Request was born with the image of a future where invoices can be denominated and paid in any currency with the tokenization of fiat, as well as where legacy banking systems no longer exist in transactions.

Cryptocurrency is the most modern and popular finance solution that industries are looking forward to using due to its decentralization. The demand for the application of cryptocurrency platforms is increasing among individuals and businesses.

What Is Request?

Inspired by the freedom and transparency of Bitcoin and Ethereum, Request’s CEO, Christophe Lassuyt, wanted a fair financial system.

Request is the evolution of E-invoicing, representing the next step in invoice digitization making invoices smart and connected, including any request for payment, including, for example, loans, grants, or payslips.

The team improved its payment request technology over two years and officially launched in 2019, offering product-market fit for apps like wallet integrations, crowdfunding, and decentralized P2P payment requests.

Payments Made Easy

Request is the world’s first finance technology that provides invoices based on blockchain and connects them to payment networks. The team established Request Labs to build apps based on the Request protocol.

The payment request platform is an alternative to the banking system, as it represents the old form of centralized capitalism.

These apps don’t force users to stay and put users at the center of their experience as owners of their financial data. When users want to be part of a healthy ecosystem and have skin in the game, (d)Apps need to cooperate to serve their needs.

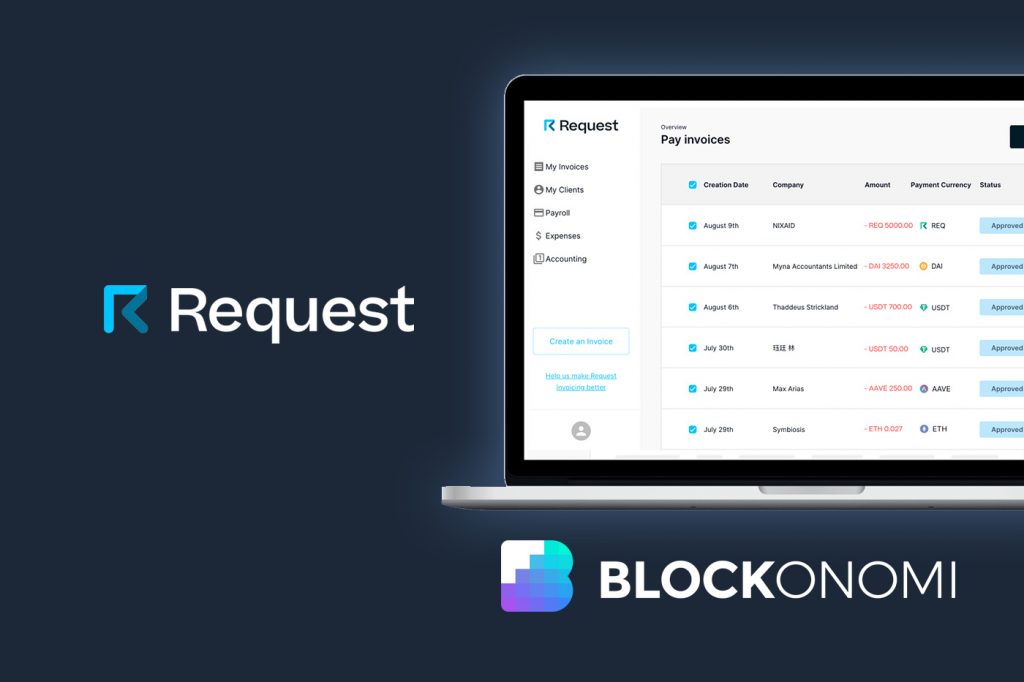

The Request Invoicing App

Request Invoicing is an app for crypto companies, allowing users to issue invoices in their local currencies and get paid in digital currencies.

It takes advantage of the power of cryptocurrencies such as instant transfers, low fees, and passive income while maintaining your bookkeeping in users’ local currency. Therefore, it makes accounting at the end of the year simple and easy.

In addition, users are able to maintain control over their own data at all times, helping them to be always in control of who can access their information.

Anyone can use the app to issue invoices in the currency of their choice, and clients can pay their invoices in either fiat or cryptocurrency. Request allows the management of all crypto transactions in one place and is built to be compliant with every crypto.

There’s a fee equal to 0.1% of each invoice’s value, which capped at US$2 per invoice.

Why Choose Request?

Request’s invoices are built on immutable, and fraud-resistant blockchain, top of a universal, open and interoperable, distributed ledger of all payment requests Request protocol.

Its technology not only automates cryptocurrencies payment detections but also integrates with Gnosis Safe to batch payments.

It can also allow the paying company to pre-fill the invoice that will be sent to them through the InvoiceMe feature and store hashes on the blockchain for each approval step including Accept or Reject.

Therefore, it creates a reputation system for payers. Besides, there’s a range of features released, including escrow, scheduled payments, automated late payment charges, and instant invoice financing, to support its users.

Insurers that use the platform will see it is a way that is easier to invoice and get paid in crypto with pre-filled invoices and features like recurring invoices.

Meanwhile, payers are offered tools to pay invoices in crypto in the most convenient, compliant, and professional manner.

By integrating Stripe and Metamask that supports encrypted data, peer-to-peer transfers, compliant documents, and no more copy/paste of blockchain addresses.

More Ways to Keep Track of Payments

People and businesses across the world are offered full control in the management of their financial assets. They can pay hundreds of crypto invoices to different addresses with just one click, even making batch payments possible by linking Gnosis Safe on Request.

In addition to featuring automated reconciliations enabling to track and verify the payment status of invoices automatically with on-chain data, Request invoicing also allows people to own their financial data and break away from traditional financial platforms.

Anyone anywhere is able to pay and get paid with confidence in a trustless environment and the currency of their selections.

Request Makes Business Better

Request provides SaaS (Software-as-a-Service) accounting tools to major DeFi companies in the market like TheGraph, Fantom Network, AAVE, Ocean, NEAR, and MakerDAO. Also, it helps organizations and freelancers who want to pay or get paid, in crypto.

The rise of remote work globally due to the COVID-19 pandemic and the boom in the blockchain industry have made the growth in a growing number of freelancers that want to be paid in crypto.

Request invoices can be paid in fiat while actual funds are received in crypto as well as simplifying the invoicing, payments, and accounting experience for freelancers dealing with crypto.

On another hand, its technology helps businesses tackle compliance and accounting challenges with cryptocurrency by simplifying the invoicing, payments, and accounting experience for companies dealing with crypto.

It also helps to boost the adoption for companies of all sizes to run their business on crypto.

Currently, the company has appealed to over 800 users and handled over US$140M crypto invoices through the app since its launch.

It is supporting over 31 cryptocurrencies, over 9 local currencies, and more than payment networks available on its app for users to send and receive payment.

The Team at Request

The team at Request is made up of top-tier industry professionals.

Here are a few of the principles at Request:

- Christophe Lassuyt, a YCombinator Alumni, is a co-founder and CEO at Request Labs.

- Julien Devoir, who served as a growth marketing manager YCombinator in 2017, is Request Labs’ Product Manager.

- Request Labs’ CTO Yoann Marion has experience as Regional IT manager at Amaris Consulting in Switzerland.

The company also is supported by many long years of experience employees and engineers in blockchain and DeFi space.

The Request Foundation raised $30 million via a REQ token generation event at the end of 2017 to develop an open-source payment request technology, which became the Request protocol with the participation of investors such as 1kx and Blocktower Capital.

In 2020, the team founded Request Labs to develop Request Invoicing. Currently, the Request Labs team is making a comprehensive suite of financial tools to meet the rapidly increasing demand for crypto adoption.

A Company that Can Make an Impact

The goal of creating Request is to address the frictions and inefficiencies of the current financial system that have been still limited in the current financial system.

Since most banking apps do not interoperate with each other it’s often painful to transfer money between customers of different banks. Adopting blockchain can reduce friction and bring interoperability between banking apps.

Besides, while two-thirds of SMBs (Small and Medium-Sized Businesses) often get their application for invoice factoring or financing rejected by banks because of lack of trust, blockchain can help to increase trust by guaranteeing the uniqueness of invoices.

As a result, SMBs will have better service, and less problems.

Its current features have impressed users including payments made in stablecoins, denominate in FIAT but pay in crypto, and batch payments features, among others.

The team is now focusing on helping builders use the Request protocol and the launching of the REQ token economics V2.0 is one of the missions the team is working on.

Other premium services including escrow, scheduled payments, automated late payment charges, and instant invoice financing are also set to launch in the coming months.

The post Request Finance: A Suite of Financial Tools for Businesses & Freelancers appeared first on Blockonomi.