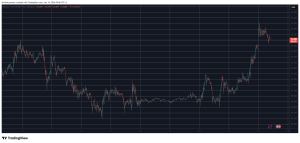

Bitcoin (BTC/USD) sought technical support early in the Asian session as the pair depreciated to the 49714.85 level after trading as high as the 50558.75 area, with the interday high representing a test of the 61.8% retracement of the recent depreciating range from 51064.44 to 49590. Stops were elected above the 50784.99 area, representing the 76.4% retracement of the depreciating range from 58539.53 to 26264. Significant Stops were recently elected above the 50388.60 area, representing the 23.6% retracement of the appreciating range from 43016 to 52666. Traders are paying attention to additional upside price retracement levels including the 51109, 52608, and 53259 areas.

Following the pair’s recent advances above the 50000 figure, downside retracement levels and areas of potential technical support include the 49885, 49276, 49245, 48259, and 47705 levels. Traders are observing that the 50-bar MA (4-hourly) is bullishly indicating above the 100-bar MA (4-hourly) and above the 200-bar MA (4-hourly). Also, the 50-bar MA (hourly) is bullishly indicating above the 100-bar MA (hourly) and above the 200-bar MA (hourly).

Price activity is nearest the 50-bar MA (4-hourly) at 48688.04 and the 50-bar MA (Hourly) at 49915.85.

Technical Support is expected around 42405.29/ 39903.28/ 37401.27 with Stops expected below.

Technical Resistance is expected around 51355.26/ 51569.56/ 51997.03 with Stops expected above.

On 4-Hourly chart, SlowK is Bearishly below SlowD while MACD is Bullishly above MACDAverage.

On 60-minute chart, SlowK is Bearishly below SlowD while MACD is Bearishly below MACDAverage.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.