on BlockFi’s platform

- Ability to earn interest borrow USD secured by your crypto

-

Phase 2

- Expand the addressable market to include people who don’t own cryptocurrency yet.

- Launch the ability to buy and sell on the platform and payments category products like a Bitcoin rewards credit card

-

Phase 3

- Focus on global expansion and expand the addressable market to include users that may not ever want to own crypto

- Heavily utilize stablecoins to provide traditional banking products on blockchain rails

BlockFi’s newest product, the BlockFi Credit Card (source: BlockFi)

Final Thoughts: Is BlockFi Legit?

All of our indicators for this BlockFi review (history, team, communication with support, and business model evaluation) point to yes: BlockFi is legit. There is very little evidence that suggests otherwise. There are a handful of negative reviews online from disgruntled users, but they mostly seem to be rooted in misunderstanding, like assuming the interest was paid in USD and not in BTC/ETH/GUSD.

Whether or not BlockFi is worth it comes down to your risk profile and what you’re doing with your cryptocurrency. The BlockFi interest rates are quite competitive for the industry, and for some digital assets, industry-leading.

If it’s just sitting on an exchange, you may as well reap the benefits of compounded interest. 10 BTC would turn into 10.6+ BTC in a year, a not insignificant gain of around $36,000 for the year. You could also receive the benefits or downside of Bitcoin’s price fluctuation, so keep that in mind.

However, it’s worth remembering that any time your cryptocurrency leaves your hardware wallets, it’s exposed to a higher degree of risk. If BlockFi or Gemini were to experience some (highly unlikely) catastrophic hack, your cryptocurrency would be at risk.

Our BlockFi review comes back positive. After speaking with team representatives, and with their support team on the client-side, we look forward to seeing BlockFi establish itself further in the space. Projects such as BlockFi simply existing provide cryptocurrency investors a much-needed diversification of revenue streams, something that die-hard HODLers have missed through the past few years.

BlockFi Referral Code: Receive A $25 USDC Bonus When You Click And Fund A New BlockFi Account With At Least $500. Terms Apply.

Editor’s Note/disclaimers: The above article isn’t investment advice. This review is written for educational and entertainment purposes.

The post BlockFi Review: Is BlockFi Safe, Legit, and Worth Your Time? appeared first on CoinCentral.