Trava is the next generation of Lending Protocols, employing an innovative model of multiple lending pools created by users. This groundbreaking cross-chain lending development is something you have to check out if you ever wanted to create and manage your own lending pool, starting an online lending business and potentially earn big profits from it. The Trava smart contract is now live on both Binance Smart Chain and Fantom Network.

A Decentralized Marketplace for Cross-Chain Lending

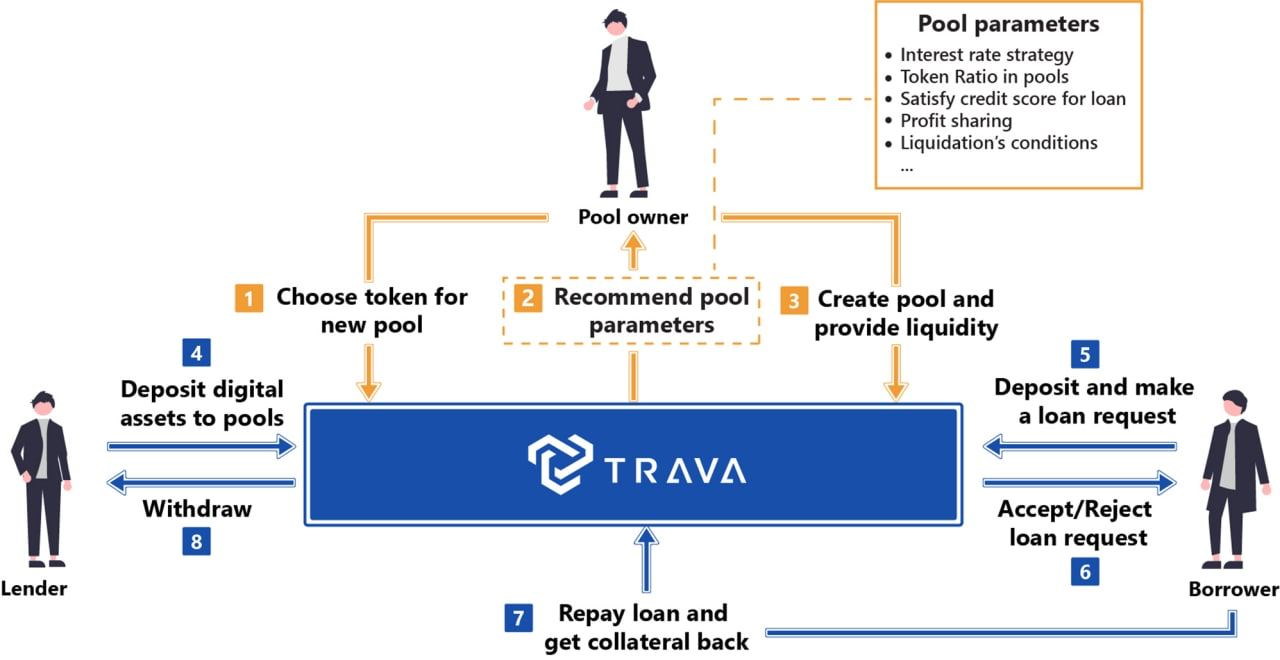

Trava.Finance is the world’s first decentralised marketplace for cross-chain lending and offers a flexible mechanism in which users can create and manage their lending pools to start a lending business. Initially deployed on the Binance Smart Chain, Trava allows for lending with BSC tokens at initial stages, with cross-chain lending with various tokens on Ethereum and other blockchain networks enabled after. Established in 2018 with an initial 20+ members, the team has gathered outstanding specialists and individuals in blockchain, security, finance, risk management, and law to aid its growth.

The BSC Trava lending pool supporting 14 assets. While existing approaches provide only one or a few lending pools with their own parameters such as borrow/supply interest rate, liquidation threshold, Loan-to-Value ratio, or a limited list of exchangeable cryptocurrencies, Trava offers a flexible mechanism in which users can create and manage their own lending pools to start a lending business. Trava also offers the credit score function based on financial data on-chain analysis as a useful tool that reduces risk and increases profits for all users.

The main innovation behind Trava is that it allows users to create their own pools with their own parameters such as borrow/supply interest rate, liquidation threshold, etc. However, there are other important differences between Trava and existing solutions. Trava provides users with a credit score – The pool owners can define a credit-score threshold for borrowers to reduce the lending risks and set a high Loan-to-Value ratio for borrowers with high credit scores. NFT, stock tokens, and other digital assets as collaterals: to increase the liquidity. This service will be released in Q4, 2021.

Cross-chain identification and cross-chain lending is another Trava advantage. It can identify all wallet addresses of the same users on different chains. After that, users can use up all of their cryptos as collateral for a huge loan in a single transaction. Trava plans to offer many statistical functions and analyze data for users, so they can reduce the risks and increase profits in a professional manner.

Trava Launches Lending Pool on Fantom Network

The Trava team recently announced that they will open a Lending Pool on Fantom Network on November 4th. Together with the launching of the lending system on Fantom Network, Trava will run its W2.1 Liquidity Mining Program for depositors and lenders when participating in the Lending Pool on Fantom Network. At this early stage the lending pool supports six assets, covering: FTM, DAI, USDC, USDT, ETH, and BTC.

Dr. Minh Nguyen, Trava CEO & co-founder, commented: “Deploying Trava lending pool on Fantom network is a pre-planned of Trava.Finance that proves Trava.Finance’s commitments to users including: (1) gradually support cross-chain lending, (2) serve more users of Defi services in different potential networks like Fantom, and others, and (3) formed the Trava DEFI 2.0 ecosystem with upcoming products launched by Trava.Finance.”

Trava has a lot more developments coming up, such as opening rTrava vault on Fantom, launching NFTs staking and NFT marketplace, adding more tokens on BSC and FTM pools, creating a credit score-based lending pool, sharing profits from Trava Bridge for rTrava holders, new partnerships and listings on top-tier exchanges. So to keep up the project visit the website, and make sure to follow the team on Twitter, Telegram, Reddit, and Medium.

This is a sponsored post. Learn how to reach our audience here. Read disclaimer below.