In this piece, we dive into how Bitcoin scales, and the multilayer approach to Bitcoin.

Build Your House On The Rock

“Everyone then who hears these words of mine and does them will be like a wise man who built his house on the rock. And the rain fell, and the floods came, and the winds blew and beat on that house, but it did not fall, because it had been founded on the rock. And everyone who hears these words of mine and does not do them will be like a foolish man who built his house on the sand. And the rain fell, and the floods came, and the winds blew and beat against that house, and it fell, and great was the fall of it.” — The Holy Bible. Matthew 7:24–27

“Centralized systems create misaligned incentives and inefficiencies with slow growth and innovation while enriching those in power and screwing over the rest of us. Distributed systems create better outcomes, fairer interactions, and more robust systems.” — Join Dhruv Bansal and Ryan Gentry

Bitcoin is an unstoppable technology.

These are the features of Bitcoin that no altcoin project has:

- Fixed supply that is not dependent on demand: It´s super salable across time and space. The scarcity of Bitcoin is not a problem for making payments. One Bitcoin is exactly equal to 100,000,000 Satoshis. One Satoshi is 0.00000001 BTC. The conversion factor is 100 million in each case.

- Monetary policy enforced by a distributed network: This makes for the most secure network in the world. The Bitcoin blockchain is relatively small. Anyone can create a node for the blockchain for about $200 and thereby help to secure the network. On itnodes.io you can find about 10,000 nodes currently running on the Bitcoin network. They are globally distributed. In comparison, the internet has 340 “internet exchange points,” or IXPs.

- Predictable issuance: You can determine exactly how much bitcoin there is and how much more bitcoin will yet be created. Currently the inflation rate of the Bitcoin network is 1.73%, and moving towards 0% over time. The current stock-to-flow ratio of bitcoin is 57, making bitcoin one of the hardest assets in the world.

- Open, global, permissionless: It works the same everywhere and Bitcoin is for everybody. Bitcoin has no CEO or company. To use Bitcoin, you only need a smartphone and internet.

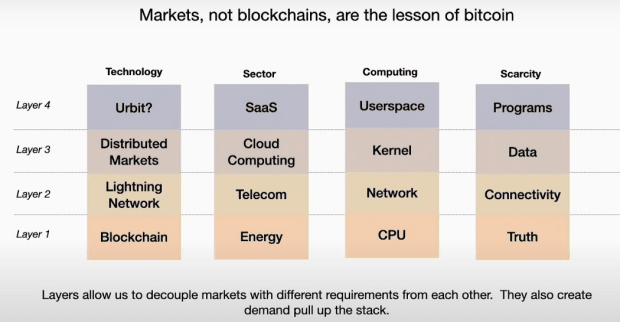

- Technological progress: You can immediately get to the same level of technological development and financial infrastructure as everyone else. Bitcoin’s blockchain is the first layer. Currently, the second and third layers are being developed. At the end of 2021, there will also be a new major software update with new functionalities. Bitcoin can never be duplicated again. Bitcoin has the largest market capitalization, highest liquidity/volume, best known brand, largest network effect, millions of investors and much more.

- Energy consumption: Bitcoin is difficult to mine and the only relevant proof-of-work network in the world to distribute trust amongst computational power (bitcoin mining). The hash rate increases over time. The energy required to maintain the Bitcoin network is not a bug, rather a feature. This makes Bitcoin the most secure network in the world and virtually impossible to be successfully attacked, especially for any meaningful duration of time. The current ban on bitcoin mining in China is the biggest attack on the Bitcoin network so far. The hash rate has fallen, but Bitcoin has not been destroyed or manipulated. Everything continues as it should.

“Bitcoin enables untrusted individuals to reach distributed consensus by solving the Byzantine General’s Problem with proof-of-work. It is resistant to inflation, seizure, and censorship.” — @Wiz

“Bitcoin is a system of software rules and no rulers. It is truly decentralized, because Satoshi took a step back and he put us, the community, and the value of Bitcoin first, and his ego second. You know that is not true with other cryptocurrencies.” — Alyse Killeen

“Bitcoin is an open distributed market that anybody can join and build on.” – – Dhruv Bansal and Ryan Gentry

Bitcoin is a monetary software on top of which you can build as much as you want.

“Bitcoin itself cannot scale to have every single financial transaction in the world be broadcast to everyone and included in the block chain. There needs to be a secondary level of payment systems which is lighter weight and more efficient.” — Hal Finney, 2010

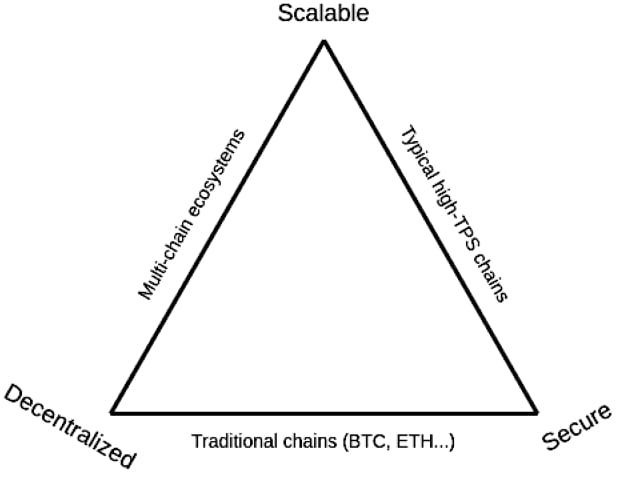

“Base layer scalability is a tradeoff…” Arjun Balaj

Bitcoin’s block size is not too “small.” It is simply not optimized to secure many transactions. Bitcoin’s main layer (a.k.a., its “base layer,” or “blockchain,” or or ”Layer 1”) is perfectly optimized as a store of value.

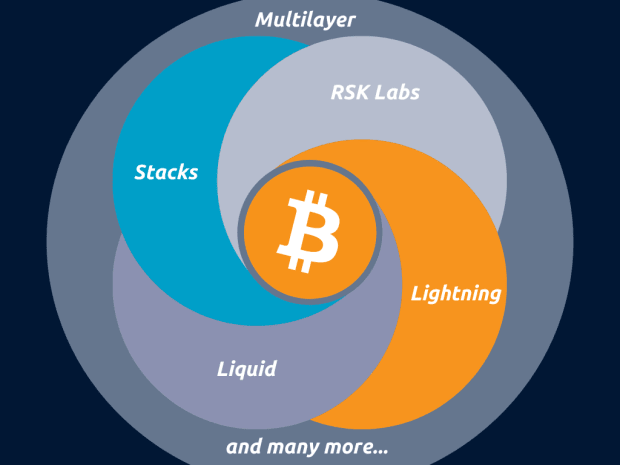

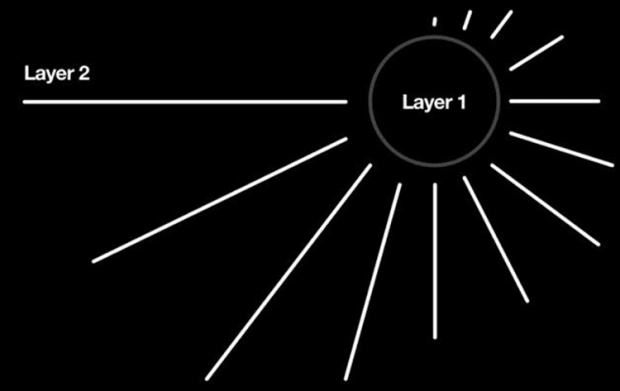

This is the reason why Bitcoin is migrating to a multi-layer ecosystem. Many developments are now already running on the second or third layer. For example, another way to transact on the Bitcoin network is to use the Lightning Network. The Lightning Network is a second layer technology built on top of Bitcoin’s first layer, and everything is open-source. You can think of it like an onion. It has different layers that build on each other but they are ultimately secured by the base layer.

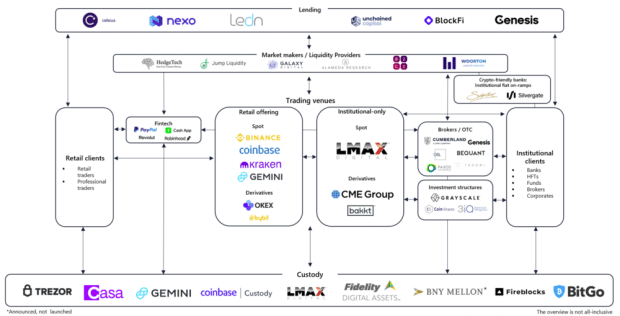

Bitcoin already has the best payment and trading ecosystem.

But what about smart contracts, DeFi (decentralized finance) or other further developments?

“Bitcoin has always had smart contracting capabilities. Bitcoin is programmable money and so you have always been able to require multiple signatures, for example, in a transaction or to require that a certain amount of time or a certain date passed before a transaction is triggered. In a Bitcoin development environment what is most important first and foremost is that the environment is secure and stable. The benefit of that is that Bitcoin has never seen a breach or hack at the core protocol level. We have also seen very limited downtime. And of course that is of critical importance when we are talking about a financial technology that holds billions of dollars of wealth.” — Alyse Killeen

“Lightning is a network that achieves things like identity within the network. It achieves a standard to send a payment, a standard to receive a payment, a standard of trust between two peers, a standard of final clearance, and what does finality look like. And when you think about that holistically and you think, “Well, how do other monetary networks operate?

Visa does the same thing within their network. Visa defines identity; how do I know that this is my Visa card and that’s Peter’s Visa card? There are certain numbers on it, right? And you have a certain account. And, how do I send and receive; how is credit, how is settlement done? We think that not only is Bitcoin better, cheaper, faster, and more global than any other monetary network, but most importantly, it’s open. And when it’s open, open networks, excluding money, just generally, always win. Open networks have defined economies of scale and network effects that are immensely powerful. And so, if you think a competitor were to come into a network — on an open network, every new participant is additive, it actually strengthens the network. So, competitors actually are ‘good for your business.’” — Jack Mallers

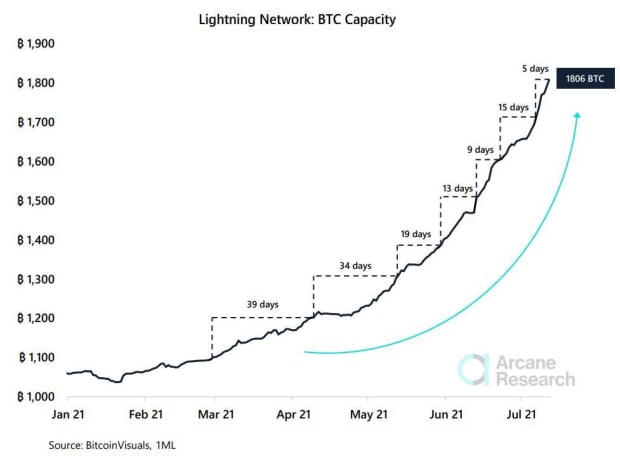

“Capable of millions to billions of transactions per second across the network. Capacity blows away legacy payment rails by many orders of magnitude. Attaching payment per action/click is now possible without custodians.” — https://lightning.network/

On the Lightning Network, one pays a fraction of a cent in transaction fees, and can send money in real time, and almost for free.

“That is why I am committed to Lightning, because this is going to be used by more and more people and my belief in Bitcoin is, it is an amazing asset but the internet needs a native currency. We need to be able to transact around the world with it. The only reason Square got into Bitcoin is to that end.” – Twitter and Square CEO Jack Dorsey

There are already many apps that use Bitcoin and the Lightning Network: Strike, BlueWallet, Wallet of Satoshi, Breez, Muun and many more! If you think Lightning is all about the future, you’re wrong. It’s all happening right now.

What will be possible in the future is incredible.

“Altcoins are testnets for future Bitcoin second layers.” — @BTCSupport21

You lock up some of your bitcoin on the base layer, using multisig (which in itself is already a smart contract). When the bitcoin is locked, you can issue new “tokens” (it is still bitcoin or sats) at different layers and do whatever you want with them. Bitcoin is like a black hole and every important financial service gets sucked into it.

“The blockchain technology itself is a synchronized securely time-stamped database, that can store information about ownership. And that means ownership of anything.” — Andreas M. Antonopoulos

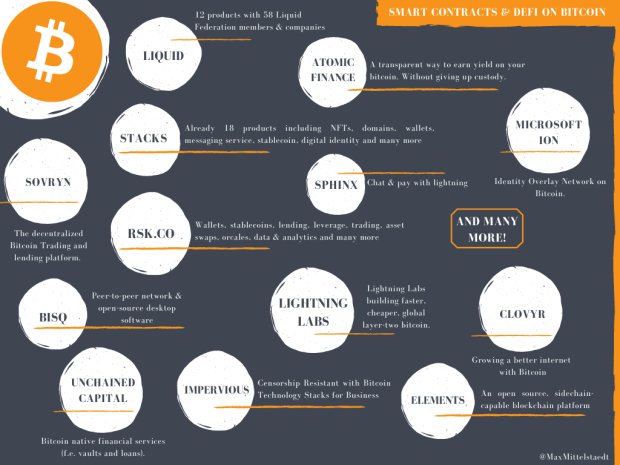

Smart Contracts, DeFi And Other Technologies On Bitcoin

*this is not an endorsement of the following companies – simply a list displaying the wide variety of tools being built in the space.

Liquid: “Faster, more confidential Bitcoin transactions. Liquid is a sidechain (pegging BTC onto another chain that is independetly secure) based settlement network for traders and exchanges, enabling faster, more confidential Bitcoin transactions and the issuance of digital assets.”

Atomic Finance: “Bitcoin finance without compromise. Finally, a transparent way to earn yield on your bitcoin without giving up custody.”

Stacks: “A better internet, built on Bitcoin. Stacks makes Bitcoin programmable, enabling decentralized apps and smart contracts that inherit all of Bitcoin’s powers. Build apps and smart contracts on Bitcoin. Stacks connects to Bitcoin, enabling you to build apps, smart contracts, and digital assets that are integrated with Bitcoin’s security, capital, and network. There are already: NFTs, registrar for .btc domains, wallets, blogs, digital identities, exchanges and much more.”

RSK.: “Open Finance. Trustless and transparent finance on Bitcoin. Bitcoin is the greatest DeFi opportunity and fully enabled on RSK, the most secure smart contract platform in the world. Bitcoin users now can lend, borrow, trade and earn interest on their Bitcoin. The future of finance is decentralized.”

Bisq: “Bisq is a peer-to-peer trading network, not a centralized service. It’s software you run on your own hardware, not a website run by someone else. It’s open-source and community-driven. Bisq is code, not a company. It is an open-source project organized as a decentralized autonomous organization (DAO) built on top of Bitcoin.”

Sovryn: “Your keys, your control. The decentralized Bitcoin Trading and lending platform.”

Digital Ids with Microsoft´s ION: “ION (Identity Overlay Network) moves to Bitcoin mainnet. We’re thrilled to see ION make the leap to Bitcoin mainnet for its public beta. ION is an open, public, permissionless ‘Layer 2’ network built on open source code that anyone can review, run, and contribute to. From the very start, ION has been developed as a decentralized network designed to operate independently of centralized parties and trusted intermediaries, including Microsoft. ION doesn’t rely on special utility tokens, trusted validator nodes, or additional consensus mechanisms; the deterministic progression of Bitcoin’s linear block chronology is the only consensus it requires. The core promise of DID technology is to empower all individuals and entities with ownership and control over their identities, which aligns well with our mission of empowering every person to work, play, and achieve more. […] As an open, public, and permissionless network, ION does not rely on privileged validators or trusted authorities of any kind — anyone can run a node to participate in the network.”

Unchained Capital: “Our approach to collaborative custody provides greater security and access to a range of financial services. Bitcoin native financial services (f.e. vaults and loans).”

Impervious: “Impervious provides infrastructure to securely transport and host data on private cloud servers while ensuring unfettered access and preserving operational integrity. Leveraging the Lightning Network, Impervious opens instant and secure channels to ensure shielded access to data hosted on private cloud services.”

Lightning Labs: “Building faster, cheaper, global layer-two bitcoin. At Lightning Labs, we develop software that powers the Lightning Network. Our open source, secure, and scalable Lightning systems enable users to send and receive money more efficiently than ever before. We also offer a series of verifiable, non-custodial Lightning-based financial services. We bridge the world of open source software and the next-generation of bitcoin financial software.”

Elements: “Elements is an open source, sidechain-capable blockchain platform, providing access to powerful features developed by members of the community, such as Confidential Transactions and Issued Assets. Built upon and extending Bitcoin’s codebase, it lets developers familiar with the bitcoind API to quickly and cost-effectively create working blockchains and test proof-of-concept projects.”

Drivechain (BIPs 300+301): “Once on a sidechain, coins can change hands an unlimited number of times, and in an unlimited number of new ways. Thus, BTC-owners can opt-in to new features or tradeoffs. Meanwhile, the Bitcoiners who don’t opt-in, never need to care what any sidechain is doing.”

Sapio: “Nailing the Ethereum Contract Developer Experience for Bitcoin. A Bitcoin Programming Language”

Spacechains: “A permissionless method to create trustless blockchains that improve the Bitcoin ecosystem by explicitly not competing as a store of value.”

Sphinx Chat: “Chat and pay over Lightning, each user gets a dedicated server.”

Clovyr: “Clovyr is building friendly, flexible tools that bring the usability of modern applications to decentralized ones. We’re helping individuals and teams of all sizes create ecosystems that prioritize privacy, security, and choice, without compromising convenience and user experience.”

Lastbit: “Low cost, instant and borderless payments for anyone. Built on the Bitcoin Lightning Network.”

OpenNode: “Bitcoin payments and payouts made simple: Get lightning-fast, low-cost bitcoin payments and payouts for your business with our powerful API, ecommerce plugins, or hosted payment pages.”

Lolli: “Lolli gives you free bitcoin or cash when you shop at over 1,000 top stores.”

Swan Bitcoin: “Swan is the best way to accumulate Bitcoin with automatic recurring buys and instant buys.”

Crusoe: “Crusoe repurposes otherwise wasted energy to fuel the growing demand for computational power in the expanding digital economy.”

Layer1: “Building Bitcoin Batteries. Layer1 Technologies Inc. builds turnkey, fully-integrated Bitcoin mining data centers that boost the profitability of energy assets and improve the reliability of electrical grids.”

Bitcoin-Backed Stablecoins?

Jack Dorsey just recently announced that he will be starting a new bitcoin smart contracts company:

Development also continues for large institutions. For example NYDIG is the Bitcoin subsidiary of Stone Ridge, a $11 billion alternative asset manager. “We are aligned behind the mission of safely unlocking the power of Bitcoin through technologies and financial services that enable forward-thinking companies and investors to access this asset class.”

All of this already works without the two major updates Taproot and Schnorr, which are coming at the end of 2021. Each new layer built on top of Bitcoin makes the first layer more valuable and improves network effects. It already makes no sense to chase other projects because Bitcoin is technically superior, and you can build anything on top of it.

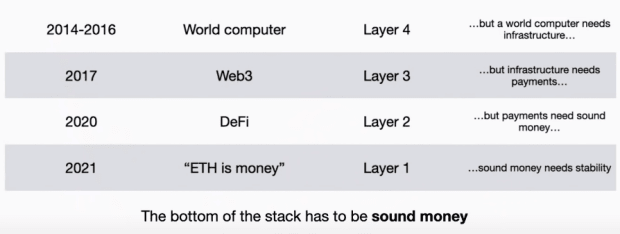

For example the Ethereum network is backwards:

In Bitcoin there is the same process but in the right way. The main layer in Bitcoin is now optimized for security and scarcity (sound money). Everything can now be built on top of it. All other projects do not care about the underlying infrastructure. Only Bitcoin has optimized the basic infrastructure.

There will only be one Bitcoin network, just as there is only one internet. Hopefully you can see that an “altcoin” is just another new feature that will be added to the most secure network in the world, Bitcoin´s blockchain. And this layered approach is what makes Bitcoin so incredibly valuable and gives it a whole new use case. Bitcoin can do what the other projects want to do but in a better, more scalable and robust fashion.

“Bitcoin this is money that is software, if there’s something that’s missing, just build it. You really wanna bet against engineering? Betting against engineering is betting against humanity.” — Jack Mallers

This is a guest post by Max Mittelstaedt. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.