There is a lot of noise about the legitimacy of the stablecoin Tether (USDT), with claims of “pumping the price of bitcoin” being made.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

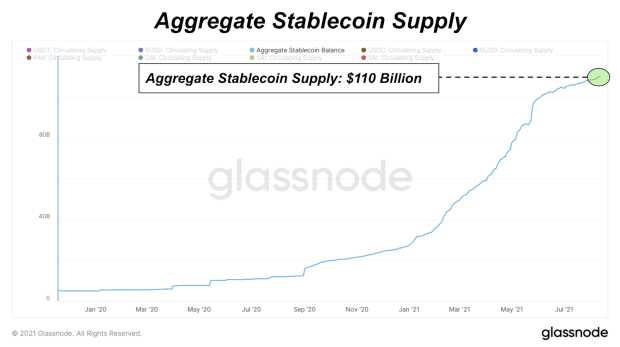

There has been a lot of noise made in recent weeks, months and years about the impact of stablecoins on the bitcoin (and more broadly, the crypto) market. In aggregate, the total global supply of stablecoins continues to grow and make new highs, with a current tally of $110 billion in circulating supply at the time of writing.

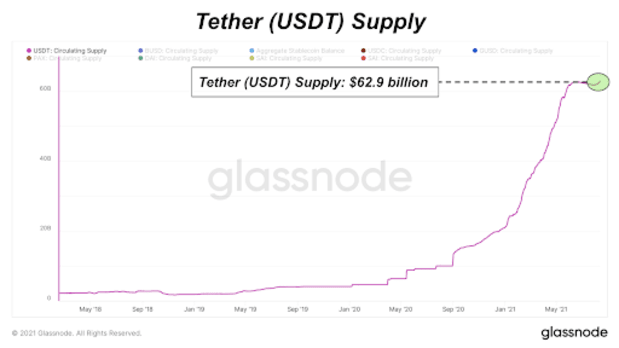

In particular, a lot of noise has been generated on the legitimacy of the stablecoin Tether (USDT), with claims of fractional reserve or “pumping the price of bitcoin” having been made. The circulating supply of USDT is $62.9 billion at the time of writing.

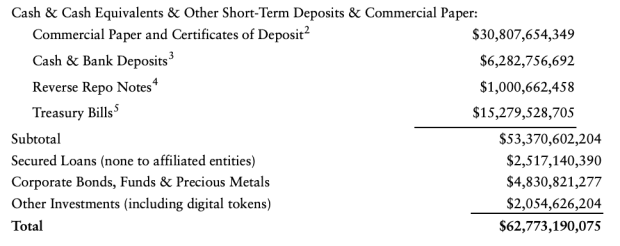

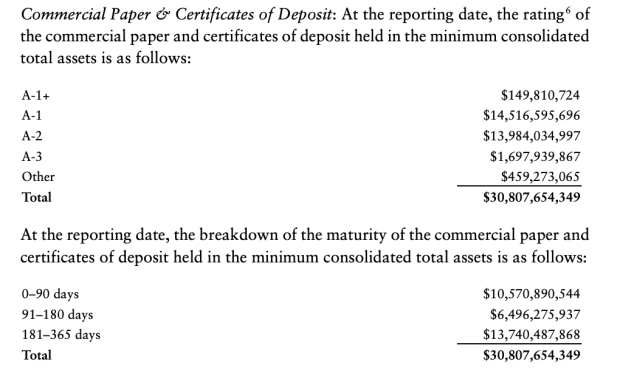

On August 6, Tether made their reserves audit from June 30 public, in which they broke down the asset allocation and the maturity of the commercial paper held by the stablecoin issuer. This was a very notable step taken by Tether to increase transparency on the largest stablecoin in the crypto market.

With Tether increasing the transparency and the legitimacy of the market’s leading stablecoin, an interesting trend has emerged in the stablecoin and bitcoin markets.