NordFX is a brokerage company that serves clients across the globe and offers a full range of services for online trading. You can use NordFX to trade silver and gold or currencies in the forex market. It also offers the ability to invest in global stocks with a high income and capital protection of up to 100 percent.

NordFX prides itself on offering minimal spreads with immediate order execution. The spreads on major currency pairs are just 0.2 to 2 pips, lower than most competitors. That savings helps increase profits while cutting expenses. Clients can also take advantage of the leverage ratio of up to 1:1,000, which clients can use for both metals and all currency pairs. Accounts, deposits, and withdrawals are all available in USD for ease of use.

NordFX began in 2008, and clients have opened more than 1.2 million accounts since then. These clients are spread across more than 100 countries. NordFX’s parent company is NordFX CY (NFX CAPITAL CY LTD) which is headquartered in Limassol, Cyprus.

Clients will also appreciate the range of assets you can trade with NordFX. There are 33 forex currency pairs, as well as equities investments, Cryptocurrencies and precious metals. The various platforms offer something for all trading styles, including mobile accessibility. NordFX also supplies reliable, stable trading due to the stability of its platforms and servers. Thanks to the servers and platforms, orders are executed in just 0.5 seconds.

It is also very quick to register for an account, with the entire process taking place online for convenience. This means that new clients can start trading nearly right away.

NordFX Account Types

There are four types of accounts available from NordFX. All account types give you access to a trading manual and MetaTrader 5. With a Fix account, there are no commissions and the minimum deposit is just $10. The spreads for this type of account start at 2 pips and you can enjoy credit leverage of up to 1:1,000. These accounts can have their balances in USD, BTC, or ETH and have a quote precision of four digits. With this type of account, clients can trade 28 currency pairs as well as gold and silver.

Pro Accounts still have no commission and have the same leverage and account balance currencies. There is a minimum deposit of $50 and the quotes are precise to five digits. The spreads start at just 0.9 pips with this account type. The access to assets is also greater, with 33 currency pairs plus metals and cryptocurrencies.

The Zero Account is ideal for traders who want the lowest possible spreads as spreads go from 0.0 pips. There is a minimum deposit of $100 and there is a commission of 0.0045 percent per trade on each side. You have the same three account balance currencies and leverage with access to 33 currency pairs, cryptocurrencies, and metals.

Finally, NordFX offers a Crypto Account with a minimum deposit of $1 and spreads from one pip. The accounts can be in USD, BTC, or ETH and there is access to 16 cryptocurrency pairs plus four cryptocurrency indices. There are maker fees of -0.02 percent (paid to the trader) and taker fees of 0.09 percent.

Account Verification Requirements

In general, NordFX does not require any documents to register an account. Even so, it is sometimes necessary to supply documents to verify an account. If this is the case, you will need to submit scans of a photo ID as well as proof of residence, with the information on those documents matching the information on your trading account registration. You will need to verify your account if you plan to use your bank card to make your deposit.

NordFX Demo Accounts

NordFX does offer a free demo account without any expiration date. The lack of expiration date is nice since many other brokers limit the amount of time that traders can use a demo account. The only thing to keep in mind is that if your demo account is inactive for more than 14 days, it gets automatically deleted. You can easily create a demo account via MetaTrader 4 or MetaTrader 5 or in the Trader’s Office for your live account.

Viewing the Trader’s Office

The Trader’s Office is where you will find your account information on NordFX. You will see it when you log into your account. If you go to the Personal Settings section of the Trader’s Office, you will see your personal data as well as key account parameters, including the account type, selected credit leverage, and balance. This is where you can choose to transfer funds to either MT4 or the Trader’s Office. If you do not select an option, the default is crediting the funds to your MT4 balance. For those concerned about security, you can limit the IP addresses from which it is possible to access your Trader’s Office. To do so, enter the IP addresses that are allowed, separating each by a comma, new line, or space.

NordFX Deposits & Withdrawals

To appeal to a range of clients, NordFX offers a range of funding methods. You can fund your account in USD, EUR, or RUB using a bank transfer, which will take three to five business days. Your bank may charge fees for this, but NordFX will not. You can also make an instant deposit via Visa or MasterCard with these three currencies without a commission.

Alternatively, NordFX supports over a dozen online payment systems, all of which are instant. Those without fees include Ngan Luong (in VND), DCPay (in USD or EUR), Fasapay (in USD or IDR), Alipay (in USD or CNY), Yandex.Money (in RUB), Alfa-Click (in RUB), Neteller (in USD), Skrill (in USD or EUR), and QIWI (in RUB). You can deposit USD, EUR, or RUB via WebMoney for a fee of 0.8 percent but not more than $50. You can make Visa or Maestro deposits via Neteller for a fee of 1.75-4.95 percent or 0-4.95 percent, respectively. There is a fee of $0.50 for USD deposits with PayWeb and a commission of 4 percent when depositing THB with PayToday. Finally, you can deposit USD or EUR with Perfect Money, which has a fee of 0.5 percent with premium or verified accounts and 1.99 percent with unverified accounts.

Withdrawal methods are nearly identical with a few notable exceptions and a longer transfer period. Withdrawals via bank transfer take three to five business days. Withdrawals via Visa and Mastercard take five to six business days and cost 4 percent plus $7.50. PayToday has instant withdrawals with a commission of 2 percent. The other online payment systems take a business day for withdrawals. QIWI, Neteller, PayWeb, and Ngan Luong do not charge fees, while WebMoney charges the same fee for withdrawals as deposits. Skrill charges 1 percent and Perfect Money charges 0.5 percent.

There is also a final option of withdrawing from your NordFX account as an internal transfer in USD or EUR without a commission. It is instant for consolidated accounts and takes one business day otherwise. Keep in mind that all withdrawals are just processed between 9:00 and 18:00 CET. Withdrawals submitted after this time limit will be completed the following business day and NordFX does not process withdrawals on weekends or holidays.

If for some reason you make a deposit, but the funds do not get credited to your account balance, you can visit the Trader’s Office online and then head to the Lost Transfer Notification section. There, leave a notification that includes the transfer details. The money should arrive in your account within a business day after this. If it does not, you should email the NordFX Finance Department.

Trading Platforms

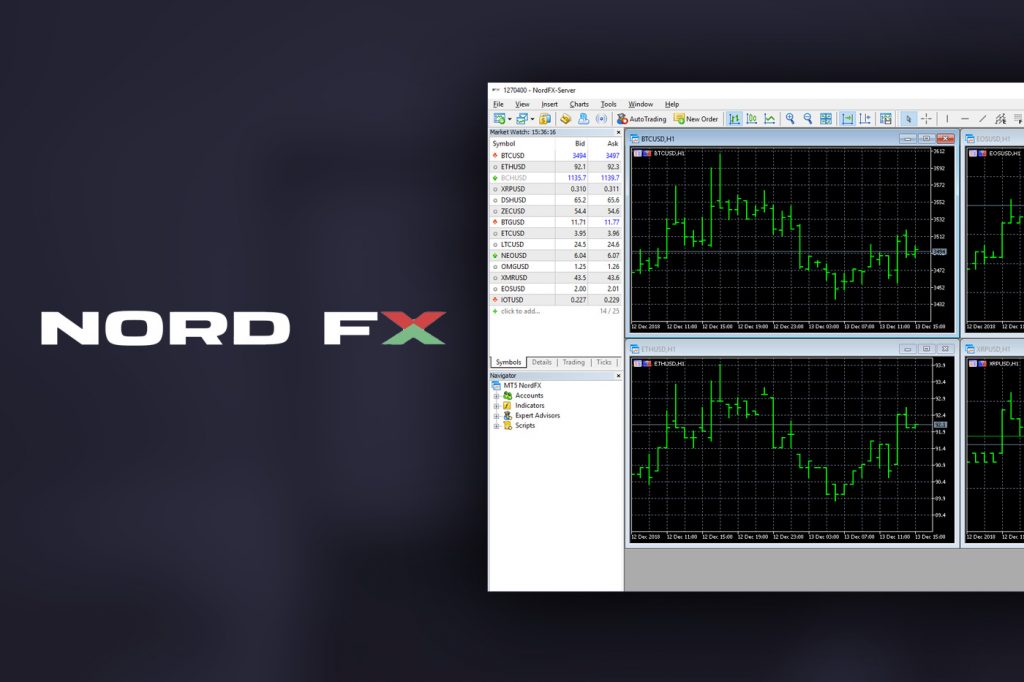

You will find NordFX traded on MetaTrader 5, MetaTrader 4, iPhone/iPad, Android, and MultiTerminal.

MetaTrader 5

MetaTrader is an extremely popular platform, and MetaTrader5 is the most modern version available. There are several advantages you will find from the other platforms and it is designed more for the exchange trade and Forex market, as well as trading cryptocurrencies. Metaquote, the developer, considers it promising because of its efficiency in operations trading on the exchange market and technical analysis in real-time that is comprehensive.

Some top advantages of MetaTrader 5 include:

- Plenty of statistical and graphical data for exchange trading efficiency.

- May be able to get news from leading agencies.

- For use with exchange trading cryptocurrencies.

- 7 order types and market executions.

- MetaTrader 5 Strategy Tester offers expert advisors and high-precision rapid testing of selected strategies.

- Possibility of getting volumes offered at current prices or ‘Depth of the Market.’

- Plenty of scripts, graphical tools, expert advisors, and other technical indicators built-in to help with technical analysis that is highly accurate and essential to providing advice in transactions and decision making.

It’s fast when placing sell or buy orders and with the wide selection of trading strategies, you have many order types available. The programming language with this platform allows you to use expert advisers and apply individualized indicators, offering higher speeds of execution and more accurate price dynamics analysis.

MetaTrader 5 is available as a download for desktop or an application for either Android or iPhones.

MetaTrader 4

MetaTrader 4 allows for trading on the forex market as well as precious metals trading. With this platform, you can enjoy instant execution as well as market execution and access a range of order types to let you adapt your trading style. MT4 makes it possible to create then test scripts and indicators. MetaQuotes Language 4 is easy for developers to use to create expert advisors and indicators to test your trading strategies. Or you can use the built-in indicators and the other graphical tools available. MetaTrader 4 is commonly considered the standard for forex trading, meaning that there are many tutorials and support resources available. MetaTrader 4 also has high-grade security for the trading transactions and can incorporate news feeds right into the platform.

Some advantages of MetaTrader 4 include:

- Newsfeed integration from multiple agencies, such as Dow Jones, the world-famous agency.

- Tools that allow for real-time technical analysis.

- Ability to create then test your own scripts and indicators.

- Both Market Execution and Instant Execution.

- Various time intervals available for trading.

- Superior security.

Because of its popularity and widespread use, NordFX traders can use MetaTrader 4 on a lengthy list of devices. There are desktop versions for both Windows and Mac as well as mobile applications for both Android and iPhone.

MultiTerminal

NordFX also appeals to those who manage multiple accounts or traders with several accounts by offering trading via MetaTrader 4 MultiTerminal. This platform is specifically designed for managers and traders who have to work with multiple accounts simultaneously. The interface is highly user-friendly, and it includes all of the major features of the MetaTrader 4 platform.

With MT4 MultiTerminal, you can place a buy or sell order, modify an existing order, and close a position either partially or fully. There is also automatic or manual distribution of the required trade volume for every individual account. Of course, this platform also has the expected high levels of security via Advanced Security for safe data transmission.

Some key advantages of the MetaTrader 4 MultiTerminal include:

- Ability to fully or partially close positions.

- Ability to make and change buy and sell orders.

- Only carries out operations in the investor’s account, allowing for some supervision of the actions of the manager.

- Choice of automatic or manual distribution of the trade volume required for every account individually. (This is done either by letting the program distribute trade volumes automatically based on equity ratios or using algorithms of equal distribution.)

It is important to note that using an MT4 MultiTerminal platform is somewhat challenging for all but advanced traders. As such, NordFX strongly suggests that you read the User Guide for this particular platform before using it and that you first test the program using a demo account. You should also keep in mind that with the MetaTrader 4 MultiTerminal, all of the managed accounts must be on a single server.

Mobile Trading Devices

iPhone and iPad

MT4 for your iPhone is designed to be used with MetaTrader 4 users. Those with iOS mobile devices will be happy to learn the application facilitates foreign exchange instruments online trading from anywhere at any time. One benefit of the application is that it provides an intuitive interface as well as many of the functions from MetaTrader 4 to provide for successful trading while mobile.

Some features you can expect to enjoy include:

- Three chart styles: broken lines, candlesticks, and bars.

- Total account control.

- Real-time quotes on financial instruments.

- Direct trading from the chart.

- Entire trading history.

- Real-time, interactive charts with scrolling and scaling.

- Full trading orders set, as well as pending orders.

- Simple to use interface.

- Charts have volumes and trading levels clearly displayed.

- Thirty different oscillators and indicators.

- All types of trading operations executed and supported.

- Minimal data used.

- 7 different timeframes: D1, H4, H1, M30, M15, M5, and M1.

- Network allows for secure data transmission.

- Can go offline. (Trading history, charts, quotes, and current trading positions).

This application is available from the Apple Store, with a link on the platform description on NordFX’s website.

Android

The features of the Android platforms available from NordFX are essentially identical to those of iOS platforms, including the full list of features mentioned above. The Android application has an intuitive interface and delivers the features of MetaTrader 4.

To download the Android application, you can visit the Google Play Store, click the download link in the application description on the NordFX website, scan the QR code on this page on your phone, or download it via email.

With either MetaTrader mobile applications, whether it is for iOS or Android, it becomes possible to trade on NordFX wherever you go at any time. The applications have full functionality, although the smaller size of your smartphone screen does somewhat limit the ability to view information in a chart in great detail. These applications are, however, incredibly useful for beginner traders who do not want to use complicated strategies. They can also be helpful for advanced traders who have to be away from their computers for a period of time and want to confirm that their trading strategies are going as planned.

NordFX Managed Investment Products

NordFX offers Investment Funds as a simple, transparent, and affordable method of investing in shares of leading companies around the world. New investors with limited amounts to invest can also use these funds to take advantage of professional asset management.

The Pro-Industry Fund from NordFX has an expected yield of 27 percent per annum and includes companies like Motorola, Nike, Ferrari, HP Inc, McDonald’s, Johnson & Johnson, Pfizer, Boeing, and Coca-Cola. This fund has a minimum investment amount of $1,000 USD with an investment period between six months and a year.

The Pro-TECH Fund includes AMD, Adobe Systems, NVIDIA, Cisco Systems, Apple, Microsoft, Intel Corp, Electronic Arts, and Alibaba for an expected yield per annum of 40.9 percent. The minimum investment is $3,000 and the investment period can range from 3 months to one year.

Finally, the Pro-Expert Fund includes Netflix, Visa Inc, Amazon.com, Mastercard, PayPal, Facebook, FedEx, Google, and 21 Fox. The investment period is three months to one year with a minimum investment of $5,000 and an expected yield of 57 percent per annum.

In addition to the NordFX Investment Funds, the broker offers other investment products. These instruments offer maximum protection of investments along with potential profits that exceed bank deposits. NordFX creates a balance by allocating some funds to lower-risk financial instruments that are less profitable and some to instruments that are relatively risky but have a greater potential for profit. These products include guaranteed income and capital protection. You can sort the options by the minimum investment amount and/or the term of investment.

NordFX Trading Tools

As with any reputable broker, NordFX offers a range of tools traders to use to help them strategize and make a profit. One of these features is regular analysis and market news, including weekly forecasts for both forex and cryptocurrencies.

Unsurprisingly, there is also an economic calendar that lets traders know which upcoming events may influence the markets. The economic calendar includes the time and date for each event, as well as the title, the currency, the impact, and figures for actual, forecast, and previous. It is also possible to use filters on the economic calendar to better view the events relevant to your trading strategies.

NordFX traders can use the Trader’s Calculator to calculate their potential profit. You begin by entering your account type, leverage, and currency. From there, the calculator lets you input your trading positions. For each, you indicate the instrument, the position size, and sell or buy. The open and close prices are filled in automatically. Once you press calculate, you will see the calculated price, the pip value, the spread, the swap, the margin, and the profit for each position. At the bottom, there are total calculations that account for all the positions input into the calculator, displaying the total profit and total margin.

All clients of NordFX also get access to trading signals via MetaQuotes Software Corp. These trading signals are integrated right into the MetaTrader 4 platforms and let traders connect with thousands of different trading signal providers worldwide. Traders can then automatically copy the preferred signals right in their accounts. NordFX also lets clients become signal providers to increase their income. The Signals service has an easy subscription and includes protection against wrong calculations for trading lot sizes as well as excessive deposit loads. It is highly secure for the signals providers and traders and includes transparency for the trading history.

Neither traders nor providers must allow third-party access to balances and accounts; you do not even need your password to subscribe to the Signals. Depending on the chosen signal, it will have a fee or be free of charge. Other than this, using Signals does not increase commissions or spreads and the subscription term is typically one month.

NordFX also works with Fozzy, a hosting provider, to give traders the ability to use a VPS. The Fozzy Forex VPS sits with the NordFX servers and helps traders ensure they experience 24/7 trading worldwide without any interruptions. The price for the forex VPS from Fozzy for NordFX clients is twice cheaper than the standard price, delivering savings. Because Fozzy VPS is right by NordFX trading servers, there is an excellent transfer rate of less than a millisecond, 200 times faster than the exchange rate you get between the NordFX server and your computer. There is also 24/7 uptime with the VPS so expert advisors can trade without interruptions. The service is also simple to use and reliable thanks to daily backups of all the stored data.

Educational Resources

NordFX gives traders access to a vast range of educational resources as well. The Learning Center is an online resource that provides traders with the resources they need regardless of their skill levels. The educational information there can help all traders develop skills and get insights for successful trading. There are sections for forex, a glossary, the economic calendar, a Trader’s Guide to Markets, and the ability to test forex robot advisors. Both the forex section and the glossary supply the expected information, detailing what you need to know about the forex market and its basics in the former while the latter includes an extensive list of definitions.

The Trader’s Guide to Markets is especially useful with a range of topics, such as how to start trading with MT4 and MT5, the calculator, articles on various strategies, trading crypto, cryptocurrency strategies, using 1:1,000 leverage, and more.

The section for Testing Forex Robot Advisors looks at some of the more popular robot advisors for forex trading and tests them out. There are a range of advisors tested in this section, including simple to difficult ones and those that are free as well as paid advisors. To expand this section, NordFX also welcomes traders to submit their own results when using some of the robot advisors.

NordFX Awards

NordFX has received several dozen awards over the years. Going back to 2010, the broker earned the Best Forex Dealing Service award from China’s Financial Annual Champion Awards HeXun. 2011 saw the broker earn the 7th Guangzhou International Investment & Finance Expo’s Best Forex Broker Trading China and Academy Masterforex-V’s World Best Forex Dealing Service honors. 2012 honors included a repeat of the latter, as well as the World Best Micro Forex Broker honor from the same organization and the title of Best Broker for Trading with Advisors from the IAFT Awards.

In 2013, NordFX won CFI.com Magazine’s Best FX Broker in Asia; MENA 12th Forex Show’s Best Forex Arabic Platform; China Forex Expo Awards’ Best Micro Forex Broker; and Academy Masterforex-V’s World Best Bonus Program, World Best Dealing Service, and World Best Micro Forex Broker. 2014 saw a continuation of honors from Academy Masterforex-V, including World Best Micro Forex Broker, World Best Broker with Trading Signals Service, and World Best Forex Dealing Service. From the Forex Awards Ratings, the broker earned the title of Best Micro Forex Broker and Best Forex Broker, Russia.

2015 included honors from the Forex Awards Ratings for the Best Micro Forex Broker and Best Execution Broker. That year, NordFX received the honors of World Best Forex Broker, World Best Micro Broker, World Best Broker for Copy Trading, and World Best ECN Broker from Academy Masterforex-v. NordFX also earned the title of Best Broker in Asia from the IAFT Awards and Best Broker/Forex Trading India from the IAIR Awards.

2016 saw a repeat of the last of these awards as well as honors for Best 24/7 Customer Service (from Forex Expo Awards), Most Reliable Broker 2016 (from the Forex Awards), World Best Broker (from Academy Masterforex-V), and Best Affiliate Program (from Forex Awards Ratings). In 2017, NordFX earned the titles of Most Reliable Broker from ShowFx World, Best Bonus Programs and Promotions in Asia from the Forex Expo Awards, the Best Broker to Work with Cryptocurrencies from the IAFT Awards, the Best Forex Affiliate Program and World Best Broker from Masterforex-V EXPO, and Best Crypto Broker Asia from the Forex Awards Ratings.

So far in 2018, NordFX has already received the title of Most Trusted Cryptocurrency Broker from the Global Brands Awards. The broker has also already received the honors for Best News & Analysis Provider from Fxdailyinfo Awards and Best Broker for Trading Cryptocurrencies from the International Business Magazine Awards.

How Is NordFX Customer Support?

You can access NordFX customer support by clicking on the support button by the top right of the page. Alternatively, you can click on Contact in the main navigation menu. This will take you to the contact form, which asks for crucial information. Start by selecting the department you wish to contact, with options including customer service, payments, technical support, marketing, introducing brokers, and human resources. From there, you input your name, email address, the subject, and your message, say whether you are already a NordFX customer, and complete a quick human test to prevent spam.

At the bottom of this page, you will also find the phone numbers for support, with specific numbers listed for China, the Russian Federation, Thailand, India, and Sri Lanka. The support email address is also listed here, as is an address in Vanuatu. This page also has a brief FAQ section. While it answers the most important questions, it is not as extensive as the FAQ sections on some competitors.

Competitors

NordFX is in competition with our similar brokers which have covered before, as follows:

Conclusion

NordFX is a broker that provides access to trading for forex, precious metals, and cryptocurrencies. NordFX prides itself on offering very tight spreads, and it has a range of deposit and withdrawal options.

This broker has a good reputation and a range of account types to meet the varying needs of clients from retail traders to more experienced traders.

Their trading platform is good with a range of options to suit most traders.

A stand out feature of NordFX is the face they also offer managed investment funds, something that not many other similar brokers offer.

The post Beginner’s Guide to NordFX: Complete Review appeared first on Blockonomi.