Zero-fee crypto trading often refers to “zero-commission” trading, where the exchange entity doesn’t directly charge you, the user, for the transaction.

This new value proposition is changing the cryptocurrency exchange business model, as new exchange upstarts aim to unthrone their commission-charging competitors from their thrones.

Legacy platforms like Coinbase, Binance, and Gemini may have captured the bulk of entry-level cryptocurrency traders, but a shift began around late-2020.

New platforms began attempting to subvert the incumbent exchanges with the promises of “zero-fee” trading– a business model where exchanges don’t charge traders a commission fee, but rather seek to make their money another way.

There’s no such thing as a free lunch, so what does zero-fee trading entail?

The following article explores zero fee cryptocurrency trading and what it means for traders, entrepreneurs, and the industry at large.

Is Zero Fee Crypto Trading Legit?

So, what’s the catch?

The cryptocurrency exchange model can be remarkably profitable at scale– small fees on every trade can add up to billions. For example, the top-earning cryptocurrency exchange in 2018 was Binance, and it was making about $3.48 million per day. During the same year, the top twenty exchanges averaged about $1 million per day in profits.

Exchanges typically make money in a few ways:

- Deposit fees.

- Withdrawal fees.

- The bid/ask spread. Exchanges can profit by exploiting the differences in the prices buyers and sellers expect to pay via market making.

- Trading commissions. This is the most common monetization method for exchanges, crypto and stock alike. Think of a trading commission as a service fee for brokering the trade between a buyer and a seller.

- Listing fees. Fees paid by coins to be listed on the exchange.

For those curious about the mechanics of cryptocurrency exchanges, check out Coinbase’s 2020 S1 Statement. Coinbase, now a publicly-traded company, had to disclose its primary revenue-generating activities.

The zero-fee invasion is a two-pronged threat to this model.

First, DeFi. Users could maintain custody of their private keys and exchange assets using similar blockchains. The only fees paid are usually network fees, which have been nothing to scoff at if you’ve been using the Ethereum DeFi ecosystem.

Second, zero-fee CeFi. The exchange takes custody of your private keys and executes the trade, similar to Coinbase, but it makes its bread another way. Voyager, StormGain, and Robinhood are two companies that have adopted this model at the forefront of their value proposition.

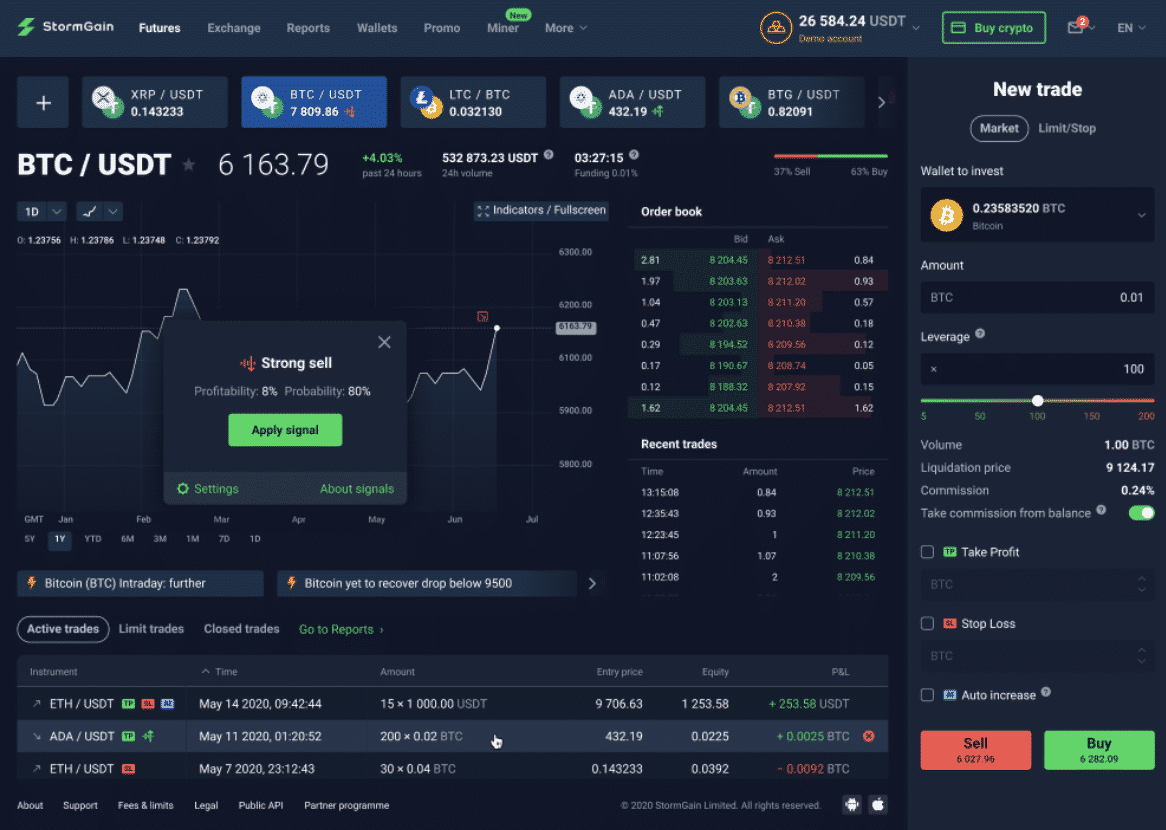

The StormGain trading mechanics are also billed as zero-fee. There isn’t a commission on the trade, but rather, a profit share of 10% is taken only from profitable trades.

For example, assume you bought BTC at $30k on StormGain. It’s now $50k, and you want to trade it for USDC. Your profit would be $20k, and StormGain would take a 10% ($2,000) cut of this trade.

A snapshot of the stormgain platform

Alternatively, if BTC fell to any amount under $29.99k after you bought it at $30k and decided to cash out for USDC, StormGain would fulfill the trade at no cost.

This sort of model is appealing for someone trading on a loss, but can get wildly expensive when a significant profit margin is taken into account.

Voyager claims to route its customers’ crypto transactions to various exchanges in order to find the best possible rate; it advertises that it only makes money on your trade if it saves you money. According to Voyager, you won’t pay anything above the quoted price of a trade; if Voyager finds you a better exchange trade price, it takes a cut of the difference of the price below its quote, and you keep the remainder.

However, Voyager is the party that sets the initially quoted rate. Disgruntled users have claimed that this practice doesn’t necessarily make Voyager “zero fee” as its commission is disguised as an artificial bid-ask spread.

Robinhood’s crypto service is similar– it doesn’t charge a commission, but it makes money on the bid-ask spread.

Final Thoughts: Is Zero-Fee Crypto Trading Friend or Foe?

The cryptocurrency ethos at large is enamored with the disintermediating advantages of decentralized currency. For some of the more hardcore cryptocurrency advocates, centralized exchanges charging commission or making a single dollar on your trades might as well be the Sith.

There isn’t anything inherently unfair about an exchange charging a fee to use the infrastructure it has potentially invested millions or billions to build.

The zero-fee trading model, albeit primarily utilized by centralized exchanges, is one step closer to aligning trader and exchange interests. The “we only make money if you do” has an appeal, especially for those higher-frequency traders that spend thousands of dollars per year placing simple trades.

To keep these interests aligned, the zero fee crypto trading platforms must be completely transparent in how their profit is generated.

Intentionally quoting a trader a higher price so you can make money on a greater bid-ask spread is akin to shopping mall outlets raising their prices before running a steep “discount” to lure customers.

Higher-frequency traders would be wise to intimately study how an exchange charges its fees, and how it performs against other competitor exchanges. DeFi platforms like Uniswap or Aave tend to set a pretty good baseline for the actual cost of a trade.

The post How Does Zero-Fee Crypto Trading Actually Work? appeared first on CoinCentral.