This Daily Dive excerpt highlights some of the comments made during The ₿ Word virtual conference, with charts and commentary.

The below is an excerpt from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

The ₿ Word virtual conference occurred yesterday with presentations from Nic Carter, Lyn Alden and many more, followed by a panel with Jack Dorsey, Cathie Wood and Elon Musk, moderated by Steve Lee following afterward.

This Daily Dive will highlight some of the comments made during the conference along with using some charts for visuals and providing some commentary.

Highlights from the call with Elon Musk, Cathie Wood, Jack Dorsey and Steve Lee:

Elon Musk:

- “Money is just an information system for labor allocation.”

- “I own bitcoin, Tesla owns bitcoin, SpaceX owns bitcoin.”

- “Government is just a corporation… it’s the biggest corporation of all and it has a monopoly on violence.”

Jack Dorsey:

- “You don’t have to trust anyone, you can verify with open source code.”

-

“[Bitcoin is] not controlled by any bank, state, or corporation.”

-

“A lot of our monetary policies and systems cause so much distraction and cost.”

-

“Bitcoin incentivizes renewable energy.”

-

“My role through the companies I run is to push for more decentralization.”

-

“My hope is that [Bitcoin] creates world peace by fixing a fundamental level of society.”

Cathie Wood:

- “Money has powerful network effect qualities.”

- “Bitcoin is a hedge not only against inflation but also deflation (counterparty risk).”

Broadly speaking, the conference was a success, and it can be inferred that there were deep institutional pockets watching closely throughout.

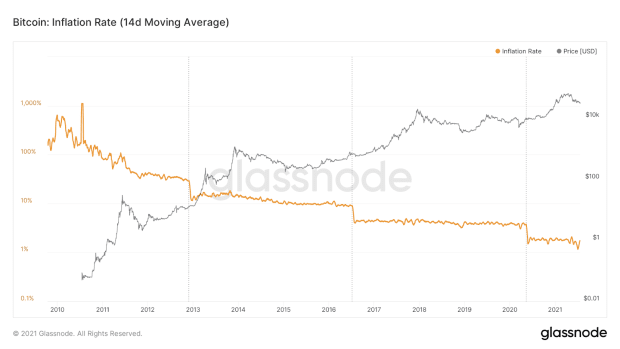

Bitcoin has a terminal inflation rate of zero, but the distribution of bitcoin occurs in asymptotic fashion, with the final satoshi estimated to enter circulation in the year 2140. Compared to the current fiat monetary system, where commercial banks store reserves at the central bank, and create money through the act of credit expansion, bitcoin is far superior.

A particular quote from the notorious Satoshi Nakamoto sticks out:

“Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve. We have to trust them with our privacy, trust them not to let identity thieves drain our accounts.”

Don’t trust, verify. That is the Bitcoin ethos. Whether you are Elon Musk, Jack Dorsey, Michael Saylor or someone residing in a developing nation, you play by the same rules when using Bitcoin.