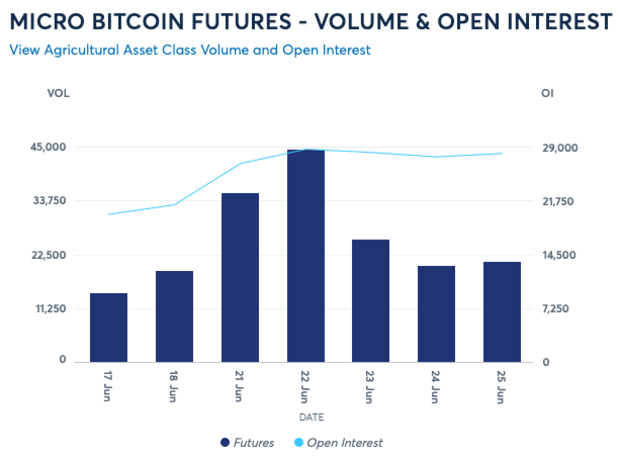

CME Group saw more than one million of its micro bitcoin futures contracts traded in under two months after launch, indicating high interest.

Major derivatives marketplace CME Group has announced that the volume of its micro bitcoin futures offering surpassed one million contracts, less than two months after its launch.

“We continue to see strong customer demand and rapid uptake in our new Micro Bitcoin futures contract since their introduction a little more than a month ago,” said Tim McCourt, CME Group’s global head of equity index and alternative investment products, in the announcement.

The micro contract opened up a more accessible avenue into futures trading. CME introduced the contract to provide market participants with a much smaller contract option to hedge and trade bitcoin. At the time, traders and institutions had to resort to contracts in denominations of 5 BTC. Only a week after launching in May, the micro contract saw over 100,000 contracts traded.

“At one-tenth of one bitcoin, this micro-sized contact is designed to provide market participants — from institutions to smaller, sophisticated, active traders — with another tool to hedge their spot bitcoin price risk or execute bitcoin trading strategies in an efficient, cost-effective and easily accessible way,” said McCourt.

The micro contract has seen both institutional and retail interest since it started trading, per the announcement. According to Brooks Dudley, global head of digital assets at ED&F Man Capital Markets, there’s been more institutional volume than anticipated. And the CEO of NinjaTrader Group, Martin Franchi, provided insight on the retail side. He claimed that he’s seen a fast rise in popularity of the new micro-contract among active retail traders in different asset classes, who have since entered the Bitcoin futures marketplace.

Since CME announced its first bitcoin futures product in 2017, similar offerings have surfaced. Intercontinental exchange Bakkt launched its own BTC futures product two years later, but with a key difference: While CME’s product is cash settled, Bakkt’s are settled on actual bitcoin. And more recently, Goldman Sachs started offering derivatives based on the BTC price and trading bitcoin futures with Galaxy Digital.

Futures markets are meaningful because they increase liquidity for institutional investors and drive adoption, as more players enter the game in a cascading effect.