Though regulations in some Canadian regions make bitcoin mining difficult, the country overall is poised to become a top-three mining hub.

There’s been plenty of jibber-jabber about how much the United States stands to benefit from the great hash rate migration from China, but what about the U.S.’s continental cousin, Canada?

A few months ago, a news report surfaced that said Bitfarms, one of Canada’s largest bitcoin miners, was quitting Quebec on account of rising energy prices and stringent regulations. In fact this isn’t true; Bitfarms is expanding in Quebec, but it’s just moving moving part of its fleet to South America in a bid to diversify its operations.

Still, the news peg painted Canada as a poor jurisdiction for miners to set up shop, but lest we paint the entire country with broad strokes, we should take a look at other jurisdictions to get the full picture, as well as examine Quebec’s large hash rate footprint despite the industry being tied up by red tape.

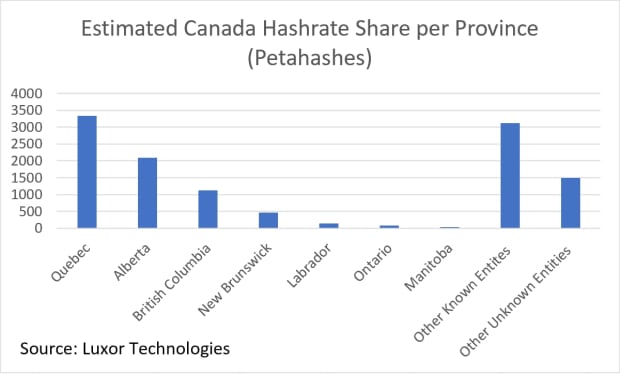

Figures from the University of Cambridge’s latest mining report factor that Canada currently represents 3% of the network’s hash rate. This is skewed due to the fact that the report relied on IP login data to pinpoint mining operations (so if a firm operates machines in Canada but it managed its machines from the U.K., then its hash rate would be registered in the U.K.). Luxor Technologies estimates that a more accurate figure is 7.8%, based on the size of the ASIC fleets of key players in the region and the current network hash rate.

2018 figures from Cambridge pinned Canada’s hashrate share at 13% — why the huge discrepancy between then and now? Could the mining landscape have changed that much?

Canada Is More Than Quebec

When observers compare Canada to other mining hotspots, the country’s ostensibly stringent regulatory environment — particularly in regards to energy regulation — is often one of the primary pain points of their critiques. Even so, the region has the largest concentration of miners in the country, with over 3 exahashes of hash rate currently in operation.

Each Canadian province isn’t the same, though, and they each feature their own regulators and power authorities.

Quebec’s sole public power utility, Hydro-Quebec, for instance, placed a power moratorium on Bitcoin mining in the spring of 2018, and some actors in this province, like Blockstream’s mining arm, have quit the region, citing difficulty with working with the power provider.

After the moratorium, Hydro-Quebec set up a program for miners to apply for up to 50 megawatts (MW) through an RFP. The power provider sectioned off 300 MW of capacity for public tender through this program, but the application process was so lengthy and strenuous that only 20 MW to 30 MW ended up being contracted. In addition to language barriers (the application was in French), Hydro-Quebec requested proof that the miners had procured proper infrastructure (transformers, warehouse space), so miners who had connections in the area and could secure infrastructure ahead of time had a leg up over outsiders. Additionally, the agreements were strict about electrical draw: if you signed up for 5 MW, you had to consume that much or you would have your rates jacked to a level that would make your operation uncompetitive.

Because of this program, those miners who were already operating in the area or knew the landscape secured agreements, while others either didn’t meet requirements or gave in entirely.

Still others, like Bitfarms, have no plans to leave the region anytime soon. The venture operates five facilities in the region and plans to double its capacity in Quebec in the future, according to comments from CEO Ben Gagnon on a recent Compass live stream.

The problem for would-be miners in Quebec, though, is that Hydro-Quebec is limiting the amount of power they are willing to sell to Bitcoin miners. So, incumbents like Bitfarms, which have already established rapports with the energy producer, will have a leg up when trying to secure power purchasing agreements (indeed, Gagnon claimed in the Compass live stream that, during the 2018 bear market, Bitfarms was able to secure 50% of the energy allotted to miners by Hydro-Quebec for a given power purchasing agreement block).

“Quebec’s mining gold rush came and went as soon as the 2018 moratorium was put into effect. However, from this regulatory hurdle came clarity. Hydro-Quebec and the Régie de l’Énergie established a request for proposal process to award power purchase agreements dedicated to cryptocurrency mining,” Mike Cohen, who operates multiple farms in Canada, said in an interview for this article, summing up the situation. “While the energy cost may not be the best in the world at around 0.05 Canadian dollars per kilowatt hour (kWh), it’s still competitive and the security and peace of mind that comes from a five-year fixed rate agreement with a government-run utility company in a jurisdiction where the climate is cold, the courts work and the energy is almost entirely from renewables has great value in our industry.”

Alberta, Other Jurisdictions May Have More Room To Grow

Still, there are other jurisdictions where power isn’t monopolized by the government and Independent Systems Operators (ISOs) operate as private entities. In Alberta, New Brunswick and Ontario, for example, ISOs dominate and provide an abundance of cheap energy. Oil-rich Alberta stands out from the rest here and has been a boon for companies like Upstream Data, which has been capturing flared gas from this region to mine bitcoin since 2017.

Typically, these oil producers (operating as they do in the middle of nowhere) don’t want to transport this natural gas to consumers, as they would lose money with shipping cost, so they flare it instead. Bitcoin miners soak up this otherwise wasted energy and provide the drillers with a payday — a win-win for all involved.

Additionally, Hut 8, one of the largest miners globally, operates in Alberta, with its CEO Jaime Leverton noting in the past that the more-conservative province has been kinder to Bitcoin miners.

Jurisdiction Hopping

It’s also worth noting that some miners operate multiple farms in different provinces.

This jurisdictional arbitrage is crucial considering some provinces (like Alberta and Labrador) are much more favorable to Bitcoin miners than a place like Quebec (which, while still viable for those who know how to navigate the regulatory landscape, is harder to break into).

Additionally, provinces on the East Coast like New Brunswick are ripe for mining and are still largely unexplored compared to Canada’s historical mining epicenters. These coastal states have an abundance of cheap hydro and other renewables, but they lack the population density to soak up what they produce.

Bitcoin miners, then, could provide an economic battery of sorts that provides these power producers with a steady buyer of first and last resorts to balance costs. The mining industry is still in the fledgling stages in these areas, but we expect it to take flight in the coming years as miners make headway with providers and regulators in these areas and the industry is flush with new participants.

Advantages Versus The U.S.

Canada’s Bitcoin mining sector is often compared to the United States’ own, and not without reason: both share the same continent, so both are competing for the same market to an extent.

Most observers frame the United States as a more competitive market, but Canada has its own advantages over the U.S.

Principle among these, Canada’s import taxes are much lower, roughly 5% for general sales tax on imported goods. Trump-era tariffs, along with the usual 2.6% duty levied on imported goods, add a 27.6% tax on the ASICs that U.S. companies purchase from China. That’s a sizable load to add to any operation’s CAPEX.

Additionally, Canadian companies traditionally have had an easier time listing their stocks on Canadian stock exchanges. The Toronto Stock Exchange, for instance, hosted Hut 8, Hive and Bitfarms well before any of those stocks went live on the Nasdaq (which just happened this year).

North America’s only operating ASIC manufacturer, ePIC Blockchain, resides in Toronto, as well. The company only manufactures Siacoin ASICs currently, but its CEO has stated its intentions to eventually break into the Bitcoin ASIC market (Argo, for instance, inked a deal with ePIC to get first dibs on its bitcoin miners when they reach production).

If and when this occurs, it’ll give miners in Canada (and North America more broadly) easier access to machines and repairs. Additionally, British Columbia- and Quebec-based miner Blockstream just announced its intentions to begin manufacturing ASICs, as well.

“Canada has an opportunity in its hands right now to promote itself as a national host for trusted infrastructure providers, like Hut 8,” Hut 8 CEO Jaime Lerverton said in an interview. “The single task they must do to achieve this is to confirm their commitment to our industry and establish clear and favorable policies and programs to support our growth and innovation. There is much to be gained by Canada, and as a proud Canadian company, we hope our government will take the opportunity to lead globally with us.”

Canadian mining will likely grow slower than in the U.S., where gun-hoe states like Texas and Wyoming have fewer red tape restrictions, thus allowing accelerated business operations. But grow it will, and we expect Canada to be a top-three mining hub in the world over the next decade as new entrants search for reliable, abundant power in countries with strong property rights and legal protections.

This is a guest post by Colin Harper. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.