Centrifuge is the first decentralized operating protocol that connects real-world assets with DeFi with the goal of lowering capital costs for small and medium-sized enterprises (SMEs).

It also provides DeFi investors with a stable source of returns in the volatile cryptocurrency market.

Founded in 2017 under Sector Tokenizing RWA, with Centrifuge, users can transact on a global network while maintaining ownership of their data, which may include verified company details as well as reputations, and business relationships.

It is now possible to access a trillion dollar real-world asset market (RWA) that has previously been totally untapped.

The opportunity is now open for businesses that want to utilize Centrifuge to gain access to the liquidity provided by DeFi – and also gain a return on their capital.

Centrifuge: What Does it Do?

Since its launch, Centrifuge has worked to create the next stage in fintech. The current fintech world is built on top of a centralized financial system, but this system is geared toward the benefit of large banks and other large organizations – like central banks.

Centrifuge is on its mission to alter the rules of global trade in order to bring economic opportunity to everyone in the global marketplace. Its target for the moment is small and medium-sized enterprises (SMEs).

Because SMEs require more work to sustainably grow compared to major corporations, they need easier access to capital.

Solutions that are currently available only address a small portion of these needs.

Therefore, the project team created and developed Centrifuge to enable businesses to exchange business documents (such as invoices) and encrypt those assets for greater financial access, thereby unlocking previously inaccessible value that was locked away.

Centrifuge addresses the concerns about the involvement of banks through smart contracts which operate online, allowing borrowers to renew their loans without a third-party that has total control over how capital flows.

The platform acts as a bridge between borrowers and investors, allowing them to gain access to the decentralized financial system.

Regarding liquidity, with smart contracts, Centrifuge’s automated process enables any business to pool their assets to attract liquidity. These assets could include mortgages or SMEs invoices.

The Highlights

In terms of Total Value Locked (TVL) growth, Centrifuge paved the way for the TVL of real-world assets (RWA) in the DeFi space.

Real-world assets, such as bills, real estate and other types of property, once encrypted, have the potential to bring trillions of dollars to the DeFi ecosystem.

Centrifuge tokenizes real-world assets by converting them into non-fungible tokens (NFTs) on the Centrifuge Chain.

Specifically, Centrifuge tokenizes physical assets by converting them to Centrifuge Chain NFTs. RWA TVL quantifies the value of Centrifuge’s active real-world assets.

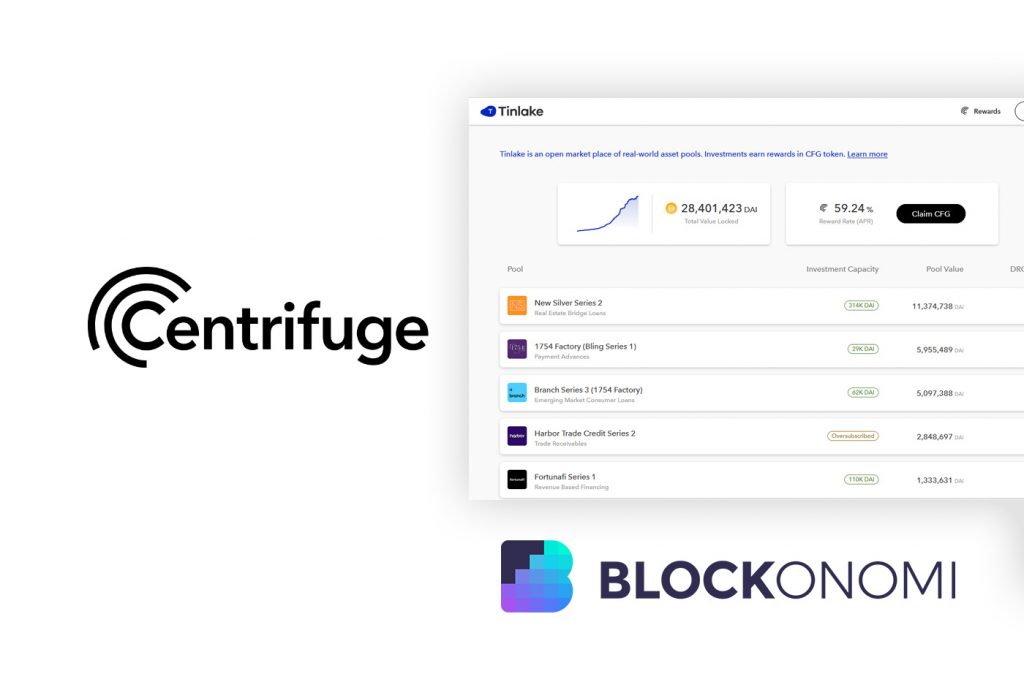

Centrifuge is one of the pioneer projects to run a Parachain on Polkadot. Centrifuge can benefit from the prompt speed and low fees on Polkadot while Tinlake, Centrifuge’s powerful Dapp, is built to take advantage of Ethereum’s massive liquidity.

Centrifuge is bringing the real-world assets to MakerDAO’s DAI and developing AAVE’s first real-world asset marketplace. Centrifuge’s integration with a number of high-profile DeFi projects enables users to obtain instant liquidity and make DeFi protocols more secure.

Centrifuge Chain

Centrifuge Chain serves as a bridge between real-world assets and the Blockchain technology.

Centrifuge Chain on Substrate Parity was developed as part of the project, with an initial bridge to Ethereum. Centrifuge will be able to move quickly and use a more consistent approach for important features.

Meanwhile, the chain works as a standardized bridge to Ethereum that can be used by other projects, thereby increasing interoperability in general.

Substrate Parity enables Centrifuge access into the Polkadot ecosystem and to connect with other blockchains that support the Polkadot standard with relative ease.

As a result of the protocol, a larger ecosystem of many connected blockchains will be created – where Ethereum dApps can use data from other chains, value can freely move, and Centrifuge will allow off-chain assets to access financing via the DeFi ecosystem.

Designed specifically for the transactions required by a specific use case, Centrifuge Chain is a high-performance distributed ledger.

This specific mission enables the project to make significant improvements to its existing architecture in a number of key areas, including speed, cost, storage efficiency, and security.

Centrifuge Chain forms the foundation for indigenous real-world assets. It enables users to store their assets virtually as a NFT connected to the Ethereum blockchain.

The Centrifuge Token

The Centrifuge Chain is powered by Centrifuge token (CFG), providing its owners with governance and incentivizing validators to operate it.

CFG is linked to the largest DeFi ecosystem in the world through the use of a substrate-based token that is connected to Ethereum.

CFG holders can also stake their CFG in order to nominate their node as a Validator candidate, or they can stake their CFG to another Validator.

Tinlake

Tinlake is the first Ethereum-based dApp on Centrifuge Network that enables investors and borrowers to fund their own pool of assets. In addition to being open source, Tinlake’s smart contracts are simple to integrate into the DeFi ecosystem.

The dApp allows traditional investors to tokenize RWAs (real-world assets) into non-fungible tokens on Centrifuge’s network, making it easier for them to participate in DeFi protocols.

Investors have the ability to start investing in asset pools immediately after becoming a Tinlake member due to the company’s flexibility.

Tinlake is designed to eliminate bureaucracy and risk by utilizing better data and trustless technology to accomplish this.

CFG Tokenomics

- Token Name: Centrifuge

- Ticker: CFG

- Blockchain: Centrifuge Chain

- Token Type: Utility, Governance

- Total Supply: 425,000,000 CFG

Token Allocation

- Early Ecosystem: 8.3%

- Development Grants: 11.8%

- Community Grants: 7.1%

- Foundation Endowment: 11.8%

- Community Sale: 9.5%

- Core Contributing Members: 27%

- Total Backers: 17.1%

- Rewards and Grants: 7.3%

Core contributors and early backers have vested tokens every month for 1 year since July 2021. Core team locks for 48 months and vest tokens for 12 months.

As part of the PoS block rewards, DOT lock rewards, and liquidity rewards, 3% of CFG tokens are additionally expected to be minted annually.

Transaction fees will be burned, but the total supply of CFG tokens will be stabilized over time due to the burnt transaction fees.

Centrifuge: Background

Centrifuge is backed by a team of top global organizations whose background and experience are extensive in both traditional and crypto finance. Together their vision is to unlock economic opportunity for all people around the world.

The project has also captured interest from many investors.

Is has formed partnerships with IOSG, Fenbushi, Blueyard, Galaxy, Fintech Collective, Mosaic, Rockaway, Moonwhale, TRGC, HashCIB, Crane Venture Partners, Fabric Ventures, Atlantic, Inflection, Semantic, Mariano Conti, Stani Kulechov, Julien Bouteloup and many more.

With the support of these world-class investors, advisors, partners and team, Centrifuge will continue to build real software that solves real business problems.

Centrifuge Unlocks Massive Value

Centrifuge is a protocol that brings real-world assets to the blockchain by encoding these assets into NFTs.

The protocol is revolutionizing the way people around the world access financial services. Using DeFi, Centrifuge makes capital available to investors, which no one could ever imagine before.

Built as a DeFi-backed platform, Centrifuge’s chain is opening the gateway for any real-world asset to participate in the blockchain multiverse.

As the day that we no longer refer to these assets as “real world assets” draws nearer, all assets in the world will be able to move in and out of the blockchain – saving time and money – as well as creating a level of liquidity the world has never before seen.

If you are interested in learning more about Centrifuge, and all the tools it has created, please click here to visit its website. You can also keep up with the company on Twitter, Telegram, as well as Medium.

The post Centrifuge: Makes Real World Assets Liquid on Blockchain appeared first on Blockonomi.