With some jurisdictions around the world apparently eager to crack down on cryptocurrencies, there is one jurisdiction that is continuing to welcome cryptocurrency companies, given a far more regulatory-friendly environment. 300 crypto-related companies have applied for licences in Singapore so far.

The prevailing regulatory environment for Bitcoin and cryptocurrencies has not been favourable over recent times. A few countries have made generally negative sentiment felt in the crypto sphere. China especially, appears to be attempting to squash cryptocurrency in order to give its own central bank digital currency (CBDC) enough room to get itself established.

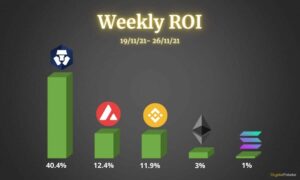

China’s ban on companies directly dealing with cryptocurrency entities, plus its shut-down of much of the bitcoin mining capacity in the country, has led to the cryptocurrency markets taking quite a tumble over the last few weeks.

However, there are a few places globally where cryptocurrency activities are generally accepted and welcomed. According to an article today on Insider, crypto companies are flocking to Singapore, given its “regulatory environment, and its potential for growth”.

The article outlines how CZ, and his company Binance, the biggest cryptocurrency exchange by trading volume, moved to Singapore in recent years in order to benefit from the “warmer regulations and license exemptions.”

The current regulatory environment certainly does appear to be favourable to crypto companies. While the Monetary Authority of Singapore (MAS) requires crypto companies to have a license to operate in the country, they can apply to the MAS for an exemption until their license applications are finalised.

As things currently stand, cryptocurrencies are not legal tender in Singapore but they are considered “goods that can be used for exchange”.

Among the cryptocurrency companies operating at least part of their business out of Singapore is the highly regulated Gemini cryptocurrency exchange, co-founded by the Winklevoss twins. According to the Asia Pacific managing director Jeremy Ng:

“Gemini is planning to stay in Singapore long-term.”

Another potential long-term crypto resident is the fintech company BC Group. This is the parent company of OSL exchange, which has operated an office in Singapore since 2019. Matt Long, the OSL head of distribution and prime said:

“If you look at the environment with respect to regulation, with respect to financial markets, and within that fintech and blockchain, the growth in wealth and asset management, all the positive things that the MAS has done — I think the question is why wouldn’t we be setting up in Singapore?”

Disclaimer: This article is provided for informational purposes only. It is not offered or intended to be used as legal, tax, investment, financial, or other advice.