Widely followed on-chain analyst Will Clemente says that the argument for a Bitcoin bull trap is fading as long-term BTC holders dominate the supply of the leading cryptocurrency.

Clemente tells his 187,300 Twitter followers that long-term holders, or entities that have held their BTC for at least six months, now own over $637 billion in Bitcoin, representing more than half of the leading crypto asset’s total supply.

“Supply held by long-term Bitcoin holders has reached new all-time highs. These entities now hold 12,674,515 BTC. That’s 67% of supply, 84% when adjusting for lost coins.”

According to Clemente, long-term holders do not see Bitcoin’s rise to $50,000 as an opportunity to take profits.

“$50,000 is the last reasonable level for a macro lower high. Long-term holders aren’t taking exit liquidity on this move. The case for this being a dead cat bounce is fading.”

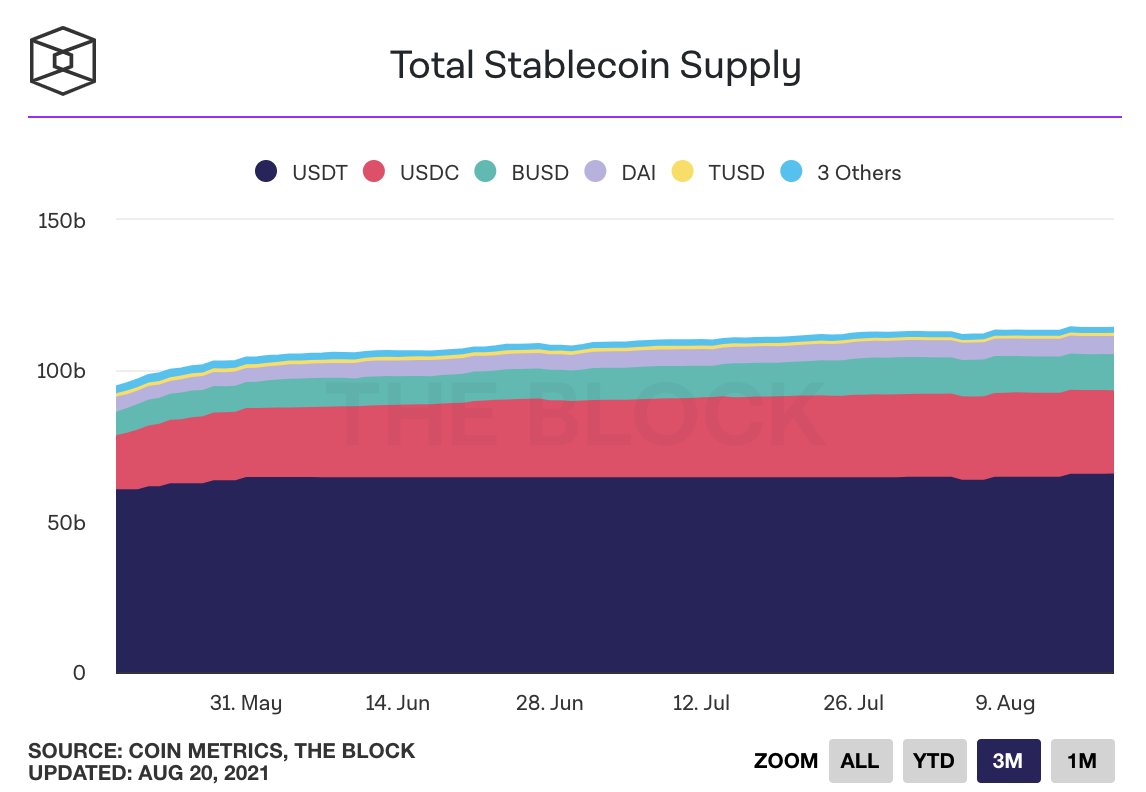

The on-chain analyst is also looking at the amount of stablecoins stashed on crypto exchanges. Clemente says that he’s watching the exchange reserve ratio, which he notes serves as a proxy to calculate the capital sitting on the sidelines.

“Multiplying this ratio by overall stablecoin supply shows roughly $20 billion of stables sitting on exchanges right now.”

Traders often track the amount of stablecoin reserves on exchanges as it indicates investors’ appetite to enter the crypto markets.

Fellow analyst Lex Moskovski appears to support Clemente’s findings as he says that $19.44 billion worth of stablecoins have flowed into the crypto markets in the last three months.

“This is not what a bear market looks like.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

The post Bearish Case for Bitcoin Is Fading As Long-Term Holders Dominate BTC Supply: On-Chain Analyst Will Clemente appeared first on The Daily Hodl.