The Kraken exchange has published a report on NFTs, explaining their origins and the main steps in the history of this phenomenon, which actually started back in 2012.

The exponential growth of NFTs

The report begins by explaining how the non-fungible token sector took off in 2021, giving some data on this exponential growth that has seen NFTs rise 5404% in one year.

“NFT reportedly recorded over $56M in sales in 2020 and over $927M in 1H2021 alone. This marks a 5.404% growth year-over-year when compared to 1H2020”, the report explains.

NFT archaeology explained by Kraken

The report goes on to tell the whole story of non-fungible tokens. As explained in the long PDF released yesterday by Kraken, the origins of NFTs are to be found in the so-called “colored coins” of 2012, i.e. tokens that represented real assets based on the blockchain of Bitcoin and in particular of the smallest part of BTC, the satoshi.

Next, in 2016 came the time of the Rare Pepe as cards for a decentralized video game. After the success of Rare Pepe which started at the time to trade for as much as $300k, John Watkinson and Matt Hall decided to co-found the CryptoPunks project, a series of Ethereum-based cards whose characters were designed in 8bit. The project was launched on 23 June 2017 with 10 thousand unique NFTs of varying rarity.

2017 was also the year of CryptoKitties, which were the first to use the ERC721 standard instead of ERC20. The phenomenon caught on so quickly that in those weeks Ethereum’s network became congested with these virtual kitties and it was difficult to make transactions, resulting in a boom in gas costs.

The different applications and use cases of NFTs

Certainly one of the most prolific sectors for these blockchain-based trading cards is gaming, and Kraken’s report lists some of the most interesting projects in the sector such as Plasma Bears, Voxies, Cryptobots, Mytherium and ChainGuardians.

As we know, NFTs have dozens of different applications such as in the arts, sports, collectibles, metaverse and utilities such as Ethereum Name Service or Unstoppable Domains.

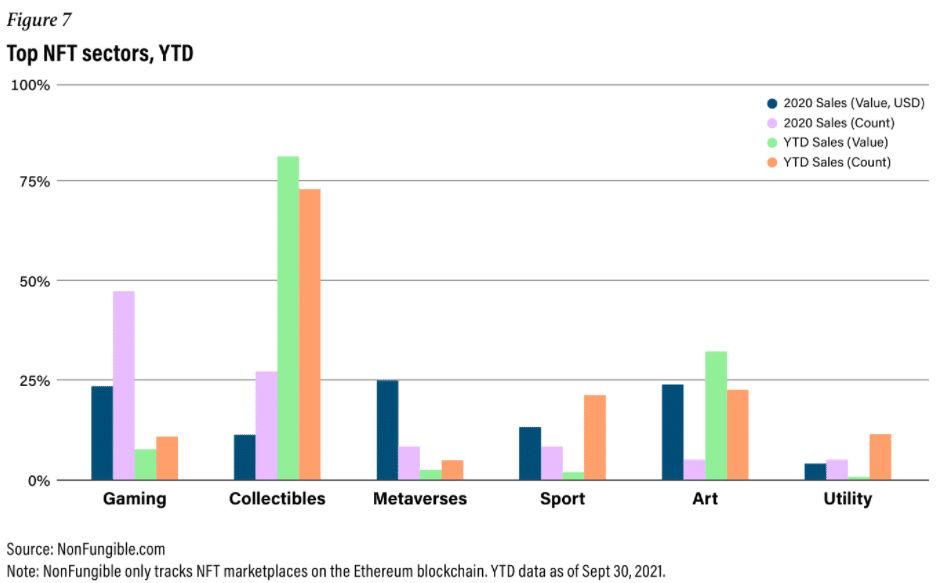

Looking at 2020, Kraken explains:

“the gaming sector came out on top with over 629k sales. In terms of sales value, the metaverse and art sector saw the highest value with over $14M and $12.3M in sales respectively”.

In 2021, the sector in which NFTs made the most sales was collectibles with almost $4bn.

The most famous creators in the world of crypto art and beyond

In giving its overview of the sector, Kraken also compiled a ranking of the artists who have made the most sales. In the list we find:

- Beeple with $139 million for over 1,000 works;

- Pak with 39 million for over 7000 NFT;

- Fewocious, 20 million for 3186 NFT;

- Trevorjonesart, 19 million for 5286 NFT.

There was also no shortage of celebrities who decided to launch their own NFTs. Here we find Snoop Dogg, Paris Hilton, Grimes, Jay Z, Kings of Leon and Lindsay Lohan.

The pros and cons of NFTs

A particularly interesting section of Kraken’s report is dedicated to the pros and cons of using non-fungible tokens.

On the one hand, the pros of NFTs include the possibility to protect the intellectual property of a work, the lowering of barriers to entry into the art market to sell artwork and the verifiability of ownership.

On the other hand, however, NFTs also present cons according to Kraken. These would include the fact that NFTs are often digital copies of physical works and therefore offer no added value; the replicability whereby an artist can easily decide to sell as many copies of a work as possible, thus devaluing it; and the fact that the market seems to be in a bubble phase, as well as unresolved regulatory issues.

The post Kraken: “NFTs are a market based on hype” appeared first on The Cryptonomist.