It is easy to get trapped in watching short-term price fluctuations of BTC, so it helps to zoom out and learn more about Bitcoin.

Short-term price action can often get in the way of a more fundamental understanding of Bitcoin. Newcomers are especially prone to selling coins at a loss if they don’t go through the learning curve and dig deep into good resources.

But for those who have fallen down the rabbit hole, frequent red candles are nothing but a distraction to them because they have understood the actual value of Bitcoin. If you still care about the USD value of BTC and are still somewhat affected by daily movements in the bitcoin price, here are a few data points that might bring you some peace, from Bitcoin ROI.

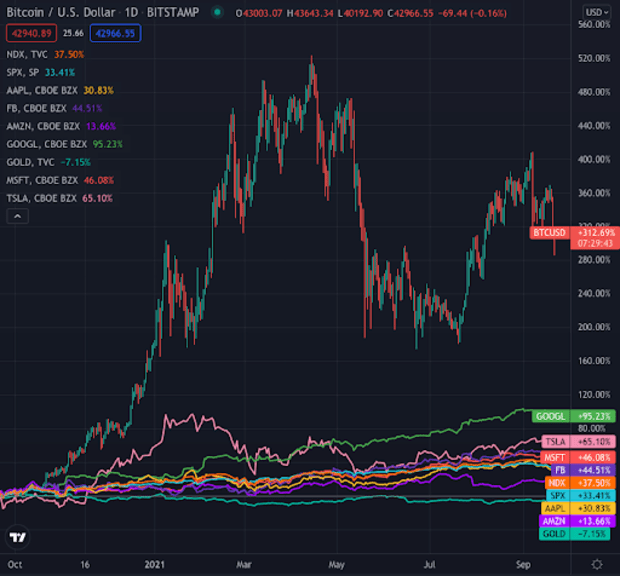

First, it helps to zoom out and compare the bitcoin price with a less-volatile currency, commonly used as a store of value and medium of exchange by regular people. BTC has increased over 7,000% in value in the past five years, 300% in the past year, and 46% year-to-date against the U.S. dollar, the world’s reserve currency.

However, the U.S. dollar is hardly ever sought after by people to increase their purchasing power since it is widely used as a unit of account. Naturally, for that purpose, investors allocate at least part of their money into higher-risk investment vehicles. Over the past decade, tech stocks and major indexes like the S&P 500 and the Nasdaq have seen the biggest gains in U.S. dollars among traditional investment vehicles.

In either case, Bitcoin beats the pack once more. In the past five years, the peer-to-peer digital monetary network has been up more than 3,400% against the S&P 500. Bitcoin is also leading by more than 200% in the past year and 25% year-to-date. With the Nasdaq, it is no different. BTC has outperformed the tech index by over 2,000%, 190%, and 25% over the same three periods.

Individual tech stocks, usually referred to as “growth stocks,” have also underperformed. Over the past five years, bitcoin has increased more than 2,500% in USD value against Facebook, 1,600% against Amazon, 1,300% against Apple and Microsoft, and 1,900% against Google. The peer-to-peer money has also outperformed the FAAMGs in the past year by over three-digit percentage marks. Bitcoin also beat Tesla over all three timeframes.

Bitcoin doesn’t disappoint the store of value folks either. Gold, historically the most sought-after asset for store of value purposes, has been losing the price appreciation race against bitcoin in nearly all timeframes. BTC has outperformed gold by over 5,000% in the past five years, 340% in the past year, and 57% year-to-date.

In short, Bitcoin has been the best performing asset in the world for some time now. Even when adjusted for risk, BTC beats all other investment vehicles with the best return on investment (ROI). The only way for bitcoin to lose in the price appreciation race is if it’s set on too short of a course. Considering very short-term timeframes, six months or less, BTC can indeed be seen losing the race for some assets. However, that is precisely the point.

All short-term price action is nothing but noise, and Bitcoin should be seen for the transformative technology it is. Successful investors will be those who mute the daily, weekly, monthly fluctuations in price in favor of the big picture — the set of lasting changes with which Bitcoin can provide society at large.

Bitcoin makes outstanding gains in price over more extended periods because it takes people time to understand it, purchase it, and hold it long term. Until someone truly understands Bitcoin’s potential, they are prone to sell at a loss, blinded by the short-term price movements. Don’t be short-sighted; zoom out and get up on learning more each day with these great resources and understand why Bitcoin exists.