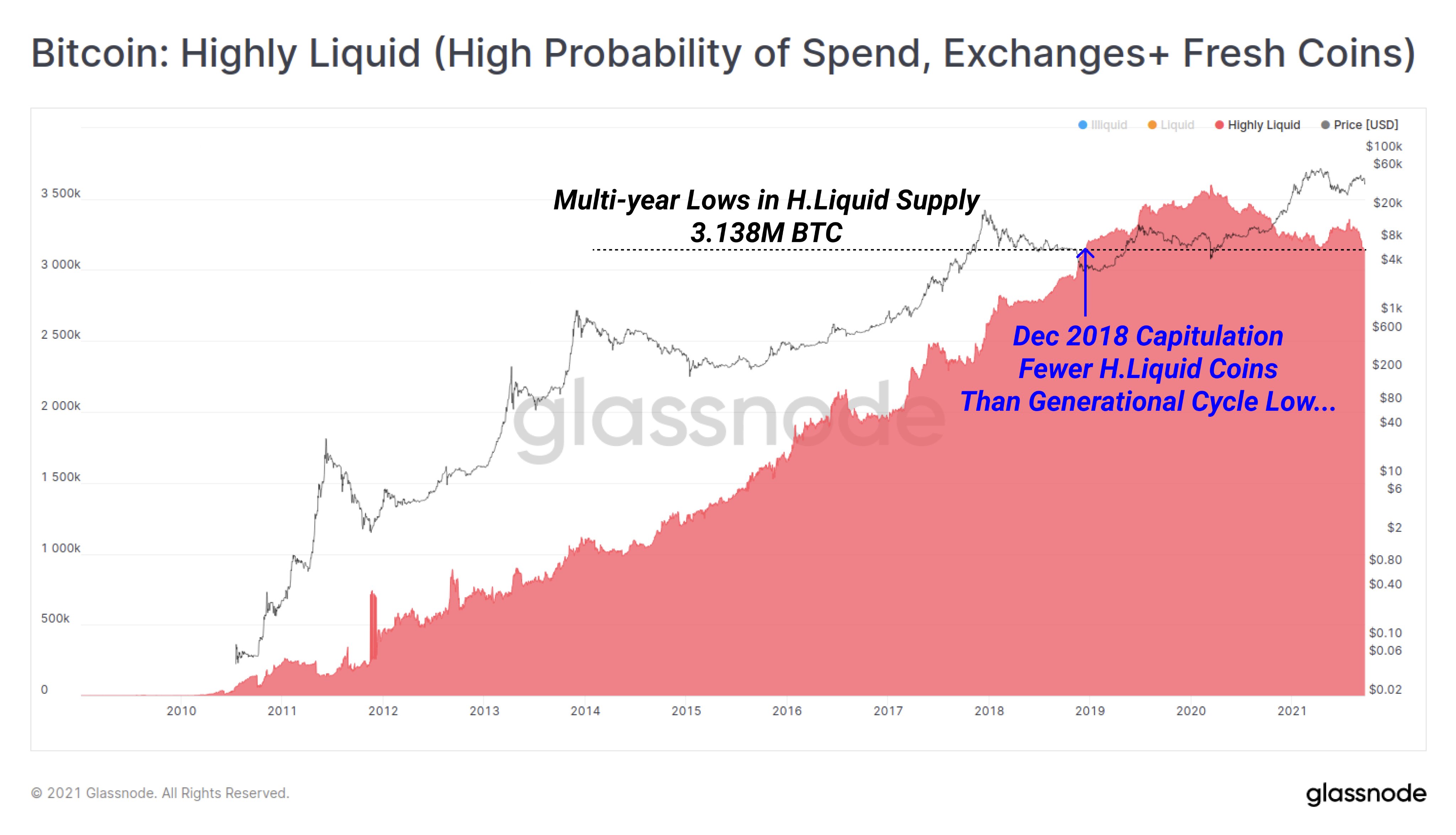

According to the latest data from crypto analytics firm Glassnode, there are currently fewer Bitcoin in a highly liquid state than there were at the very bottom of the infamous December 2018 capitulation.

Diving deeper into the numbers shows that this is incredibly bullish not just for Bitcoin, but for the rest of the market as well, as it shows there are fewer BTC to buy—despite the massive price dip.

Bitcoin’s illiquid supply matters more than its price

When the entire market goes red, it’s logical to conclude that the demand for selling increases as well. However, the inherent transparency provided by blockchain technology enables us to analyze the movement of cryptocurrencies and determine whether or not they’re exchanging hands as much as price charts might indicate.

Sell pressure is easy to detect, as it always correlates with a huge influx of funds to cryptocurrency exchanges. The amount of cryptocurrencies held in cryptocurrencies is their “liquid supply” and indicates how many of them are available for purchase. When cryptocurrencies are kept off exchanges, they’re usually not available for trading and have the potential to create a supply crunch when the demand is high.

This seems to be the case with Bitcoin, which saw over 10% shaved off its price in the past week.

The latest on-chain analytics from Glassnode indicate that Bitcoin’s illiquid supply—i.e. the number of coins with a low probability to be spent—is at an all-time high. There are currently over 14.43 million BTC held off of exchanges, the data showed.

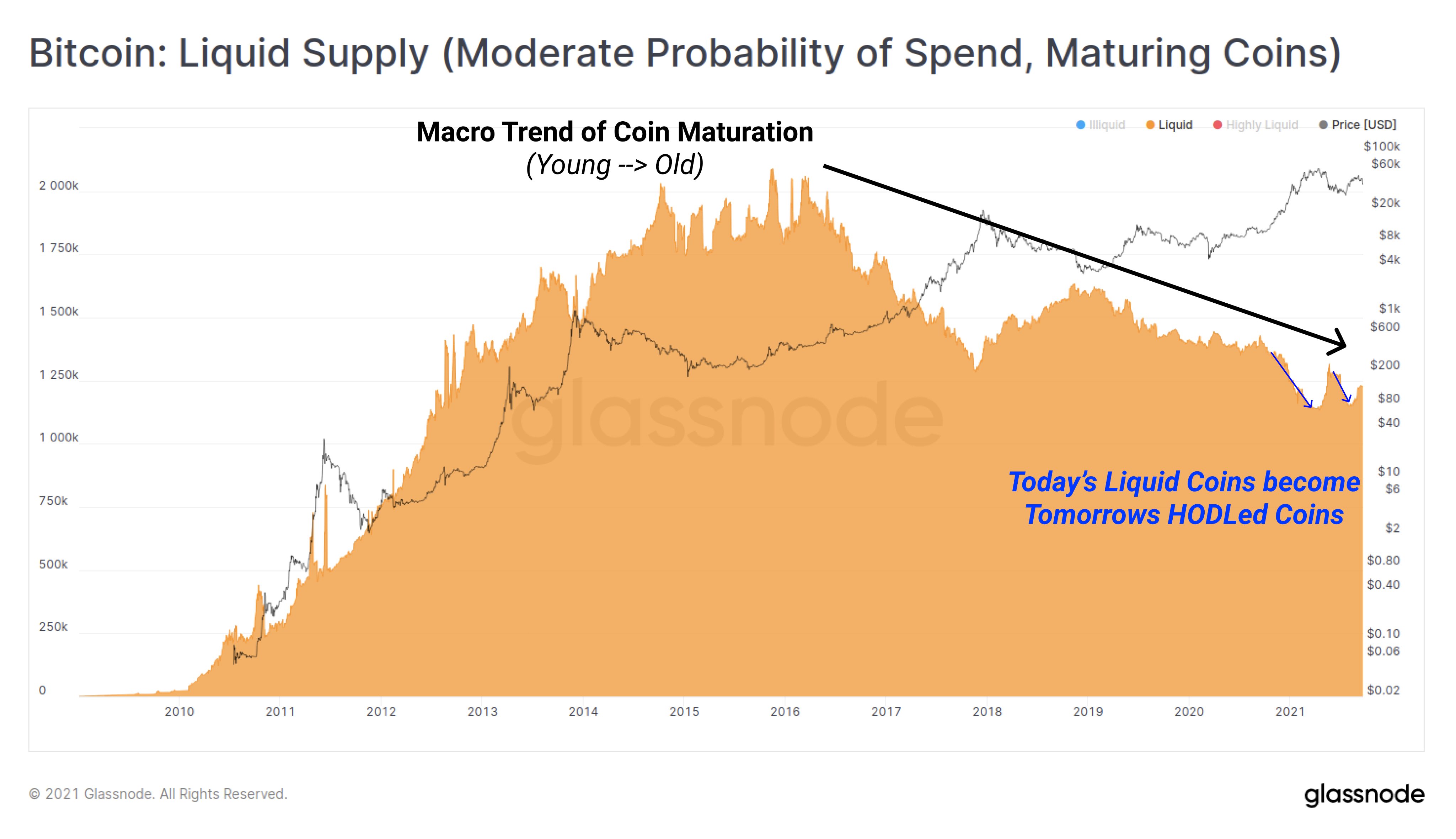

Bitcoins with a moderate probability of being spent have also been maturing steadily. Research from Glassnode showed that the tokens have shown a macro maturation trend and will soon transition into the “low probability of spending” category.

The number of bitcoins with the highest probability of being spent, which includes freshly bought and coins held on exchanges, has reached its multi-year low. Bitcoin’s highly liquid supply currently stands at 3.13 million BTC, which is lower than in December 2018 when the market saw its infamous capitulation.

The steady decrease in the number of bitcoins available on exchanges also correlates with the popular Stock-to-Flow (S2F) model, which predicts that BTC’s price will continue to increase after each halving event due to increased demand and reduced supply.

There are currently fewer coins in a Highly Liquid state (meaning easily sold in a single click) than there were at the very bottom of the Dec 2018 capitulation.

Fewer coins to buy than at the generational cycle low.

And you are thinking of selling your $BTC?

If so, you are mad— _Checkmate

checkonchain.com

(@_Checkmatey_) September 22, 2021

The post There’s now fewer liquid Bitcoin to purchase than at 2018’s ‘generational lows’ appeared first on CryptoSlate.