Top DeFi protocol Aave is currently passing a governance vote for the implementation of V3. According to a recent post, the V3 protocol update is necessary to keep up with the continued growth of the DeFi ecosystem.

“After these two years of substantial growth, this Aave Request for Comment (ARC) to Aave Governance seeks community approval for a new iteration of the Aave Protocol: Introducing Aave V3.”

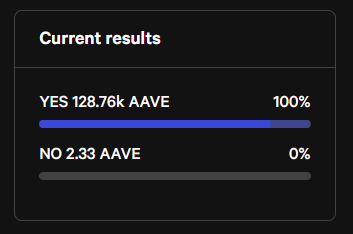

Voting is still live on Snapshot, with the current result showing near 100% of votes in favor of supporting the V3 proposal.

As a certain shoo-in for implementation, what should the community expect in terms of improvements?

What does V3 entail?

Aave V3’s proposal underlines the increasing importance of cross-chain compatibility, and orientation towards Ethereum Layer 2s as well. Devs also mention increasing capital efficiency and enhancing the user experience through better security.

“The design of V3 is poised to create the next generation Layer-0 DeFi protocol that can drastically improve user experience while offering increased capital efficiency, a higher degree of decentralization and further enhanced security.”

The most significant update is perhaps “Portal,” which enables users to move their supplied liquidity across different blockchains. This feature makes use of Aave interest-bearing tokens or aTokens for short.

User’s supplied liquidity can be transferred across different networks by burning aTokens on the source network while minting them on the destination network. Portal is the network interconnection that supports this feature.

“Portal will be able to bridge solutions like Connext, Hop Protocol, Anyswap, xPollinate and others that tap into Aave Protocol liquidity to facilitate cross-chain interactions.”

Aave Governance can grant any cross-chain protocol access to the Ports after receiving a proposal to do so.

The expected outcome is greater capital efficiency, as users will be able to move assets according to where demand, and therefore yields, are greatest.

Aave fights to be the top DeFi lending platform

With $14 billion locked in Aave, it trails Maker, which has $18 billion locked in terms of the top lending protocol.

In a bid to beat Maker, Aave is also looking to address risk management in the new V3 protocol. This involves:

– Supply and borrow caps to minimize infinite minting or price oracle manipulation and liquidity pool insolvency.

– Granular borrowing power control to change collateral factors for future borrowers without affecting the positions of existing borrowers or triggering liquidations.

– Risk admins with the addition of a permit list which greenlights only approved entities to alter risk parameters without a governance vote.

– Price oracle sentinel to incorporate a grace period for liquidations, which also disables borrowing under certain circumstances.

The post Aave is looking to deploy advanced new DeFi features in V3 protocol appeared first on CryptoSlate.