The adoption of SegWit on Bitcoin has been booming for the past few months. Segregated Witness, aka SegWit, is a new feature introduced in 2017 that allows for lighter (in terms of kB), and therefore cheaper, bitcoin transactions.

A new surge in SegWit addresses

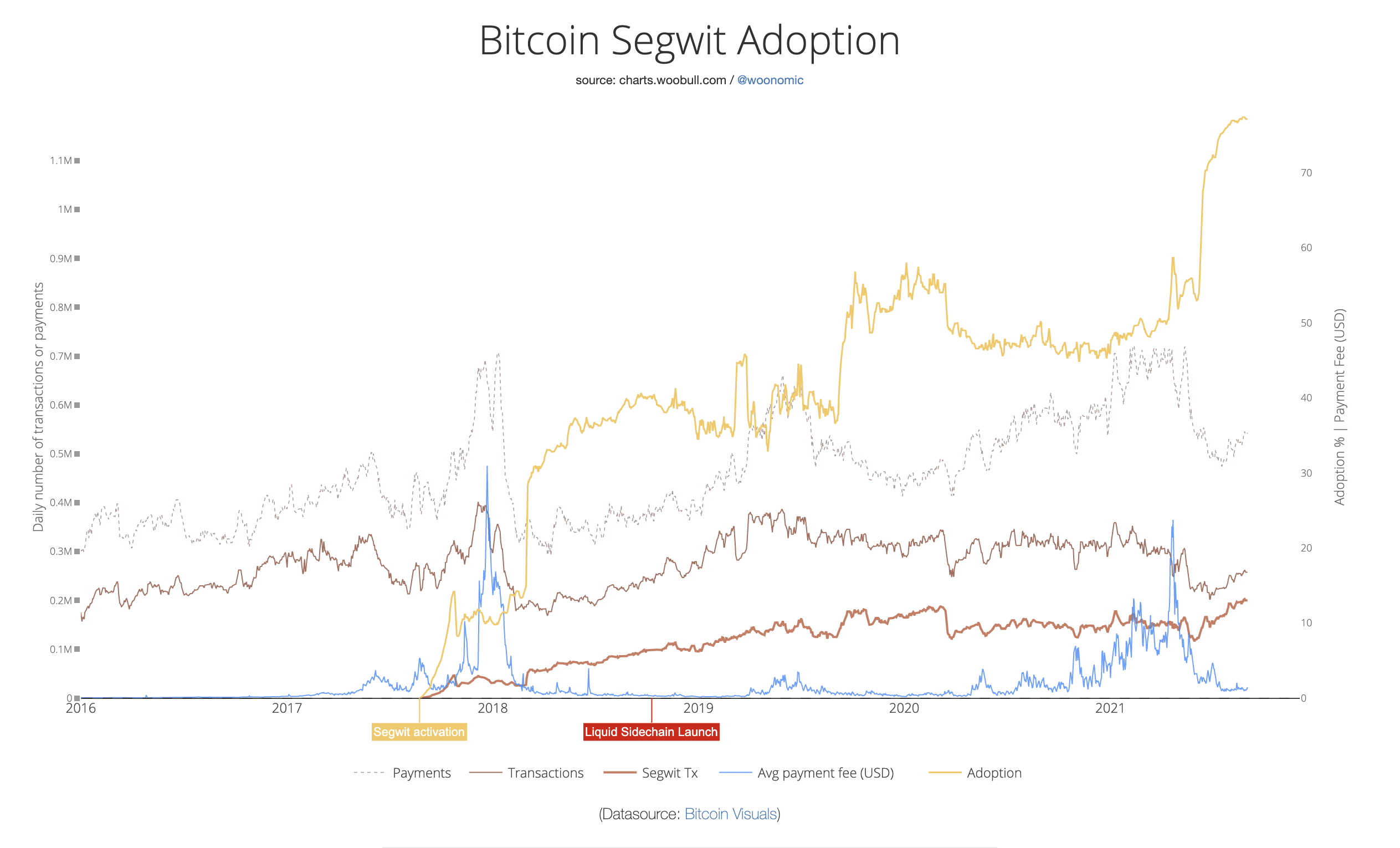

The SegWit adoption graph shows that after the initial boom in 2017, there was a halt in its uptake, followed by a new surge in March 2018.

However, the number of daily transactions using SegWit wallets grew slowly, so much so that even after March 2020 it began to decline, despite a new surge in SegWit addresses in September 2019.

The turning point came starting in March, with a new big boom in SegWit addresses created, and especially new all-time highs in the number of transactions using this more advanced version of the Bitcoin protocol.

In particular, the month of August just ended saw the highest ever peak in total transactions using SegWit, at the same time as the highest number of new SegWit address activations was reached.

In other words, it seems that since the bitcoin price crash in May, there has been a rush to create and use SegWit addresses instead of the older, more expensive bitcoin addresses.

There has also been a marked increase in the use of the Lightning Network, Bitcoin’s second layer, which allows for almost immediate and inexpensive transactions without the need to register them on Bitcoin’s slow and expensive blockchain.

Nearly 80% of all transactions recorded on Bitcoin’s blockchain every day are now SegWit transactions, 40% more than in May and almost double the number at the end of last year.

If instead of the transactions recorded on Bitcoin’s blockchain on a day-to-day basis one were to analyze the total BTC held on addresses in various formats, one would find that even today the vast majority of BTC are still held on traditional, or legacy, addresses.

Two security factors not to be overlooked

However, there are two decisive and important factors causing this dystopia.

On the one hand, legacy addresses also include many addresses in which BTC are stored that are now lost, i.e. immovable and unusable, due to the loss of the private keys for those addresses, or for example the death of their owner.

Of the nearly 11.8 million BTC that are still held on legacy addresses, perhaps a third should be considered immovable from there because they are unusable due to the loss of the private key needed to move them.

In addition, there are still many BTC that are simply kept for the long term by their owners who do not intend to use them, but only to store them for the long term as a form of savings.

It should also be added that often the BTC that are moved with transactions that are recorded on the blockchain are more or less always the same, i.e. by BTC owners who are used to using and moving them. They will most likely prefer to use SegWit addresses, which will save them some fees, so it is only logical that those who do more transactions on the blockchain will prefer to use SegWit addresses. For others, this need might easily be less felt.

It should be noted that the boom in June this year follows the adoption of SegWit by Blockchain.com, one of the world’s leading services for using and exchanging bitcoin.

This demonstrates once again that, despite everything, there are still many who rely on custodian platforms to carry out their bitcoin transactions, even though it was created specifically to allow BTC holders to eliminate any intermediary, or third-party custodian, for their money.

The post Bitcoin: SegWit adoption booms appeared first on The Cryptonomist.