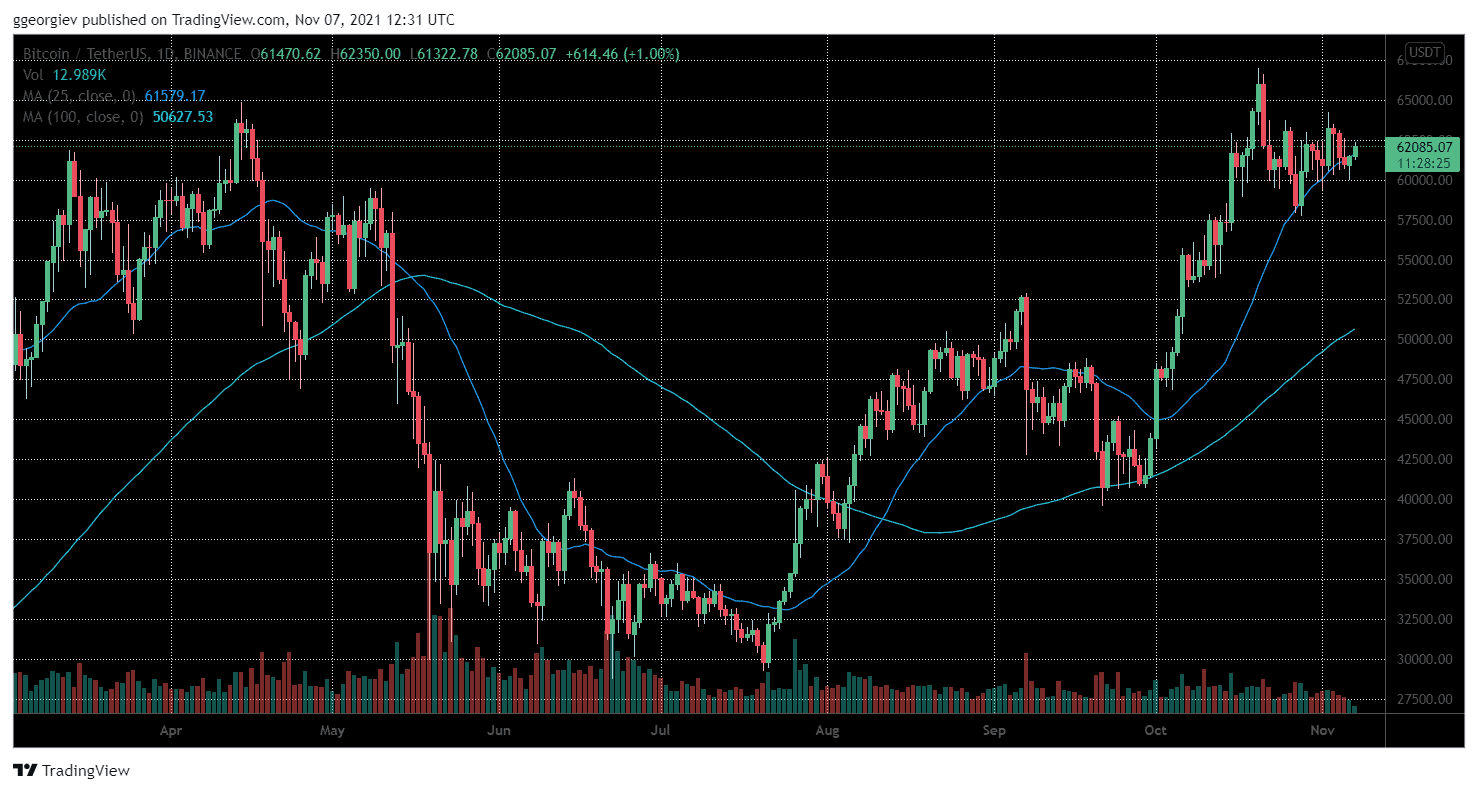

In the past few days, we saw Bitcoin’s price nearly touching $60K again and it’s now important to reclaim the 21-ay MA in the near term. Meanwhile, the strong resistance continues to lie between $63.7K and $64.8K.

The ideal scenario for BTC bulls would be to complete the cup and handle breakout above $63.7K and $64.8K, which should send the price to the range between $70K and $80K.

There are still no signs of a distribution trend forming but we did see some light profit-taking on behalf of older coins. The miners continue to hold and there were no major spikes in CDD or SOPR, which signals that there’s not a lot of profit-taking happening.

As we mentioned in the previous BTC analysis the price action and on-chain performance do resemble these from late 2020 before BTC broke out to all-time highs. The initial breakout to new ATHs in 2020 took multiple attempts and it even saw a correction.

The cycle top indicator is nowhere near to previous bull market peaks but it’s becoming increasingly important for $60K to continue holding. If it fails, we can look at the leaves at $58.3K, $571.K, $56.2K, $55K, and $53K for support. The strong area of both on-chain and technical support, however, is found between this are. It’s highly likely that these levels will hold if tested.

It’s still looking likely that there will be a large breakout towards $70K and $80K later in November and December – there’s no trend of distribution forming which also increases the probability of this bull market to extend into Q1 of 2022.