Bitcoin, a record month

On Sunday, despite finishing in red figures, BTC made the highest candle close in the asset’s history on the monthly timescale – this achievement coincidentally came on the 13th anniversary [October 31, 2009] of the release of The Bitcoin White Paper.

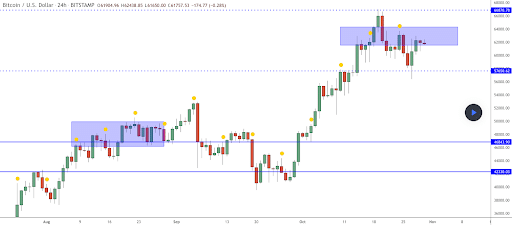

The BTC/USD USD chart below from MarcPMarkets shows a higher low was made at the $57k level on the recent pullback under the $60k level and that BTC’s price could already be nearing another quick close to a consolidation effort around the $60k level.

This chart also shows BTC’s been stuck inside a fairly tight range between $57k-$64k for the last week.

The Fear and Greed Index is reading 74 Greed and is equal to Sunday’s reading.

BTC’s 24 hour price range is $60,306-$62,597 and its 7 day price range is $58,501-$63,917. Bitcoin’s 52 week price range is $13,401-$67,276.

Bitcoin’s price on this date last year was $13,720.

The average bitcoin price for the last 30 days is $57,880.

Bitcoin [-0.82%] closed Tuesday’s daily / weekly / monthly candle worth $61,330 and in red digits for the second straight day.

Ethereum Analysis

October came and went and Ether bulls not only pushed ETH’s price to above the $4k level for the first time in history during October’s bullish surge but also managed to close the monthly timescale at its highest level ever.

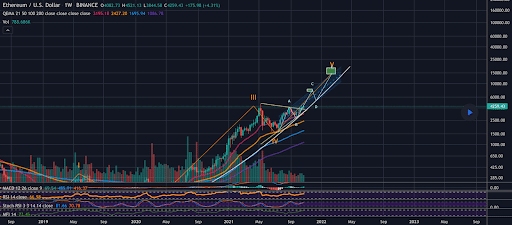

The ETH/USD 1W chart below from wali4 shows the potential that Ether could be in the midst of an Elliot Wave pattern that takes Ether to $15k-$20k.

If the chartist is correct, Ether is currently in between the ‘B’ to ‘C’ wave. The conclusion of the ‘C’ wave corresponds with an ETH price of $7,5k-$8k.

Of course, ETH bears could negate this trend by breaking the market equilibrium [demand line] at $3,5k and closing below this level on significant timescales.

ETH’s 24 hour price range is $4,196-$4,397 and its 7 day price range is $3,944-$4,467. Ether’s 52 week price range is $380.83-$4,467.57.

Ether’s price on this date last year was $394.94.

The average ETH price for the last 30 days is $3,815.79.

Ether [-0.79%] closed Tuesday’s daily / weekly / monthly candle worth $4,287 and in red figures for the second consecutive daily candle close.

MANA Analysis

MANA’S price experienced a bullish breakout over the weekend that sent the price over 150% on Saturday.

On Sunday, however, the price pulled back quite steeply and was -19.79% after finishing Saturday’s candle +157%.

So, what does the MANA/USD 30M chart tell us about low time frame price action and where MANA’s price may be going next?

The MANA/USD 30 chart below from Joelsaccount posits that MANA may have found some support at the $2.55 level and could be about to squeeze shorts before again breaking out to the upside.

If Decentraland bears want to regain some momentum and stifle another major runaway move by bulls, they’ll need to send the price below the $2.55 for starters on the 30 minute timescale.

MANA’S 24 hour price range is $2.6-$4.11 and its 7 day price range is $.751-$4.11. Decentraland’s 52 week price range is $.06-$4.11.

MANA’s price on this date in 2020 was $.065.

The average MANA price for the last 30 days is $.0959.

MANA [-19.79%] closed its daily / weekly / monthly candle worth $2.89 on Sunday.

The post Bitcoin and Ethereum Both Set Record Monthly Closes appeared first on The Cryptonomist.