Fresh data from Glassnode revealed today that Bitcoin’s mining difficulty dropped by 28%, making it the largest negative adjustment in the history of the cryptocurrency.

What is Bitcoin Mining Difficulty Adjustment?

For clarity, Bitcoin mining difficulty is a metric that describes how hard it is for miners to mine a new block on the network. When the difficulty increases, it becomes harder and miners will need to dedicate more computational power to find the next block hash and vice versa. As computational devices increase, the hash rate also increases, which in turn makes the network more secure and robust.

But just like the price, Bitcoin’s mining difficulty also fluctuates and it automatically adjusts after every 2016 blocks are mined, which takes about two weeks since the average time for mining each block is 10 minutes. This, in turn, is referred to as a bitcoin mining diffuclty adjustment. Generally, as more hash power enters or leaves the network, the difficulty fluctuates.

China’s Ban on Bitcoin Mining

Over the years, the hashing power on the Bitcoin network has steadily increased, with up to 65% of it coming from miners based in China. This has led to many controversies in the past, as some argued that the Bitcoin network is centralized since the majority of its miners are concentrated in one region.

Fast forward to Q2 2021, China became overly aggressive towards miners. The country has launched a full crackdown on mining operations and has made the region unbearable for miners. As a result, China continues to lose its hash rate dominance as miners are being forced to shut down their machines and migrate to other countries like the United States and Kazakhstan to conduct their operation.

Although China’s ban seems like a negative development in the short term, it will help increase Bitcoin’s decentralization and security in the long run. The migration of the hash rate from China removes the over-concentration of mining power in the country, and thus eliminates the possibility of the so-called “Chinese 51% attack,” as argued by some.

What Does It Mean for Bitcoin Miners?

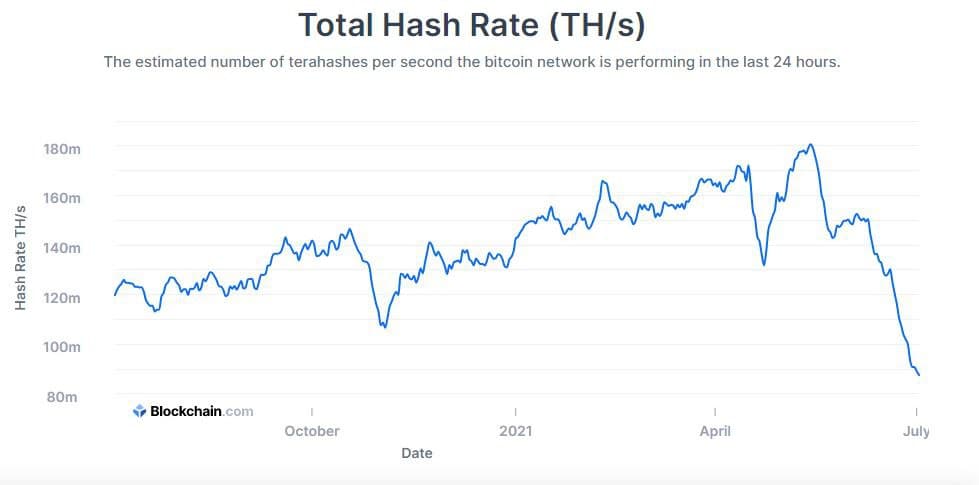

The negative adjustment was also followed by a decrease in Bitcoin’s hash rate. At the time of writing, the total hash rate, according to blockchain.com, is at a one-year low of 87.6M TH/s, after dropping by more than 50% in less than two months. In May, the hash rate hit an all-time high of 180M TH/s.

In any case, a drop in the hashrate suggests that there’s less competition for mining a block, and as new players start to capitalize on the opportunity, the hashrate is likely to start going up again.