Arab Bank Switzerland will enable its institutional clients to store, stake, and trade XTZ – the native cryptocurrency of the popular blockchain project Tezos. This announcement comes amid the token’s recent price surge, which led it to a new all-time high.

- The press release seen by CryptoPotato reads that the banking organization, founded in 1962, has selected Tezos to develop a new set of “innovative and compliant” on-chain digital financial products.

- The private bank will also allow its customers to stake, store, and trade the XTZ token on its institutional-grade platforms.

-

“Digital assets are a cornerstone of our strategy, requiring strong agility while complying with the highest security standards. Our mission is to bridge tradition and cutting-edge innovation. Tezos, with its scalability, high-quality governance, and staking possibilities, fits perfectly within our vision.” – commented Rani Jabban – Managing Director of the bank.

- Tezos already has experience with working with large banks. Back in April this year, the protocol partnered with Societe Generale as the French institution wanted to employ the Tezos blockchain to issue its own security token.

- Additionally, Tezos has cooperated with multiple Swiss-based organizations. The trio of Crypto Finance Group, InCore Bank, and Inacta recently picked it to enable asset tokenization.

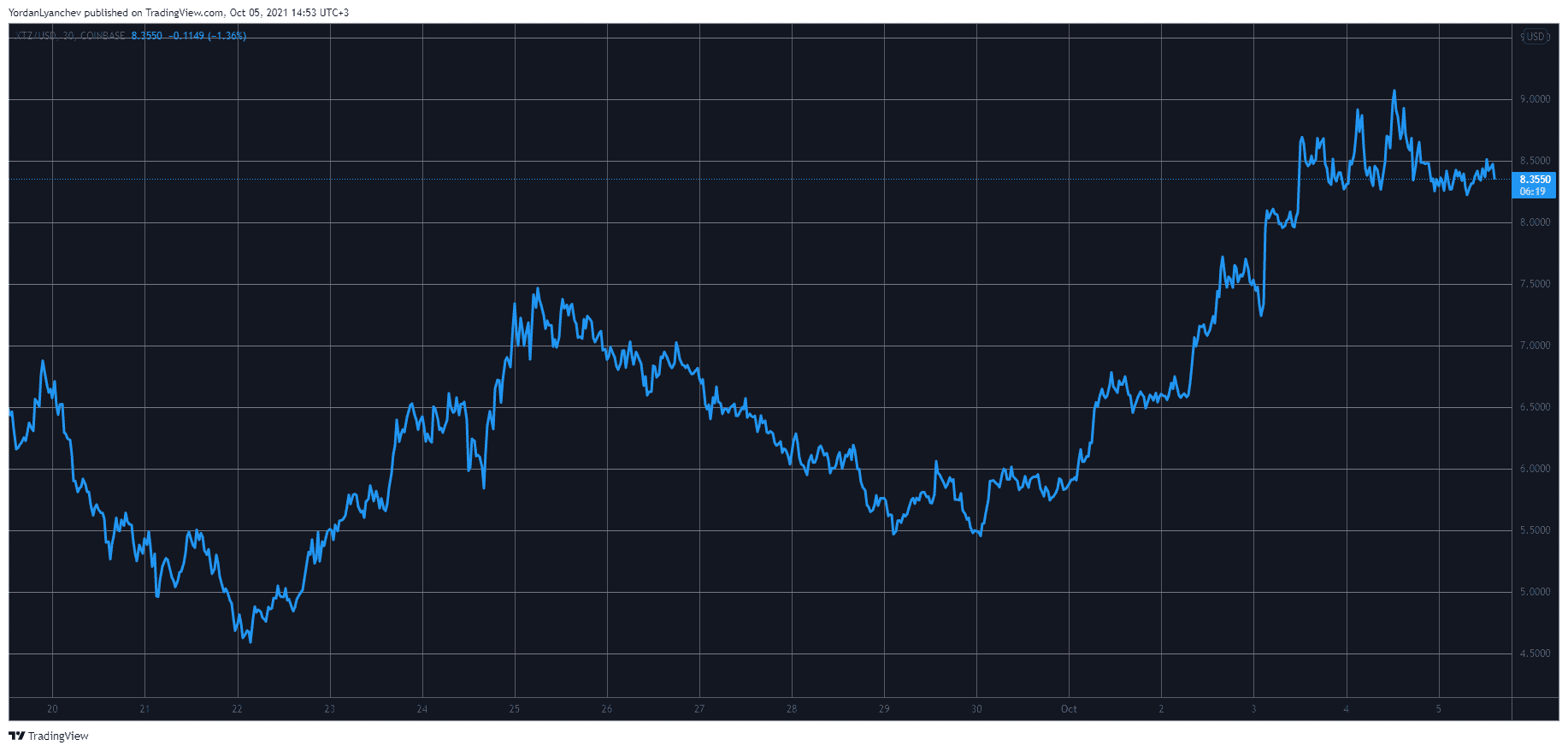

- The price of the native token has been on a roll lately as well. It had dropped below $4.5 on September 22nd but more than doubled its value and tapped a new all-time high above $9 yesterday.

- As of now, it trades north of $8, and it has entered the top 30 largest cryptocurrencies by market capitalization.