In 1940, the chances of children outperforming their parents in terms of income was 41%. In 1980, this decreased to 8%, according to Opportunity Insights. Given the current inflation trajectory followed by wide-scale suspension of economic activity throughout 2020, it seems likely that social mobility compared to previous generations will continue to decline.

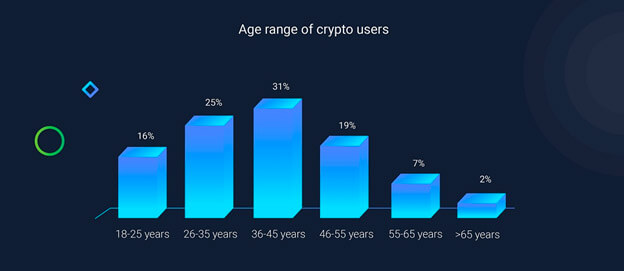

One way in which this trend can be combated is through investing in deflationary assets – such as some cryptocurrencies. Unsurprisingly, younger generations, led by millennials, are at the forefront of crypto adoption.

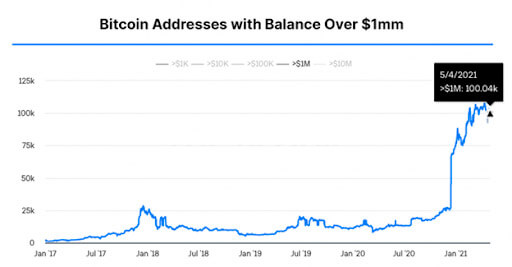

There are many ways one could invest in such digital assets. The most passive way is to simply buy an asset, hold it, and hope to sell it when its value doubles, quadruples, or beyond. This form of investment, which is based largely on timing, minted many crypto millionaires. In May of 2021, there were about 100,000 BTC addresses with over $1 million worth of Bitcoin.

Seeing such a rapid rise in wealth of so many, there’s no wonder why some retail traders now view the crypto market as a get-rich-quick scheme. Within this mindset, one of the more active investment methods to use is margin trading, drawing its root all the way back from the late 1800s as a way to bankroll railroads. As we fast-forward over 120 years, let’s take a look into how margin trading works in the crypto space.

What Is Margin Trading?

Margin trading is leveraging your market position to reap greater rewards with a small initial investment. This is possible by adding a collateral called margin – the funds you borrow from a third party (brokerage or exchange) – to your trade. However, in the same way your leverage can bring about X times profits, it can also incur devastating losses if the asset’s price defies your expectations.

In practice, if you were to margin trade $50 worth of BTC for a 5X leverage, you would borrow $200 to buy $250 worth of Bitcoin (BTC). Therefore, your effective trade with which you would enter the market would be at $250 instead of $50. In turn, no matter how the trade pans out, you would have to return $200 + the platform’s fees.

If a crypto’s price move goes wrong – down instead of up since you entered your position – the crypto exchange will “margin call” your trade when the price hits a level when you start losing borrowed funds. To avoid getting margin calls, and having your trade turn into a loss, you would have to keep adding funds above that level.

When you bet that the crypto’s price will go down, you enter a short position. Correspondingly, when you bet that the crypto’s price will go up, you enter a long position. In the crypto space, margin trading is especially risky because crypto assets are inherently volatile. After all, they all hold relatively low market capitalizations (compared to the traditional stocks, that is) which makes it more likely that crypto whales can move prices to their benefit. For example, Bank of America recently estimated that it would take $93 million to move the price of BTC by 1%.

According to Tim Fries, co-founder of financial education platform The Tokenist, margin calls bear significant risks. Whenever a margin call cannot be met, many traditional stock brokers have the right to close out other open positions held by the investor, in order to meet the minimum amount in the leveraged position. Fries explains:

“Margin calls could end up costing you a huge amount in short-term capital gains tax, as well as unrealized profits from investments that are showing signs of recovery or further growth.”

For this reason, it is prudent to start your margin trade small – under $100 – and increase by fractions. Likewise, you should have a clear plan for when to exit the market and take the profit. Many traders become too greedy and want to test the volatility beyond the point of profit. More often than not, there is a price reversal and the investor must cut their losses instead.

Margin Trading in Practice

Although exchanges have different interfaces and styles, you will notice they all have the same key elements:

- Price charts with tools – technical indicators, from Japanese candlestick to MACD, RSI, and many others. They help you understand the probability of the asset’s price movement. Based on them, you decide whether to engage in a short or long position.

- Order book – just like in the stock market, order books record buy and sell orders and their ask and bid prices. This is very useful because an order book can visualize buy or sell walls. If there is a higher buy order volume, the price will tend to go up and vice-versa.

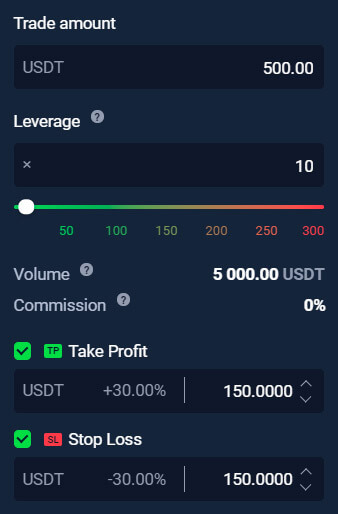

Then, you have the range of possible leverage – from 2X to 300X – although most exchanges have it limited to 200X or lower. Here is how margin trading works in practice. Let’s say you commit to a $500 position, equal to 500 USDT. With leverage of 10X, you would effectively enter the market at $5000.

Then, you have two options – manually track how your trade performs or automate it. In the crypto space, automation of margin trading is accomplished with two tools:

- TP – Take Profit order – allows you to customize the profit range, either through a percentage or raw value, resulting in you automatically exiting the market when the pre-defined profit is reached.

- SL – Stop Loss order – allows you to customize the loss range you are comfortable with to automatically exit the market at a loss.

As previously mentioned, if your account balance drops under the Maintenance Margin Requirement (MMR), you will get margin called. To prevent it, your account will either have to be filled to account for 10X loss (according to our example above) or additional funds will need to be added during the margin trade.

If you follow through this logic, you will immediately see how devastating margin trading can be. You enter a certain bet – short or long – and the price goes opposite that bet. Then, you hope this is temporary so you add more funds to the trade to avoid getting margin calls. But, the price can continue going the other way of your market entry position, bloating losses even further.

As you can see, the risk falls entirely on your shoulders. On the other hand, the whim of the crypto market can give you massive gains as well. To mitigate the risks involved, don’t put in more funds than you are prepared to lose. Equally important, learn to read technical analysis indicators so you can properly employ them to maximum effect.

With that in mind, it’s a best practice to first trade with demo accounts and virtual funds. This allows you to put your strategy into practice without any risk whatsoever.

Digital assets are becoming increasingly integrated in many aspects of the world, from automating payments for businesses to, you guessed it – margin trading. Here are some of the most popular cryptocurrency exchanges that offer margin trading:

- StormGain – zero commission for spreads, demo account, and up to 300X leverage.

- FTX – tiered fee structure, demo account, and up to 20X leverage.

- Kraken – up to 5X leverage, and one of the lowest fees for US residents.

- BitMEX – up to 100X leverage, auto-deleveraging if there is insufficient liquidity to execute orders.

Due to the high-risk nature of margin trading, both Coinbase and Binance have recently limited or excluded this feature for retail investors. This – in and of itself – should warn you to not take margin trading lightly.

The post Beginner’s guide to margin trading cryptocurrencies appeared first on CryptoSlate.