Bloomberg Intelligence analyst Mike McGlone sees “a refreshed bull market” for bitcoin. Comparing the performance of the cryptocurrency to the start of 2019, he explained, “we see performance parallels that could get the benchmark crypto back on track toward $100,000.”

Bitcoin Back on Track Toward $100,000

Bloomberg Intelligence published analyst Mike McGlone’s August cryptocurrency outlook with a price prediction for bitcoin Wednesday.

McGlone described that bitcoin is set to turn $40,000 into support, stating that “This year is prime for bitcoin to take the next step in its price-discovery stage and we see a refreshed bull market.” He further explained:

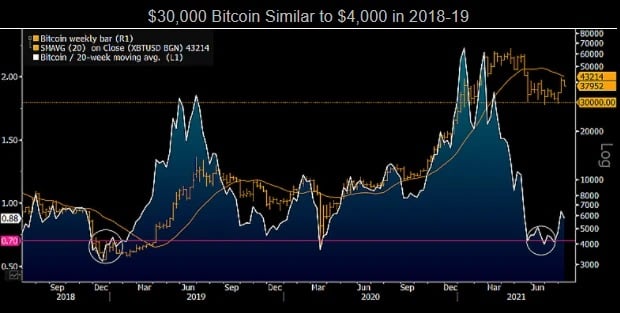

Bitcoin appears to have built a base around $30,000 that’s akin to $4,000 at the start of 2019, and we see performance parallels that could get the benchmark crypto back on track toward $100,000.

“The longest period below its 20-week moving average since 2018-19 indicates weak longs have been cleansed within an enduring bull market,” the analyst added. “What’s changed in about three years is sufficient to sustain more of the same for most of Bitcoin’s history — rising prices. Supply is declining while demand and adoption are rising in most countries that welcome open discourse and free-market capitalism.”

He noted that the crypto crackdowns in China and the increased regulatory efforts by the U.S. government are part of bitcoin’s maturation. “The increasing dichotomy between China pushing back and the U.S adding clearer rules may mark part of a new and different kind of cold war. Countries restricting capital flows may fall behind in the digitalization process of money and finance,” he opined.

Furthermore, the analyst said: “Bitcoin and gold are poised to follow the resumed upward trajectory of U.S. Treasury bond prices in 2H … Probabilities are rising that bearish 1H consensus will turn out to be temporary and provide an opportunity for more-enduring bull markets starting from a discount.”

McGlone has long been bullish about bitcoin. The Bloomberg Intelligence analyst said in October last year, “The key thing about bitcoin is that I don’t see what’s going to stop it from doing what it has been doing for most of its life, and that’s appreciating.”

Last month, he said that “Bitcoin is more likely to revert toward $60,000 resistance vs. $20,000 support if its history of recovering from similar too-cold conditions are any guide.”

Meanwhile, a panel of crypto experts has predicted that by December 2025, the price of BTC will go up to $318,417. Furthermore, 54% of them think hyperbitcoinization — the moment that bitcoin overtakes global finance — will happen by 2050.

Do you agree with Mike McGlone? Let us know in the comments section below.