Bitcoin analysis

Bitcoin’s price traded sideways and in red figures for the bulk of Wednesday’s daily candle. BTC is -3.4% at the time of writing and the bulk of the alt coin market is posting similar numbers on the day.

It was an important daily close for the short-term health of BTC. Bitcoin just managed to close above $35k and there’s still hope the top of the range around $41k-$43k is met again instead of further downside.

Bulls are hoping to avoid further downside after more than 2 months of almost continuous sell pressure on the market from the world’s number one digital asset.

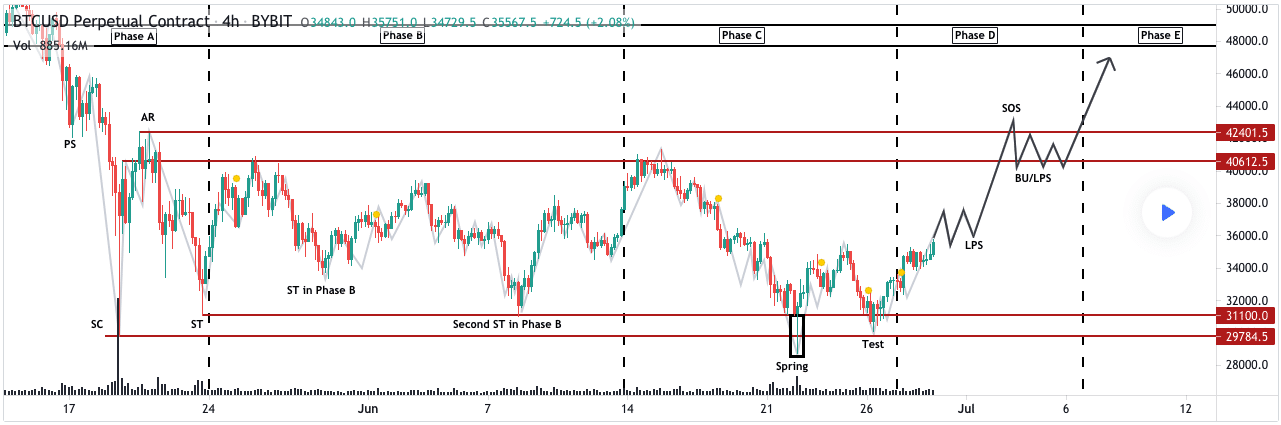

Bitcoin’s 4hr chart is starting to really resemble a true Wyckoff Accumulation Phase. The below chart by VincePrince shows just how strong the correlation is between classic Wyckoff Accumulation and what BTC is painting on its 4hr chart.

BTC’s 24 hour price range is $34,428-$36,099 and 52 week range is $8,950-$64,374.

Bitcoin’s daily candle closed at $35,043 [-2.37%] on Wednesday.

Solana analysis

Solana’s one of the hottest projects in all of the cryptocurrency space for the last 12 months.

SOL enthusiasts believe Solana’s ecosystem is set to thrive because of its design for the next layer of dApps and also the company’s connections in the blockchain sector.

The purchase of Miami’s main arena, now FTX Arena, has caused some to speculate that purchases surrounding the arena will be available for SOL. While FTX Arena could potentially be only one location to spend SOL and may seem like a small victory or somewhat arbitrary victory at first glance – a further inspection illuminates the vast implications this could have for Solana.

Sam Bankman-Fried, owner of FTX and Co-Founder and CEO of Solana Labs, Anatoly Yakovenko, have a very good working relationship. Bankman-Fried’s already launched his DEX, SERUM, on the Solana platform. The tandem look to be set on taking Solana to the top of the blockchain sector and are working on scaling solutions in new ways.

SOL is the #14 ranked cryptocurrency by market capitalization [$9.55 billion]. Solana is +4,009% for the last 12 months and could be one of the most interesting projects to watch in a bear or bull market moving forward.

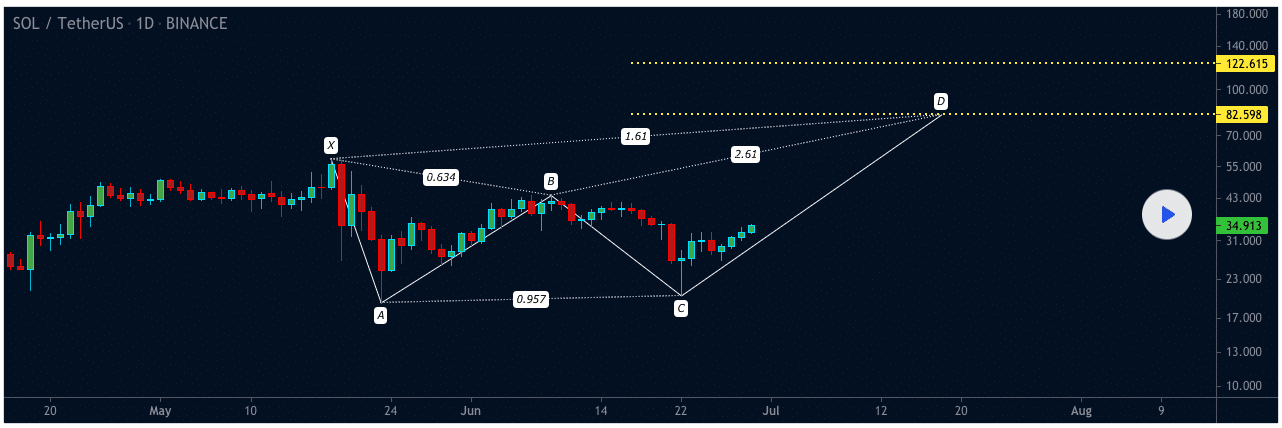

The short term outlook on SOL from SALAH-LH is quite bullish. From the bullish perspective below SOL could set up in mid-July for the first target charted at $80.

The secondary target is at $122 and could be reached at some point in August if the chart plays out.

The author of the chart doesn’t get into detail about a bearish scenario if the macro fails to keep trending upward.

From the chart, it appears that anything below $22 moving forward could bring prices in the mid-teens soon thereafter.

The 24 hour price range for SOL is $31.70-$35.81 and the 52 week range is $.628-$56.08.

Solana closed Wednesday’s daily candle worth $35.23 [+4.97%] and for a fifth consecutive day SOL’s candle closed in green figures.

The post Bitcoin (-3,4%) and Solana (+5%) Price Analysis appeared first on The Cryptonomist.