As Bitcoin gains momentum around the world, financial regulators step up their game to try and save the crumbling financial system.

The International Monetary Fund (IMF) sent out a warning, telling us that using crypto assets as national currency would be “a step too far.” Personally, I think a step too far is the existence of an unaccountable, global body that imposes an unsustainable monetary system on the entire word, but that’s just me. Leaving that aside, let’s look at the IMF’s arguments and see if they hold any weight.

Don’t Fear Short-Term Volatility

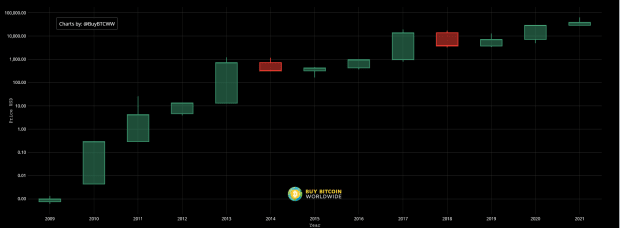

The IMF begins by warning us that crypto assets are extremely volatile, as if we didn’t know that. The IMF said that bitcoin, “reached a peak of $65,000 in April, but then crashed to less than half that value just two months later.” So yes, it’s volatile.

But here’s the piece the IMF is missing. If you’re measuring your investments in weeks and months, you’re going to lose every single time. You need to zoom out and look at it over the long run.

Above is the price of bitcoin in yearly candles since 2009. We can see that it has continued to go up and up, with only a couple of down years. This is a very different picture than what the IMF tells you. Even considering bitcoin’s recent downturn, it’s still up about 300 percent in the last 12 months. Taking the longer view is key. The IMF is trying to scare you by looking only at short-term volatility.

“Stable Inflation” Versus Accumulation

Next, the IMF argues that, “crypto assets are unlikely to catch on in countries with stable inflation.” Inflation means that my money is losing value. It’s losing purchasing power. I wouldn’t call that stable, nor do I accept my money losing value at a steady rate of a central bank’s choosing. To me, stability means my wealth doesn’t get inflated away.

The IMF goes on to say the people would have very little incentive to save, even if a crypto like bitcoin was made legal tender. And they allege that people would much rather hold a global currency like the dollar or the euro.

They seriously expect you to believe that people living under “stable inflation” would rather hold and save in fiat currencies, which are guaranteed to lose their value, instead of putting your money into bitcoin, which has a long track record of growing over time. Which one would you choose? And what do people living in countries like Argentina, Lebanon and Venezuela feel about seeing hyperinflation and their currencies blow up? Which one would they choose?

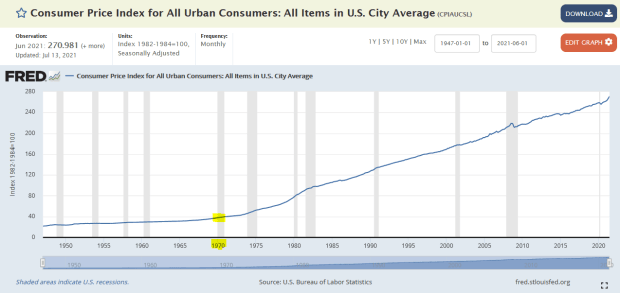

Inflation is an absolute killer, even if you live under a “stable inflation” regime. You can see the U.S. Consumer Price Index rise rapidly after we went off the gold standard in 1971. Inflation was mellow until that point, and then it’s basically gone straight up. That’s your wealth being stolen over decades.

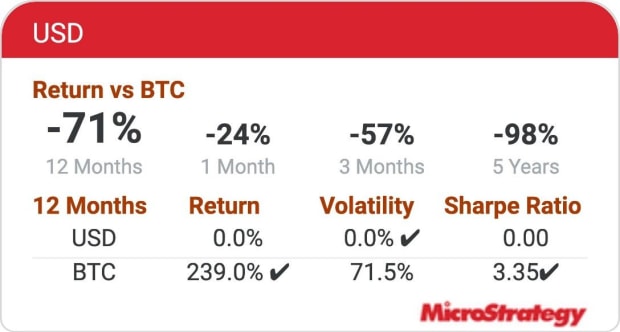

The dollar has a laughably poor performance compared to other assets. We can see on this chart put together by Michael Saylor of MicroStrategy, the dollar lost 98% of its purchasing power in just five years versus Bitcoin.

In a similar calculation compared to the S&P 500, the dollar lost 91% of its purchasing power over 30 years. Your fiat dollars continually lose value and underperform compared to bitcoin and equities. And yet, the IMF says you’d prefer to hold dollars instead of bitcoin, which gives you a 239% return per year. That’s nuts. I’ll happily trade some short-term volatility for the opportunity to build real wealth.

I want to be fair to the IMF here. There’s one thing in their article I agree with. They say that crypto assets may catch on with the unbanked. About two billion people have no access to the financial system. That’s a big problem. In El Salvador, where I recently visited, it costs anywhere from $25 to $50 a month to hold a bank account. That’s about half of what people earn in a month, and so banking is cost prohibitive. Bitcoin will be the key to giving the world’s unbanked access to the financial system.

Scare Tactics: IMF Says Crypto Will Fund Criminal Activity And Terrorism

The IMF is worried about crypto endangering financial integrity saying that without strict regulation, “cryptoassets can be used to launder ill-gotten money, fund terrorism, and evade taxes. This could pose risks to a country’s financial system…” So, the couple hundred bucks or thousand bucks you hold in crypto could fund terrorism, they say. Never mind the $400 million in cash the Obama administration put on a plane and flew to Iran, one of the world’s largest sponsors of terrorism. No. they’re more worried about you HODLing some bitcoin.

This concern-trolling flies in the face of all reality. In September 2020, the The International Consortium of Investigative Journalistsreleased a bombshell report titled, “Global Banks Defy U.S. Crackdowns By Serving Oligarchs, Criminals And Terrorists,” showing trillions of dollars of dirty money flowed through big U.S. banks, doing business with corrupt regimes, organized criminals and fraudsters. Trillions of dollars, not bitcoin, get laundered to fund criminal activity, and who knows what else? Yet the IMF thinks you’re the problem, you’re the criminal risk for keeping some bitcoin. It’s laughable.

Lost Productivity

The IMF also claims that adopting Bitcoin would cause macroeconomic instability and lost productivity, saying, “households and businesses would spend significant time and resources choosing which money to hold as opposed to engaging in productive activities.” You’re going to spend all day fretting over which currency to use. Sure.

I want to address the idea of productive time. Under a central bank-controlled fiat system of never-ending inflation and currency debasement, productive time is stolen from you. They literally steal your time with inflation.

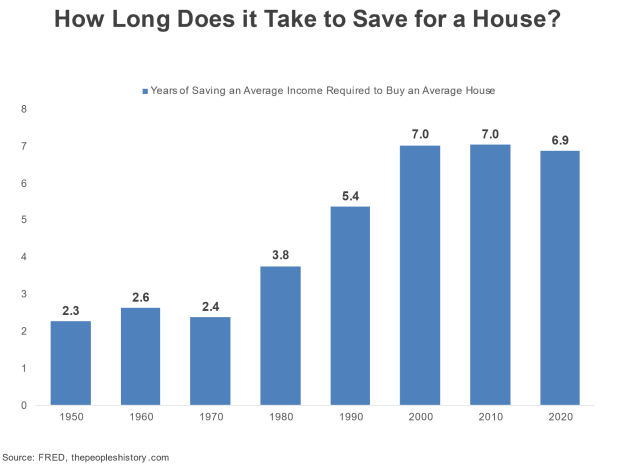

For example, I recently researched the impact runaway housing inflation has had on the typical family over the years. I calculated the time needed to save for a home. The results were striking.

In 1950, it took 2.3 years of your life, your labor, to save for the cost of an average home. By 2020, that figure ballooned to nearly seven years. The system has stolen that time from you through inflation.

But the IMF isn’t concerned with the four and half years of your life lost to keeping up with housing inflation. They’re more worried about the few minutes you might have to spend to decide how you’ll allocate your money in dollars or bitcoin.

The truth is, under stable money, you would become more productive, not less.

Bitcoin Is A Threat To Their Power

After all these flimsy arguments, the IMF gets to the heart of it all, admitting “monetary policy would lose bite.” Mass crypto adoption means central banks would lose their teeth. They wouldn’t be able to dig in and enforce their actions. They wouldn’t be able to exert total control over interest rates. That’s a good thing. We want them to lose their bite. The free market should decide interest rates, not central bankers. If there are more lenders than borrowers, interest rates should come down. If there are more borrowers than lenders, interest rates should go up. The central bank should have no role here. But central banks don’t want to give up their control and that’s why they want to crack down so hard on crypto and Bitcoin, warning you of their dangers.

Senator Elizabeth Warren recently said, “We don’t want our policies to be in the hands of shadowy super-coders.” Instead, we’d rather have our policies in the hands of central banks that lack transparency? How’s that been working out for us?

The irony is that they’re making the arguments for us. The strong reaction against crypto from the central authorities tells us we’re over the target. They’re telling us that crypto is an existential threat to central banking.

Bitcoin is the one thing that can bring this whole corrupt monetary system down and the way for us to build real, lasting wealth because it’s the only cryptocurrency that solves the problems this current system has created.

This is a guest post by Mark Moss. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.