Taking a look at some of the structural changes in the bitcoin derivatives market over the course of 2021 and what they mean.

The below is a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Yesterday’s Daily Dive took a look at some of the structural changes in the bitcoin derivatives market over the course of 2021 and what they mean.

First, what is a derivative?

A derivative is a contract between two (or possibly more) parties whose value is derived from one or more underlying assets. A contract speculating on the price of bitcoin six months from now is an example of a derivative contract.

Why does this matter, and how does it shape underlying supply and demand dynamics in the bitcoin market?

Derivatives and leverage can most certainly whipsaw price, yet what matters for the bitcoin market is the spot market (i.e., real dollar or other fiat demand to buy BTC). Derivatives and futures contracts are just directional bets on what the spot price will be.

However, derivatives markets offer the ability to use leverage to increase position size. An entity can take one bitcoin worth of capital and place trades with 10 bitcoin worth of buying power, however a 10% move in either direction can double your money, or wipe your account entirely.

During the late months of 2020 and early months of 2021, it became increasingly popular amongst traders to use bitcoin as collateral to margin long bitcoin. This strategy was extremely profitable up until April as bitcoin doubled in value in just a four month period.

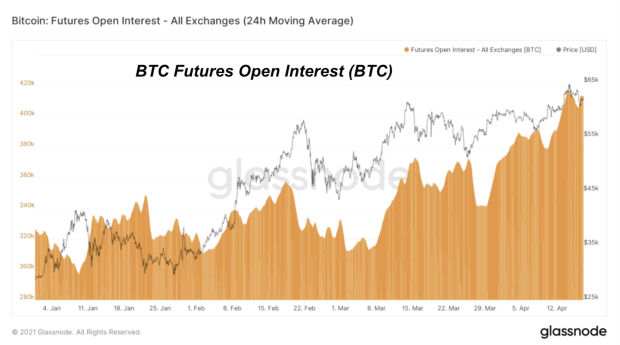

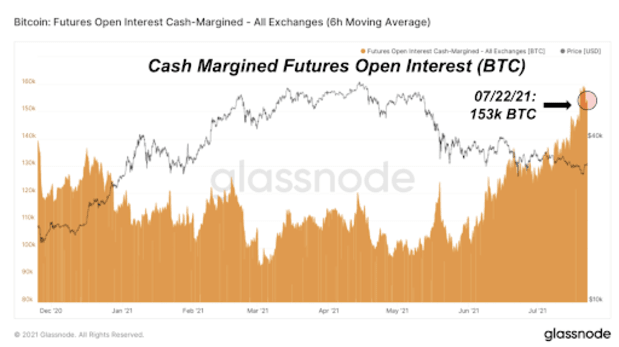

This can be seen in the chart above, showing bitcoin futures open interest climbing in bitcoin terms from January to April. The strategy of using bitcoin as collateral to leverage long bitcoin can work as long as there is fresh capital entering the market to buy the underlying asset in spot markets.

However, in April the spot bid began to slow up, and the market was left with a bunch of overextended bulls that were using their bitcoin as leverage. The problem with using bitcoin to margin long bitcoin is that during a market downturn, your position is losing value at the same time your collateral value is decreasing. There is a negative convexity to this strategy.

So why does this matter?

Because following the local top of $64,000 in April, the structure in the derivatives market has changed significantly.

Bitcoin-Margined Vs. Stablecoin-Margined Futures

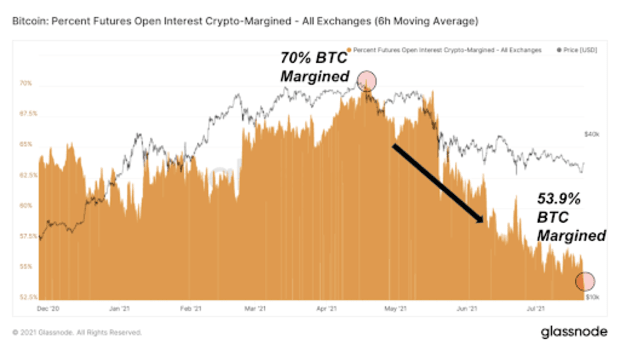

The day of the $64,000 all time high (and coincidentally the Coinbase IPO), 70% of the bitcoin futures market was using bitcoin as collateral. As highlighted above, this dynamic can lead to reflexive selling as collateral values and position profit and loss drawdown in unison.

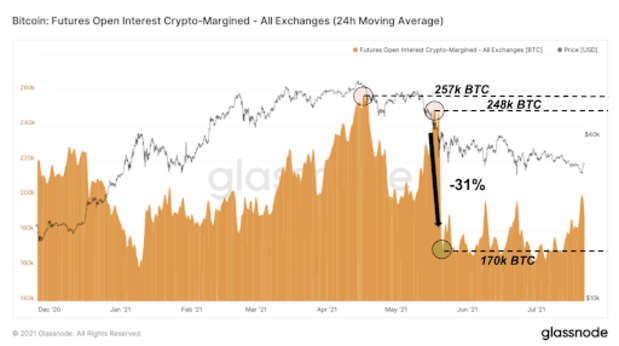

At the top of 2021, bitcoin-margined open interest hit a high of around 257,000 BTC, and was at approximately 248,000 BTC just before the May 19 flash crash, as open interest on bitcoin-margined futures contract drew down 31% in bitcoin terms, displaying the negative convexity highlighted previously.

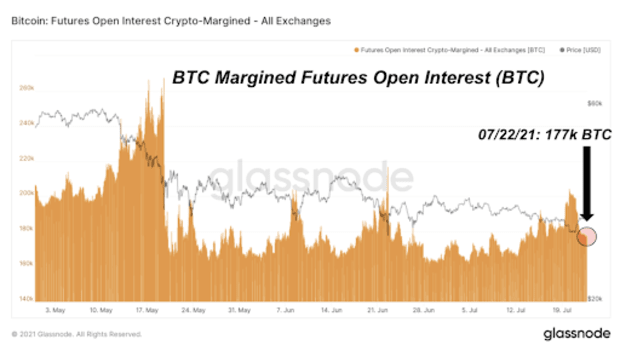

Currently, bitcoin-margined futures open interest is at approximately 177,000 BTC.

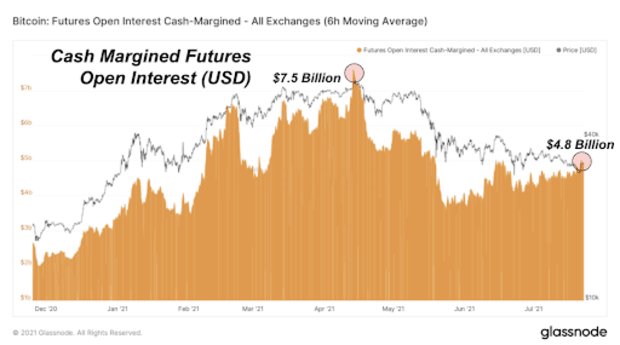

What has taken the place of bitcoin-margined contracts is of course stablecoins. The chart below shows the explosive growth in stablecoin-margined futures contracts, which are not subject to the same dynamics during a downturn.

The chart is denominated in bitcoin to display the relative growth of open interest despite the volatility in the bitcoin price.

Here is the same chart in dollars for context.

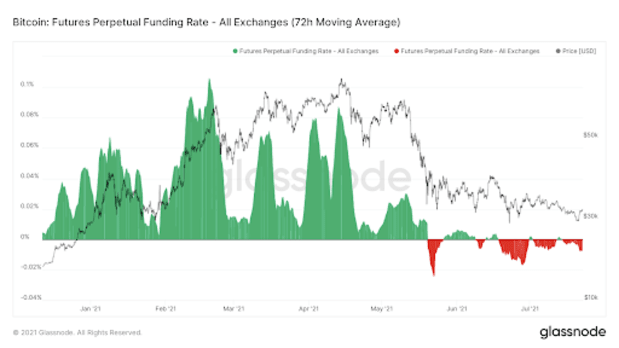

Another large change in market structure from the early months of 2021 is the funding rates on perpetual futures contracts. In the early months of 2021, funding was consistently positive, meaning that shorts were being paid by longs due to the overwhelming demand to go leverage-long bitcoin.

However, since the middle of May, funding has stayed muted and has often trended negative, meaning that shorts pay longs to enter a position.

This dynamic as well as the shift to stablecoin-margined derivatives means that the likelihood of a derivative market blowup and subsequent crash is extremely unlikely over the short term.

WIth stablecoins as collateral, as bitcoin draws down, your buying power relative to what you are looking to buy increases. While this is an obvious statement to some, this means that dips will be bought aggressively, especially when funding is already in the negative.

With bitcoin-margined futures playing an increasingly diminished role in the market, events as severe as March 13, 2020, and May 19, 2021 are far less likely.

In that sense, the explosive growth in the stablecoin ecosystem should be celebrated.