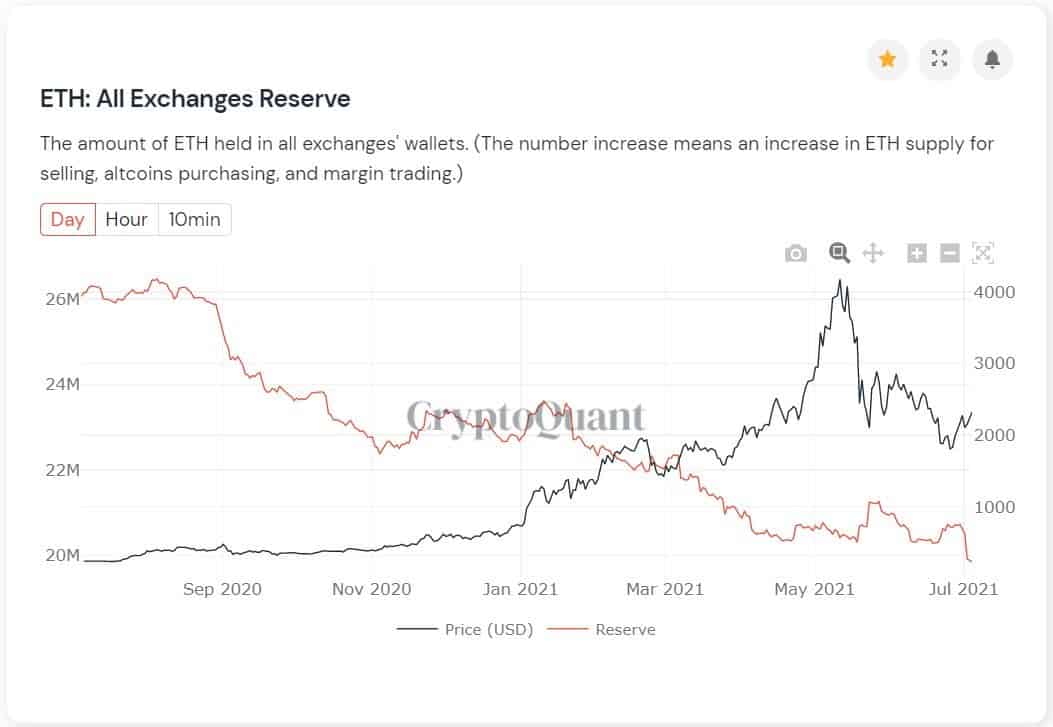

The number of ether coins held on exchanges continues to decrease and has reached its lowest position in more than two years. This comes as the tokens sent to the ETH 2.0 contract reached a new all-time high of over six million.

ETH on Exchanges Down to a 2.5Y Low

According to data from CryptoQuant, the ETH reserves on centralized exchanges had seen a massive drop in the past several days and especially after the mid-May market crash when investors rushed to deposit their tokens into trading platforms.

With the latest sharp decline, though, the number of coins has decreased to its lowest level in about two and a half years. As the popular cryptocurrency analyst Willy Woo pointed out, most of this could be linked to the rapid rise of Ethereum-based DeFi protocols and ETH 2.0, which enables stacking.

The latter has been particularly popular lately as it allows investors to lock their ether holdings to earn staking rewards. As such, the number of tokens sent to the ETH 2.0 contract has continuously increased.

Per data from Dune Analytics, there’re more than six million ether sent as of now, with a USD value of roughly $14 billion – an all-time high.

What About BTC?

The bitcoins on exchanges have also been on the decline lately. Santiment data from earlier today showed that the supply on trading venues has “encouragingly” decreased to “its lowest since early January.”

This could be attributed to the recent buying spree from whales, as they accumulated roughly 60,000 coins in just a few days at the start of July. Furthermore, institutions have also kept buying as Canada’s Purpose Bitcoin ETF has increased its holdings by about 30% in weeks.

Santiment described the aforementioned developments as a “promising sign, as it generally will indicate that there is a decreased risk of more major BTC sell-offs.”

Actually, the same could be said about ether as well.