India, already home to 1.37 billion people (nearly 4x that of the United States), is one of the fastest-growing countries. India’s population demographic is much younger than that of China and the United States, and its middle class is anticipated to be the largest in the world (in terms of quantity of people) by 2025.

It has the world’s second-fastest-growing mobile market, but only 10% of its population is considered to be digitally literate.

The Indian government has also been particularly mercurial in regard to cryptocurrency. It recently considered one of the world’s strictest anti-cryptocurrency bills, which would criminalize the possession, mining, and trading of cryptocurrency assets.

Indian cryptocurrency exchanges like CoinDCX have their work cut out for them: if they can mollify anti-cryptocurrency legislation and increase India’s digital literacy penetration, they stand to win a chunk of an incredibly lucrative market.

The number of Indians trading digital currencies crossed the 15 million milestone in 2021, with a surge of cryptocurrency investments from $923 million in April 2020 to nearly $6.6 billion in May 2021.

CoinDCX recently claimed unicorn status with a valuation of $1.1 billion– fresh off a $90 million Series C round, led by Eduardo Savarin (former Facebook Co-Founder), and returning investors Coinbase and Polychain.

The smartest Indians are working in crypto. And in the future, smarter Indians will continue to join crypto in some way

— Sumit Gupta (CoinDCX) (@smtgpt) September 9, 2021

Founded in 2018, CoinDCX has seen the ebbs and flows of the cryptocurrency market with front-row seats. Sumit Gupta, Co-founder and CEO of CoinDCX, joins CoinCentral to discuss his journey into the cryptocurrency world, CoinDCX’s plans for the future.

Can you walk us through the CoinDCX story? What was it like starting a cryptocurrency exchange in India?

Neeraj and I have been friends for the last fourteen years. We grew up as small towners and the mention of Mumbai and IIT sounded so aspirational. We were in the same department in electrical engineering where we attended cryptography classes together, discussing technology, start-ups, and how our future would unfold. We always dreamed to do something that we could call our own.

After I graduated, I got placed in Sony Japan where I worked for some time. But I always wanted to work for myself, so I paid attention to how corporations functioned, gathered all the experience I could, and then came back to launch my own startup.

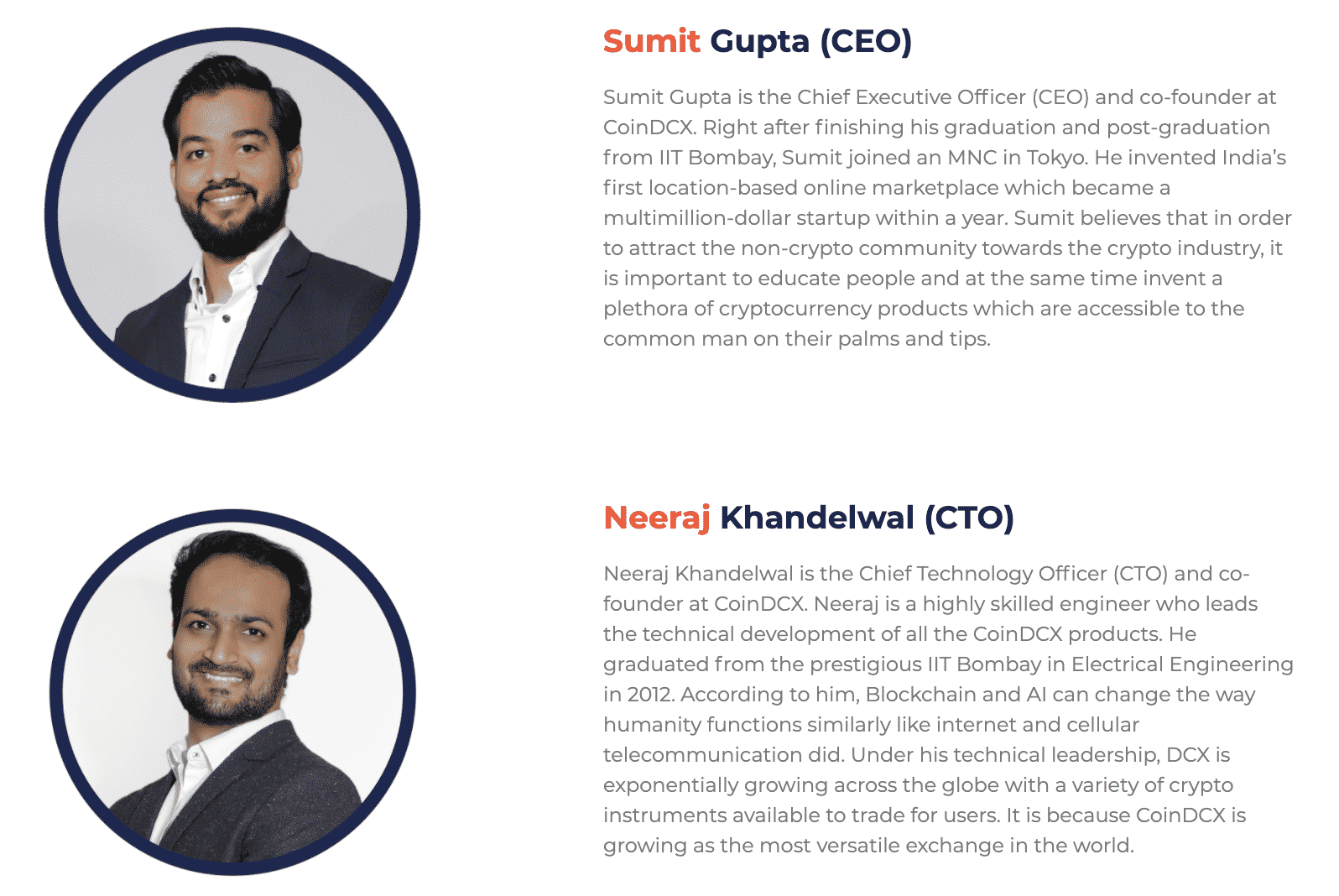

The site bios for CoinDCX Founders Sumit Gupta and Neeraj Khandelwal, courtesy CoinDCX

With my first startup in place, all the pressure fell on me and I had almost used up all my savings sustaining the business. Neeraj saw my struggle, and after his work hours, he’d help me out. I tried my best, but I knew I had to shut my company down.

That was when Neeraj encouraged me and said, ‘Sometimes it’s important to let things go. There’s something better waiting.’ After almost a year of not working, Neeraj motivated me to use my time to learn from other entrepreneurs. I spent hours reading about cryptocurrency and we found that crypto exchange was an untapped market. In a leap of faith, we decided to start a business in that space.

Today, it’s been 3 years and we’ve hired over 150 people. We have over 3.5 million users now and things are moving at an accelerated rate.

What makes CoinDCX stand out? Can you touch on how CoinDCX has been established to raise capital from organizations like Coinbase Ventures, Polychain Capital, Block.one?

CoinDCX is India’s safest cryptocurrency exchange. We launched it from Neeraj’s flat with the idea of helping traders build strong crypto exchanges. When we first started, the Reserve Bank of India ordered banks to stop trading with crypto companies, our investors backed out and I saw myself at the finish line even before the race began.

We had two options – we could either give up or pivot to a different strategy. We chose the latter; Neeraj said, ‘Nothing worse can happen to us. We can only move up now.’ So with a team we could count on our fingertips, we started from scratch. We worked tirelessly, got our own office, and after the reversal of the ban our investors came back; we had weathered the storm.

The idea of CoinDCX is to provide instant fiat to crypto conversions with zero fees, so that our users can have access to a diverse suite of financial products and services that are backed by industry-leading security processes and insurance protection.

We closed our first Series A funding back on 24 March 2020. It was on the backdrop of unprecedented levels of crypto adoption in India following the lifting of an industry-wide banking ban by the Reserve Bank of India enacted in 2018. That was when prominent investors including Polychain Capital, Bain Capital Ventures, and HDR Group, operator of BitMEX, along with other venture capitalists took a stake in the company, enabling us to supercharge our growth.

Our most recent Series C funding round this month was led by B Capital, which was founded by former Facebook Founder Eduardo Savarin, along with returning investors such as Coinbase and Polychain, as well as other veteran investors. The funding brought our valuation to valuation to $1.1 billion, making us the first Indian cryptocurrency exchange to reach unicorn status.

Can you give us a bit of the story about how Eduardo Savarin ended up leading your latest raise?

The pace of crypto adoption has accelerated dramatically in India in recent years — naturally, it has attracted the interest of investors looking to take a slice of this burgeoning market. For our recent Series C round, I am glad to have returning investors, Coinbase and Polychain Capital on board, for it demonstrated the trust they have in our business. Given the close-knitted nature of the investor community, I am also thankful to have been introduced to Eduardo, who was a lead investor for the round.

As we accelerate our business growth and scale our operations, I look forward to turning our vision of granting 50 million users in India access to cryptocurrencies a reality.

For someone looking to get involved, either as an investor or as an entrepreneur, how would you define opportunity in the cryptocurrency space in 2021 and beyond?

Globally, there has been an estimate of more than 300 million cryptocurrency users across the world, yet this remains a fraction of users in the traditional markets.

With more businesses now accepting cryptocurrencies as a form of payment, it is likely to keep growing in the market – which revolutionizes the way corporations interact with their customers. We’ve seen airlines, hotels and resorts, and even insurance companies accepting the new form of payment.

But cryptocurrency isn’t just about payments. There are many other use cases. For individuals or even corporations looking to make transactions, cryptocurrencies offer the ability to do so with relatively lower transaction costs and faster transaction speeds, greatly easing the entire process altogether.

Crypto traders and investors have been using the digital asset in investments, too — as a portfolio hedge as well as a store of value. In recent months, there has been an increasing number of companies shoring cryptocurrencies on their balance sheet — a testament to their maturation as an asset class.

Seeing the crypto and blockchain industry jump through many hurdles over the past few years, it will not be unsurprising to witness the industry continue growing and progressing to keep serving an expanding number of crypto users and encouraging greater innovation in the space.

How have you seen blockchain and cryptocurrency change day-to-day life for your users?

Through the years, we’ve seen blockchain technology being used in wider industries and applications, from a safer and faster way to transact to a more convenient and affordable way to make payments.

Aside from transactions and payments, we have also seen cryptocurrencies increasingly used as a means to derive passive income. Through lending or staking functionalities, users are able to earn interest on their cryptocurrencies — typically at interest rates higher than what is currently offered by traditional financial institutions such as banks.

This provides an additional source of investment income, in addition to the potential capital upside from holding the cryptocurrencies themselves.

Cryptocurrencies are also instruments by which individuals participate in the new crypto economy. Through investments in projects with real-world impact and use cases, investors have the opportunity to fund technological innovations as well as gain exposure to an alternative asset class.

At CoinDCX, we strive to increase accessibility to cryptocurrencies through the provision of a safe and secure platform to transact, as well as user-focused education. It is our vision to have 50 million users in India.

Congratulations on the big round! What are the next steps for CoinDCX?

Thank you! We have so much in the pipeline, and we are excited to continue our venture in pursuing new business initiatives. We’re looking forward to the launch of CoinDCX Prime initiative, a HNWI/Enterprise product for assisted investment in crypto baskets, as well as Cosmex, CoinDCX’s global trading product which will give international users access to one-third of Global Liquidity.

The CoinDCX team, courtesty CoinDCX team

We’re excited to expand our cryptocurrency investor base through partnerships with key fintech players, and launching our Research & Development (R&D) facility.

We’ll also continue to collaborate with the government to introduce favorable regulations and education, and we plan to support programs to strengthen policy conversations through public discourse.

At CoinDCX, it is our vision to make cryptocurrencies accessible to 50 million users in the country.

We will continue to leverage our marketing campaigns, social channels, and media publications to further spread the education, understanding, and adoption of cryptocurrency and blockchain. We will also focus on addressing misconceptions and encouraging healthy discussions in the space.

Thank you, Sumit Gupta!

The post India’s First Crypto Unicorn: Interview with CoinDCX CEO Sumit Gupta appeared first on CoinCentral.