Robinhood shares suffered a lackluster performance on Thursday, sinking dramatically in a market debut that indicated flat investor demand. By the end of the New York session, $HOOD closed 8.4% lower, having earlier sunk by as much as 12%.

The popular fee-free trading app gained notoriety earlier this year. Young and “un-professional” traders turned to it in record numbers during the meme stock craze as many countries were deep in lockdown.

Investor snub Robinhood

Robinhood filed its Form-S1 at the start of July, revealing its financials for the first time.

The figures show, for the year to December 2020, total revenue was $959 million. This is up an impressive 245% from the previous year, at $278 million. Net income came in at $7 million versus a loss of $107 million for the year to December 2019.

Similarly, data on its monthly active users showed a strong performance. In Q1 2021, they were 17.7 million, versus 8.6 million for Q1 2020.

However, the firm admitted it was overexposed to Dogecoin at the time, saying 34% of its cryptocurrency transaction revenue (for its ‘crypto’ business) is derived from the meme token. They warned that if DOGE demand falls and isn’t replaced by an alternative, they could be “adversely affected.”

“If demand for transactions in Dogecoin declines and is not replaced by new demand for other cryptocurrencies available for trading on our platform, our business, financial condition and results of operations could be adversely affected.”

Dogecoin to the rescue?

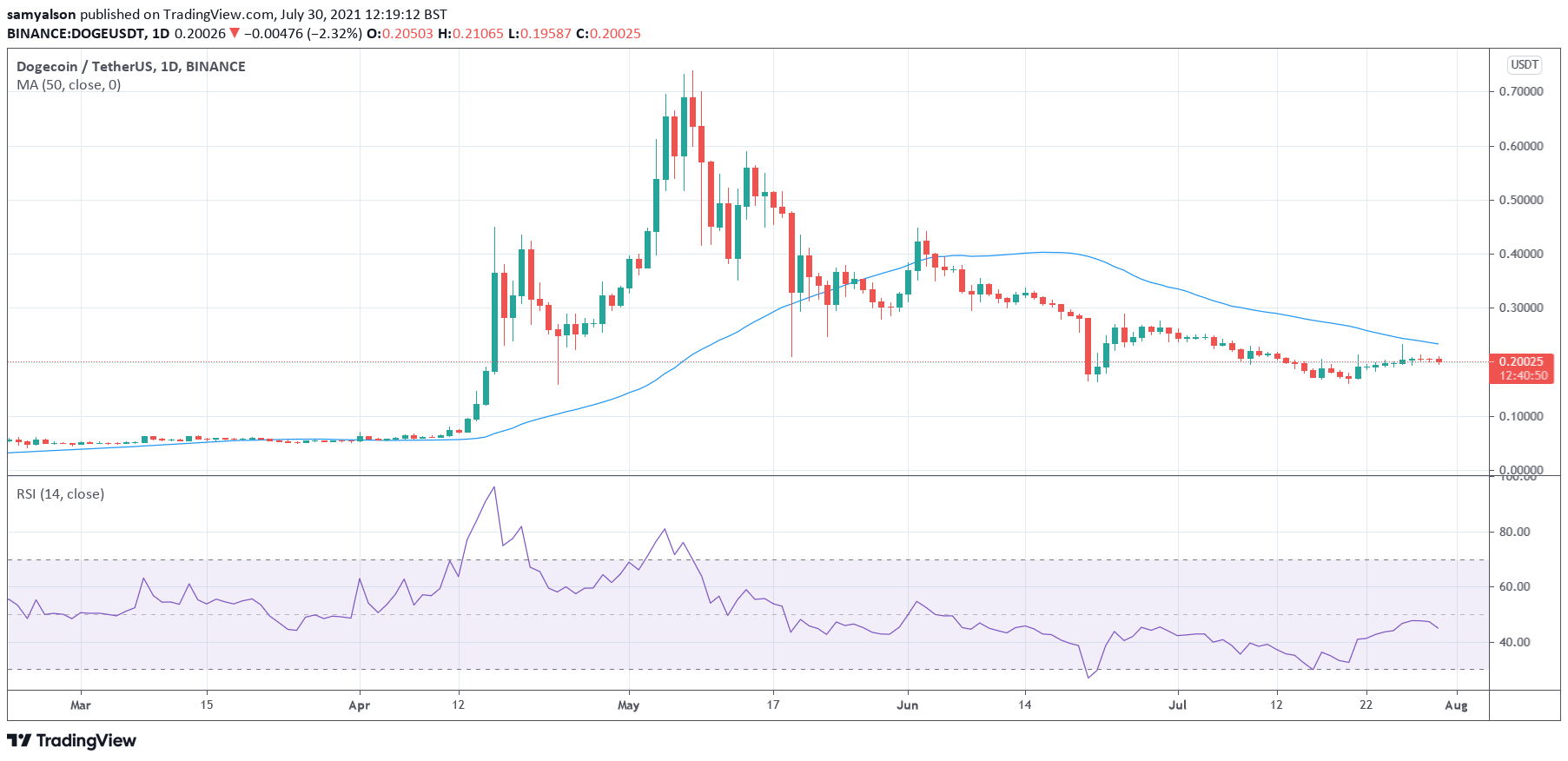

Unfortunately, Dogecoin’s performance since the May local top has fallen short. Since then, the controversial meme token is down 74%, and a failure to break above the 50-day moving average suggests buyers have turned their attention elsewhere. For now, at least.

With a string of prominent crypto figures continuing to sound the alarm on Dogecoin, namely, over its poor fundamentals, one wonders whether memes alone can recapture DOGE’s previous form.

The Ripple chairman Chris Larsen doesn’t think it can. He recently likened investing in DOGE to gambling.

The firm previously mentioned it is on the lookout for a Dogecoin alternative. So far, nothing has emerged that comes close to the impact of DOGE earlier this year. Its next nearest rival, Shiba Inu, is trading equally as flat.

Although they previously spoke of being “adversely affected,” it’s also important to note that cryptocurrency accounts for only 17% of its revenue.

The bigger issue at hand is whether they can ride out the regulatory scrutiny that’s coming. Robinhood has drawn flak over the way it handled the GameStop/AMC saga, plus there’s the issue of “gamification” of trading.

The post Robinhood’s Nasdaq debut ends with sputter, can Dogecoin (DOGE) save it? appeared first on CryptoSlate.