Gemini was founded in 2015, by Tyler and Cameron Winklevoss (Co-Creators of Facebook).

Gemini has gained a large percentage of the cryptocurrency trading market and has built its reputation on years of building its exchange project, launching new features such as its cryptocurrency interest account called Gemini Earn, and working with regulators to facilitate cryptocurrency adoption for the mainstream.

In this Gemini Review, I’ll show you the pros and cons of this exchange.

- Key Information

- How to Use Gemini to Buy Bitcoin and Ethereum

- Is Gemini Safe?

- Supported Locations

- Deposit Limits

- Withdrawal Limits

- Fees

- Summary

Gemini Review: Key Information

| Key Information | |

|---|---|

| Site Type | Cryptocurrency Exchange |

| Beginner Friendly | Yes, but familiarize yourself with its more advanced options |

| Mobile App | Yes |

| Company Location | New York |

| Company Launch | 2015 |

| Buy Methods | Bank Transfers & Wires |

| Sell Methods | Bank Transfers & Wires |

| Available Cryptocurrencies | Bitcoin, Ethereum, and 28 more. |

| Community Trust | Great |

| Security | Great |

| Fees | Very Low (0.5% – 3.99%) |

| Customer Support | Good |

| Site | Get $20 in BTC after trading $100 or more. |

In a rapidly growing industry, many exchanges have struggled to keep up with growing customer support needs. Gemini began to separate its from the pack with excellent customer support.

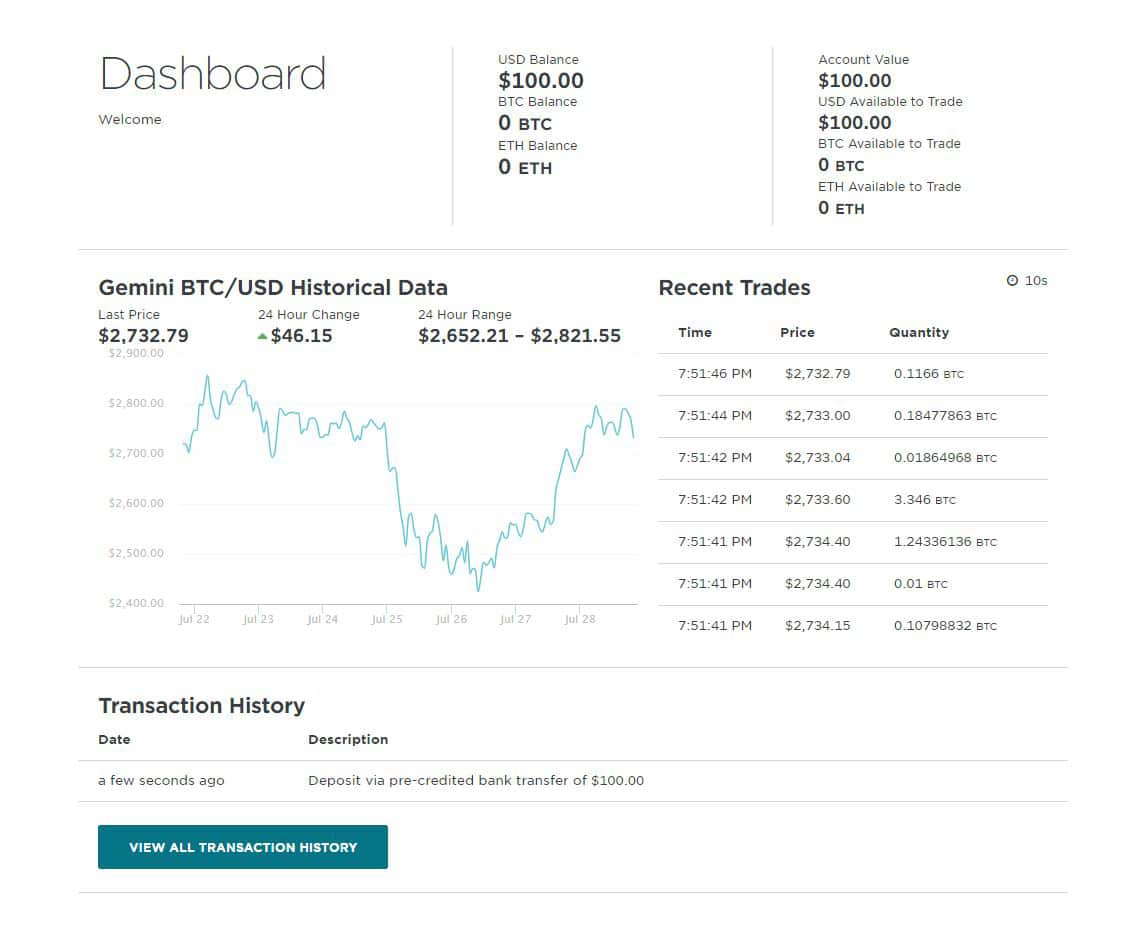

Another benefit of Gemini is its fast and beginner-friendly services. Unlike most exchanges, Gemini allows you to begin trading as soon as you deposit via bank transfer. While you cannot withdrawal from the exchange until your deposit is fully processed, this allows you to purchase your first Bitcoin or Ethereum immediately after depositing.

How to Use Gemini to Buy Bitcoin and Ethereum

Below we’ll show you the process for creating a Gemini account and buying cryptocurrency with a bank transfer.

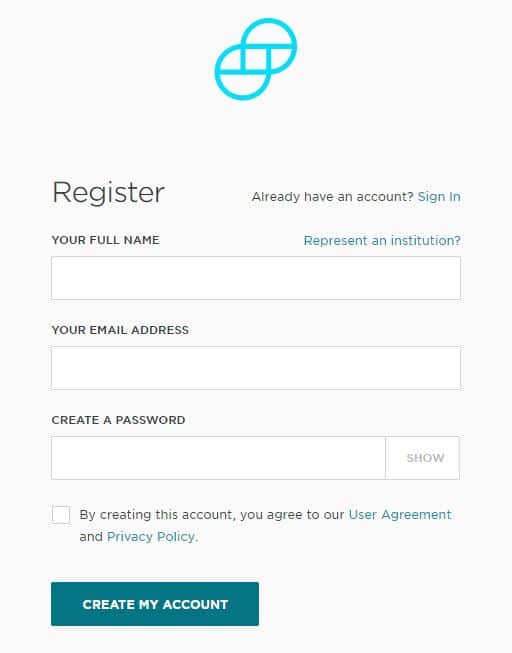

1) Sign Up

Signing up on Gemini is a simple process.

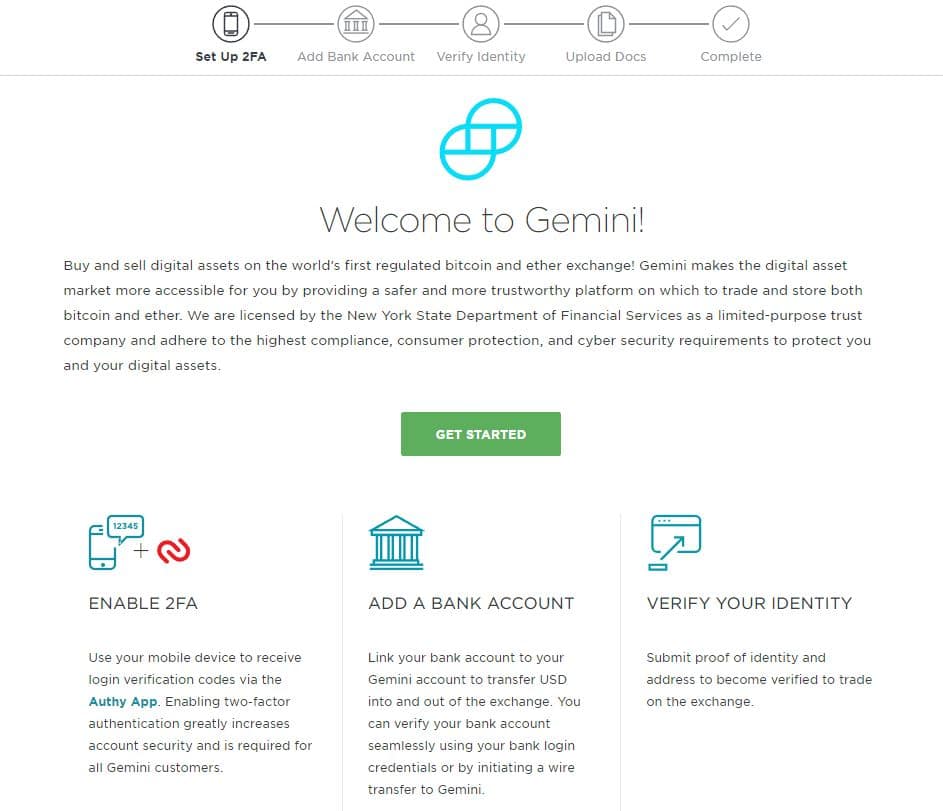

After you’ve verified your email, you’ll be taken through Gemini’s KYC and onboarding process. You’ll be required to:

- Enter your location and phone number, then enable 2-Factor Authentication (2FA). 2FA will help keep your account secure, by requiring an additional code when logging in.

- Add the bank account you want to use to deposit. Bank transfers and wires are the only deposit methods currently accepted at Gemini.

- Verify your identity by uploading your government-issued ID. This is required by nearly all cryptocurrency exchanges that allow users to deposit, withdraw, and trade in fiat currencies (USD, EUR, GBP, etc). It is required for the exchanges to comply with various government regulations. This verification can take up to a few days during times of high application volume.

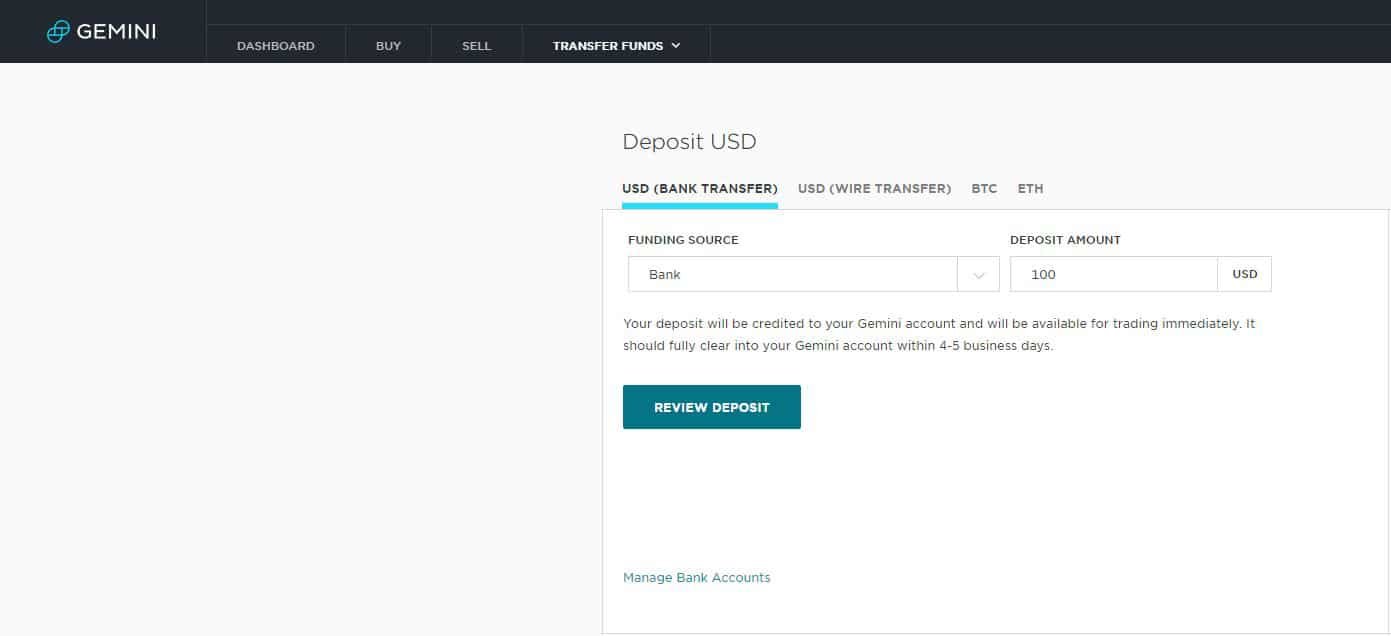

2) Deposit Funds to Gemini

Once your account is created and verified, it’s time to make a deposit. Through the menu, navigate to Transfer Funds > Deposit Into Exchange > Bank Transfer. Enter the amount you’d like to deposit (limited to $500 if using bank transfer).

When using a bank transfer, your deposit will immediately be available for trading.

3) Buy Bitcoin and/or Ethereum

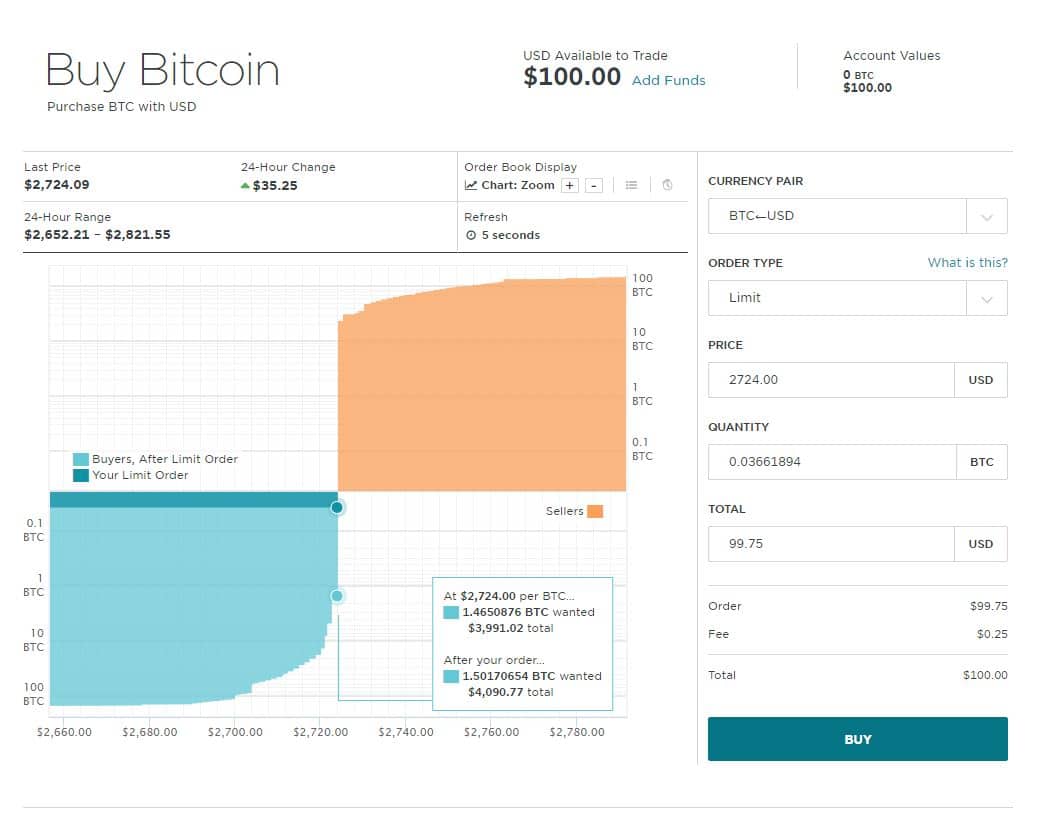

Through the menu, navigate to the pair you wish to trade. If you’re wanting to buy Bitcoin, you’d go to Buy > BTC/USD.

Enter the price and quantity for your buy order. You can also choose a market order, that’s “filled immediately against resting order”.

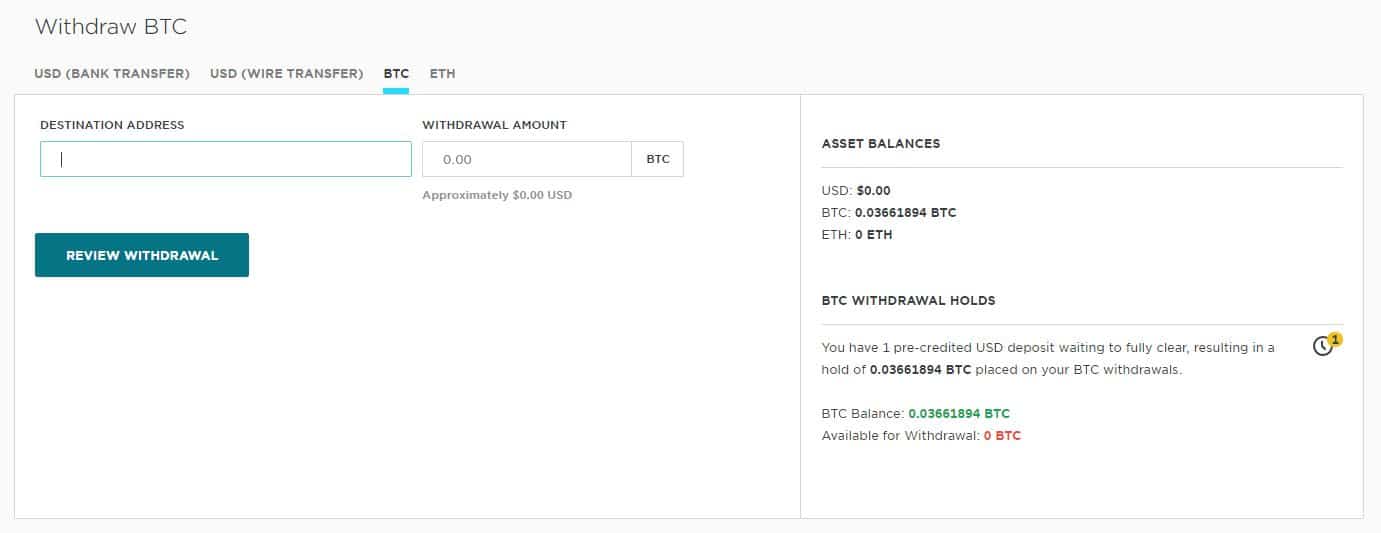

After your purchase is complete, you will now have Bitcoin in your account. Note that you cannot withdrawal until your bank transfer has finished processing, although you can sell the Bitcoin you purchased on the exchange.

Is Gemini Safe?

If you’re reading this Gemini review, the safety of Gemini is likely one of your top concerns. In short, Gemini appears to be one of the safest cryptocurrency exchanges. Below I’ll examine how Gemini holds up in 3 crucial aspects of any cryptocurrency exchange’s security.

Company Legitimacy

As a New York-based cryptocurrency exchange, Gemini is fully regulated and compliant with all the necessary regulators.

Gemini Trust Company, LLC is regulated by the New York State Department of Financial Services (NYSDFS). This requires them to meet capitalization, compliance, anti-money laundering, consumer protection, and cyber security requirements set by the NYSDFS.

Users can also take solace that the company was founded by the Winklevoss twins. After co-creating Facebook and rowing in the Olympics, Tyler and Cameron Winklevoss have invested in a number of successful startups.

Safety of Funds

Gemini takes a variety of steps to ensure customer funds are held safely.

The majority of cryptocurrency funds are stored in offline cold storage, rather than hot wallets. Multi-Signature technology is used to eliminate single points of failure. These offline wallets are stored in multiple secured facilities. You can learn more about Gemini’s security here.

Fiat funds are FDIC insured, up to $250,000. These funds are segregated from company operational funds.

Personal Account Security

Gemini requires all users to enable 2-factor authentication, which will be used as a second code when logging in and withdrawing. You can use SMS texts or the Authy App as 2FA methods.

Supported Countries

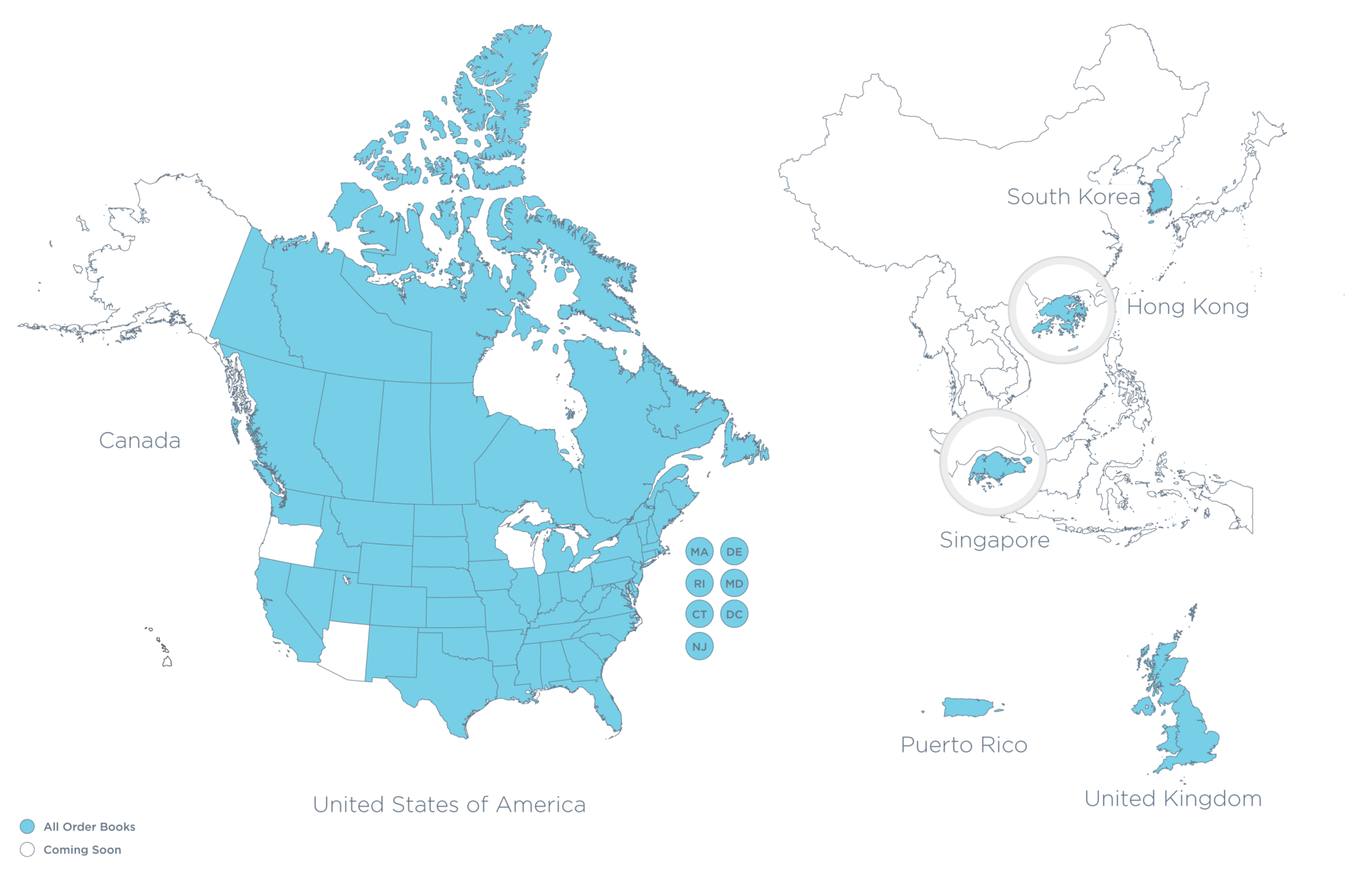

Gemini services customers in the United States, Canada, United Kingdom, Puerto Rico, Hong Kong, South Korea, and Singapore.

Deposit Limits

- Bank transfer $500 per day, $15,000 per 30 days.

- Wire transfer unlimited.

- Cryptocurrency unlimited.

Withdrawal Limits

- Bank transfer $100,000 per day.

- Bank wire unlimited.

- Cryptocurrency unlimited.

Fees

Deposits and withdrawals do not have fees on Gemini.

Trading on the exchange comes with fees, but they’re usually 0.25% or lower.

Gemini Review Summary

Gemini is a low-fee, beginner-friendly method of buying Bitcoin and Ethereum. The company has quickly built a great reputation in the cryptocurrency community, partly due to its above-average customer service.

CoinCentral readers can get $20 when they trade $100 or more on Gemini.

The post Gemini Review: Is Gemini Safe? appeared first on CoinCentral.