A method known as “dollar-cost averaging” is the most popular amongst HODLers to maximize their bitcoin stack.

How To Save Bitcoin: DCA Is The Way

Saving money used to be a simple and standard practice – park your cash in a bank account and watch it grow. The 1926 book “The Richest Man in Babylon” famously advocates putting aside just 10% of your income to start building wealth. For a variety of reasons, the wisdom of saving is slipping away from our culture.

For one, saving doesn’t feel like the path to success anymore. Teenagers looking at college tuition costs watch their peers use TikTok to shoot from penniless to multi-millionaire status. Corporate employees fighting for a raise see online chat startups claiming $1 billion valuations before their app even releases publicly. Kids who skipped the playground to buy pictures of penguins suddenly find themselves richer than their parents. In this world, what good is saving and diligently deploying 10% of my income for a healthy return? It sure seems like life is a lottery these days, not a fair uphill climb.

Second, spending receives praise from every angle. Decades of overwhelming advertising and economics education also bombard us with the message that spending is good, not just for our own well-being but for society as a whole. Spending keeps the economic engine running, they tell us — and every penny counts.

Finally, the younger generations just have less to save. According to Pew Research, millennials have less wealth than prior generations did at equivalent ages and also carry much more student debt, dragging on their ability to save even when wages are nominally rising. Even with wages rising, most of that is only seen by the college educated, with those not holding a degree having lower income than past generations – going back to the early boomers.

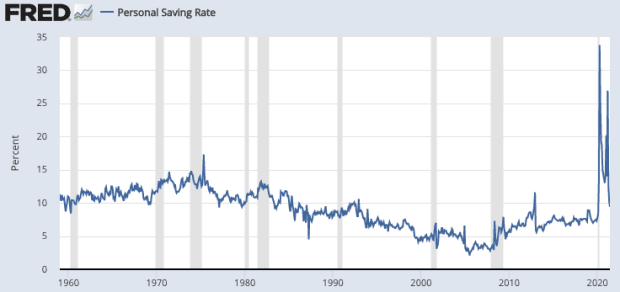

Saving behavior saw one “saving grace” in recent times: the COVID pandemic and government reactions. Forced lockdowns and business closures coincided with a massive spike in the personal savings rate, unprecedented in recent times.

While this is likely to be temporary (nod to Jerome Powell), this extra cash has left many Americans wondering – what should I do with this cash?

We used to have a clear choice.

The Appeal Of The Savings Account

After the last major world crisis — marked by two back-to-back world wars and a deep economic depression in between — stability was a highly-sought luxury. Booming populations of workers wanted to raise families, build businesses, and ensure the security of their futures.

The humble savings account provided a safe place to store wealth and a simple means to grow it steadily over one’s working years. People could focus on their career or business, and not have to worry about where to put their money – it could go right in the savings account.

In countries with strong and stable institutions, like the United States, savings account “yields” (growth on the dollars in the account) generally trended up from the 1950s until the 1980s, then slowly back down.

Banks played a productive role in the economy, powering growth as a middleman between savers with cash who lacked investment experience and entrepreneurs with business acumen and ideas who needed cash.

The savings account during these decades was a humble vehicle for earning nearly-guaranteed returns with a high degree of safety. FDIC insurance protected balances (to a degree) and depositors didn’t have to be their own investment advisors to earn a decent return. A normal middle-class worker could put in their eight hours of honest work, stash away 10% of their earnings in a savings account, and feel secure in their financial future.

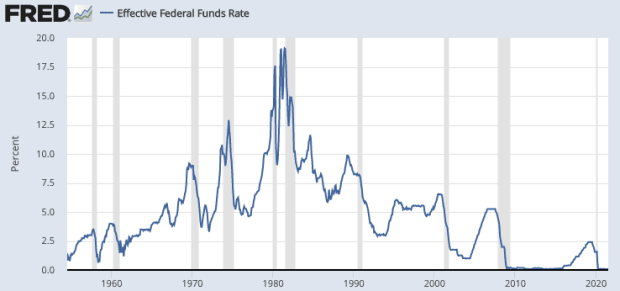

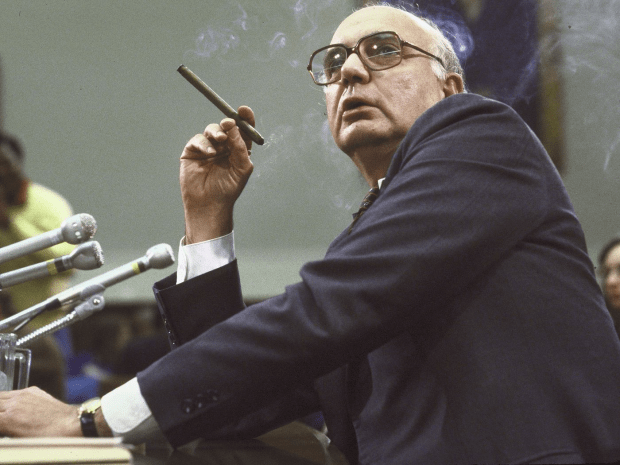

The situation we find ourselves in today, with meager returns for the humble savings account, was precipitated in the 1970s. Many will point to the OPEC oil embargo and the ensuing rampant stagflation, but with more clear hindsight we can see that Nixon’s “temporary” disconnection of the U.S. dollar from gold played a large role. The market reckoned with this reality by running from the dollar and buying up other assets, like commodities, deemed scarcer. Prices for goods across the economy soared, forcing the Federal Reserve to raise interest rates in order to bring confidence back to the dollar and to “break the back of inflation.”

From that period of reckoning forward, interest rates steadily dropped as the new normal of constant monetary inflation took hold. Today, we are living in the end state of that move to “fiat” money, no longer backed by any hard assets – with savers earning 0% yield, and in some areas actually paying to save money.

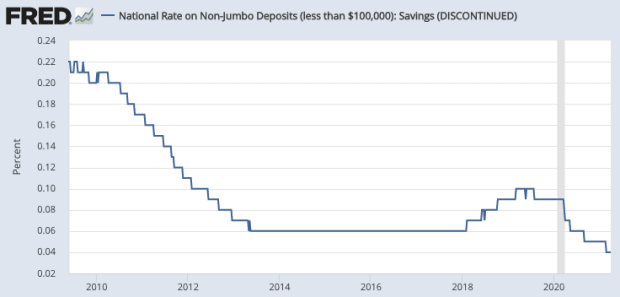

In the United States, banks can borrow cash from the Federal Reserve for a tiny 0.25% – so why would they pay you any more on your savings – which allows them to borrow your cash? They currently pay a paltry 0.04% on average.

As yields fell to laughably low levels, the entire concept of a savings account quietly disappeared into the bushes. Bank accounts now focus on convenience – online banking, debit cards, instant payments to your friends – not yields.

There’s no reason to maintain a savings account anymore, collecting tiny fractions of a penny on the dollar every year. The Federal Reserve forced interest rates too low for too long – lighting a fire under everyone’s cash.

These actions eliminated the savings account as a simple vehicle for growing wealth over time.

So what are we to do with our cash now?

Everyone Is A Professional Investor

The disappearance of savings accounts as a viable option for growing wealth (or just retaining savings!) left us with a new frontman for the savings movement: the stock market.

Passive investing in equities – through index funds or otherwise – seems to promise similar returns to the old savings account. However, this path comes with a lot less assurances and far more risks.

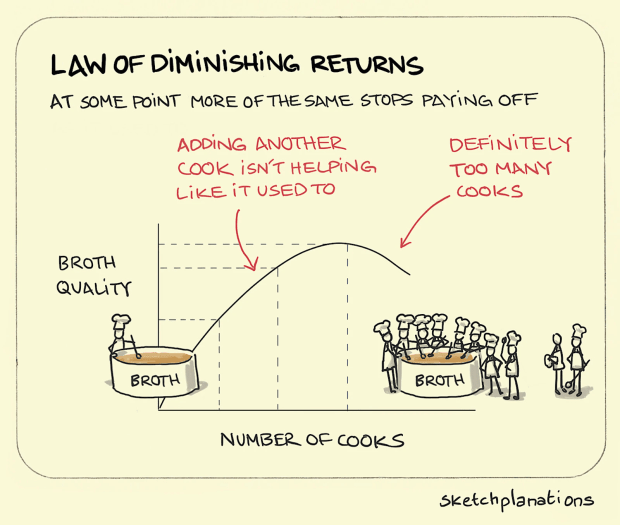

Funny enough, this is by design: part of the accepted economic rationale for lowering interest rates is to drive spending and investment in riskier projects, which is thought to drive growth. This works in the short term. However, just like that fifth coffee does a lot less than the first, simply taking another hit of economic stimulus in the form of lower rates only pushes growth so far, and the effect of each hit diminishes as the economy gets used to the adjustment. At some point, you’ll need to stop working and reset. Economies need a rest too.

In today’s zero (and still descending!) interest rate environment, making any return at all means taking on larger and larger risks. Savings accounts no longer make a return, so everyone needs to play stocks. Index funds have proven to be a popular option, but even those are being led by a handful of volatile tech stocks. Just five companies now make up 23% of the S&P500, up from 19% just last year. These few stocks are where all the returns come from, but they also carry heavier volatility! Returns are concentrating, and riskier.

To get a decent return on your savings as a middle-class worker, you now need a second job: professional investor. Parking your money in a savings account won’t cut it. You need to study stocks, pick your winners, deal with volatility and evolve your allocations as times change.

But there is one other staple of the American dream that might provide a simpler option… buying a home. Let’s look at that.

Chasing The American Dream

The fifth “cure” for a “lean purse” in “The Richest Man in Babylon” is to own your principal residence and make it an investment. The conventional wisdom goes something like this: land is scarce and everyone needs a home, so owning one of your own will serve you well as an investment over your lifetime.

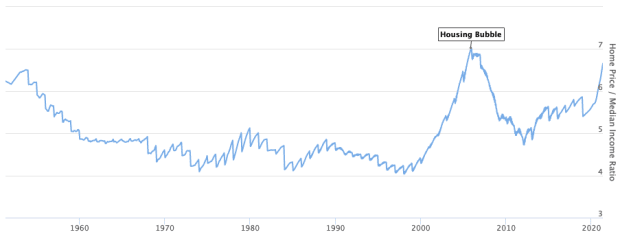

Unfortunately, that dream is driving away faster from each passing generation than we can run to catch it. Home prices hovered around the level of 4.5 years of median income from 1960 until 2000, then spiked massively going into the housing bubble. In 2021, we are back to housing bubble levels, with a house costing almost 7 years of the median income in the U.S.

Working for 30 years to pay off a mortgage on a house is a dangerous game to play, especially when home prices previously cratered from the 7-year home price to median-income ratio.

Taking a step back from charts and taking a look outside doesn’t offer much more security in the home-as-savings approach. Nearly one in five millennials have simply given up on owning a home, citing affordability as their main reason. Lifestyle changes are also precipitating a move away from permanent residency, meaning single-family homes are not what they used to be. The American dream for younger generations includes far more travel and flexibility than a single, owned residence can afford.

With home prices where they are today, a consistent 30% of income spent on mortgage payments means truly owning a home will take 23 years. Many aren’t willing to take that bet and the commitment that comes with it.

So what do we have left, in a world where cash is free and no investment is safe?

We must follow the signals of our overlord bankers – embracing the risk they want us to take while simultaneously spurning the system they’ve foisted upon us.

Bitcoin Dollar-Cost Averaging As The New Savings Account

Similar to a savings account 50 years ago, bitcoin offers a safe place to store wealth and a simple means to grow it steadily over one’s working years.

That statement might jar you at first – pundits and politicians love to rail on bitcoin as volatile. How could it possibly serve as a savings account?

For one, bitcoin is safe from confiscation – a real threat when living under oppressive regimes and even in the bastion of the free world.

However, many point to bitcoin’s volatile price as the reason it’s “unsafe” as an investment. To better understand this situation, consider the fact that when people call bitcoin volatile, they are referring to a price quoted in fiat currency, like the U.S. dollar. There are two assets at play when we call bitcoin volatile – BTC and the dollar.

Let’s say we have 100 apples and 100 oranges, and through bargaining we find the price of an apple is one orange. An orange grove is discovered, and now there are 5,000 oranges. The market adjusts, and an apple is now selling for 50 oranges. Which should we call “volatile” – the apple or the orange?

When we look at the bitcoin price, we have to consider – while governments are printing cash with reckless abandon to bail out everyone from banks to cruise ship operators, bitcoin continues emitting exactly the amount intended at regular intervals since its creation in 2009 day after day. Which is the volatile asset here?

The fundamentals of the Bitcoin network are what makes it a suitable substitute for the savings account. While the fiat monetary system wreaks havoc on prices across the economy, changing incentives for producers and consumers, bitcoin continues executing as expected – as if nothing is happening at all.

The Bitcoin network represents stability and predictability, something we are sorely lacking in every investment option today.

And while in the short term, the price of bitcoin in terms of fiat currency looks absolutely absurd, over longer stretches of time people are realizing the worth of such a stable asset – causing the price to prefer going up. That’s exactly what we want out of a savings account.

Unfortunately, the damage central banks have done to our monetary system means there are no stable, constant growth investment options anymore – the kind that tick up 5% each year with incredible safety assurances, like a savings account. Those options that are stable – like government bonds – carry historically low or even negative yields. Negative yields mean people and institutions are being charged to save money!

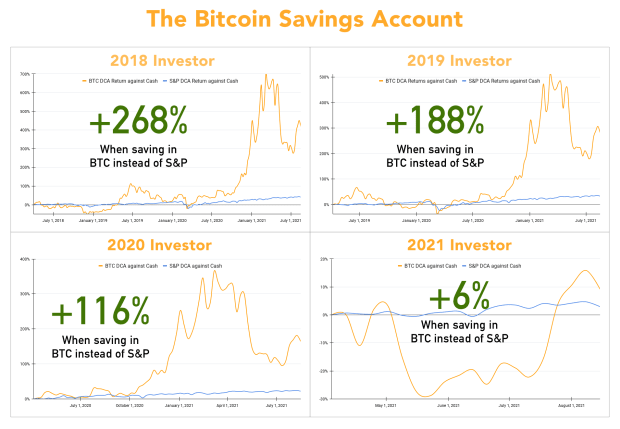

Dollar-cost averaging into Bitcoin is what makes this asset most similar to a savings account. Simply putting aside a small amount of income regularly as your savings, and storing it in bitcoin, takes no mental effort at all and seems to work pretty well over most time scales.

Here’s what happens if you save just 10% of your income and start investing weekly just after tax time into either bitcoin or the S&P 500. You’ll notice that it’s never too late to start.

Bitcoin dollar-cost averaging doesn’t give you a savings account that climbs up in a steady, straight line day by day like a savings account. However, no investment does that in this day and age.

What bitcoin does offer is a fundamental stability that is unmatched not just in investments today, but in investments throughout known history. No system has operated as predictably and precisely as bitcoin for so long, and with so much value at stake.

Bitcoin also offers incredible security assurances, since you can hold your own bitcoin on a hardware device or with a password in your head. Some dollar-cost-averaging tools will even allow you to deposit your automatic purchases directly to that hardware “wallet.”

If you want to get started buying bitcoin regularly, check out a simple option like Swan Bitcoin.

Welcome to your new savings bank – we’re happy to have you.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.