The billionaire investor and CEO of Galaxy Digital, Mike Novogratz, says the bitcoin market is in good shape, noting that he sees “so much capital coming into the space.” He also commented on the dwindling influence China has over the crypto market.

Billionaire Investor Says the Market Is ‘in Good Shape’ — ‘I’m Not Nervous’

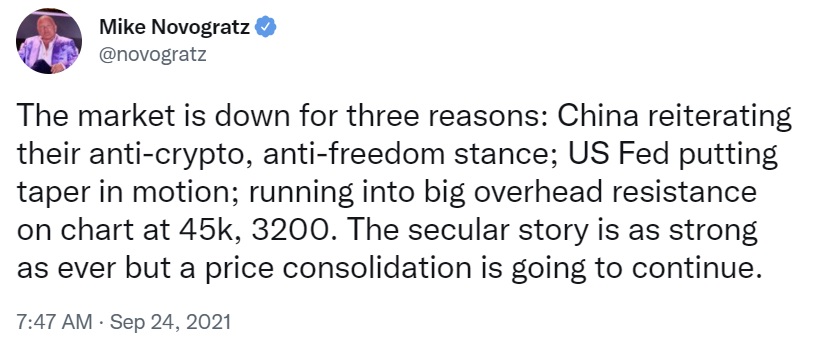

Galaxy Digital CEO Mike Novogratz commented on the crypto market and the latest news of China’s crackdown on cryptocurrencies Friday.

He explained that the crypto market was down for three reasons. The first is China reiterating its anti-crypto and anti-freedom stance. The second is the U.S. Federal Reserve “putting taper in motion,” and the third is the big overhead resistance level for bitcoin and ether. Novogratz noted that he believes BTC and ETH will consolidate.

At the time of writing, the price of bitcoin stands at $43,695 and the price of ether stands at $3,090 based on data from Bitcoin.com Markets.

Furthermore, the billionaire CEO believes that the bitcoin market is in good shape. In an interview with CNBC last week, he explained that the $40,000 level for bitcoin and $2,800 for ethereum “are very important levels for people to watch,” noting:

As long as those hold, I think the market is in good shape.

Novogratz further shared: “I’ve seen nothing but engagement activity from our investing clients and our corporate clients. The level of inquiry, the level of business hasn’t been higher.” He continued:

We see so much capital coming into the space, in private ways and public ways. I am not nervous.

Commenting on China’s influence over the prices of cryptocurrencies, particularly BTC and ETH, Novogratz said: “It was a lot more important five months ago before China basically said we’re banning crypto so miners have moved out of China.”

He continued: “China was never a big source of innovation in the space but it was a big source of trading and I think there’s still plenty of trading in China … The Chinese are smart, they know how to use VPNs, but it’s harder and harder and so I think it’s less and less important.”

Do you agree with Mike Novogratz? Let us know in the comments section below.