SOL has been among the best crypto performers in the past month and has entered the top ten after a new all-time high of roughly $65. This comes amid numerous developments and records from the Solana blockchain, including ATH for transactions and a fresh NFT collection drop that raised quite a few eyebrows.

What Happened With Solana Lately?

Dubbed as the (next) “Ethereum killer,” Solana describs itself as a “high-performance blockchain supporting builders around the world creating crypto apps that scale today.” Its network has seen a substantial increase in popularity among developers and users in recent months.

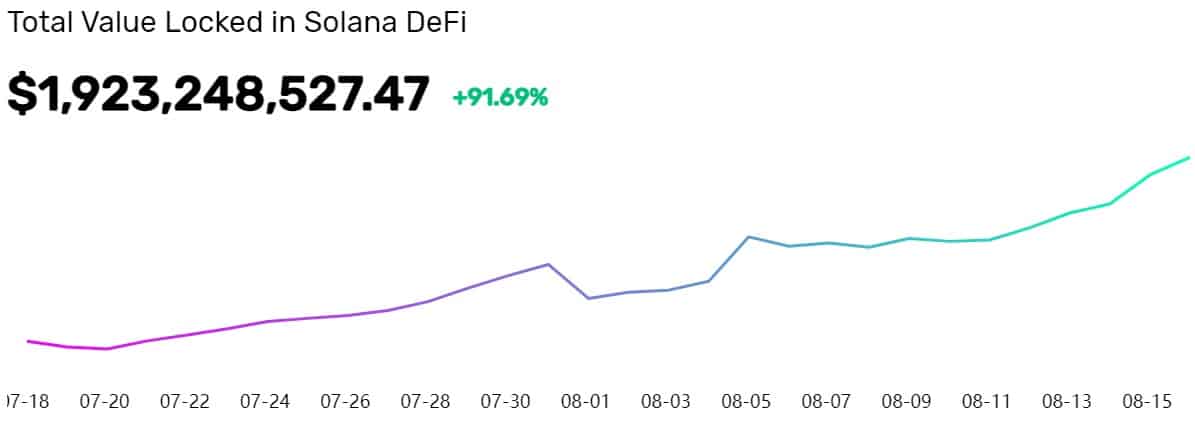

This is evident from the total number of transactions, which exceeded 24 billion, according to the project’s website. Furthermore, the total value locked in Solana has also gone for a record of its own at just over $1.9 billion.

The blockchain is also home to numerous NFT projects. As such, it has been able to capitalize on the exponential growth of the non-fungible token sector. The latest launch to cause a massive uptick in user interactions came from Degenerate Ape Academy.

Although the release didn’t go as smoothly as the protocol might have hoped, the transaction volume reached new highs. In fact, it was also observed on Arweave, which has an active bridge with Solana.

Arweave’s Founder outlined this on Twitter, saying that the daily request volume on the network “reached the insane height of 60M requests/day recently.” Moreover, when the DegenApeAcademy’s product dropped, Arweave saw 1 million requests in a single minute.

…and then this happened.

Daily request volume on the https://t.co/3S12ndZ16m gateway reached the insane height of 60m requests/day recently.

When @DegenApeAcademy dropped, https://t.co/3S12ndZ16m received 1m requests in a single minute.

https://t.co/OTbIZjrNYn pic.twitter.com/7GIVSXtbx4

— Sam Williams (@samecwilliams) August 15, 2021

SOL Reacts By Entering Top 10

Somewhat expectedly, this activity on the network and increase of user interest has impacted the price of Solana’s native cryptocurrency – SOL.

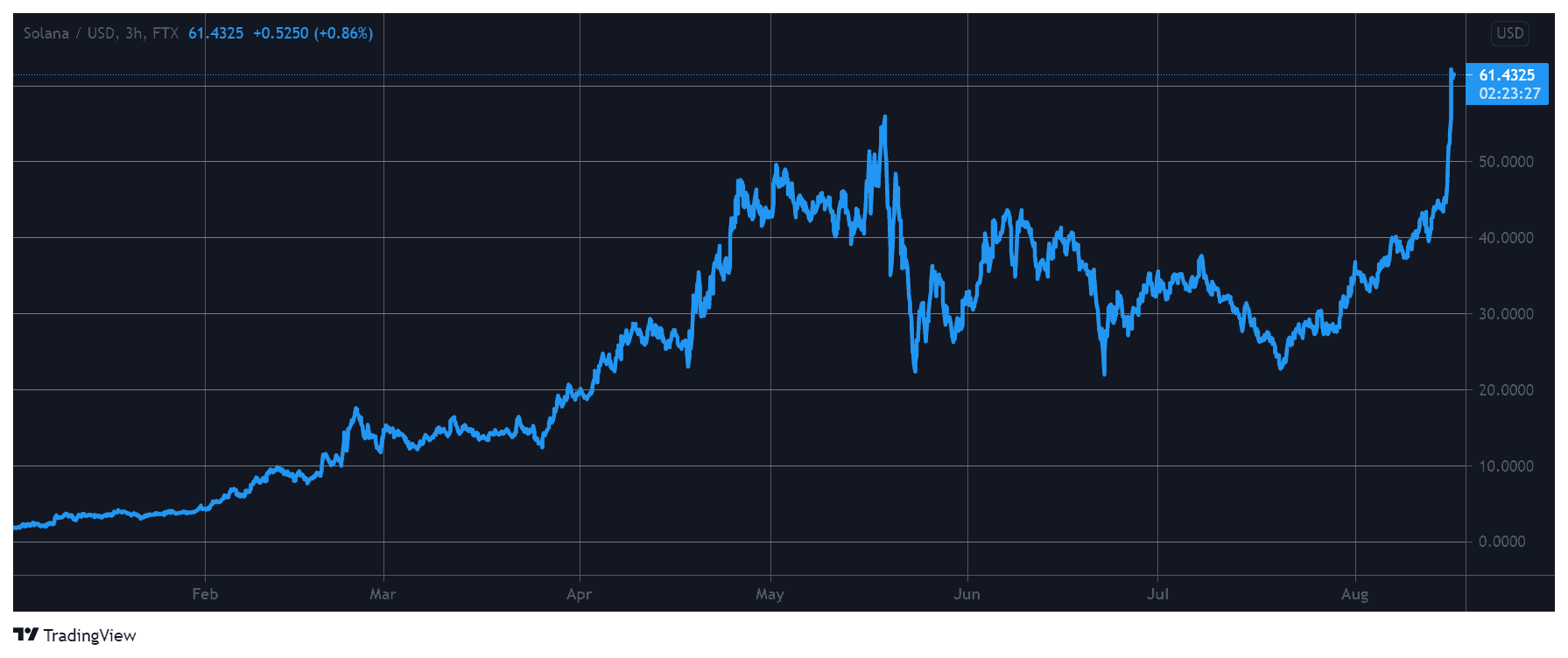

On a macro scale, the token entered 2021 at around $1.5 but took full advantage of the bull run in the first half of the year and reached an all-time high of $58.5 (on Bitstamp) on May 18th. Following this 3,750% surge in months, SOL, as most of the market, retraced heavily to approximately $20 on July 20th.

Despite the correction, though, the interest for the token remained high and 21Shares AG, the Swiss-based ETP issuer launched such a product tracking the performance of SOL.

The asset’s price went on a tear in the following weeks, as the market recovered, and reached $45 this weekend. However, the run was not over yet – just the opposite, it only intensified in the past 24 hours.

As reported earlier, SOL exploded by more than 40% and painted a new price record of $65. Its market capitalization grew to about $18 billion, and it found a place in the top ten digital assets by that metric.

As of now, SOL has retraced slightly and stands at just over $60. Nevertheless, it’s still one of the best performers this year, with gains of 3,900% since January 1st, 2021.