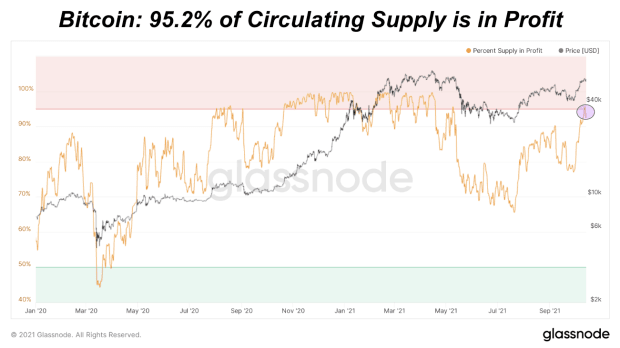

As we approach bitcoin price all-time highs, we start to see the percentage of circulating supply in profit reach 100%.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Supply In Profit

As we approach bitcoin price all-time highs, we will start to see the percentage of circulating supply in profit climb up to 100%. More importantly, we will see long-term holder supply climb to higher profit ranges. Since long-term holders are driving the market with 81% of circulating supply, their profit-taking behavior is key to identifying when the market may cool down as price starts to rip up to new highs. Long-term holders realizing huge profits into previous ATHs signaled the spot market cooling down as derivatives markets took over.

Currently, 95.2% of all bitcoin supply is in profit. During bull cycle top run-ups, supply can exist over 95% in profit for several weeks before healthy drawdowns. Even after these drawdowns, the larger trend can exist for months during bull cycles.

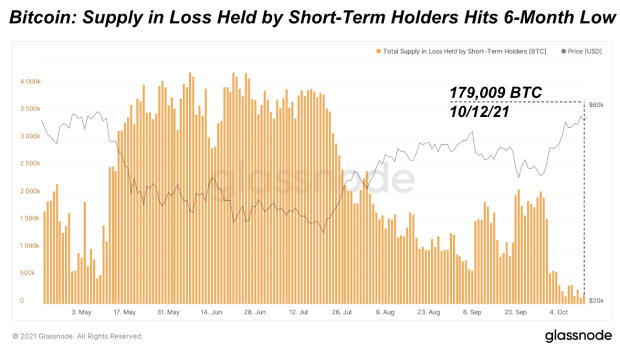

Supply In Loss

The bitcoin supply in loss has hit a six-month low. This further shows how little stands in the way between new all-time highs; any holder that wishes to exit at breakeven cost will likely have the opportunity over the coming days/weeks ahead.

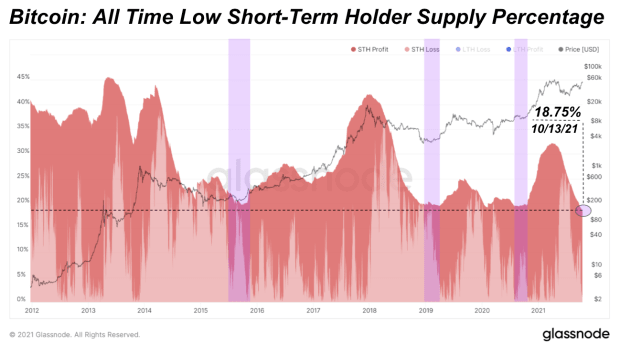

With the feverish increase in holdings by long-term holders since the middle of 2021, the percentage of supply held by said holders continues to break all-time highs.

A different (inverse) look, showing the percentage of short-term holder supply, shows the historic supply squeeze currently taking place. Historically, when short-term holder supply approaches approximately 20%, a bitcoin move upwards is in play. The proverbial spring looks to be as coiled as ever.