BlockFi and Nexo are both strong cryptocurrency interest account competitors that offer the ability to earn relatively high APY on various cryptocurrencies, take out crypto-backed loans, and more.

BlockFi was founded in 2017 and is a New Jersey-based company as a crypto lender and interest-earning platform. The company is currently valued at $3 billion and has raised over $508.7k from its 40+ investors, including Pomp Investments.

BlockFi manages over 15 billion worth of assets for its over 230,000 users.

Nexo was founded in 2017 and is based in London. It has a cocktail of offerings, including an exchange, crypto loans, an interest account, and its native NEXO token.

The European company brings an intriguing twist to the crypto interest game, offering competitive APY rates for both crypto tokens and fiat currencies like USD and GBP. Nexo has over 2M users and over $30m worth of assets under its management.

Both BlockFi and Nexo are impressive companies in their own rights, but who brings the most to the crypto interest table?

If you’re split between using BlockFi or Nexo or considering using both, look no further.

The following BlockFi vs. Nexo review will outline key features, various interest rate comparisons, security, and sign-up bonuses.

BlockFi vs. Nexo: Key Information

Item |

BlockFi |

Nexo |

|

Site type |

Interest account, trading account, crypto-backed loans |

Interest account, exchange, crypto loans, token, crypto-backed loans |

|

Company Launch |

2017 |

2017 |

|

Location |

Jersey City, New Jersey, US |

London, England, UK |

|

Beginner Friendly |

Yes |

Yes |

|

Mobile App |

Yes |

Yes |

|

Available Cryptocurrencies |

BTC, ETH, GUSD, 10 others |

BTC, ETH, USDC, 17 others |

|

Customer Support |

Good |

Good |

|

Community Trust |

Great |

Good |

|

Fees |

Low |

Low |

|

Promotions |

None |

|

|

Reviews |

Feature #1: Interest Rates – Who Has Better APY, BlockFi or Nexo?

Bitcoin:

BlockFi offers tiered annual interest rates depending on the amount of BTC you hold in your account:

- 4% on <0.25

- 1.5% on <5 BTC

- 0.25% on >5 BTC

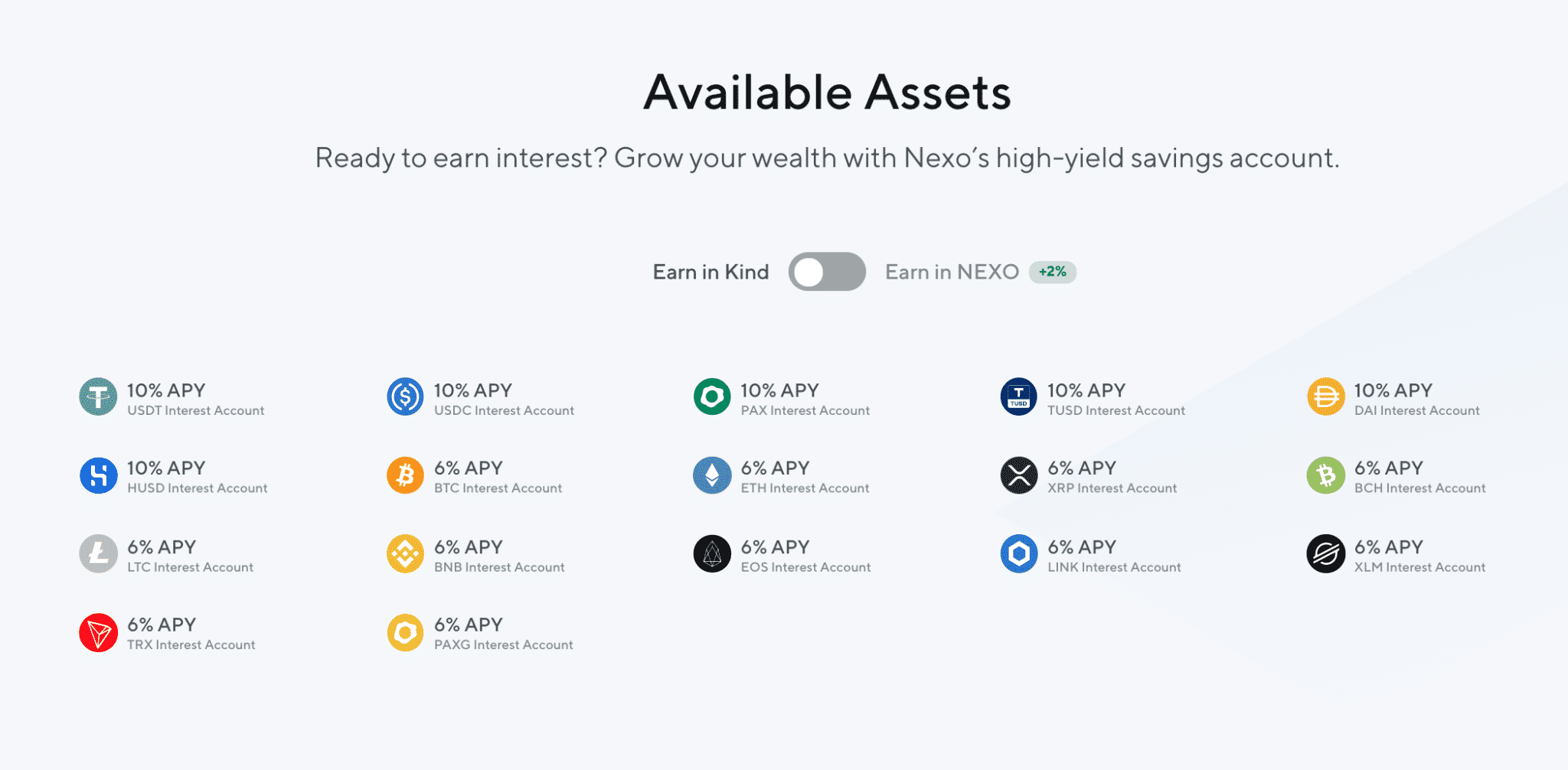

Nexo offers a fixed 6% APY on all BTC deposits.

Ethereum:

BlockFi lets you earn 4% APY on up to 5 ETH, 1.5% between 5 and 50 ETH, and 0.25% above that.

Nexo offers its users 6% APY on ETH deposits.

Stablecoins:

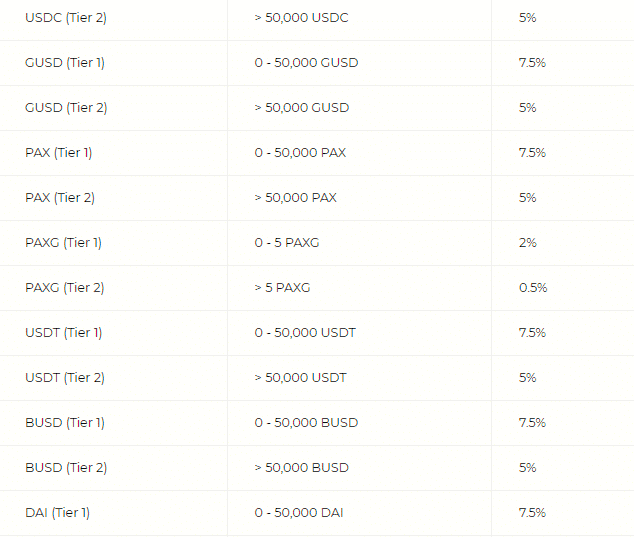

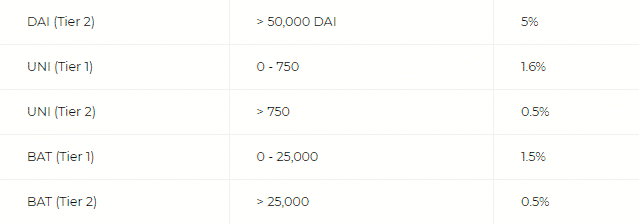

BlockFi’s tiered offerings give users 7.5% APY on stablecoin deposits (USDT, USDC, GUSD, PAX, BUSD) between 0 and 50,000, then 5%. The company offers 8.5% APY on Dai deposits between 0 and 50,000, then 6%.

Nexo offers 10% APY on dollar-backed stablecoins (USDT, USDC, DAI, TUSD, HUSD) and 6% on PAXG.

BlockFi’s highest rates go to DAI holders, while Nexo offers 12% APY to holders of its NEXO token.

Nexo users who opt to receive their interest earnings in NEXO get a 2% interest increase on all currencies.

Unlike most other accounts, Nexo also allows its users to earn interest on fiat. Users can make 10% APY on EUR, GBP, and USD. These rates also go up to 12% if you choose to receive your fiat earnings in NEXO rather than the currency you deposit. However, “Earn in NEXO” is not available in the US.

NEXO APY when the “Earn in Kind” option is selected.

How Do BlockFi and Nexo Make Money?

BlockFi

BlockFi borrows assets at a particular rate (the interest it offers users) and makes money by lending those assets to retail and institutional borrowers through cryptocurrency loans. Borrowers get liquidity without having to sell their cryptocurrency assets.

BlockFi is known for more cautious lending strategies and performs credit assessments of its borrowers. For safety, BlockFi stores its crypto reserves (which it uses to fund users’ withdrawals) with Gemini Trust, its primary custodian.

BlockFi also offers collateralized loans to individual consumers, and it funds these loans using stablecoin deposits (~7.5% – 5% APY). These consumers must have holdings at least 2x the value of the amount they wish to borrow.

For example, if you want to take out a $5,000 loan on BlockFi, you’d have to keep at least $10,000 of crypto in your account. If during the period of your loan, the total value of your crypto holdings in your account drops below $10,000 and you don’t deposit more, BlockFi will immediately liquidate your holdings to pay back the loan. That’s called a “margin call.”

To avoid margin calls, it’s best to maintain an LTV higher than 50%. The LTV percentage you should have will depend on the volatility of the currency you hold.

BlockFi pays interest based on the yield that it generates from lending. The company funds its consumer loans (usually charging ~10 – 13% APR) using stablecoin deposits, which means it can pay higher interest rates to users who deposit GUSD and other stablecoins.

Nexo

Like BlockFi, Nexo makes money from the difference between the interest it pays the users it borrows from and what it charges borrowers.

The platform makes loans to both its consumers and institutional borrowers.

Feature #2: Payouts and Withdrawals

Your assets in BlockFi will begin accruing interest the day after you make your deposit. Interest is compounded monthly.

On Nexo, interest is compounded daily.

BlockFi gives users one free crypto withdrawal and one free stablecoin withdrawal each month. Users can only use this free withdrawal on one currency, and BlockFi charges fees (below) with specific withdrawal limits per coin.

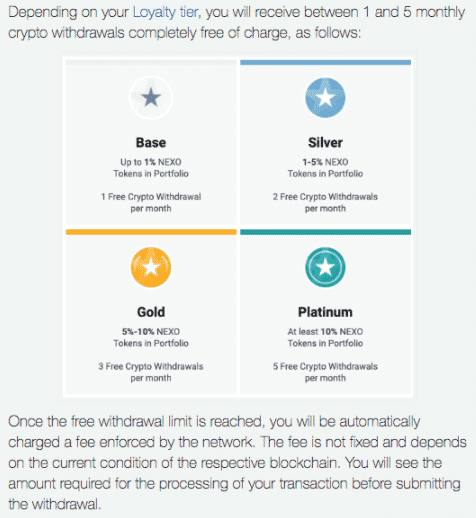

In contrast, Nexo offers 1 to 5 free withdrawals to its users depending on their loyalty tier (or the amount of NEXO they hold on the platform.

Nexo users can make unlimited fiat deposits, transfers, and withdrawals at no charge.

Feature #3: BlockFi vs. Nexo Security

BlockFi secures users’ funds with Gemini Trust, which is known for its industry-leading crypto security practices.

Gemini has over $30 billion worth of crypto in its custody and is a New York Trust company subject to the New York Department of Financial Services (NYDFS). The company has completed SOC 1 Type 2 and SOC 2 Type 2 exams and has an ISO 27001 certification.

Gemini holds BlockFi assets in offline cold storage and insured hot wallets for security but doesn’t insure those assets once they’re deployed.

As of this writing, BlockFi was hacked for user account information, but users lost no funds. The breach was announced on May 14th in an email to BlockFi users; the malicious actor gained access to clients’ contact info (email, SMS) via a sim-swapping attack.

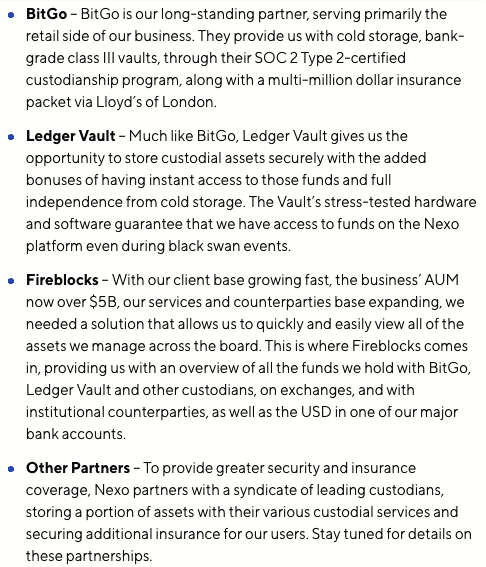

Nexo makes use of a couple of custodians, including BitGo, Ledger, and Fireblocks, to keep funds safe.

The platform is insured up to $375M, about 3% of its total assets under management. Here’s a breakdown:

Feature #4: Ease of Use

Both platforms are beginner-friendly and accessible via a web app, as well as Android/IOS apps.

Feature #5: Standout Features

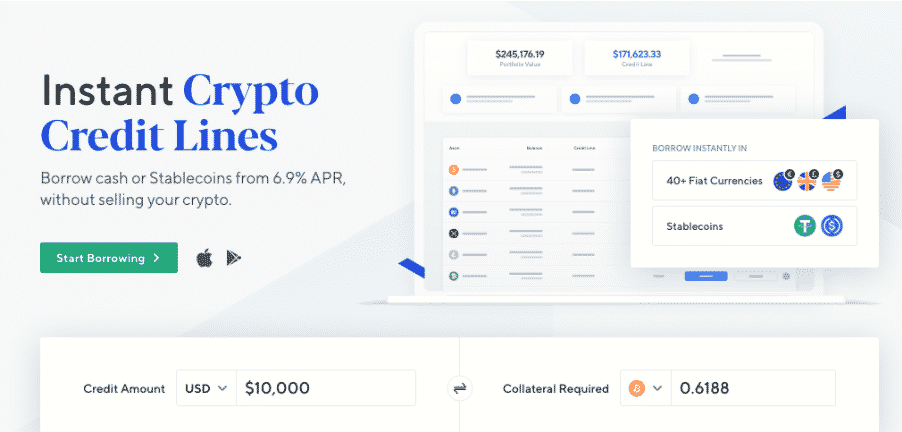

BlockFi’s credit card gives users 1.5% back on all purchases. On the flip side, Nexo lets users borrow crypto-backed credit lines on over 40 fiat currencies.

Nexo’s native token NEXO is available in most crypto exchanges. Its supply is pegged to 1bn tokens, and there are currently 560M NEXO in circulation.

The Court of Public Opinion: BlockFi vs. Nexo Reddit

Many users prefer Nexo over BlockFi for its higher BTC rates.

However, a good number prefer BlockFi because it doesn’t require that you hold any native token to access premium rates.

Overall, support for both BlockFi and Nexo is stable across the board.

Customer Support

Both BlockFi and Nexo maintain a support center with FAQs and other customer information. Nexo’s support representatives are available 24/7. Users can contact BlockFi support at support@blockfi.com.

BlockFi vs. Nexo: Which is the Better Crypto Interest Account?

BlockFi and Nexo are both considered two of the best cryptocurrency interest accounts.

Both platforms use industry-leading security, and both have more or less disclosed enough information about their lending practices to give users a rough idea.

If you had to pick BlockFi vs. Nexo, you should consider the following:

- In order to get Nexo’s higher rates, you’d need to hold its token NEXO, which is fairly volatile.

- BlockFi has a sign-up bonus for CoinCentral readers of up to $250, whereas Nexo does not.

- BlockFi is a U.S.-based company, whereas Nexo is based in Europe.

- Nexo offers up to 12% APY on fiat currencies, with no charges for withdrawals or transfers, whereas BlockFi only offers interest on crypto.

- BlockFi has a credit card that pairs nicely with the interest account.

The choice to undertake the risk of using a cryptocurrency interest account is yours.

For a more detailed dive, check out the full Nexo Review and BlockFi Review.

The post BlockFi vs. Nexo: Which is the Best Crypto Interest Account? appeared first on CoinCentral.