WHAT’S NEXT FOR ETHEREUM FOLLOWING LAST WEEK’S ATH?

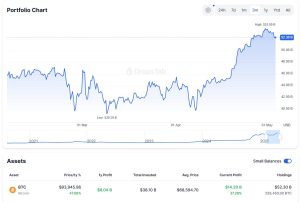

Last week Ethereum (ETH/USDT) finally managed to break its all-time high price recorded back on the 12th of May, albeit only by a couple of dollars. Still, we have got a new record in the books ($4375 on the 20th of October) and obviously a higher high on a macro scale too. At least technically we do, although some traders, including myself, are not convinced 100% and would like to see the max price slightly higher to confirm the long-term bullish momentum. What certainly is very optimistic for ETH is the fact that the token has recently performed much better than BTC (BTC/USDT) taking the ETH/BTC ratio from the lowest reading in three months (0.0593) back above the very important 0.65 level and all the way up to 0.673, where it is presently fighting to get back above the 50-MA. So, no more lagging behind Bitcoin, could this be a sign of an altcoin season that’s already around the corner? A couple of questions spring to mind immediately: what phase of the ongoing bull cycle are we in – that’s number one, and what clues can we find in the charts that could help us to establish ETH’s most likely price action over the coming weeks? To answer the first one I have thoroughly analyzed the blockchain’s (Ok I know the argument that it’s not a blockchain, relax) on chain data primarily in order to check on the whales since it’s undoubtedly the largest investors in the game that are going to decide when the party is over by moving their coins to spot exchanges with a view to eventually take their profits. Here is what I have found for you.

ON-CHAIN DATA AND TECHNICAL ANALYSIS

Starting with the MVRV Z-Score (market cap minus realised cap / std market cap) and already a huge green flag pops up for farther growth. So, the value today is at roughly 3 while the 2017 top was at 8 and just above 6 right before the crash back in May. This is one of the main indicators that I use keeping in mind that its value will go vertical slightly preceding a parabolic upside movement of price action. Historically it’s been a perfect signal for investors to get ready to take profits as close to a peak as possible (2013 & 2017). Another crucial indicator in my toolbox – NUPL (Net Unrealized Profit/Loss). Its range is 0 to 1 and in the previous cycle (2017) the very top of the market was when NUPL reading was above 0.9. This past May NUPL showed approximately 0.77 when ETH was above $4k and right now the reading is a touch below 0.69. Another green flag it is.

Moving on to addresses that hold the largest amounts of ethereum, what have they been up to in recent weeks? First of all, addresses with over 100 ETH – they have been steadily accumulating. Addresses with more than 1000 ETH – no sign of any serious selling, they are pretty much ‘diamond handing it’. And finally the biggest addresses, the fattest whales – they aren’t selling either! Lets not forget, many of these players are also miners. If miners aren’t selling, that’s seriously bullish. These vital three indicators, and many more, point to a continuation of an uptrent without a doubt.

As far as TA goes, seven days ago ETH broke out of the double bullish pattern (Cup & Handle + Inverse Head and Shoulders) that I discussed in my last insight for cryptodaily.co.uk, although I would have liked to see much more volume on that move. The break obviously resulted in new ATH yet the bears were able to take control immediately and dropped the price below $3900 followed by the token’s bounce which led to what was essentially two more attempts to establish another record price, and both of those got rejected. Lots of selling pressure above $4300 turning this level into a formidable challenge to face in the coming days/weeks. Right now we are seeing a bit of a correction caused by BTC dipping below $59k today (due to over-leverage as per usual) and the RSI 14 on the daily has broken down from a month-old ascending channel, we will have to watch this situation closely.

The price action is also seemingly falling off from an ascending channel/triangle and if that gets confirmed then we will have to rely on our supposedly solid chunk of resistance around the $3750 mark and below. Last two daily candles are looking distinctly bearish for ethereum’s short-term and I would say that a small correction at the very least is more than likely. As long as the price stays above the 50-MA, whose support was crucial on multiple ocassions over the recent two months, we should remain calm in my humble opinion. A small pullback would ‘shake out the weak hands’, cool the market’s sentiment down (that was dangerously signalling Extreme Greed only days ago) and ultimately get us ready to continue flying higher. The fundamentals are strong, the big boys aren’t selling, ETH 2.0 is on a horizon (Altair upgrade is live as of Wednesday the 27th Oct, another step complete), this bull cycle is not likely to end any time soon. Stay cold-blooded in the markets, happy trading.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.