Getting started in cryptocurrency investing can be an intimidating step. Cryptocurrencies are infamously unpredictable, making it challenging to make informed investment decisions, especially for new investors. In light of these challenges, you could benefit from using the stock-to-flow model to make a more structured decision.

Like in traditional stock markets, wise crypto investments rely on predicting where different assets’ values could be heading. You can find many crypto price prediction models, but stock-to-flow has become one of the most popular, as it has lined up with Bitcoin’s actual price changes for years. Here’s a closer look at this model, how it works, and why you should understand how to use stock-to-flow in crypto.

Why Other Models Are Unideal

Many popular cryptocurrency investment models today come from traditional, often less volatile, markets. Although they may have a history of reliability with more traditional investment types, cryptocurrency is an entirely different beast, largely due to its novelty among other reasons. Since crypto reacts to developing factors like investor behavior more heavily, traditional models may not be as reliable long-term.

Some models, like the Elliott Wave Theory, attempt to predict changes in investor sentiment and psychology. These often fall short because they rely on so many unknowns and influencing factors. Investor decisions aren’t always uniform and can come from more than just price changes, so predicting them isn’t as easy as these models make it seem.

Other models, like the rainbow chart, rely on historical data, but the future doesn’t always line up with the past. For example, when Bitcoin hit a then-all-time-high of $1,000 in 2013, many investors thought it was too expensive to buy. After Bitcoin’s continued growth, that price seems cheap in hindsight, so the rainbow chart would’ve led you astray in this instance.

What Is the Stock-to-Flow Model?

The stock-to-flow model takes a simpler approach to predicting value changes. It measures the current stock of an asset against the flow of new production or how much is mined in a year.

A higher ratio indicates more scarcity, which in turn indicates a higher value.

Investors originally applied stock-to-flow to gold and silver, but have since modified it to apply to crypto, primarily Bitcoin. Like these commodities, crypto is scarce and expensive to produce, so its supply and flow are perhaps the most significant factors behind its value. Unlike the original stock-to-flow model, though, the crypto stock-to-flow adaptation holds that all scarcity is relative.

Whereas you can turn gold and silver into products or components, you can’t consume cryptocurrency. Consequently, all crypto stock is a potential supply, since investors could sell all of their holdings at any moment.

So, with crypto, a high stock-to-flow model indicates relative, not absolute, scarcity.

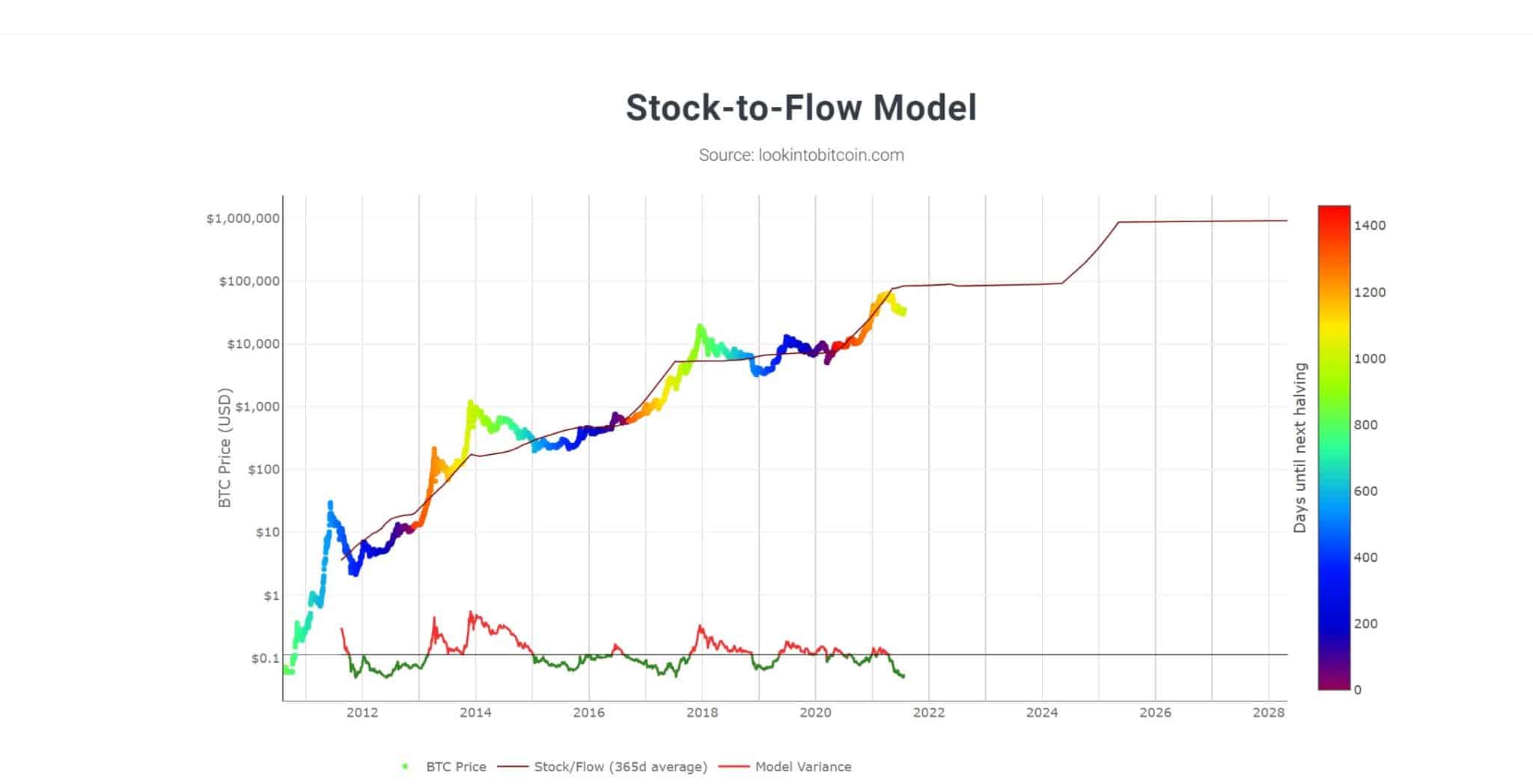

The Bitcoin price stock-to-flow model currently indicates strong growth, predicting BTC could reach $115,000 by August. However, recent events have made BTC’s price diverge from the model. Bitcoin fell to roughly $35,000 in late June when 2019 stock-to-flow predictions estimated it would be closer to $77,900. April’s price of $64,829 was closer, though.

What’s the Appeal of Stock-to-Flow?

While it initially applied to commodities like gold and silver, stock-to-flow tends to be more accurate with Bitcoin. Technological advances in the precious metal mining world lead to faster gold production, but halving events give Bitcoin a more even production schedule. This relative consistency in flow inherently makes Bitcoin’s stock-to-flow ratio much easier to predict, although, as recent data shows, it’s not always perfect.

Crypto stock-to-flow is also simpler than other models, which introduces less uncertainty into its predictions. This also makes it easier to understand, helping you make reliable investment decisions on your own instead sololey relying on an investment firm, which will gladly take 2% and 3% in fees for managing your money.

This article isn’t financial advice and is meant for educational purposes.

Perhaps the most substantial argument in favor of the Bitcoin price stock-to-flow model is its history. Over the past couple of years, Bitcoin’s price has lined up with stock-to-flow predictions with almost no major departures.

For example, Bitcoin’s actual price only deviated from stock-to-flow by a couple of hundred dollars at most between January 2015 and January 2017. You’ll notice both Bitcoin’s price and the stock-to-flow line follow the same upward trend since 2010. Few, if any, other models have showcased that kind of accuracy over time.

Where Stock-to-Flow Falls Short

As accurate as the stock-to-flow model has been in the past, it’s still not perfect. In June 2021, Bitcoin’s price lingered around $40,000, which was $60,000 less than what stock-to-flow said it should be. While this is only the second deviation of this size in Bitcoin’s history, it highlights this model’s shortcomings.

The model’s simplicity is advantageous at times, but it can be its downfall, too, since it can’t account for all influencing factors. For example, while it can indicate demand, it doesn’t include it in its predictions. Changing cryptocurrency laws and other outside factors can change demand in ways stock-to-flow can’t predict, leading to deviations.

Crypto stock-to-flow also can’t account for factors like blockchain disruptions, cyberattacks, or general investor sentiment. Unexpected changes arise in crypto all the time, like the century-old Kodak company launching an ICO, and these can influence investors’ decisions. With such a small supply, these choices impact value more heavily, leading to significant, unpredictable changes.

How to Invest in Crypto Using the Stock-to-Flow Model

Despite these shortcomings, learning how to use stock-to-flow in crypto investments can yield positive results. As the model’s history has shown, as crypto stock-to-flow ratios rise, so will crypto prices, at least in theory. You can use this relationship to guide your investment decisions.

For example, a high stock-to-flow ratio, like 50 or higher, indicates high relative scarcity, suggesting values will also be high. You could see that ratio and decide to sell some of your crypto, capitalizing on its high price. Alternatively, you could buy more when the ratio is low but predicted to rise in the future.

Many traders incorporate a combination of models into their strategies because no model is perfect. For example, you could compare Bitcoin price stock-to-flow predictions with predictions about investor sentiment like the Elliott Wave Theory. This would help you get a better view of both supply and demand.

Hybrid approaches like this offer the most security. While stock-to-flow may be more historically accurate than other models, it’s not comprehensive enough to use on its own.

Final Thoughts: All Crypto Investors Should Understand Stock-to-Flow

Knowing how to use stock-to-flow in crypto can be a helpful investment tool, despite its limitations. As you invest in crypto, you should consider adding this model to the predictive tools you use.

Again, this article isn’t financial advice and is purely meant for educational purposes. Understanding stock-to-flow will help you understand where its figures come from, leading to smarter decisions. When you know why different models say what they do, you can use them more effectively.

The post The Stock-to-Flow Model: What Cryptocurrency Investors Should Know appeared first on CoinCentral.