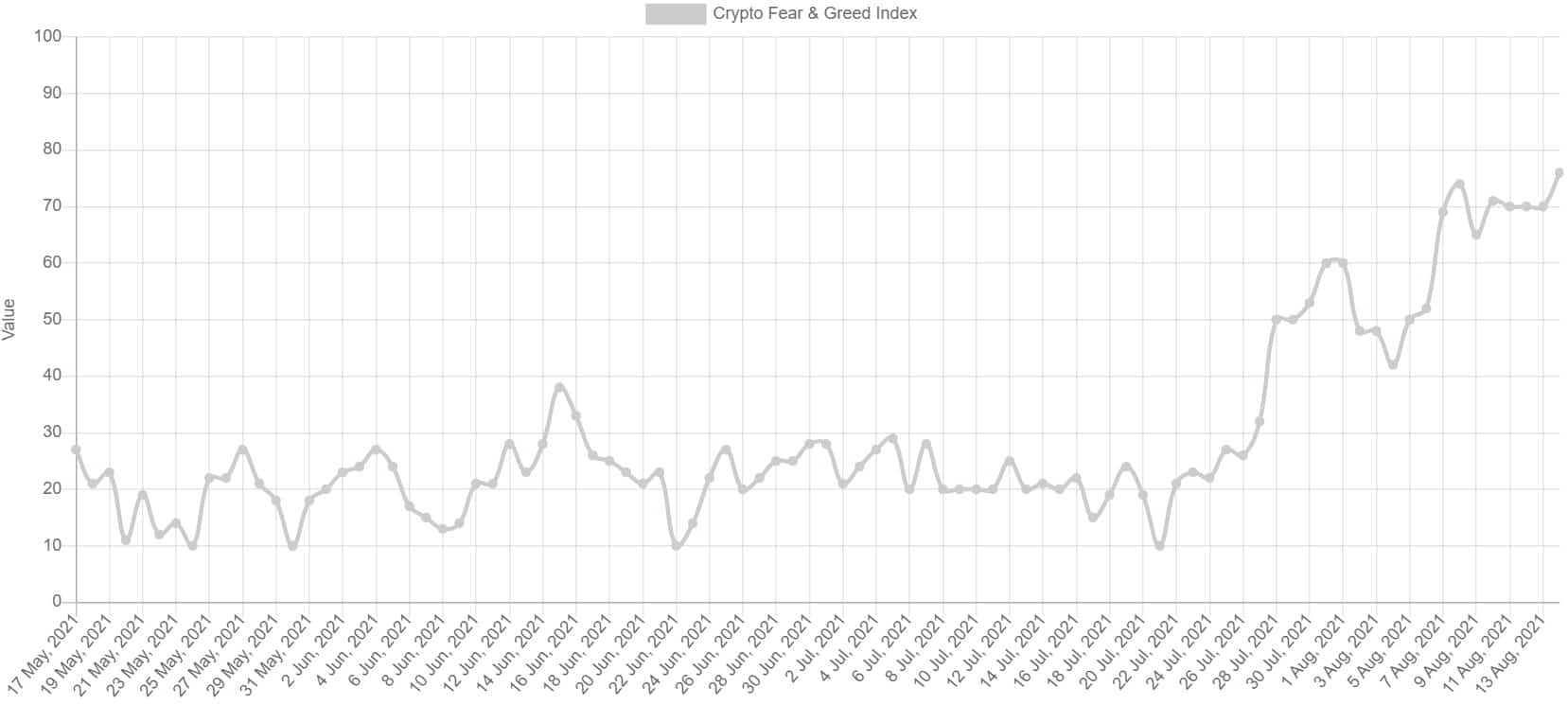

Following the latest developments in the cryptocurrency markets in which BTC’s price skyrocketed by double-digit percentages in a matter of weeks, the general sentiment has changed significantly. The popular Bitcoin fear and greed index has gone into an “extreme greed” territory for the first time in nearly three months.

Extreme Greed Is Back Again

The Bitcoin fear and greed index estimates the general feelings in regards to the primary cryptocurrency by following several aspects. Those include surveys, volatility, volume, social media comments, and more.

It provides results ranging from 0 – extreme fear to 100 – extreme greed. What typically drives the most changes of the metric is the price of the asset. Consequently, the index was deep in a state of extreme fear with a low of 10 for numerous weeks after bitcoin started its USD descend in mid-May.

However, the situation started to change after BTC bounced from its latest sub-$30,000 adventure. The index went into a state of greed at and above 50 for a while. However, it has jumped into extreme greed once more now at 76.

This coincided with the latest surge from bitcoin, in which it added several thousand dollars in hours and spiked above $48,000 for the first time since – yes, mid-May.

Similarly, the Ethereum fear and greed index – which basically works the same but tracks ETH instead of BTC – is very close to such a state of extreme greed. The second-largest cryptocurrency has also been on a roll lately, almost doubling its value in less than a month.

Ethereum Fear and Greed Index is 75 ~ Greed pic.twitter.com/n66fiPCoQG

— Ethereum Fear and Greed Index (@EthereumFear) August 14, 2021

What Does On-Chain Say About BTC’s Price

As the price seems to be the most connected to the fear and greed index, it’s worth checking some of the metrics that could provide an overall perspective of what could transpire next. Aside from the technical aspects, some on-chain data suggest that large investors refrain from selling now.

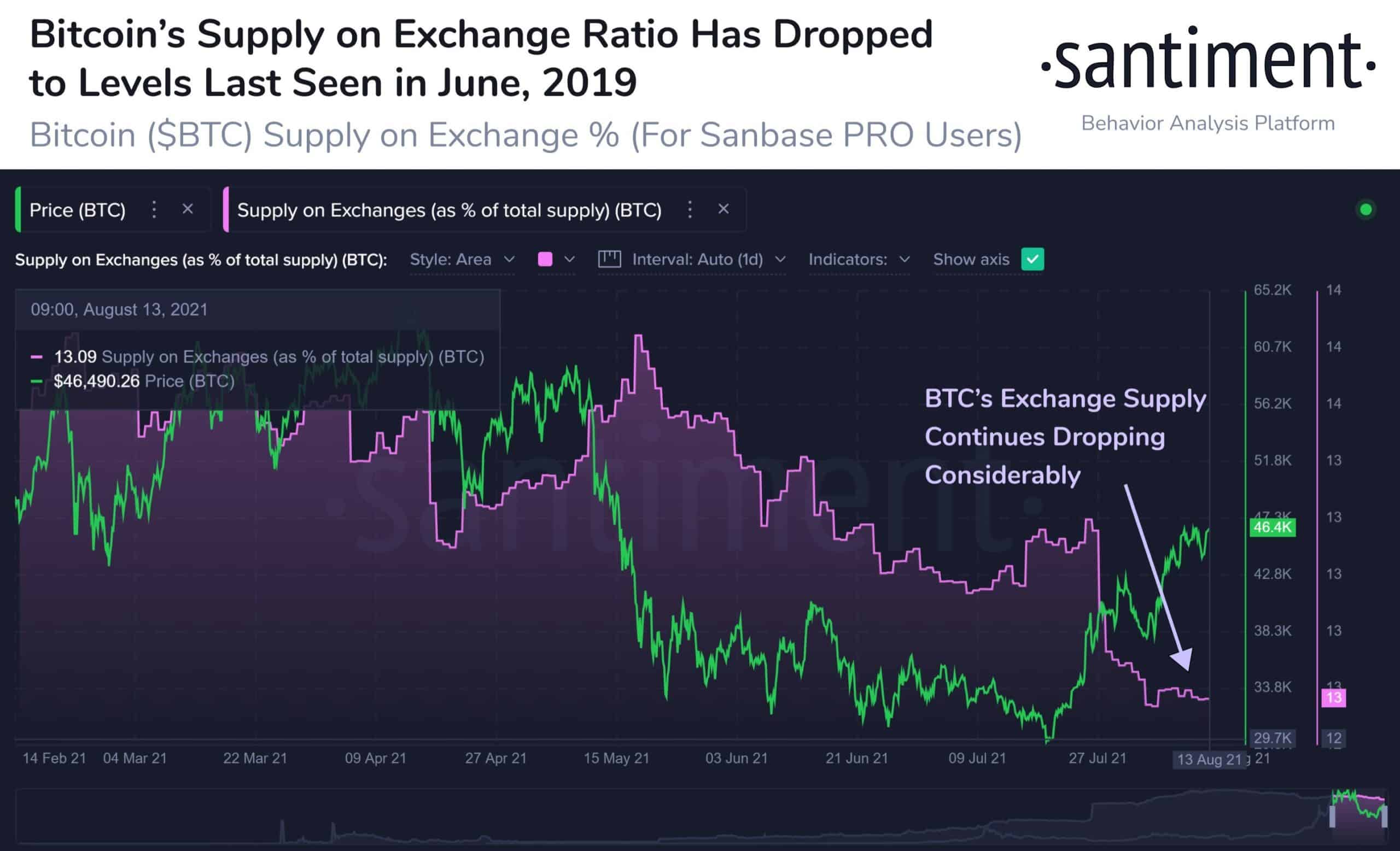

According to Santiment, the BTC supply on digital asset exchanges has dropped “substantially” in the past two weeks. The analytics company classified this as an “encouraging sign” for the bulls.

“As traders move more of their funds to cold wallets, this hodl mentality mitigates the risk of future large selloffs occurring.”

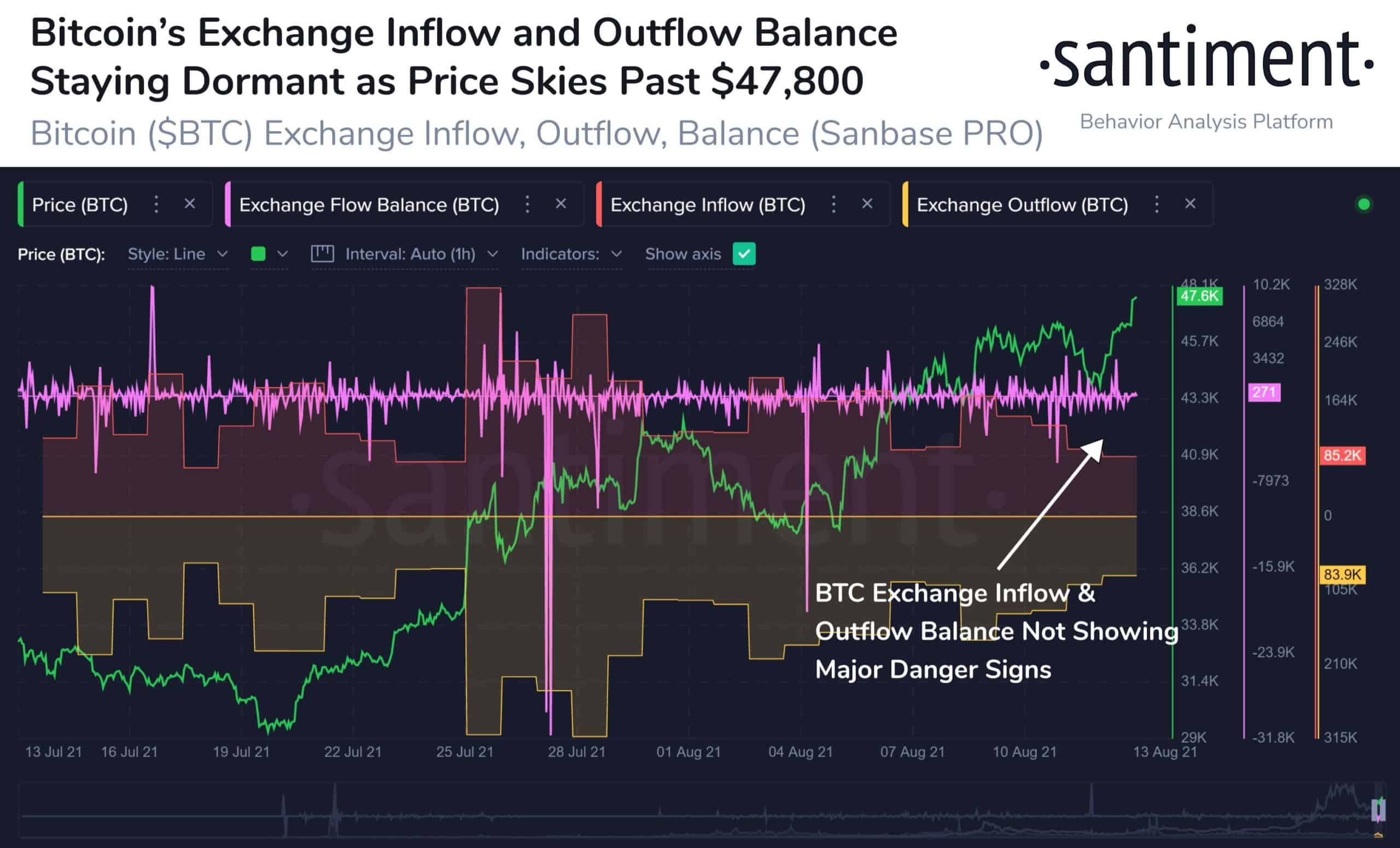

Further confirmation that investors are not in a selling mood comes from the BTC inflows to exchanges, which has dried up lately. Therefore, even after bitcoin’s 60% surge three weeks, Santiment said there’s a “sign that BTC will approach ATH levels again,” as exchange inflows stay dormant.